- Home

- »

- Plastics, Polymers & Resins

- »

-

Nonwoven Fabrics Market Size, Share, Growth Report, 2030GVR Report cover

![Nonwoven Fabrics Market Size, Share & Trends Report]()

Nonwoven Fabrics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Durables, Disposable), By Material (Polypropylene, Polyethylene Terephthalate), By Technology, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-278-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nonwoven Fabrics Market Summary

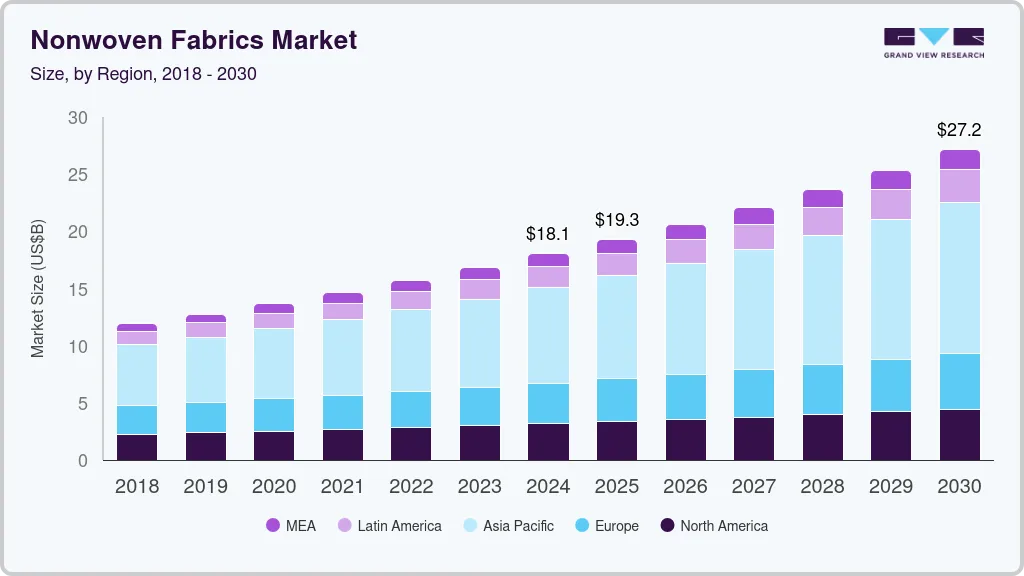

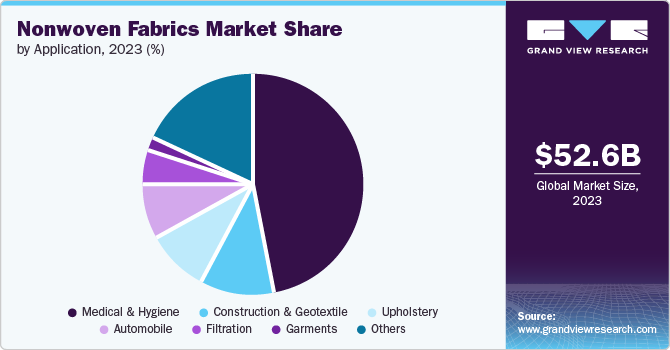

The global nonwoven fabrics market size was estimated at USD 52.56 billion in 2023 and is projected to reach USD 75.74 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. Nonwoven textiles are widely used in various sectors such as construction, healthcare, agriculture, and more.

Key Market Trends & Insights

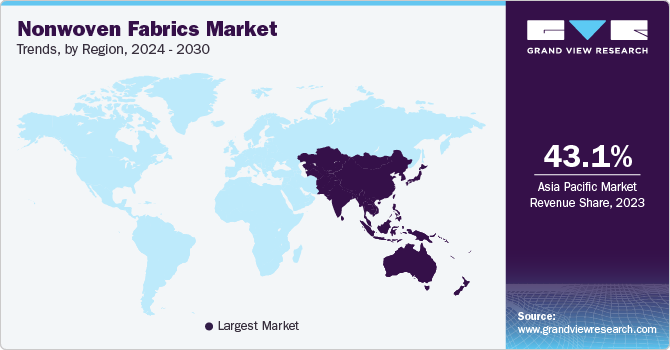

- Asia Pacific dominated the global nonwoven fabrics market with a share of 43.1% in 2023.

- The market for nonwoven fabrics in India is predicted to expand quickly during the forecast period.

- By product, the disposables segment dominated the market with 59.8% share in 2023.

- By material, the polypropylene segment dominated the market with a share of 45.3% in 2023.

- By technology, the spunlaid segment dominated the market with a share of 48.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 52.56 Billion

- 2030 Projected Market Size: USD 75.74 Billion

- CAGR (2024-2030): 4.9%

- Asia Pacific: Largest market in 2023

It is projected that the increasing need for strong, affordable, and lightweight materials in these industries will result in the growth of the nonwoven fabric market.

