- Home

- »

- Pharmaceuticals

- »

-

Non-steroidal Anti-inflammatory Drugs Market Report, 2030GVR Report cover

![Non-steroidal Anti-inflammatory Drugs Market Size, Share & Trends Report]()

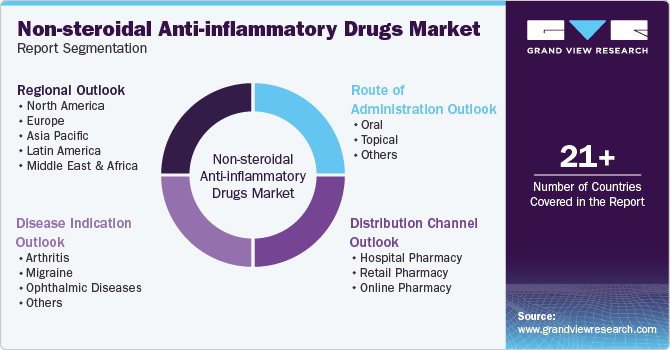

Non-steroidal Anti-inflammatory Drugs Market Size, Share & Trends Analysis Report By Disease Indication (Arthritis, Ophthalmic Diseases), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-952-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

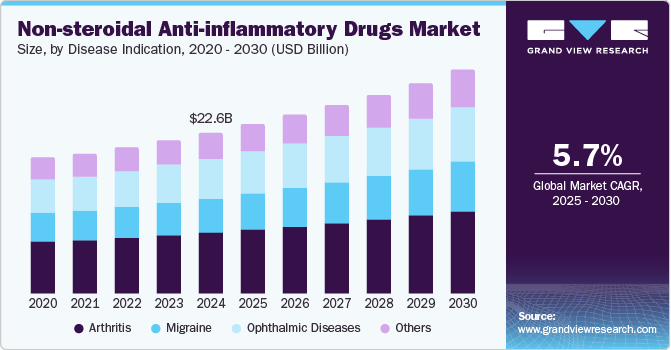

The global non-steroidal anti-inflammatory drugs market size was estimated at USD 22.58 billion in 2024 and is expected to grow at a CAGR of 5.66% from 2025 to 2030. The growth of the non-steroidal anti-inflammatory drugs (NSAIDs) market is driven by the global rise in chronic pain prevalence and the increasing geriatric population. Expanded demand for OTC NSAIDs and broader applications in conditions such as headaches, migraines, toothaches, and menstrual pain further support growth projections. Additionally, a diverse NSAIDs product portfolio and new product approvals and launches contribute to market momentum during the forecast period.

The increasing prevalence of arthritis and other pain-related disorders is expected to support industry growth over the forecast period. In 2024, nearly one-quarter of U.S. adults are estimated to have arthritis, equating to over 350 million cases globally. The most prevalent types include osteoarthritis, affecting over 32.5 million Americans, and rheumatoid arthritis, impacting approximately 1.36 million. Among those diagnosed, nearly 50% are aged 65 and older, while the condition significantly affects women. Racial disparities are evident, with 41.3 million non-Hispanic white adults, 6.1 million non-Hispanic Black adults, and 4.4 million Hispanic adults reported as affected.

The geriatric population is more susceptible to diseases such as CVDs, cancer, diabetes, chronic pain, arthritis, and others. Thus, the rising geriatric population across the globe is expected to support market growth. WHO’s October 2024 report highlights the rapid aging of global populations, noting that by 2050, 80% of older adults will reside in low- and middle-income countries. This shift emphasizes the need for robust health systems to address age-associated conditions like osteoarthritis and chronic pain, commonly managed with NSAIDs. As demand grows for NSAID-based treatments in these regions, industry expansion is expected, especially where aging demographics drive accessibility improvements and policy support. These factors align with anticipated non-steroidal anti-inflammatory drugs market growth, given rising needs in chronic pain management.

The growth of the NSAIDs market is driven by a diverse product portfolio. Notably, Pfizer Inc. produces Ketorolac tromethamine, indicated for treating moderate to severe acute pain requiring opioid-level analgesia. Additionally, GSK's Excedrin, a combination of paracetamol, aspirin, and caffeine, remains a top choice for headache relief. The strong industry presence of established brands and the rising availability of combination therapies are expected to enhance growth prospects during the forecast period further.

Disease Indication Insights

The arthritis segment dominated the non-steroidal anti-inflammatory drugs industry and accounted for the largest revenue share of 37.72% in 2024 due to the increasing prevalence of arthritis and a growing aging population. The rise in treatment options, including nonsteroidal anti-inflammatory drugs (NSAIDs) and biologics, has further fueled industry growth. Additionally, heightened awareness of arthritis and advancements in treatment technologies have contributed to this segment's dominance. Market players are also focusing on innovative product development to address the diverse needs of arthritis patients.

