- Home

- »

- Advanced Interior Materials

- »

-

North America Air Conditioning Systems Market, Report, 2030GVR Report cover

![North America Air Conditioning Systems Market Size, Share & Trends Report]()

North America Air Conditioning Systems Market Size, Share & Trends Analysis Report By Type (Package Air Conditioners), By Technology (Inverter), By End-use (Residential), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-131-3

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

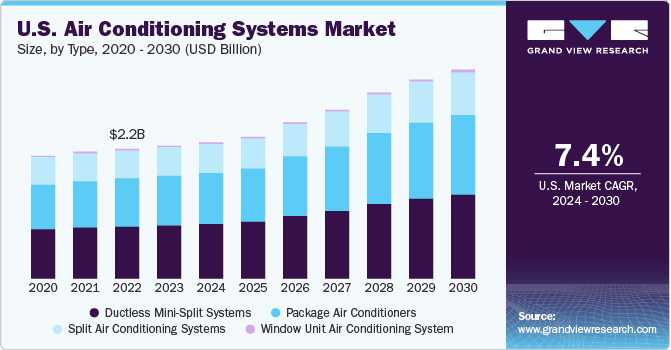

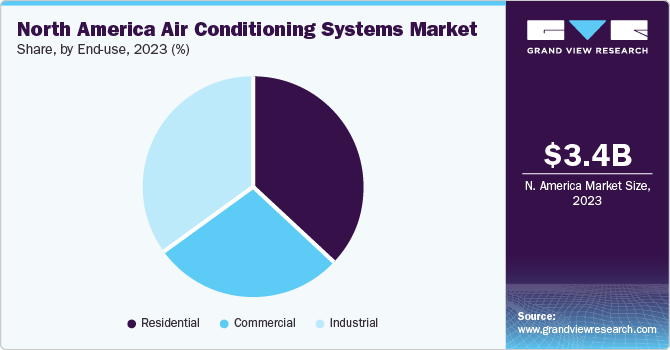

The North America air conditioning systems market size was estimated at USD 3.45 billion in 2023 and is projected to grow at a compounded annual growth rate (CAGR) of 7.0% from 2024 to 2030. Rising demand for energy-efficient and power-saving products is expected to be the major factor driving the market growth. With the advent of technology, the market is anticipated to witness a wide array of new product development and innovation. Inverter-based systems and natural refrigerants are projected to influence demand favorably. Moreover, the increasing need for power-saving ratings and strict policies and regulations concerning efficient ways of utilizing energy in the U.S., together with better consumer awareness, is projected to fuel demand.

Air conditioning systems use refrigerants that are detrimental and toxic, thereby contributing substantially to global warming. Replacement products available in the industry are expected to drive market growth over the forecast period. The market is expected to witness growth in shipments on account of the growing construction sector. However, competition between established organizations and Chinese suppliers who market products at reduced prices may challenge growth in countries including the U.S. and Canada. Preventive measures from non-profit organizations (NPOs), public forums, media, and government to spread awareness among end-users related to environmental issues are expected to encourage people to adopt eco-friendly equipment.

In addition, intense competition from Chinese producers, such as Haier, Gree, and Midea, is anticipated to remain a cause of concern for local manufacturers, subsequently resulting in reduced profits. Stringent norms regarding energy efficiency are expected to accentuate the R&D expenditure to develop new products. However, the continued and undeviating focus of companies on customer service is anticipated to serve as a potential prospects for maintaining share and earning profits in the market. Driven by the high disposable income of consumers, currently, the U.S. dominates the global real estate market.

Trends, such as the emergence of various real estate investment vehicles, including real estate investment trusts (REITs), commercial mortgage-backed securities, and real estate private equity funds, in the residential sector are key propellers to the real estate industry. This growth in real estate has a positive impact on the market in the U.S., supported collectively by a rise in construction spending as well as increased building permits for the construction of residential, commercial, and industrial spaces. For instance, in the U.S., the construction sector is expected to continue growing as the federal government is spending heavily on infrastructure development. Along with government-sponsored commercial construction projects, private commercial construction projects are also on the rise.

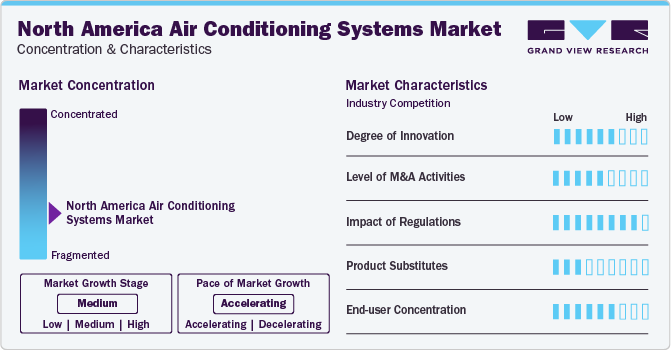

Market Concentration & Characteristics

Market growth stage is medium and the pace of its growth is accelerating. The market is characterized by a high degree of innovation owing to rapid technological advancements. Moreover, companies are adopting various organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions (M&As), and collaborations, to strengthen their position in the industry.

