- Home

- »

- Medical Devices

- »

-

North America Advanced Wound Care Market Report, 2030GVR Report cover

![North America Advanced Wound Care Market Size, Share & Trends Report]()

North America Advanced Wound Care Market Size, Share & Trends Analysis Report By Product (Moist, Antimicrobial), By Application (Chronic Wounds, Acute Wounds), By End-use (Hospitals, Specialty Clinics), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-159-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

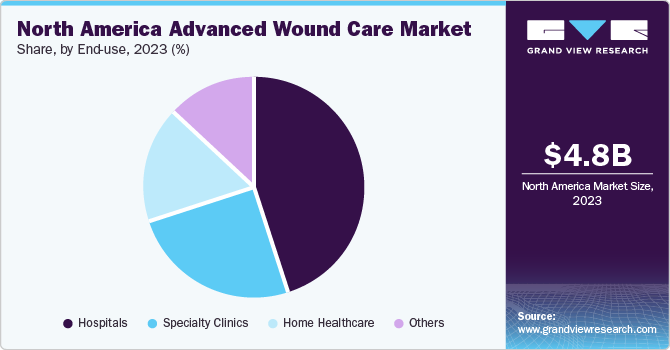

The North America advanced wound care market size was estimated at USD 4.8 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2030. The demand for advanced wound care products is increasing owing to the rising prevalence of chronic diseases across the region. Furthermore, increasing geriatric population is expected to impel market growth, as geriatric population has slow healing capabilities. For instance, as per a United Health Foundation report (published in May 2023), more than 55.8 million adults aged 65 and older lived in the U.S., accounting for about 16.8% of the nation's population in 2021, which is expected to propel market growth.

Advanced wound care products help to cure diabetic foot ulcers. For instance, according to JAMA Network, about 1.6 million people in the U.S. are affected by diabetic foot ulcers. Thus, an increase in number of diabetic patients is expected to increase the use of advanced wound care products. These products help in moisture retention and allow rapid healing of wounds internally as well as externally. Moreover, these products help in absorption of necrotic tissues and are effective in case of surgical site infection. Thus, healthcare professionals prefer to use advanced wound care products, which is anticipated to propel market growth over the forecast period.

The technological advancements in wound care products are projected to have a significant impact on the market. Some of the major technologically advanced products in this field are expected to be commercialized soon. For instance, nanoparticle-based wound healing and skin regeneration bioactive molecules have been developed, which when applied over the affected area, help sustain drug release and specifically improve the therapeutic effectiveness of drugs. Similarly, gene therapy products, which induce wound healing by introducing normal healthy genes into cells, are expected to be commercialized. For instance, in January 2023, Convatec launched the ConvaFoam in the U.S. ConvaFoam is a family of advanced foam dressings designed to meet the demands of medical professionals and their patients. This helped the company strengthen its presence in the U.S. market. Thus, with such advancements in wound care products, the market is expected to grow during the forecast period.

Market Concentration & Characteristics

The North America advanced wound care market is characterized by a high degree of innovation, with new technologically advanced wound care products being introduced regularly. With rising prevalence of chronic diseases in the region, market players are investing in new product launches to keep up with the growing demand.

Several market players such as Smith & Nephew; Mölnlycke Health Care AB; ConvaTec Group PLC; Baxter International; and Coloplast Corp. are involved in mergers and acquisitions (M&A). Through M&A activities, these companies can expand their geographic reach and enter new territories.

Companies are actively investing substantial resources in clinical trials and making regulatory submissions to obtain regulatory approval for pipeline products. This may result in companies incurring higher cost for developing novel advanced wound care products.

A wide range of product substitutes are available, as advanced wound care is a relatively new and rapidly evolving field of medicine. This is essential for meeting the varying treatment needs of patients with different types of chronic diseases.

