- Home

- »

- Alcohol & Tobacco

- »

-

Non-alcoholic Beverages Market Size & Share Report, 2030GVR Report cover

![Non-alcoholic Beverages Market Size, Share & Trends Report]()

Non-alcoholic Beverages Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Carbonated Soft Drink, Bottled Water), By Distribution Channel (Food Service, Retail), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-206-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Non-alcoholic Beverages Market Summary

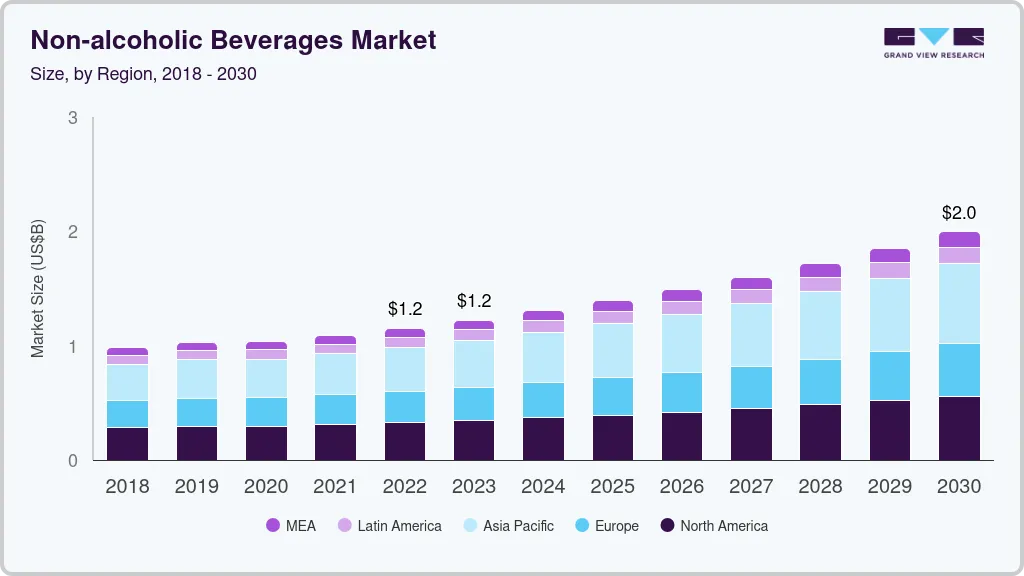

The global non-alcoholic beverages market size was estimated at USD 1,223.93 billion in 2023 and is projected to reach USD 1,997.25 billion by 2030, growing at a CAGR of 7.4% from 2024 to 2030. With the growing acceptance of the no-alcohol and low-alcohol categories by consumers, manufacturers in the market are catering to the new trends and have been innovating existing product portfolios, which is likely to bode well for future growth.

Key Market Trends & Insights

- Asia Pacific dominated the non-alcoholic beverages market with a revenue share of 33.5% in 2023.

- China accounted for the largest share of the market in Asia Pacific in 2023.

- By product, the carbonated soft drinks segment accounted for the largest share of 28.10% in 2023.

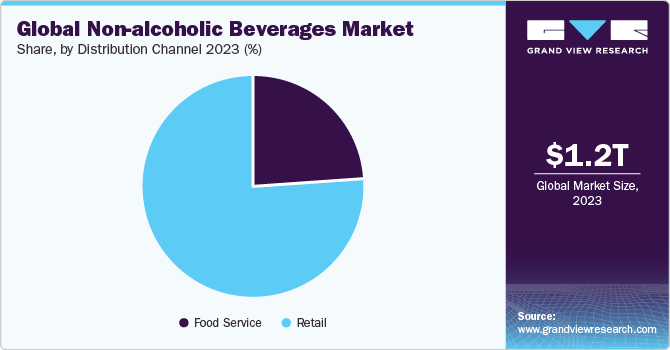

- By distribution channel, the retail segment dominated the market in 2023 and is projected to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1,223.93 Billion

- 2030 Projected Market Size: USD 1,997.25 Billion

- CAGR (2024-2030): 7.4%

- Asia Pacific: Largest market in 2023

The ripple effect of consumers opting for non-alcoholic drinks and beverages has been the development of a whole new segment of premium, complex-tasting soft drinks aimed at adult palates. According to a Waitrose Food and Drink Report published in October 2021, searches for alcohol-free drinks continue to increase by 22% every year. Brands have been keeping up pace with new trends by launching new offerings or expanding existing product lines. For instance, in May 2020, U.S.-based tea brand Good Earth expanded its product offering in the UK. The company’s portfolio includes a range of fruit & herbal, green, and black teas, as well as original and flavored kombucha, each blended with natural ingredients. According to the 2022 Bacardi Cocktail Trends Report, approximately 58% of consumers globally are shifting to non-alcoholic and low-ABV cocktails and beverages.

