Nordic Beverage Packaging Market Trends

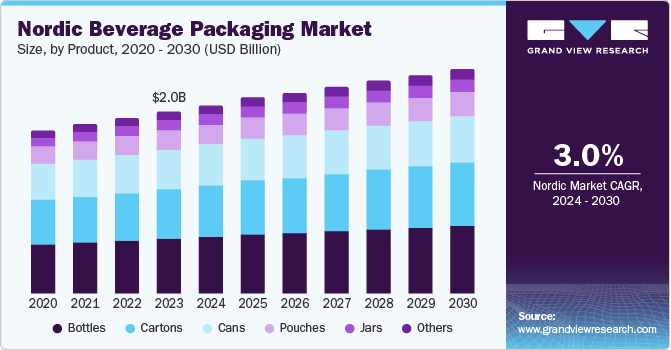

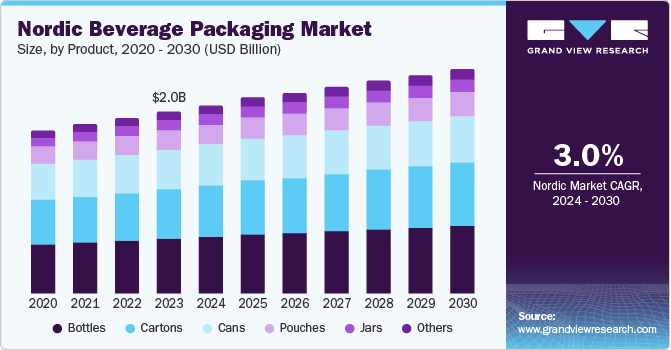

The Nordic beverage packaging market size was valued at USD 2.02 billion in 2023 and is projected to grow at a CAGR of 3.0% from 2024 to 2030. Growing demand for beverage packaging, coupled with increasing demand for carbonated and fruit and vegetable juices, is anticipated to drive product demand over the forecast period. Beverage packaging in the Nordic region is used in applications such as alcoholic and non-alcoholic beverages. Beverage manufacturers count on packaging solutions that aid in preventing leakage, chemical deterioration, and alteration in flavor of the products. Packaging also plays an important role in improving shelf appeal. The surge in e-commerce demands innovative packaging solutions, while regulatory pressure for circular economy practices is driving the adoption of eco-friendly materials in packaging.

Increasing consumption of both alcoholic and non-alcoholic beverages across the region is driving demand for packaging solutions. The increasing popularity of products such as smoothies and organic juices further fuels this demand. There is a noticeable shift towards premium alcoholic beverages among consumers, where older demographics are favoring high-quality products. This trend drives demand for sophisticated packaging solutions that enhance product presentation and brand image.

The Nordic region places a strong emphasis on sustainability, leading to a growing demand for environmentally friendly packaging solutions. Consumers are increasingly aware of the environmental impact of packaging waste, prompting manufacturers to adopt sustainable practices such as using recyclable materials and bioplastics. Innovations in packaging technology have improved the functionality and appeal of beverage containers. Packaging plays a crucial role in attracting consumers’ attention on retail shelves. Bottles and jars are favored not only for their practicality but also for their aesthetic appeal, which enhances brand visibility and consumer engagement.

Product Insights

Cartons accounted for the largest market revenue share of 27.2% in 2023 due to their sustainability and convenience. As consumers increasingly prioritize eco-friendly choices, cartons made from renewable resources such as paperboard are becoming the preferred packaging option. The advancements in carton technology have enhanced their barrier properties, allowing for the packaging of a wider range of beverages, including dairy products and juices.

Jars are expected to register a CAGR of 3.3% during the forecast period. Jars offer a unique advantage as they can be used for a wide range of beverages, from juices to smoothies and even alcoholic drinks. Their transparent nature allows consumers to see the product inside, enhancing visual appeal and encouraging impulse purchases. Consumers are seeking out unique and high-quality beverages, and glass jars offer an elegant and sophisticated packaging solution.

Material Insights

The conventional segment accounted for the largest market revenue share of 38.6% in 2023. The increasing demand for conventional beverage packaging materials, such as glass, aluminum, and PET (polyethylene terephthalate), can be attributed to their established reliability, recyclability, cost-effectiveness and durability. In addition, the rise of e-commerce and on-the-go consumption trends has fueled the need for durable yet lightweight packaging solutions that conventional materials can provide.

The bioplastics segment is expected to register the fastest CAGR of 9.7% during the forecast period. Consumers and brands are seeking eco-friendly options, and bioplastics offer a viable alternative to traditional plastics. Derived from renewable resources, they reduce dependence on fossil fuels and can be biodegradable or compostable, aligning with the region's circular economy goals.

