- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Oat Milk Market Size & Share Report, 2020-2028GVR Report cover

![Oat Milk Market Size, Share & Trends Report]()

Oat Milk Market (2020 - 2028) Size, Share & Trends Analysis Report By Source (Organic, Conventional), By Product (Plain, Flavored), By Packaging (Cartons, Bottle), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-776-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

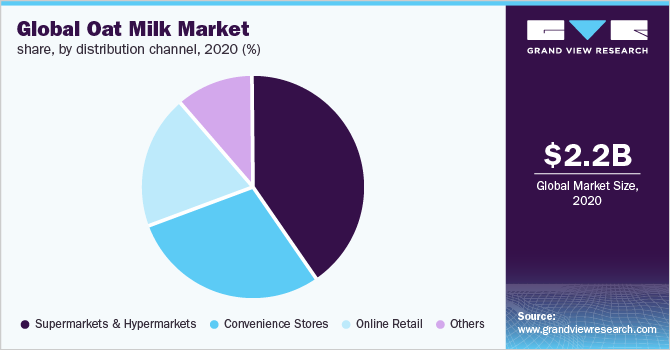

The global oat milk market size was valued at USD 2.23 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 14.2% from 2020 to 2028. The market growth is attributed to the rising vegan population, coupled with health-conscious consumers demanding plant-based milk with high nutritional properties. Issues such as lactose intolerance, allergies, and the rising popularity of low-cholesterol diets have pushed manufacturers to introduce a range of plant-based alternatives. This has benefitted the market for oat milk, which caters to the customers’ demand for being allergic-free, along with offering several health benefits.

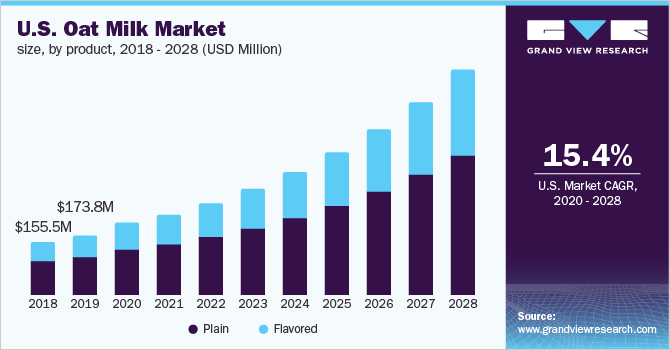

With the awareness created by the animal rights organizations as well as animal lovers, a change has been witnessed in the customer buying behavior, which supports animal protection. Thus, a large customer base is shifting towards a vegan diet, which is expected to drive sales of oat milk during the forecast period. The U.S. held the largest revenue share in the North American market in 2020. The trend of the consumption of plant-based food and beverages in the country, coupled with a strong foothold of key manufacturers and a rise in vegan consumers, is contributing to the high growth of oat milk in the country.

The manufacturers such as Oatly are seeking new ways of extracting milk in an attempt to gain unique selling points and differentiate their products in the market. Manufacturers are purchasing high-quality raw materials directly from farmers, allowing the end product to be more cost-effective, thus positively impacting the market growth. The dominant trend towards the consumption of high-protein products among consumers has enhanced the growth of the plant-based milk industry. With the population being inclined towards sports and fitness, the demand for protein-rich beverages has increased, which is further expected to escalate the product demand during the forecast period.

During the outbreak of COVID-19, there were interruptions in supply chain and logistics during the initial phase of the pandemic. However, support from the government to manage the demand for essential products has minimal impact on the growth of plant-based products, such as oat milk. The pandemic exposed the importance of nutrition for the body when it comes to the immune health system and overall health. Customers turned more conscious and eliminated carbohydrates, fats, and sugary drinks and switched to nutritionally balanced and nourishing products, which increased the demand for dairy alternatives.

Source Insights

The conventional source segment accounted for the largest revenue share of over 70.0% in 2020 owing to its high penetration in the global market due to its cost-effectiveness. Additionally, manufacturers are launching new products to gain market share. For instance, in April 2021, The Coca-Cola Company launched a new oat milk product under its Simply brand in different flavors to attract a large customer base. The organic source segment is expected to register a significant CAGR from 2020 to 2028. This higher growth is associated with an increase in health consciousness among consumers, inclination towards pesticide-free grown products, and awareness regarding adulteration in conventional products.

Additionally, the higher concentrations of antioxidants and nutritional minerals in organic products as compared to conventional variants are drawing customer attention towards organic oat milk. Thus, the awareness regarding the health benefits associated with organic oat milk is further expected to drive the market from 2020 to 2028. Several boards and organizations are supporting the farmers and NGOs for the adoption of organic farming. Additionally, non-profit organizations such as IOFAM Organic International, USDA, and National Organic Standard Board are aiding the production of organic products, thus benefitting the growth of the market during the forecast period.

Product Insights

The plain segment emerged as the dominant product segment with a share of over 55.0% in 2020. The flavored segment is expected to expand at a significant CAGR during the forecast period as the flavored product range is targeting both health and comfort categories, thus drawing customers’ attention. Consumers’ demand is increasing for products that enhance the taste bud and offer an indulgent experience, along with offering health beneficial properties. There is a significant rise in the number of customers purchasing oat milk with added flavors owing to the interest in ethnic and exotic flavors offered by the manufacturers.