With the growing acceptance of the no-alcohol and low-alcohol categories by consumers, manufacturers in the market are catering to the new trends and have been innovating their current product portfolios, which is likely to bode well for future growth. The rising consumer consciousness about the health benefits of consuming bottled water is projected to drive the segment. An inclination toward bottled water over ordinary water, particularly among younger consumers, drives product sales. Observing this trend, several restaurants are providing various types of bottled water.

Another key factor propelling the non-alcoholic beverage industry is the changing demographics and a shift in drinking habits among younger generations. Millennials and Generation Z, in particular, are showing a preference for moderation and balance, eschewing excessive alcohol consumption. This demographic trend has spurred the development of innovative and diverse non-alcoholic beverage options, ranging from alcohol-free beer and wine to craft mocktails, catering to a more discerning and sophisticated palate.

Market Concentration & Characteristics

Packaging and production are getting a makeover. Biodegradable bottles, water-saving processes, and locally sourced ingredients are becoming priorities. Consumers are thirsty for eco-conscious choices. Consumer demand for natural and organic products was influencing innovation. Beverages with fewer artificial additives, preservatives, and sweeteners were gaining traction.

Several market players such as Nestlé, PepsiCo, Unilever Non-alcoholic beverages company, Morning Foods, and General Mills are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

The non-alcoholic beverages market is significantly impacted by food safety regulations, which mandate adherence to specific safety standards. To guarantee the absence of harmful contaminants, government bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority in Europe enforce these standards for non-alcoholic beverages, aligning with the broader regulations governing food safety.

Emerging product that has gained considerable attention is the category of functional beverages. These beverages go beyond mere refreshment, offering added health benefits such as enhanced hydration, vitamins, antioxidants, and other bioactive compounds. The functional beverage market includes products like infused waters, herbal teas, and wellness shots, providing consumers with a diversified range of choices that align with their desire for health-conscious options.

Another substitute making waves in the market is the plant-based beverage category. With a growing number of consumers adopting vegetarian, vegan, or flexitarian diets, plant-based alternatives have become a popular choice. Plant-based milks, such as almonds, soy, oats, and coconut milk, has gained widespread acceptance as an alternative to traditional dairy products.

Product Insights

The carbonated soft drinks segment accounted for the largest revenue share of 28.10% in 2023. Carbonated soft drinks are known for their effervescence and wide array of flavors, catering to diverse taste preferences. The convenience and availability of CSDs in various packaging sizes further contribute to their popularity, making them a go-to choice for consumers seeking a quick and satisfying thirst-quencher.

Functional beverages segment is anticipated to witness significant market growth over the forecast period. Increasing awareness and emphasis on health and wellness. As consumers become more health-conscious, there is a growing demand for beverages that offer not just refreshments but also functional benefits. Functional beverages, which include products enriched with vitamins, minerals, antioxidants, and other health-promoting ingredients, align with the contemporary focus on preventive healthcare and overall well-being.

Distribution Channel Insights

Retail segment dominated the market in 2023. The segment is projected to expand further at the fastest CAGR during the forecast period. Supermarkets, hypermarkets, internet retailers, and other channels make up the retail channel. Due to the availability of a broad variety of brands and goods under one roof, supermarkets and hypermarkets in this subcategory hold the largest share. Several supermarkets are increasing their selections in the alcohol-free market, including Whole Foods, Target, Aldi, and Walmart.

Segment has been anticipated to grow at a rapid pace during the forecast period. Foodservice is one of the primary distribution channels for non-alcoholic beverages. Busy schedules of people worldwide, coupled with an increased disposable income, often compel them to dine out. New eateries cater to varied tastes and beverage preferences that further drive this trend. A growing number of full-service restaurants are adopting all-inclusive dining practices to serve better its consumers. This involves analyzing local dietary trends and innovating their offerings to align with the same. It increases the frequency of consumer visits.

Regional Insights

Asia Pacific dominated the overall non-alcoholic beverages industry with the market share of 33.5% in 2023. The increasing demand for alcohol-free beverages from developing countries, such as China, India, Thailand, and Malaysia, is expected to drive the regional market. Various government initiatives to develop the manufacturing sector by providing tax cuts, subsidies, and increasing FDI limits are attracting key global players to expand their operations and distribution facilities in this region. Also, due to a shift in beverage consumption patterns, consumers nowadays choose functional and flavored bottled water over carbonated drinks with high sugar content.

