- Home

- »

- Advanced Interior Materials

- »

-

Non Grain Oriented Electrical Steel Market Size Report, 2030GVR Report cover

![Non Grain Oriented Electrical Steel Market Size, Share & Trends Report]()

Non Grain Oriented Electrical Steel Market (2025 - 2030) Size, Share & Trends Analysis Report By End Use (Transformers, Motors, Inductors, Others), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-518-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Non Grain Oriented Electrical Steel Market Summary

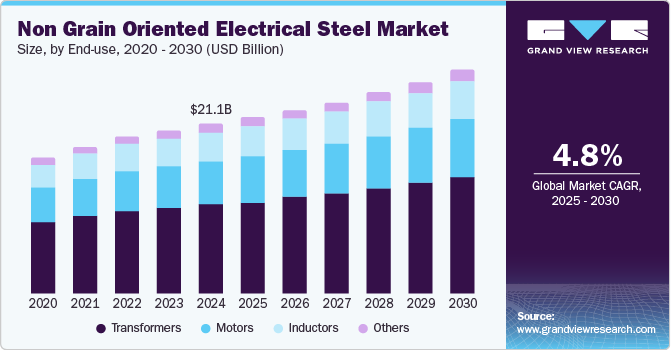

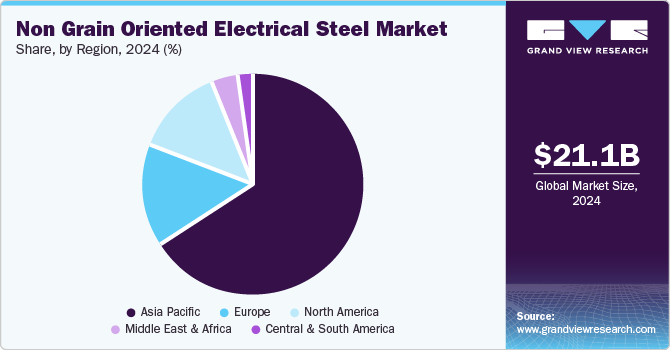

The global non grain oriented electrical steel market size was estimated at USD 21.10 billion in 2024 and is projected to reach USD 27.69 billion by 2030, growing at a CAGR of 4.8% from 2025 to 2030. Non grain oriented electrical steel, also known as isotropic electrical steel, is primarily used to manufacture electric motors, transformers, and other energy-efficient equipment.

Key Market Trends & Insights

- The North America non grain oriented electrical steel industry is anticipated to grow at a significant CAGR over the forecast period.

- The non grain oriented electrical steel industry in the U.S. is anticipated to grow over the forecast period.

- Based on end-use, the motors are anticipated to register the fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 21.10 Billion

- 2030 Projected Market USD 27.69 Billion

- CAGR (2025-2030): 4.8%

- North America: Largest market in 2024

As industries and economies strive to reduce their carbon footprint and lower energy consumption, there is an increased need for efficient electrical machines. NGOES play a crucial role in improving the efficiency of electric motors and transformers, making it a critical material for manufacturers focused on meeting stringent energy standards.

Electric vehicles rely heavily on efficient motors for optimal performance, and NGOES is used to produce high-performance stators and rotors in these motors. As governments across the globe introduce regulations to encourage the adoption of electric vehicles, the demand for NGOES is expected to rise correspondingly. The ongoing advancements in battery technology and motor design further fuel the need for high-quality electrical steel to support more efficient and powerful EV engines, making the automotive sector one of the key drivers in the NGOES market.

The growth of industrialization and infrastructure development, particularly in emerging markets, is driving the demand for NGOES. As countries in the Asia Pacific, the Middle East & Africa expand manufacturing and power sectors, NGOES is increasingly used in transformers and power networks. Its high magnetic permeability makes it ideal for renewable energy technologies like wind and solar power. With ongoing investments in sustainable energy, the demand for NGOES is expected to rise, especially in regions focusing on clean energy infrastructure.

Drivers, Opportunities & Restraints

As the global focus shifts toward reducing energy consumption and enhancing operational efficiency, the use of NGOES in these critical applications has become essential. This material’s ability to improve the efficiency of electrical machines, reduce energy losses, and lower operational costs has made it highly sought after. In addition, the rapid adoption of EVs, which require high-performance motors, and the ongoing industrialization in emerging markets further contribute to the growing demand for NGOES.