The migraine segment is projected to experience significant growth opportunities during the forecast period. This is driven by the increasing prevalence of migraines and advancements in treatment options, including prescription medications and over-the-counter (OTC) products. The demand for innovative therapies, such as neuromodulation devices and biologics, is also expected to rise. Additionally, greater awareness of migraine management and a growing focus on personalized treatment approaches contribute to industry expansion. Key players are investing in research and development to address unmet needs, positioning the migraine segment for robust growth.

Route of Administration Insights

The oral segment dominated the market and accounted for the largest revenue share of 52.46% in 2024 due to its convenience and effectiveness in delivering medications. Oral administration is preferred by both patients and healthcare providers for its ease of use, adherence, and versatility across various therapeutic areas, including pain management and chronic conditions. The rise in demand for over-the-counter (OTC) pain relief and prescription medications further fuels this segment's growth. Additionally, advancements in formulation technology enhance the bioavailability of oral drugs, making them more appealing to consumers. This trend is expected to continue as the industry evolves.

The topical segment is anticipated to experience the fastest CAGR during the forecast period, driven by increasing consumer preference for non-invasive and localized treatment options. The rising prevalence of skin-related ailments, such as psoriasis and eczema, along with the growing demand for pain management solutions, are contributing to this segment's expansion. Innovations in formulation technology, including enhanced penetration and sustained release, further bolster industry interest. Moreover, the growing trend of self-medication is expected to increase the adoption of topical treatments, enhancing their industry presence.

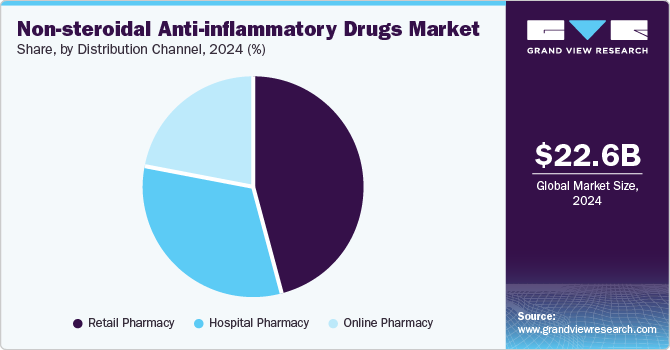

Distribution Channel Insights

The retail pharmacy segment dominated the non-steroidal anti-inflammatory drugs industry and accounted for the largest revenue share of 45.89% in 2024, driven by its extensive distribution network and accessibility to consumers. Factors contributing to this dominance include the increasing demand for over-the-counter medications and the rising trend of self-medication among patients. Retail pharmacies offer a wide range of pharmaceutical products, ensuring convenience and prompt service, which enhances customer satisfaction. Furthermore, the growing prevalence of chronic diseases is propelling the demand for continuous medication, further solidifying the retail pharmacy’s industry position. Sources indicate that this segment’s growth is expected to continue, reflecting shifts in consumer behavior and healthcare delivery models.

The hospital pharmacy segment held the second largest market share, driven by high adoption rates of advanced pharmaceutical practices and increasing patient admissions. Hospital pharmacies play a crucial role in medication management, particularly for patients with complex conditions requiring specialized care. The rising emphasis on patient safety and personalized medicine further enhances the demand for hospital pharmacy services. Additionally, innovations in drug formulation and delivery systems contribute to the growth of this segment. The integration of technology in hospital pharmacies also supports efficient inventory management and improved patient outcomes.

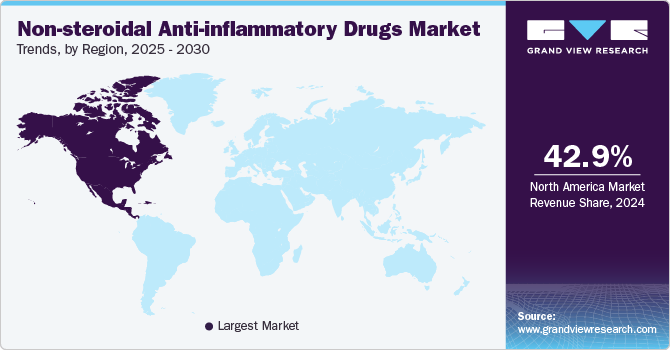

Regional Insights

North America dominated the global non-steroidal anti-inflammatory drugs industry and accounted for the 42.9% revenue share in 2024, the industry is expected to grow significantly, influenced by several key factors. A large number of manufacturers and strategic initiatives by leading companies are propelling market expansion.