The push from manufacturers in offering different unique flavors such as hazelnut, mocha, coconut, and berries supported by frequent new product launches has moved customers towards flavored oat milk. Consumers have become more conscious when it comes to choosing nutrition and flavor for the body. Additionally, customers are more progressively adopting alternative channels to self-diagnose and identify the targeted health needs with demand for flavor from natural ingredients. Thus, manufacturers operating in the oat milk space are constantly researching to cater to customers’ demands, thus benefitting the market growth in the near future.

Packaging Insights

The cartons segment held the largest revenue share of over 45.0% in 2020. This is due to the increasing demand for high-quality and high shelf-life packaging solutions. Additionally, the rising acceptance of Tetra Pak carton packages, manufactured primarily from paperboard is driving the demand for the segment. Several key players are significantly investing in carton packaging because of its lightweight properties and sustainability. An increase in global awareness regarding the sustainability of paper-based cartons has led to the high adoption of cartons packaging for oat milk. Manufacturers and suppliers are focusing on creating packaging with attractive colors and unique designs to increase sales.

Even though oat milk in carton packaging holds the largest market share, the bottle packaging segment is expected to witness the fastest growth over the next few years. The demand for on-the-go consumption of food and beverages is increasing among consumers. This has propelled manufacturers to offer oat milk packaging solutions in bottles. Manufacturers such as Oatly are offering different oat milk products in bottles to attract customers demanding convenience, thus driving the segment.

Distribution Channel Insights

The supermarkets and hypermarkets segment emerged as the dominant distribution channel segment and accounted for over 40.0% share in 2020. An improvement in the retail sector globally, coupled with the availability of global brands at these stores, is contributing towards increasing penetration of oat milk through the supermarket. Major grocery stores such as Target, Lidl, Kroger, and Walmart offer dairy alternatives, such as oat milk. The annual memberships and discounts offered on bulk purchases are expected to attract consumers to hypermarkets and supermarkets, thus boosting sales of oat milk during the forecast period.

The online retail segment is expected to witness the fastest growth over the forecast period. Easy access to products, easy online purchases, and the increased number of brands to choose from are boosting online sales of oat milk. With high fragmentation in the industry and low customer loyalty, online sales of plant-based milk are further expected to increase during the forecast period. The others segment include specialty stores and departmental stores. The robust growth of specialty stores in developed and developing countries owing to their wide product offerings in a single category, flexible store formats, and product displays are attracting customers towards specialty stores, thus benefitting the sales of oat milk through this channel.

Regional Insights

Asia Pacific dominated the market for oat milk and held a revenue share of over 45.0% in 2020. Lifestyle changes, urbanization, and shifting dietary preferences have led to a rise in the demand for nutritive food in Asia Pacific, which is likely to drive the market statistics. A favorable outlook toward the plant-based milk market on account of the rising prevalence of cardiovascular diseases and the number of weight management programs is expected to boost the market growth in the region.

North America is expected to significant growth over the forecast period owing to the high consumer awareness regarding the protein content and nutritional value in oat milk. The popularity of e-commerce portals as one of the selling mediums is high, which has contributed to the growth of the dairy alternatives market in the region. North American consumers are further expected to demand oat milk due to an increase in milk allergies and lactose intolerance cases. Food and beverage manufacturers in the region are incorporating dairy alternatives into products to appeal to a growing consumer base that is opting for plant-based products, which is further boosting the growth of the market.

The market in Europe accounted for a significant share in 2020 owing to the high customer demand for vegan and plant-based products in the region. Manufacturers operating in the market for oat milk are targeting countries in the region to increase their market share. For instance, in 2020, Califia Farms launched a long-life oat drink exclusively for customers in the U.K. market. The company intended to motivate consumers to switch from dairy milk to decrease their environmental footprint to increase the penetration of its products in the country.

Key Companies & Market Share Insights

The industry is highly fragmented and is characterized by intense competition, with both public and privately held market players focusing on innovation to stay competitive. Key players are sourcing premium-quality raw material directly from farmers to offer high-quality oat milk to customers. Key players are focused on new product launches with varied flavors and convenient packaging to attract a large customer base. Companies are also engaged in segment diversification and are launching oat milk-based ice creams, yogurts, flavored shakes, and packaged coffee, which is likely to boost product demand. Some prominent players in the global oat milk market include:

-

Oatly

-

Rise Brewing

-

Thrive Market

-

Happy Planet Foods

-

Califia Farms

-

The Coca-Cola Company

-

Elmhurst

-

Pacific Foods

-

Danone

-

HP Hood LLC

Oat Milk Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 2.19 billion

Revenue forecast in 2028

USD 6.45 billion

Growth Rate

CAGR of 14.2% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2020 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source; product; packaging; distribution channel; region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; China; Japan; India; Australia; Brazil; Argentina; South Africa

Key companies profiled

Oatly; Rise Brewing; Thrive Market; Happy Planet Foods; Califia Farms; The Coca-Cola Company; Elmhurst; Pacific Foods; Danone; HP Hood LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global oat milk market report on the basis of source, product, packaging, distribution channel, and region:

-

Source Outlook (Revenue, USD Million, 2017 - 2028)

-

Organic

-

Conventional

-

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Plain

-

Flavored

-

-

Packaging Outlook (Revenue, USD Million, 2017 - 2028)

-

Cartons

-

Bottle

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.