- Home

- »

- Medical Devices

- »

-

Non-surgical Rhinoplasty Market Size & Share Report, 2030GVR Report cover

![Non-surgical Rhinoplasty Market Size, Share & Trends Report]()

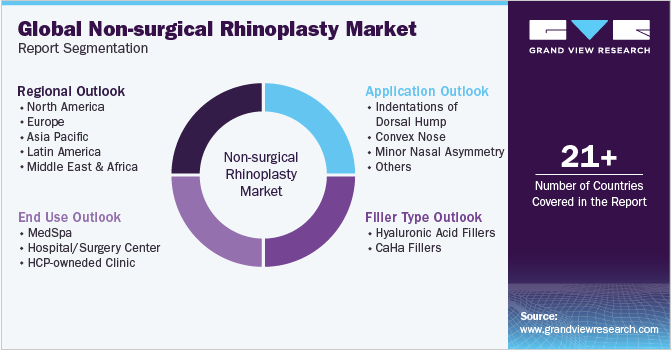

Non-surgical Rhinoplasty Market Size, Share & Trends Analysis Report By Filler Type (HA Filler, CaHa Filler), By Application (Convex Nose, Others), By End Use (MedSpa, HCP-owned Clinic), By Region And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-987-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global non-surgical rhinoplasty market size was valued at USD 696.6 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2023 to 2030. Noninvasive aesthetic procedures like liquid Rhinoplasty offer advantages including shorter downtime, less pain & surgical wounds, smaller incisions, rapid wound healing, and fewer complications compared with invasive surgeries. Moreover, currently available minimally invasive surgeries are more effective and provide better outcomes than conventional surgical treatments. These factors are expected to boost market growth.

The COVID-19 pandemic had no significant effect on the non-surgical rhinoplasty market. According to SKIN, The Journal of Cutaneous Medicine, a drop of more than 50% in patient volume was observed in the U.S. However, the International Society of Aesthetic Plastic Surgery reported in its 2021 press release that the demand for non-surgical aesthetic treatments like fillers increased significantly post-pandemic due to the rising social media influence, increasing disposable income, and aesthetic consciousness.

Non-surgical rhinoplasty/liquid rhinoplasty is a medical aesthetic procedure in which injectable fillers, most commonly hyaluronic acid brands like Restylane and Juvederm or calcium hydroxyapatite like Radiesse, are used to alter and shape a person's nose without surgery. Majority of the people are opting for this procedure as it is much less expensive than a traditional rhinoplasty. As per the American Society of Plastic Surgeons, the treatment may cost between $600 to $1,900 per session depending upon the brand of filler used which is way less compared to surgical Rhinoplasty treatments. Non-surgical nose job results generally last between nine to 18 months, depending on the hyaluronic acid-based filler used during treatment.

Hyaluronic acid and calcium hydroxylapatite are the two most commonly used fillers for injection. Recent studies have found that most injectable fillers are met with success and patient satisfaction, but vascular complications are still a serious problem, and therefore only licensed cosmetic surgeons are trained to carry out this procedure.

A 2016 study published in Plastic and Aesthetic Research Journal reports that 10% of 250 patients reported that the filler injection lasted only a short duration of less This requires patients to receive repeat injections, which increases the risk of complications and might hinder the market growth.

As per the American Academy of Facial Plastic and Reconstructive Surgery, Perlane a cross-linked HA filler launched in 2000, is very effective in non-surgical Rhinoplasty treatments as its increased density permits the surgeon to sculpt more effectively. It has less of a tendency to spread, so better definition can be achieved and also lasts longer. Moreover, increasing nasal deformities and minor injuries that affect one’s confidence have led to increasing demand for this cosmetic procedure. As per PubMed, the bump on the bridge of the nose is what drives the lion's share of patients to seek injection rhinoplasty.