Additionally, a rising incidence of chronic pain and arthritis is projected to further drive growth. According to CDC estimates, the prevalence of arthritis is set to increase substantially, with over 78.4 million adults anticipated to have a doctor-diagnosed arthritis condition by 2040. Prominent industry players, including Pfizer Inc., Johnson & Johnson Consumer Inc., and GSK Group of Companies, maintain a solid presence in North America, supporting continued market growth across the U.S., Canada, and Mexico.

U.S. Non-steroidal Anti-inflammatory Drugs Market Trends

The U.S. non-steroidal anti-inflammatory drugs industry held a significant share of the North American market in 2024 driven by the increasing prevalence of chronic pain conditions and the growing demand for effective pain management solutions. The robust product offerings and innovative formulations from key players have bolstered industry growth. Additionally, the rising focus on over-the-counter (OTC) availability and the integration of NSAIDs into combination therapies are contributing factors. This segment is expected to maintain its dominance due to ongoing advancements in drug delivery systems and formulations.

Europe Non-steroidal Anti-inflammatory Drugs Market Trends

The Europe NSAIDs market is witnessing significant growth, driven by increasing awareness of pain management solutions and the rising prevalence of chronic pain conditions. Increased education on the effective use of NSAIDs for various ailments, coupled with the expansion of OTC availability, is propelling market expansion. Additionally, the growing aging population in Europe, which is more susceptible to conditions requiring pain relief, further stimulates demand for NSAIDs. Regulatory support for innovative formulations and the development of combination therapies also contribute to this industry growth.

The UK NSAIDs market is projected to grow significantly due to increasing awareness of pain management and the prevalence of chronic conditions. The National Health Service (NHS) emphasizes the importance of NSAIDs in treatment protocols, contributing to higher consumption rates. The presence of key pharmaceutical companies enhances industry competition and innovation. The UK government’s initiatives to promote effective pain management strategies further support market growth .

The non-steroidal anti-inflammatory drugs market in Germany represents a substantial share in Europe, driven by a strong healthcare system and high demand for effective pain relief medications. The adoption of combination therapies and the integration of NSAIDs in treatment plans for arthritis and other chronic conditions are notable trends. Regulatory support for over-the-counter NSAIDs contributes to industry accessibility, facilitating growth opportunities for manufacturers.

Asia Pacific Non-steroidal Anti-inflammatory Drugs Market Trends

The Asia Pacific NSAIDs industry is experiencing robust growth, attributed to rising healthcare expenditure and increased consumer awareness of pain management solutions. The region's aging population and a higher incidence of chronic diseases such as arthritis are significant factors driving demand. Key players are expanding their product offerings to cater to diverse consumer needs, enhancing market penetration.

China NSAIDs market is expanding rapidly due to a growing population and increased incidence of chronic pain conditions. The government's focus on improving healthcare infrastructure and access to medications supports this growth. The rising prevalence of lifestyle-related diseases has led to a surge in demand for effective pain management solutions, positioning NSAIDs as a crucial component of the pharmaceutical market.

The NSAIDs market in Japan is characterized by a high level of consumer awareness and an established healthcare system. The prevalence of geriatric populations and the increasing use of NSAIDs for managing chronic pain are driving factors. Innovative formulations and targeted therapies are gaining traction, supported by extensive research and development efforts from leading pharmaceutical companies.

Latin America Non-steroidal Anti-inflammatory Drugs Market Trends

The Latin America NSAIDs market is expected to significantly grow over the forecast period owing to increasing prevalence of chronic disorders requiring the use of NSAIDs and high demand for NSAIDs. Furthermore, the rising geriatric population susceptible to chronic illness leads to high demand for pain medications including NSAIDs.

Brazil NSAIDs market is witnessing steady growth, fueled by an increasing focus on healthcare accessibility and the prevalence of pain-related disorders. Government policies to expand healthcare coverage and improve drug availability support market expansion. The demand for affordable over-the-counter NSAIDs is rising, reflecting changing consumer preferences toward self-medication.

MEA Non-steroidal Anti-inflammatory Drugs Market Trends

The MEA NSAIDs market is growing due to rising awareness of chronic pain management and an increasing incidence of musculoskeletal disorders. The expanding pharmaceutical sectors in South Africa and the UAE enhance industry dynamics. Collaborative efforts between healthcare providers and pharmaceutical companies to improve access to NSAIDs also contribute to market growth.

