- Home

- »

- Pharmaceuticals

- »

-

Non Hodgkin Lymphoma Therapeutics Market Report, 2030GVR Report cover

![Non Hodgkin Lymphoma Therapeutics Market Size, Share & Trends Report]()

Non Hodgkin Lymphoma Therapeutics Market Size, Share & Trends Analysis Report, By Therapy Type (Radiation Therapy, Chemotherapy, Targeted Therapy), By Cell Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-173-8

- Number of Report Pages: 149

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

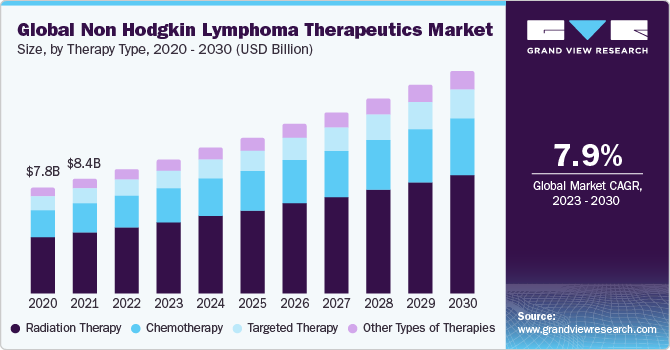

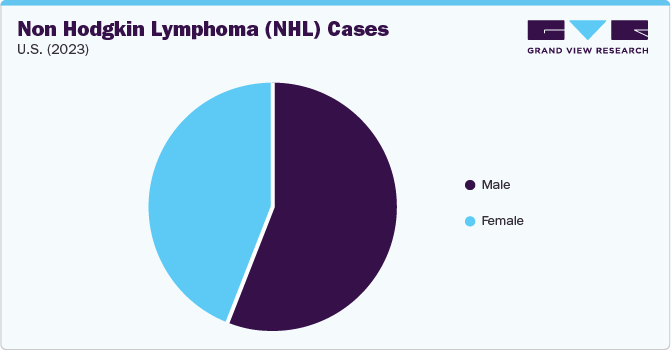

The global non hodgkin lymphoma therapeutics market size was valued at USD 9.14 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.95% from 2023 to 2030. The non hodgkin lymphoma therapeutics market is anticipated to experience significant growth due to the rising number of novel and innovative developments aimed at providing more effective treatments for non-Hodgkin lymphoma disease. There is an increasing need for effective treatments due to the ongoing increase in cancer cases. According to the American Cancer Society, in January 2023, the lifetime risk of developing NHL was 1 in 43 for men and 1 in 53 for women.

Additionally, the market is propelled by an increasing demand for cost-effective and accessible therapeutic solutions. Healthcare systems globally are confronted with the task of delivering efficient cancer treatments within budget constraints. Consequently, there is a crucial requirement for therapies that are not just clinically potent but also financially feasible for patients. This has driven pharmaceutical companies and healthcare providers to prioritize the development of affordable treatments, making them accessible to a wider population.

Therapy Type Insights

On the basis of therapy type, the market is segmented intoradiation therapy, chemotherapy, targeted therapy, and other types of therapies. The radiation therapy segment held the largest market share in 2022 as it is considered the primary choice in the treatment of non-Hodgkin's lymphoma due to its targeted nature and effectiveness in managing localized lymphomas. Its precision in targeting specific cancerous areas, coupled with technological advancements like intensity-modulated radiation therapy and proton therapy, has minimized side effects and increased its efficiency.

Moreover, the flexibility to combine radiation therapy with other treatments amplifies its impact on cancer cells. Its ability to customize radiation doses based on tumor size and location, combined with a proven track record, solidifies its position as the dominant therapy in the non-Hodgkin's lymphoma market. On the other hand,chemotherapy is expected to witness lucrative growth over the forecast period.

Cell Type Insights

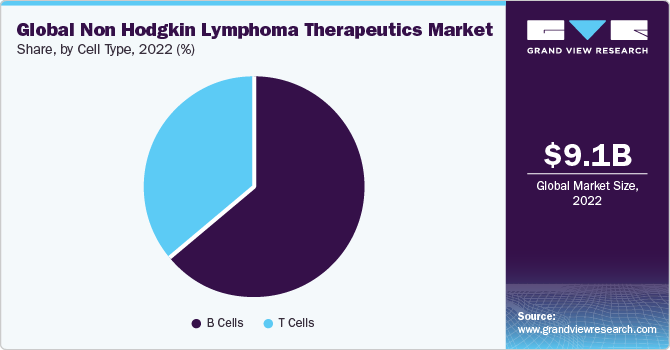

On the basis of cell type, the market is segmented intoT-cell lymphoma and B-cell lymphoma. B cells dominated the market primarily because NHL often originates from B cells making B cell-targeted therapies highly effective. B cells play a central role in the immune system and are involved in various stages of NHL development. Therapies that specifically target B cells, such as monoclonal antibodies (like rituximab) and chimeric antigen receptor (CAR) T-cell therapies, have shown remarkable success in treating B cell NHL subtypes. These therapies work by directly attacking cancerous B cells, leading to higher response rates and improved outcomes for patients. On the other hand, T cells are expected to witness lucrative growth over the forecast period.

Regional Insights

North America dominated the market in 2022. The region benefits from advanced healthcare infrastructure, a robust research and development environment, and significant investments in cancer therapies. According to the National Center for Biotechnology Information, in January 2021, an estimated 77,200 new cases of non-Hodgkin's lymphoma were diagnosed in 2020 in the US, accounting for 4.3% of cancer diagnoses. Additionally, the presence of key market players, leading pharmaceutical companies, and academic institutions conducting cutting-edge research contributes to the development and adoption of innovative therapies. Furthermore, well-established healthcare policies and reimbursement systems facilitate the widespread availability of novel treatments, making North America a hub for clinical trials and the early commercialization of breakthrough therapies.

Key Companies & Market Share Insights

Key players operating in the market are AstraZeneca Plc, Bayer AG, F. Hoffmann La-Roche Ltd, GlaxoSmithKline Plc, Seagen Inc., Takeda Pharmaceutical Company Limited, Janssen Pharmaceuticals Inc., Eli Lilly, and Company, F. Hoffmann La-Roche Ltd, and Spectrum Pharmaceuticals Inc. The market participants are working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives:

-

In May 2023, the U.S. FDA approved the SIR Pant Immunotherapeutic IND application for a phase I clinical trial to treat relapsed refractory non-Hodgkin lymphoma.

-

In June 2023, the FDA granted approval to Columvi, a bispecific antibody developed by Genentech, marking the first and only treatment with a fixed-duration course for individuals diagnosed with relapsed or refractory Diffuse Large B-cell lymphoma.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."