The North America air conditioning systems market exhibits a notable level of M&A activities, driven by various factors including market consolidation efforts, technological advancements, and strategic expansion initiatives. Companies within this market frequently engage in M&A transactions to gain competitive advantages, enhance their product portfolios, expand their geographical presence, and achieve economies of scale. In addition, increasing demand for energy-efficient and environmentally friendly HVAC solutions has prompted M&A activity focused on acquiring innovative technologies and sustainable practices.

Regulations play a significant role in shaping the market, influencing product design, manufacturing processes, and consumer preferences. Stringent energy efficiency standards, such as those set by the U.S. Department of Energy (DOE) and the Environmental Protection Agency (EPA), drive innovation and the adoption of advanced technologies to meet or exceed regulatory requirements. In addition, regulations related to refrigerants, such as the phasedown of hydrochlorofluorocarbons (HCFCs) and hydrofluorocarbons (HFCs) under the Montreal Protocol and the Kigali Amendment, are driving the development of eco-friendly alternatives and transition toward more sustainable HVAC systems.

The market demonstrates a significant degree of innovation, propelled by technological advancements, changing consumer preferences, and regulatory requirements. Innovations include the integration of smart technologies for enhanced energy efficiency and remote control capabilities, the development of eco-friendly refrigerants to meet environmental regulations, and the introduction of variable refrigerant flow (VRF) systems for improved comfort and flexibility. Moreover, advancements in heat pump technology, such as inverter-driven compressors and multi-stage cooling, contribute to higher efficiency and performance. Moreover, manufacturers are focusing on design enhancements to improve aesthetics, noise reduction, and overall user experience.

The market exhibits diverse end-user concentration, reflecting a broad spectrum of industries and residential applications. While residential consumers represent a significant portion of the market, with demand driven by factors, such as population growth, housing trends, and climate conditions, commercial and industrial sectors also contribute substantially. Within the commercial segment, end-user concentration varies across sectors, including retail, hospitality, healthcare, and office spaces, each with distinct requirements and preferences for air conditioning systems.

Type Insights

The package air conditioners segment dominated the market and accounted for the largest share of 37.1% in 2023. Package air conditioners serve as a driving force in the market due to their versatility, efficiency, and ease of installation. These units offer a comprehensive solution by integrating all components into a single package, including the compressor, condenser, evaporator, and controls, simplifying installation and maintenance processes for residential, commercial, and industrial applications.

Split systems offer installation flexibility, with the condenser unit typically placed outdoors and the evaporator unit installed indoors, allowing for efficient cooling without the need for ductwork. This flexibility makes split systems particularly popular for residential applications, where space constraints or architectural limitations may restrict the installation of traditional central air conditioning systems.

Technology Insights

The inverter technology segment is expected to register significant growth from 2024 to 2030. Air conditioner system manufacturers prefer inverter technology based on its advantages, such as the ability to adjust the power supply frequency of the compressors. The inverter-based ACs consume comparatively lesser energy owing to compressor speed adjustment for controlling the gas flow rate; this provides the inverter ACs a better control capabilities of their operating capacity.

Therefore, the low energy consumption and consequent low energy bills act as an advantage propelling the demand for energy-efficient inverters. The non-inverter segment serves as a driving factor in the market due to its affordability and wide availability, catering to budget-conscious consumers and price-sensitive markets. Non-inverter systems offer reliable cooling solutions at a lower upfront cost compared to their inverter counterparts, making them particularly appealing for residential and commercial applications where cost considerations are paramount.

End-use Insights

The residential end-use segment dominated the market in 2023. The residential segment is anticipated to witness above-average growth owing to new end-use applications, including air conditioners in tent facilities. The growing demand for residential air conditioning systems can be attributed to the increasing need among individuals for portable systems for camping trips and outdoor activities. Over the projection period, the residential segment is anticipated to have significant growth.

The robust growth of commercial infrastructure, including office spaces, retail outlets, hospitality establishments, and healthcare facilities, fuels the demand for efficient and reliable air conditioning solutions to ensure comfortable indoor environments for occupants. Secondly, stringent regulations and sustainability initiatives drive the adoption of energy-efficient HVAC systems, prompting businesses to invest in modern air conditioning technologies that reduce operational costs and environmental impact.

Country Insights

The North America air conditioning systems market is experiencing significant growth driven by rising demand for sophisticated systems and the integration of industrial automation, the Internet of Things (IoT), Industry 4.0, and smart manufacturing solutions. Furthermore, the uptick in eco-friendly and sustainable building construction projects is expected to be a key contributor to market expansion.