End-use Insights

The hospital segment dominated the market and held the largest revenue share in 2023. The growth of this segment can be attributed to an upsurge in surgical procedures and an increase in the number of hospital admissions. For instance, according to the National Library of Medicine, in 2022, 13.2 million people were hospitalized in the U.S. Thus, the increase in the number of hospitals and hospitalization rates is expected to help the market grow during the forecast period. Similarly, the rise in number of surgeries in the region is further helping the market grow. For instance, according to NIH, annually, about 64 million surgical procedures are carried out in the U.S. Therefore, the growing number of surgeries may lead to an increase in the use of advanced wound care products, propelling the market growth.

The home healthcare segment is expected to witness the fastest CAGR during the forecast period. During the COVID-19 pandemic, there was an increase in demand for home healthcare advanced wound care products. Moreover, the growing geriatric population is anticipated to propel the need for advanced wound care products further. The elderly population is more susceptible to chronic wounds, and with increasing age, wound healing ability of the body slows down. Moreover, according to Wound Care Learning Network, elderly people are more likely to be diagnosed with pressure ulcers. Thus, rise in the elderly population is expected to propel segment growth.

Product Insights

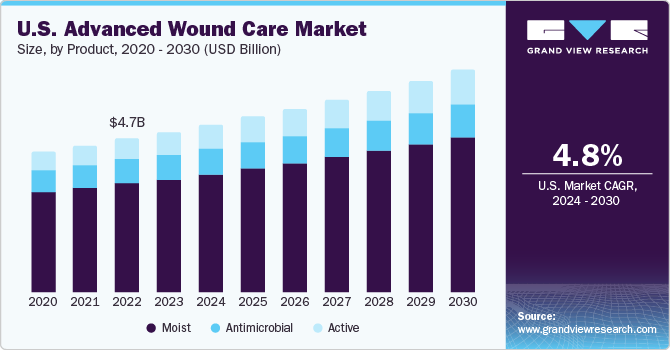

The moist wound care segment dominated the market and accounted for the largest revenue share of 70.9% in 2023. This dominance can be attributed to an increase in the number of wound cases and surgeries in the North American region. For instance, according to AHA Journals, approximately 40,000 children undergo congenital heart surgery in the U.S. As such surgeries take time to heal, advanced wound care products can help expedite recovery, thereby driving the market for advanced wound care during the forecast period.

The active wound care segment is anticipated to witness the fastest CAGR during the forecast period. This dressing offers advanced solutions for managing different chronic conditions such as diabetes, obesity, and vascular diseases. Therefore, with an increase in number of patients suffering from pressure ulcers and venous foot ulcers, the segment is expected to grow over the forecast period.

Application Insights

The chronic wounds segment dominated the market and held a significant revenue share in 2023.Increasing number of diabetic foot ulcers, venous pressure ulcers, and other chronic wounds is expected to drive the segment growth. For instance, according to Agency for Healthcare Research and Quality, more than 2.5 million people in the U.S. develop pressure ulcers every year. In addition, according to the CDC, in 2022, an estimated 37.3 million people, i.e., 11.3% of the total U.S. population, had diabetes. The rise in diabetic population is expected to increase the number of diabetic foot ulcer patients, thereby boosting market growth.

The acute wounds segment is expected to witness the fastest CAGR during the forecast period.The increasing number of different traumatic wounds, such as road accidents, is the major factor driving the segment. Moreover, the incidence of non-fatal injuries, which require medical attention, has increased in the U.S. For instance, according to data from the CDC, the incidence of non-fatal injuries in 2021 was estimated to be 23,455,654. Similarly, according to an article by Brady United Organization, about 316 people are shot every day in the U.S., out of which 210 survive. Thus, with an increasing number of acute wounds, the segment is expected to grow over the forecast period.

Regional Insights

The U.S. dominated the care market and accounted for the largest revenue share in 2023. This growth can be attributed to factors such as the presence of several key market players in this region, rising prevalence of chronic diseases in the country, well-established healthcare infrastructure, and favorable reimbursement policies and regulatory reforms in the healthcare sector. Thus, the above-mentioned factors are expected to propel market growth over the forecast period.