Saudi Arabia's NSAIDs market is expanding as healthcare initiatives prioritize pain management. The country’s Vision 2030 framework aims to improve health outcomes, driving demand for effective pain relief solutions. The presence of both local and international pharmaceutical companies facilitates market competition, further enhancing product availability and consumer access to NSAIDs.

Key Non-steroidal Anti-inflammatory Drugs Company Insights

The competitive scenario in the NSAIDs industry is characterized by the presence of several key players, including Pfizer, Bayer, and Johnson & Johnson, each offering a range of products to meet diverse consumer needs. Market strategies focus on innovation, pricing, and distribution channels. Companies invest in research and development to create advanced formulations and combination therapies. The market also sees increased competition from generic brands, which offer cost-effective alternatives. Regulatory compliance and quality assurance remain critical for maintaining market position. Collaborations and partnerships enhance distribution capabilities and market reach.

Key Non-steroidal Anti-inflammatory Drugs Companies:

The following are the leading companies in the non-steroidal anti-inflammatory drugs (NSAIDs) market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- Bayer AG

- GSK plc

- Dr. Reddy’s Laboratories Ltd

- Viatris Inc

- Teva Pharmaceutical Industries Ltd.

- Johnson and Johnson Services, Inc.

- Merck & Co., Inc.

Recent Developments

-

In April 2024, Glenmark Pharmaceuticals announced the U.S. FDA's approval of its Acetaminophen and Ibuprofen Tablets (250 mg/125 mg), classified as an OTC product. This formulation is bioequivalent to Haleon's Advil Dual Action with Acetaminophen, which generated approximately USD 84.1 million in sales over the past year. Glenmark aims to enhance its portfolio, with 195 products authorized in the U.S. and 52 ANDAs pending. The company focuses on therapeutic areas such as respiratory, dermatology, and oncology, operating globally with 11 manufacturing facilities.

-

In February 2024, Hikma Pharmaceuticals launched COMBOGESIC IV in the U.S., providing a new opioid-free option for adult pain management. COMBOGESIC IV combines acetaminophen (1,000 mg) and ibuprofen (300 mg) for intravenous use, approved by the FDA in October 2023 for mild to moderate pain relief and as an adjunct for severe pain alongside opioids. The product’s dual-action approach aligns with the American Society of Anesthesiology’s multimodal pain management strategy, aiming for quicker and sustained relief. Originally developed by AFT Pharmaceuticals, COMBOGESIC IV is also marketed as MAXIGESIC IV outside the US.

-

In December 2023, Scilex Holding Company filed a New Drug Submission to Health Canada for ELYXYB (celecoxib oral solution), aimed at treating acute migraines. ELYXYB is the only FDA-approved ready-to-use oral solution for migraines, showing efficacy in pain relief within 15 minutes. The Canadian migraine therapeutics market is projected to reach USD 400 million by 2025. Approval is anticipated in about 12 months. Scilex aims to provide alternatives for patients who do not respond to triptan therapies.

Non-steroidal Anti-inflammatory Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.76 billion

Revenue forecast in 2030

USD 31.29 billion

Growth rate

CAGR of 5.66% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease indication, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Pfizer Inc.; Bayer AG; GSK plc; Dr. Reddy’s Laboratories Ltd; Viatris Inc; Teva Pharmaceutical Industries Ltd.; Johnson and Johnson Services, Inc.; Merck & Co., Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Non-steroidal Anti-inflammatory Drugs Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global non-steroidal anti-inflammatory drugs market report on the basis of disease indication, route of administration, distribution channel, and region:

-

Disease Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Arthritis

-

Migraine

-

Ophthalmic Diseases

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Topical

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global non-steroidal anti-inflammatory drugs market size was estimated at USD 22.58 billion in 2024 and is expected to reach USD 23.76 billion in 2025.

b. The global non-steroidal anti-inflammatory drugs market is expected to grow at a compound annual growth rate of 5.66% from 2025 to 2030 and is expected to reach USD 31.29 billion by 2030.

b. The arthritis segment is expected to dominate the non-steroidal anti-inflammatory drugs market with a share of 37.72% in 2024 due to the high prevalence of disease and high prescription rate of NSAIDs for arthritis.

b. Some key players operating in the non-steroidal anti-inflammatory drugs market include Pfizer Inc., Bayer AG, GSK plc, and Viatris Inc among others.

b. Rising prevalence of chronic pain in geriatric population, increasing demand for OTC NSAIDs, and increasing government initiatives to reduce disease burden are the major factors driving the non-steroidal anti-inflammatory drugs market growth over the forecast period.

b. North America held the largest share of 42.92% in 2024 and is expected to register a lucrative growth rate over the forecast period. It is attributable to the presence of large number of manufacturers and strategic initiatives undertaken by market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."