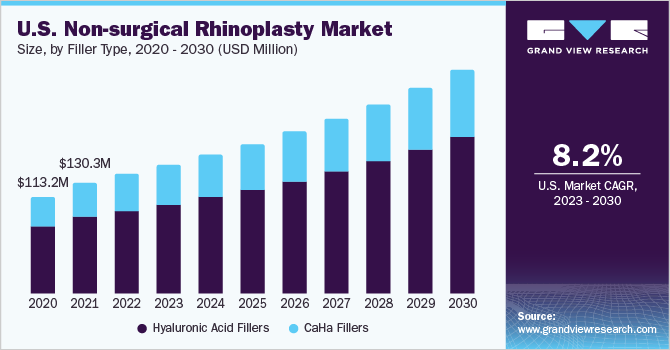

Filler Type

The Hyaluronic acid filler segment led the market in 2022 with a revenue share of more than 70.3%. The filler type segment is divided into hyaluronic acid fillers and CaHa Fillers. The HA filler segment held a large market share as the majority of plastic surgeons prefer using HA fillers which provide a softness and a natural feel to the nose after the procedure. The filler also dissolves quickly, is biocompatible with the body, and is reversible if a complication arises. HA filler brands like Restylane, Juvederm, and Perlane are the most preferred HA brands used by aesthetic professionals for non-surgical Rhinoplasty procedures.

CaHa fillers are also witnessing significant growth rate of 8.0% as CaHA makes it possible to precisely create aesthetically pleasing tip-defining points in patients with rounded and poorly defined tips. CaHa fillers usually last between 12 and 18 months, while HA fillers last between 6 and 12 months which is also a factor why some professionals opt for CaHa fillers. Factors like long duration of hold, moldability, high viscosity, high elasticity, and low immunogenicity are expected to help boost market growth. However, many studies have reported complications in non-surgical Rhinoplasty patients when treated with CaHa injections which might hinder growth.

Application Insights

The minor nasal asymmetry segment accounted for the largest revenue share of 31.7% in 2022. This is mainly due to the fact that the majority of the patients opt for liquid Rhinoplasty procedures to treat minor asymmetry like a bumpy nose. Bumpy/wavy noses are among the most prevalent nose shapes found globally and as per NCBI, 9% of the world population has a bumpy nasal structure which is also the most common nose shape. This nose is marked by its bumpy outline, with either a subtle or prominent curve in the dip. The curve can be mild or intensive.

Liquid Rhinoplasty procedures can help patients achieve a more balanced facial appearance and are therefore in high demand among millennials who are constantly conscious about their facial appearance on social media platforms.

The others application segment is also expected to witness significant growth rate of 8.2% over the forecast period. Post-rhinoplasty contour defects or revisions, drooping nose tips, wide nostrils, etc. can be treated effectively with fillers that give the nose a straighter, smooth, and symmetric appearance. However, the effects of these fillers last for a short duration and are not permanent requiring repeated sessions that might hinder market growth.

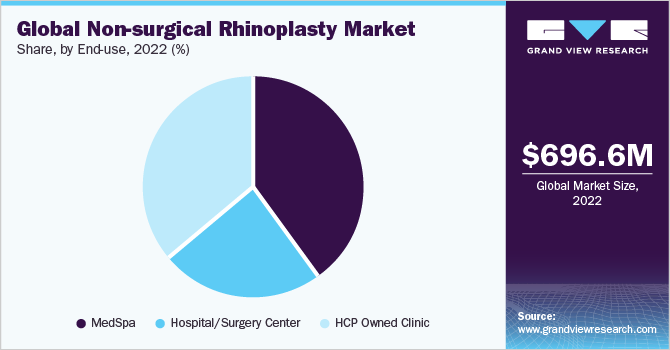

End-use Insights

Based on end-use, the global market has been divided into MedSpa, hospital/surgery center, HCP owned clinics. The MedSpa segment dominated the market and accounted for the largest revenue share of more than 39.6% in 2022. Med spas of aesthetic clinics are facilities wherein cosmetic treatments are administered under the supervision of a licensed physician. Med spas are generally a combination of aesthetic medical centers and day spas that offer corrective medical skin care treatments and products and such benefits coupled with accessibility and affordable treatment prices are expected to boost demand.

In 2017, the American Med Spa Association (AmSpa) reported that more than 4,200 Med spas are operating in the U.S. and this number has increased by 50% since 2016. HCP-owned clinics also held a significant market share of 36.4% in 2022 and is expected to grow during the forecast period. They are also known as dermatology clinics wherein both surgical and nonsurgical services are offered by certified plastic surgeons. According to IMS Health, as of 2013, there were 7,800 dermatology practices in the U.S. Among the total practices, 34% are solo practices and 48% of practices include three or more physicians.