In Canada, the market for advanced wound care is estimated to witness the highest CAGR over the forecast period. This can be attributed to rising geriatric population, increasing government funding, and rising healthcare expenditure. For instance, as per a report by CBC, published in April 2022, about 7 million adults ages 65 and older live in Canada, accounting for 19% of the total population. The geriatric population is more susceptible to chronic diseases. Thus, these above-mentioned factors are expected to drive market growth over the forecast period.

Key Companies & Market Share Insights

Smith & Nephew, Mölnlycke Health Care AB, ConvaTec Group PLC, Baxter International, Coloplast Corp., Medtronic, and 3M are some of the dominant players operating in the advanced wound care industry.

-

Medtronic has a global presence and operates from over 370 locations in approximately 160 countries.

-

Coloplast Corp. is a Denmark-based healthcare products and services company. It has a distribution network spread across 53 countries.

-

3M develops, manufactures, and markets a range of products and services around the world. The company functions across four reportable segments: transportation & electronics; safety & industrial; healthcare; and consumer.

Derma Sciences Inc. (Integra LifeSciences) and Medline Industries some of the emerging market players.

- Derma Sciences develops and markets medical technology solutions, such as implant systems, electrosurgery units, surgical laser systems, sterilization containers, OR lights, and surgical instruments.

Key North America Advanced Wound Care Companies:

- Smith & Nephew

- Mölnlycke Health Care AB

- ConvaTec Group PLC

- Baxter International

- URGO Medical

- Coloplast Corp.

- Medtronic

- 3M

- Derma Sciences Inc. (Integra LifeSciences)

- Medline Industries

Recent Developments

-

In January 2023, Convatec launched the ConvaFoam in the U.S., which is a family of advanced foam dressings designed to meet the demands of medical professionals and their patients. This helped the company strengthen its presence in the U.S. market.

-

In July 2023, Coloplast announced the acquisition of Kerecis. This acquisition would help Coloplast expand its wound care offerings.

-

In January 2022, Coloplast announced the acquisition of Triad Life Sciences. This acquisition enhanced Convatec's position in advanced wound care in the U.S. and granted it access to a unique and complementary technological platform that improves patient outcomes and helps provide advanced wound treatment.

North America Advanced Wound Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.1 billion

Revenue forecast in 2030

USD 6.7 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Smith & Nephew; Mölnlycke Health Care AB; ConvaTec Group PLC; Baxter International; URGO Medical; Coloplast Corp.; Medtronic; 3M; Derma Sciences Inc. (Integra LifeSciences); Medline Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Advanced Wound Care Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America advanced wound care market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Moist Wound Care

-

Foam Dressings

-

Hydrocolloid Dressings

-

Film Dressings

-

Alginate Dressings

-

Hydrogel Dressings

-

Collagen Dressings

-

Other Advanced Dressings

-

-

Antimicrobial Wound Care

-

Silver

-

Non-silver

-

-

Active Wound Care

-

Biomaterials

-

Skin-substitute

-

Growth Factors

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America advanced wound care market size was estimated at USD 4.8 billion in 2023 and is expected to reach USD 5.1 billion in 2024.

b. The North America advanced wound care market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 6.7 billion by 2030.

b. The moist segment that dominated the overall wound dressing market, commanding over 70.9% revenue share in 2023. This dominance can be attributed to an increase in the number of wound cases and surgeries in the North American region.

b. Some key players operating in the North America advanced wound care market include Smith & Nephew; Mölnlycke Health Care AB; ConvaTec Group PLC; Baxter International; URGO Medical; Coloplast Corp.; Medtronic; 3M; Derma Sciences Inc. (Integra LifeSciences); Medline Industries.

b. Key factors that are driving the North America advanced wound care market growth include rising prevalence of chronic diseases across the region. Furthermore, increasing geriatric population is expected to impel market growth, as geriatric population has slow healing capabilities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."