China accounted for the largest share of the market in Asia Pacific in 2023. One significant driver is the growing health consciousness among consumers. As awareness of the impact of lifestyle choices on health increases, many Chinese consumers are opting for nonalcoholic beverages as a healthier alternative to traditional sugary and alcoholic drinks. This trend is particularly pronounced among the younger generation, who are actively seeking beverages that align with their desire for a balanced and nutritious diet.

The North America region is expected to grow at a significant rate during the forecast period. North America, especially the U.S., is home to many globally renowned beverage manufacturers. However, the growing prevalence of obesity in the U.S. and Mexico along with taxes on sugar products imposed by the governments restrain the demand for Carbonated Soft Drinks (CSDs), which is a product of non-alcoholic beverages. This drives the demand for low-calorie beverages containing non-nutritive sweeteners.

Key Companies & Market Share Insights

Nestlé and PepsiCo non-alcoholic beverages Company are some of the dominant players operating in the non-alcoholic beverages industry.

-

Nestlé has a notable presence with a diverse portfolio catering to different consumer preferences. One of its flagship products is Nescafé, a globally recognized coffee brand offering a variety of coffee products such as instant coffee, ground coffee, and specialty coffee. Nestea, another prominent brand, provides a range of iced tea and ready-to-drink tea beverages.

-

PepsiCo has strategically positioned itself as a leader with a focus on offering a broad spectrum of choices to cater to diverse consumer preferences. Tropicana, a brand under PepsiCo, is renowned for its fruit juices, providing consumers with a variety of fruit flavors and nutritional options. Gatorade, another flagship brand, specializes in sports and energy drinks, targeting consumers engaged in physical activities.

Key Non-alcoholic Beverages Companies:

- Nestlé

- PepsiCo

- Unilever

- Keurig Dr. Pepper Inc.

- The Coca-Cola Company

- Jones Soda Co.

- Danone S.A

- Suntory Beverage & Food Ltd

- Asahi Group Holdings, Ltd.

- Red Bull

Recent Developments

-

In September 2023, Red Bull introduced its inaugural limited Red Bull Winter Edition Spiced Pear in the UK, featuring a complete range that comprises 250ml, 250ml PMP (Price Marked Pack), and 355ml Sugarfree variants. The product features a combination of pear infused with a hint of cinnamon.

-

In July 2022, PepsiCo, Inc. cleared an agreement to buy land near Denver International Airport, where it will build a 1.2 billion sq. ft. manufacturing facility. Denver is funding PepsiCo USD 1 Billion from its Business Incentive Fund to build the plant, which will turn out to be the company’s largest soda manufacturing facility in the U.S.

-

In February 2022, Nestlé launched a new plant-based version of Milo in Thailand. The new Ready-To-Drink (RTD) product is soy-based and combines the unique Milo malt flavor to provide a nutritious plant-based alternative.

-

In February 2022, Jones Soda Co. partnered with The ICEE Company, a leading provider of dispensed frozen beverage treats, to introduce new flavors in the market

Non-alcoholic Beverages Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,303.42 billion

Revenue forecast in 2030

USD 1,997.25 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion/trillion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Brazil; South Africa

Key companies profiled

Nestlé; PepsiCo; Unilever; Keurig Dr Pepper Inc.; The Coca-Cola Company; Jones Soda Co.; Danone S.A.; Suntory Beverage & Food Ltd.; Asahi Group Holdings, Ltd.; Red Bull

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-alcoholic Beverages Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non-alcoholic beverages market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Carbonated Soft Drinks

-

Bottled Water

-

RTD Tea & Coffee

-

Functional Beverages

-

Juices

-

Dairy-based Beverages

-

Others

-

-

Distribution channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food Service

-

Retail

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global non-alcoholic beverages market was estimated at USD 1,223.93 billion in 2023 and is expected to reach USD 1,303.42 billion in 2024.

b. The global non-alcoholic beverages market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 1,997.25 billion by 2030.

b. Asia Pacific dominated the non-alcoholic beverages market with a share of around 33.5% in 2023. This is owing to the Changes in consumer preferences and rapid urbanization coupled with the growing middle-class population are acting as primary drivers for this market.

b. Some of the key players operating in the non-alcoholic beverages market include Nestlé, PepsiCo, Unilever, Keurig Dr Pepper Inc., The Coca-Cola Company, Jones Soda Co., Danone S.A., SUNTORY BEVERAGE & FOOD LIMITED, Asahi Group Holdings, Ltd., Red Bull.

b. Key factors that are driving the non-alcoholic beverages market growth include expanding acceptance of no-alcohol and low alcohol categories among the consumers and growing demand for bottled water.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.