Non-woven fabric is utilized for producing a range of items in the medical field, including surgical gowns, aprons, drapes, face mask parts, and wound dressings. They are also utilized in hygiene items like sanitary towels, pads, tampons, diapers for babies, and liners for napkins. The continuous development in manufacturing processes for nonwoven fabrics through technological advancements is expected to result in lower production costs, upgraded properties, and better quality. This is expected to promote the use of nonwoven fabrics market growth in emerging industries in the coming years.

The market for non-woven materials is anticipated to witness rapid growth due to the rising hygiene concerns, thereby leading to an increase in the demand for sanitary care products. Furthermore, different companies are investing into the manufacturing of environmentally-friendly sanitary napkins as a response to increasing environmental concerns.

Product Insights & Trends

The disposables segment dominated the market with 59.8% share in 2023. Disposable nonwovens are widely used in personal care products, medical supplies and food packaging. The growth of the healthcare and hygiene sectors coupled with rising awareness about personal hygiene has led to an increase in the demand for disposable nonwovens.

The durable segment is projected to grow at 5.2% CAGR over the forecast period. The growing use of durable nonwoven fabrics in the automotive, construction, and clothing sectors is also driving up their demand. Durable nonwovens have benefits such as strength, durability, and resistance to damage, making them a great option for many uses.

Material Insights & Trends

The polypropylene segment dominated the market with a share of 45.3% in 2023. Polypropylene (PP) nonwoven fabrics are becoming increasingly popular due to their light weight and cost effectiveness. These materials are extensively utilized in a range of applications, including disposable hygiene items, medical fabrics, and geotextiles. The demand for PP nonwoven fabrics is fueled by the growth in these end-use industries. The growing emphasis on sustainability has prompted the creation of environmentally friendly PP nonwoven fabrics. Producers are embracing sustainable production techniques such as utilizing recycled PP materials and implementing energy-efficient manufacturing processes. These actions not only lessen the environmental effects of producing PP nonwovens but also address the increasing need for eco-friendly textile options.

The Polyethylene Terephthalate (PET) segment is projected to grow at a CAGR of 5.2% over the forecast period. PET nonwoven fabrics are recognized for their strong tenacity and modulus, making them ideal for uses that demand high strength and long-lasting qualities. The utilization of PET nonwovens in industries such as filtration, protective clothing, and automotive has risen due to their excellent mechanical characteristics.

Technology Insights & Trends

The spunlaid segment dominated the market with a share of 48.4% in 2023. Spunlaid nonwovens are commonly utilized in disposable items such as wipes, diapers, and surgical gowns. The growing world population and higher disposable incomes are fueling the demand for these goods, enhancing the spunlaid sector. Nonwoven fabrics are crucial in the medical field for making wound dressings, surgical drapes, and patient gowns. The healthcare sector's growth is being propelled by the expansion of the industry, especially in developing countries. Advancements in spunlaid nonwoven manufacturing methods, including the introduction of novel fibers and enhanced bonding techniques, are boosting the quality and flexibility of these materials, ultimately fueling market expansion.

The airlaid segment is projected to grow at a CAGR of 5.3% over the forecast period. Airlaid nonwovens are produced using natural materials such as wood pulp and cotton, which allows them to be broken down by natural processes and turned into compost. The growing emphasis on sustainability and environmental awareness is fueling the need for these environmentally friendly materials. Airlaid nonwovens are utilized in the packaging of food, as well as for tablecloths and napkins, due to their absorbent qualities and hygienic characteristics. The expanding food and beverage industry is fueling the growth of the sector. Airlaid nonwovens are employed in facial tissues, baby wipes and additional personal care items for their gentle texture and absorbing qualities. The increasing need for these items is pushing the airlaid sector.

Application Insights & Trends

The medical & hygiene segment dominated the market with a share of 47.1% in 2023. Consumers are becoming more conscious of the significance of cleanliness, especially following worldwide health emergencies such as the COVID-19 outbreak. This increased understanding has resulted in a growing need for products such as disposable wipes, diapers, and feminine hygiene products, which heavily depend on nonwoven fabrics. Strict rules imposed by the government on the safety and effectiveness of medical and hygiene products have resulted in a higher need for nonwoven fabrics that adhere to certain quality requirements. This has additionally enhanced the demand for nonwoven fabrics in these industries.

The upholstery segment is projected to grow at a CAGR of 4.7% over the forecast period. Consumers are looking for comfortable and long-lasting upholstery fabrics for their homes and commercial spaces. Nonwoven textiles are a preferred option for upholstery due to their exceptional comfort, breathability, and longevity. Nonwoven fabrics crafted from recycled or biodegradable materials are becoming increasingly popular in the upholstery industry and are leading to the market expansion.