Wind turbines use NGOES in their electrical systems, such as generators and transformers, to improve efficiency and performance. As governments worldwide prioritize renewable energy infrastructure to meet sustainability goals, the demand for NGOES in wind energy applications is expected to rise. Furthermore, EV growth presents long-term opportunities for the NGOES industry. With advancements in EV technologies and government regulations favoring clean energy solutions, manufacturers can leverage the increasing demand for energy-efficient motors to expand their product offerings and market reach.

The manufacturing process of NGOES requires precise control over material properties, which increases the overall cost compared to other types of electrical steel. This can limit its adoption in price-sensitive applications, particularly in developing regions where cost efficiency is a primary concern. In addition, the global supply chain for raw materials, such as silicon and iron, can be affected by geopolitical tensions and fluctuations in commodity prices, leading to potential supply shortages and price instability.

End Use Insights

As renewable energy installations increase, the need for transformers to handle and distribute power from these intermittent energy sources grows. NGOES is ideal for use in transformers as it can enhance the overall efficiency of energy conversion, ensuring minimal energy loss during transmission. Moreover, improving grid stability and integrating renewable energy into existing power grids requires advanced transformer technology, which relies heavily on high-quality materials.

Motors are anticipated to register the fastest CAGR over the forecast period. As manufacturing processes become more automated and industries seek to improve productivity, the demand for electric motors continues to rise. NGOES is integral in these applications, as it enhances motor performance, ensuring high efficiency even under demanding operating conditions. With growing industrialization, especially in emerging markets, the demand for motors across various sectors will continue to expand.

Regional Insights

The North America non grain oriented electrical steel industry is anticipated to grow at a significant CAGR over the forecast period. The U.S., Canada, and Mexico automotive industries are transforming, with automakers investing heavily in developing electric and hybrid vehicles. NGOES is a vital material for manufacturing the electric motors used in EVs, which require high-performance materials to ensure efficiency, power density, and reliability. The growing push for cleaner transportation, driven by consumer demand and government policies, continues to elevate the need for NGOES in EV applications, making it a major growth driver for the market.

U.S. Non Grain Oriented Electrical Steel Market Trends

The non grain oriented electrical steel industry in the U.S. is anticipated to grow over the forecast period. As the U.S. government enforces stricter energy efficiency standards through regulations like the Energy Independence and Security Act (EISA), industries are increasingly looking for materials that enhance the performance of electrical equipment. This push for greater energy efficiency in both industrial and consumer sectors is driving higher demand for NGOES in the U.S.

Asia Pacific Non Grain Oriented Electrical Steel Market Trends

The non grain oriented electrical steel industry in Asia Pacific is anticipated to grow over the forecast period. Asia Pacific is a global manufacturing hub, particularly in countries such as China, India, Japan, and South Korea; the need for high-performance materials such as NGO electrical steel to enhance the efficiency and reliability of electrical equipment is increasing. As these economies continue to develop and urbanize, the consumption of electrical steel used in industrial applications is expected to rise, thereby driving market growth.

Europe Non Grain Oriented Electrical Steel Market Trends

The non grain oriented electrical steel industry in Europe is anticipated to grow over the forecast period. As Europe moves toward smart grids and energy-efficient power systems, there is an increasing need for upgraded electrical components, including transformers and generators, which often incorporate NGOES. The region’s efforts to improve grid reliability, reduce energy waste, and integrate renewable energy sources into the existing grid infrastructure have led to greater adoption of high-performance materials to reduce core losses in electrical equipment. With significant investments in smart grid technology, energy storage, and other infrastructure projects, the demand for NGOES is expected to increase. These systems require materials that can operate efficiently at higher frequencies and improve performance.