End-use Insights

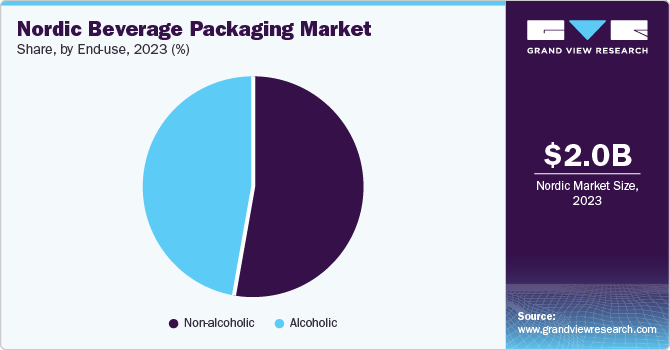

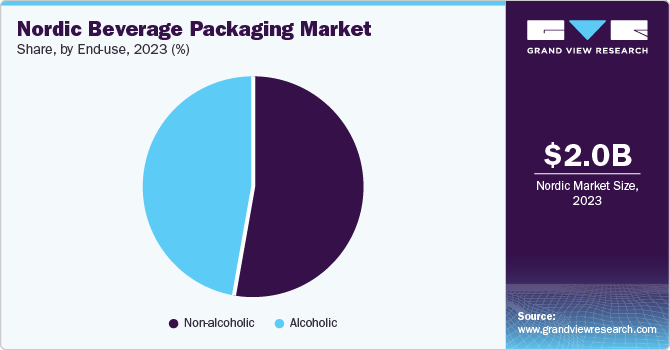

The non-alcoholics segment dominated the market and accounted for a share of 53.1% in 2023 due rising health consciousness among consumers, leading to a surge in demand for healthier drink options such as functional beverages, juices, and flavored waters. This shift in consumer preferences necessitates innovative and sustainable packaging solutions to cater to the diverse range of non-alcoholic beverages.

The alcoholic segment projected to grow at the fastest CAGR of 5.6% over the forecast period. The region's strong craft beer and spirits culture is fueling demand for premium and distinctive packaging. Moreover, the growing popularity of ready-to-drink (RTD) cocktails and canned wine is creating new opportunities for packaging solutions. Consumers are seeking convenient and portable packaging options that align with their lifestyle, driving innovation in this space.

Country Insights

Sweden Beverage Packaging Market Trends

The Sweden beverage packaging market dominated the market with a share of 29.1% in 2023. The country's well-established recycling infrastructure and consumer awareness of environmental issues have fostered a thriving market for eco-friendly packaging solutions. The combination of consumer demand for environmentally responsible practices and supportive regulatory frameworks is propelling the growth of the beverage packaging market in Sweden.

Iceland Beverage Packaging Market Trends

The Iceland beverage packaging market is expected to grow rapidly in the coming years due to its growing tourism industry and increasing disposable incomes. The country's unique natural resources and pristine environment have positioned it as a premium destination, driving demand for high-quality beverage packaging that reflects the country's brand image.

Key Nordic Beverage Packaging Company Insights

Some key companies in Nordic beverage packaging market include Amcor plc, Mondi, Coveris, Bemis Manufacturing Company, Ball Corporation, Tetra Pak, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry.

-

Amcor plc is a is a prominent player in packaging solutions, providing a diverse range of products that include flexible and rigid packaging, specialty cartons, closures, and related services. The company serves various industries such as food, beverage, pharmaceutical, medical devices, home care, personal care, and pet care.

Key Nordic Beverage Packaging Companies:

- Amcor plc

- Mondi

- Coveris

- Bemis Manufacturing Company

- Ball Corporation

- Tetra Pak

- Stora Enso

- Crown

- Reynolds Group Ltd.

- Saint-Gobain S.A.

- Sonoco Products Company

- ELOPAK

- Synvina

- Refresco Group

- Kulleborn & Stenström

- Alcoa Corporation

- BillerudKorsnäs AB

- NORNIR

- Altia Inc.

- Trensums Food AB

Recent Developments

-

In August 2024, Berry Global Group partnered with Aquafigure for a new line of reusable water bottles with an interchangeable 3D bottle card design. The collaboration is aimed at encouraging the young population to drink more water.

-

In January 2021, Lofoten Arctic Water announced the launch of new recyclable aluminum bottles made by Ball Corporation. These bottles will be filled near the water source in Lofoten Islands.

Nordic Beverage Packaging Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 2.10 billion

|

|

Revenue forecast in 2030

|

USD 2.50 billion

|

|

Growth Rate

|

CAGR of 3.0% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, Material, End Use and Region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

Norway, Sweden, Denmark, Finland, Iceland

|

|

Key companies profiled

|

Amcor plc, Mondi, Coveris, Bemis Manufacturing Company, Ball Corporation, Tetra Pak, Stora Enso, Crown, Reynolds Group Ltd., Saint-Gobain S.A., Sonoco Products Company, ELOPAK, Synvina, Refresco Group, Kulleborn & Stenström, Alcoa Corporation, BillerudKorsnäs AB, NORNIR, Altia Inc., Trensums Food AB

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Nordic Beverage Packaging Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Nordik Beverage Packaging market report based on product, material, end use and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cans

-

Bottles

-

Jars

-

Pouches

-

Cartons

-

Others

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional Plastic

-

Bioplastics

-

Paper

-

Glass

-

Metal

-

Others

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Norway

-

Sweden

-

Denmark

-

Finland

-

Iceland