Regional Insights & Trends

North America nonwoven fabrics market is expected to grow rapidly in coming years. The market has expanded due to the adoption of non-woven fabrics in medical and healthcare settings, including surgical gowns, masks, and other medical textiles. Businesses in North America are undertaking strategic partnerships and making investments to expand their

U.S. Nonwoven Fabrics Market Trends

The nonwoven fabrics market in the U.S. dominated the North America market with a share of 70.1% in 2023 due to the highly developed medical infrastructure combined with state-of-the-art technologies. A rise in medical tourism and healthcare services, coupled with a growing patient population, is anticipated to boost the demand for disposable products such as gowns, gloves, masks, surgical caps, and bed liners, driving up demand during the forecast period.

Europe Nonwoven Fabrics Market Trends

Europe nonwoven fabrics market was identified as a lucrative region in this industry in 2023 owing to the rising requirements for nonwoven fabrics in different industries such as healthcare, automotive, and construction.

The UK nonwoven fabrics market is expected to grow rapidly in the coming years due to the country's expansive healthcare industry and increasing construction sector. The shift towards eco-friendly nonwoven fabrics is being propelled by the nation's emphasis on sustainability and environmental regulations.

Germany nonwoven fabrics market held a substantial market share in 2023. The country's robust manufacturing sector and sizable automotive industry are propelling the expansion of the nonwoven fabrics market. The powerful automotive sector in the country significantl boosts the need for nonwoven fabrics utilized in car interiors and filtration systems.

Asia Pacific Nonwoven Fabrics Market Trends

Asia Pacific dominated the global nonwoven fabrics market with a share of 43.1% in 2023. The region is experiencing an increase in demand for medical and adult incontinence products due to the rising aging population and prevalence of chronic diseases. The strong economic growth in the area along with an increase in consumer goods demand has driven the requirement for nonwoven fabrics in different uses such as hygiene products, medical textiles, and packaging. Moreover, the market for nonwoven fabrics is growing due to the region's high population and increasing healthcare spending.

The market for nonwoven fabrics in India is predicted to expand quickly during the forecast period due to its expanding healthcare sector, increasing urbanization, and rising disposable incomes. The demand for nonwoven fabrics has been further increased by the country's government efforts to support domestic manufacturing and prioritize hygiene and sanitation.

The China nonwoven fabrics market held a considerable share in 2023 due to the country's status as a key global manufacturing center with a strong construction industry. The strong manufacturing industry in the country, combined with its large population and expanding middle class, has generated a significant demand for nonwoven fabrics in different sectors.

Key Nonwoven Fabrics Company Insights

Some of the key companies in the global nonwoven fabrics market include Ahlstrom; MITSUI & CO., LTD.; First Quality Enterprises, Inc.; Providencia and Fibertex. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Ahlstrom’s nonwoven fabrics are utilized in various sectors such as hygiene, medical, industrial, and automotive applications. The company is recognized for its inventive products and dedication to environmental responsibility.

Key Nonwoven Fabrics Companies:

The following are the leading companies in the nonwoven fabrics market. These companies collectively hold the largest market share and dictate industry trends.

- Ahlstrom

- MITSUI & CO., LTD.

- Polymer Group Incorporation

- Asahi Kasei Corporation.

- Fiberwebindia Ltd.

- Avgol Industries 1953 Ltd,

- First Quality Enterprises, Inc.

- Providencia

- PFNonwovens Holding s.r.o.

- Fibertex

Recent Developments

-

In May 2024, Asahi Kasei Corp. announced that that it is expected to acquire shares of Calliditas, a pharmaceutical company. Asahi Kasei anticipates the growth of the healthcare sector in developed economies, that are addressing geriatric population requirements, and is crucial to its growth as well.

-

In March 2024, Freudenberg Performance Materials launched a 100% synthetic wetlaid nonwoven product portfolio under “Filtura” brand name. These materials have been made in Germany and aredesigned for filtration and other industrial applications.

-

In September 2022, Toray Industries, Inc. announced the creation of spunbond nonwoven fabric. The fabric being hydrophilic is gentle on the skin and is suitable for masks, disposable diapers, sanitary applications, and feminine hygiene products.

Nonwoven Fabrics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 56.71 billion

Revenue forecast in 2030

USD 75.74 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Material, Technology, Application and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE and Kuwait

Key companies profiled

Ahlstrom; MITSUI & CO., LTD. ; Polymer Group Incorporation; Asahi Kasei Corporation.; Fiberwebindia Ltd.; Avgol Industries 1953 Ltd,; First Quality Enterprises, Inc.; Providencia; PFNonwovens Holding s.r.o.; Fibertex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nonwoven Fabrics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nonwoven fabrics market report based on product, material, technology, application and region.

-

Product Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

Durables

-

Disposable

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polypropylene

-

Polyethylene Terephthalate

-

Polymer

-

Rayon

-

Wood Pulp

-

BICO

-

Others

-

-

Technology Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

Spunlaid

-

Drylaid

-

Wetlaid

-

Airlaid

-

-

Application Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

Medical & Hygiene

-

Construction & Geotextile

-

Upholstery

-

Filtration

-

Automobile

-

Garments

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.