Central & South America Non Grain Oriented Electrical Steel Market Trends

The non grain oriented electrical steel industry in Central & South America is anticipated to grow over the forecast period. Countries such as Brazil and Chile have invested substantially in wind and solar power generation, which require efficient electrical components to optimize performance. According to IEA, Brazil's commitment to clean energy is evident as it accounted for 7% of the planet's renewable energy production in 2023, which exceeds its global population and GDP shares. The use of NGOES in wind turbine generators and photovoltaic systems enhances their operational efficiency, thereby supporting the overall growth of the renewable energy sector.

Middle East Non Grain Oriented Electrical Steel Market Trends

The non grain oriented electrical steel industry in the Middle East is anticipated to grow over the forecast period. As countries like South Africa, the UAE, and Egypt continue to invest in industrial sectors such as manufacturing, mining, and construction, the need for energy-efficient motors, transformers, and other electrical equipment is expanding. As industrial activities increase and more businesses adopt automation technologies, the demand for energy-efficient electrical systems powered by NGOES is expected to grow.

Key Non Grain Oriented Electrical Steel Company Insights

Some of the key players operating in the market include ArcelorMittal, POSCO, and others.

-

ArcelorMittal, a global leader in steel and mining, operates in over 60 countries and serves major markets worldwide. The company produces a diverse range of steel products for industries like automotive, construction, and appliances. ArcelorMittal offers both fully processed and semi-processed grades of NGOES, with the fully processed steels ready for immediate use, while the semi-processed grades require additional annealing after punching.

-

POSCO, a South Korean multinational steel producer, is one of the world's largest steelmakers. It serves industries such as automotive, construction, shipbuilding, and energy with a broad portfolio of steel products. POSCO manufactures NGOES with a non-uniform crystal orientation, providing excellent magnetic properties suitable for applications like motors and generators.

Key Non Grain Oriented Electrical Steel Companies:

The following are the leading companies in the non grain oriented electrical steel market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Arnold Magnetic Technologies

- Baosteel Group Corporation

- Cleveland-Cliffs Inc.

- JFE Steel Corporation

- NIPPON STEEL CORPORATION

- Nucor Corporation

- POSCO

- Thyssenkrupp

- VIZ-Steel

Recent Developments

-

In February 2025, ArcelorMittal is set to construct a new, wholly owned electrical steel manufacturing plant in Calvert, Alabama. The facility will produce up to 150,000 metric tons of NGOES annually, catering to the automotive and mobility sectors, renewable energy production, and various industrial applications. Construction is scheduled to begin in the latter half of 2025, with production expected to commence in 2027.

-

In October 2023, U.S. Steel launched its new NGOES line at its Big River Steel facility in Osceola, Arkansas. The new line boasts the largest annual product production capacity in the U.S. and offers sustainable steel solutions like InduX, which is crucial for the expanding electric vehicle market.

Non Grain Oriented Electrical Steel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.96 billion

Revenue forecast in 2030

USD 27.69 billion

Growth Rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End use, region

Regional scope

North America, Europe, Asia Pacific, Central & South Africa, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; Turkey; China; India; Japan; South Korea; Brazil; Iran

Key companies profiled

ArcelorMittal; POSCO; Nucor Corporation; Baosteel Group Corporation; NIPPON STEEL CORPORATION; JFE Steel Corporation; thyssenkrupp; Cleveland-Cliffs Inc.; Arnold Magnetic Technologies; VIZ-Steel

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non Grain Oriented Electrical Steel Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non grain oriented electrical steel market report based on end use and region.

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transformers

-

Motors

-

Inductors

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global non grain oriented electrical steel market size was estimated at USD 21.10 billion in 2024 and is expected to reach USD 21.96 billion in 2025.

b. The global non grain oriented electrical steel market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2030 to reach USD 27.69 billion by 2030.

b. The transformers segment dominated the market with a volume share of over 51.0% in 2024.

b. Some of the key vendors of the global non grain oriented electrical steel market are ArcelorMittal; POSCO; Nucor Corporation; Baosteel Group Corporation; NIPPON STEEL CORPORATION; JFE Steel Corporation; thyssenkrupp Steel; Cleveland-Cliffs Inc.; Arnold Magnetic Technologies; VIZ-Steel.

b. The key factor driving the growth of the global non grain oriented electrical steel market is the rising demand for efficient transformers and electric motors, coupled with the growing emphasis on renewable energy and energy-efficient technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.