Canada Air Conditioning Systems Market Trends

The air conditioning systems market in Canada is poised for growth driven by increasing construction expenditure nationwide, which correlates with rising demand for equipment across various applications. Building owners are prioritizing upgrades to air conditioning, ventilation, and other systems within facilities to align with the trend of reducing energy consumption. Moreover, government incentives promoting energy efficiency are anticipated to bolster market growth.

Mexico Air Conditioning Systems Market Trends

The air conditioning systems market in Mexico exhibits promising growth prospects, propelled by several key factors. Rapid urbanization, population growth, and rising disposable incomes are driving the demand for residential, commercial, and industrial air conditioning solutions across the country. In addition, the country’s expanding construction sector, including residential, commercial, and infrastructure projects, further contributes to the demand for air conditioning systems.

Key North America Air Conditioning Systems Company Insights

The market has been characterized by the presence of several large- and small-scale manufacturers, thereby resulting in a significant level of concentration. In addition, the market consists of various international as well as domestic players who are engaged in the designing, developing, and marketing of a diversified array of air conditioning systems. Key players are focusing on various strategies, including acquisition, regional expansion, and product innovation, to achieve competitive advantage and, thereby, develop a strong foothold in the industry.

For instance, in February 2023, Johnson Controls, in collaboration with Hitachi Air Conditioning, unveiled its latest innovation in the Variable Refrigerant Flow (VRF) lineup, named the air395 Max. This state-of-the-art product is designed to deliver seamless comfort, outstanding energy efficiency, and intuitive operation. The air395 Max offers a holistic solution specifically designed to meet the needs of HVAC professionals, architects, and building owners. With its advanced features and user-friendly design, the air395 Max sets a new standard in VRF systems, promising unparalleled performance and satisfaction for users across various sectors.

Key North America Air Conditioning Systems Companies:

The following are the leading companies in the North America air conditioning systems market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these North America air conditioning systems companies are analyzed to map the supply network.

- Arcelik

- BSH Group

- Carrier Corporation

- Daiki Industries Ltd.

- Electrolux

- Haier Group

- Hitachi Air Conditioning

- Ingersoll Rand

- LG Electronics

- Mitsubishi Electric

- Whirlpool Corporation

Recent Developments

-

In August 2023, Daikin bolstered its air conditioner production capabilities through the acquisition of land in Ibaraki Prefecture, Japan. This acquisition is expected to pave the way for the construction of Daikin's inaugural air conditioning plant in the Kanto region, located in Tsukubamirai City. The establishment of this new facility signifies Daikin's commitment to enhancing its Monozukuri capabilities, not only at the upcoming factory but also across its existing bases. With a keen focus on product supply, cost competitiveness, and production technology, Daikin aims to strengthen its position in the market while meeting evolving industry demands

-

In June 2022, Carrier unveiled its latest offering: single-stage split system air conditioners designed to meet the anticipated 2023 Department of Energy (DOE) minimum efficiency standards and testing protocols. These products boast an impressive SEER2 rating of up to 16.5 (17 SEER) and an EER2 rating of up to 13.5 (14.5 EER). Notably, they also feature a streamlined selection of SKUs tailored specifically for the southern regions of America

North America Air Conditioning Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.54 billion

Revenue forecast in 2030

USD 5.30 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report Updated

February 2024

Quantitative units

Revenue in USD billion, volume in thousand units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end-use, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

Arcelik; BSH Group; Carrier Corp.; Daiki Industries Ltd.; Electrolux; Haier Group; Hitachi Air Conditioning; Ingersoll Rand; LG Electronics; Mitsubishi Electric; Whirlpool Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Air Conditioning Systems Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America air conditioning systems market report based on type, technology, end-use, and country:

-

Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Package Air Conditioners

-

Split Air Conditioning Systems

-

Window Unit Air Conditioning System

-

Ductless Mini-Split Systems

-

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Inverter

-

Non-Inverter

-

-

End-use (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Country Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America air conditioning systems market size was estimated at USD 3.45 billion in 2023 and is expected to be USD 3.54 billion in 2024.

b. The North America air conditioning systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 5.30 billion by 2030.

b. The package air conditioners segment dominated the market and accounted for 37.1% of revenue share in 2023.

b. Some of the key players operating in the North America air conditioning systems market include Arcelik, BSH Group, Carrier Corporation, Daiki Industries Ltd, Electrolux, Haier Group, Hitachi Air Conditioning, Ingersoll Rand, LG Electronics, Mitsubishi Electric, Whirlpool Corporation.

b. Key factors that are driving the market growth include rising demand for energy efficient and power saving products coupled with rise in spending in the construction sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."