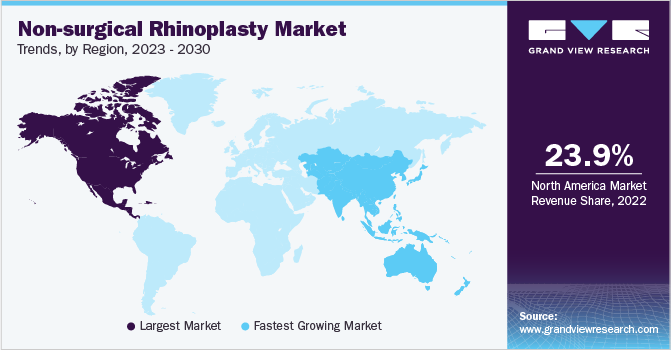

Regional Insights

North America dominated the market with a share of 23.90% in 2022. Easy availability and increasing adoption of advanced treatment options, such as liquid rhinoplasty, which help enhance esthetic appeal are among the factors responsible for market growth in North America. Increasing awareness regarding esthetic appeal and the presence of a large number of skilled cosmetic surgeons are some of the factors significantly contributing to the growth of this market.

However, the Asia Pacific region is expected to witness high growth of 8.8% over the forecast period. As per NCBI, the majority of the Asian and East Asian populations have been noted to have a dorsal hump deformity and lack nasal bridge as a large portion of the population has flat nose structures. These factors coupled with increasing aesthetic awareness, inexpensive treatment costs, and rising cosmetic treatments have led to an increase in the adoption of liquid Rhinoplasty procedure.

Key Companies & Market Share Insights

The key companies are concentrating on strategic initiatives, such as mergers and acquisitions, geographical expansions, increasing brand recognition, providing quality services, and expanding service locations. For instance, SKINovative clinic has launched a SKINovative ELITE VIP Membership, and this membership is designed to provide its members with a consistent and personalized regimen at reduced prices. Some of the prominent players in the global non-surgical rhinoplasty market include:

-

SKINovative of Gilbert - Medical Spa

-

The London Cosmetic Clinic

-

Laser Clinic United Kingdom

-

Therapie Clinic

-

Toronto Cosmetic Clinic (TCC)

-

Canada MedLaser, Inc.

-

Skin Vitality Medical Clinic

-

True MediSpa

-

Nova Aesthetic Clinic

-

VIVA Skin Clinic

-

Piedmont Plastic Surgery & Dermatology

Non-surgical Rhinoplasty Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 748.5 million

Revenue forecast in 2030

USD 1.3 billion

Growth rate

CAGR of 8.1% from 2023 to 2030

Base year for estimation

2022

Historic data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Filler type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; & MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Japan; India; China; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

SKINovative of Gilbert-Medical Spa; The London Cosmetic Clinic; Laser Clinic United Kingdom; Therapie Clinic; Toronto Cosmetic Clinic (TCC); Canada MedLaser, Inc.; Skin Vitality Medical Clinic; True MediSpa

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-surgical Rhinoplasty Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non-surgical rhinoplastymarket report based on filler type, application, end use, and region:

-

Filler Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Hyaluronic Acid Fillers

-

CaHa Fillers

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Indentations of dorsal hump

-

Convex Nose

-

Minor Nasal Asymmetry

-

Others

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

MedSpa

-

Hospital/Surgery Center

-

HCP-owneded clinic

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global non-surgical rhinoplasty market size was estimated at USD 696.6 million in 2022 and is expected to reach USD 748.5 million in 2023.

b. The global non-surgical rhinoplasty market is expected to grow at a compound annual growth rate of 8.1% from 2023 to 2030 to reach USD 1.3 billion by 2030.

b. North America accounted for the highest share of 23.9% of the non-surgical rhinoplasty market due to high awareness about non-invasive aesthetic treatment and the presence of major key players.

b. MedSpa end-use segment dominated the market owing to comprehensive services offered by such facilities, high accessibility, adoption of advanced products and technology as well as the availability of cost-effective treatments.

b. The major driving factor for the growth of the non-surgical rhinoplasty market is, immediate results, no downtime, less invasive, and inexpensive.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."