- Home

- »

- Advanced Interior Materials

- »

-

North America Asphalt Paving Geotextile Market Size ReportGVR Report cover

![North America Asphalt Paving Geotextile Market Size, Share & Trends Report]()

North America Asphalt Paving Geotextile Market Size, Share & Trends Analysis Report By Application (Paved Surface Rehabilitation, Reflective Crack Treatment for Pavements, Separation & Reinforcement), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-058-7

- Number of Report Pages: 198

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Report Overview

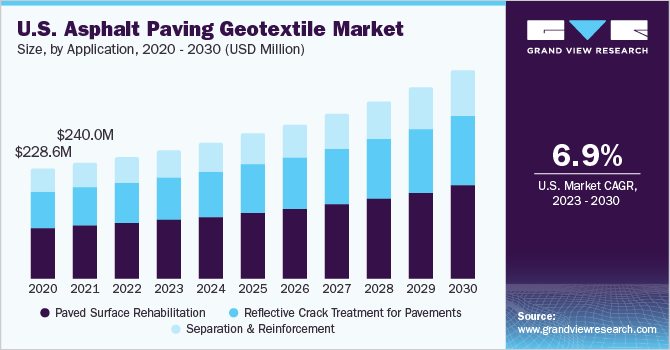

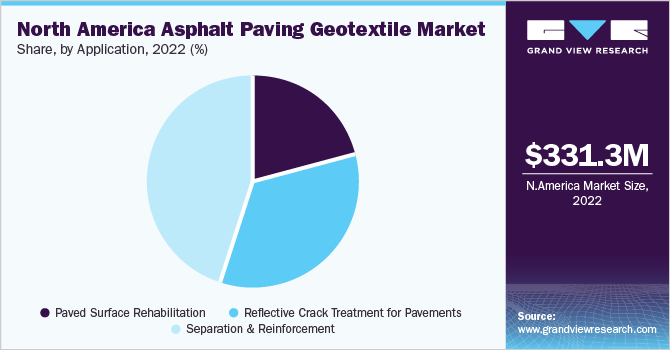

The North America asphalt paving geotextile market size was estimated at USD 331.3 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is attributed to the growing infrastructural development projects in the North American region. Asphalt paving geotextiles are widely utilized in road asphalt concrete overlays, road separation, and road reinforcement and stabilization. These geotextiles operate as a stress-relieving layer between the pavement and overlay in a pavement system. They create a moisture barrier and decrease the probability of the development of cracks. Asphalt paving geotextile also plays a crucial role in forming a barrier between a soft subgrade and a granular layer, thereby preventing them from mixing, which is often a cause of roadway distress.

Paving fabric is composed of non-woven geotextile that has been covered with a layer of bituminous, extending the service life of the overlays while acting as a moisture barrier and stress-relieving membrane between the original pavement and the asphalt overlay. These fabrics act as a barrier that helps in waterproofing the pavements and reduces reflective cracking, thus extending the life of pavement systems.

The U.S. Department of Transportation has announced project funding awards totaling USD 2.2 billion for the Rebuilding American Infrastructure with Sustainability and Equity (RAISE) program for 2022. The 2022 RAISE funds are intended to fund roads, bridges, transits, rails, ports, multimodal transportation planning, and capital projects in the U.S.

According to a 2022 report from the national transportation research nonprofit TRIP, 40.0% of the U.S. roadways including local roads, highways, and arterials are in poor or mediocre condition, costing a typical single driver USD 621.0 per year for car repair and maintenance. Furthermore, the COVID-19 pandemic resulted in a significant decrease in vehicle miles traveled and gas tax collections in 2020, with an overall negative impact on state transportation budgets.

The growth of the asphalt paving geotextile market in the U.S. is expected to be driven by the rising consumption of these geotextiles for road, highway, and pavement construction. In addition, asphalt paving geotextile has a high absorption capacity. This adds extra strength to the infrastructures that use these geotextiles, thereby extending their life.

Application Insights

The separation & reinforcement segment accounted for the largest revenue share of 45.5% in 2022. The segment is forecasted to grow at a CAGR of 6.6% till 2030. Asphalt paving geotextile stabilizes and reinforces foundations in airport structures with high surface demand, allowing them to bear dynamic loads. The geotextiles are also utilized in road expansion projects to ensure the separation and stability of subsurface and additional road construction materials.

The paved surface rehabilitation application is forecasted to grow at the highest CAGR of 7.1% over the forecast period. Paved surface rehabilitation includes resurfacing, repair, and restoration of existing pavement surfaces or roadways to extend their service life, enhance their performance, and increase the durability of asphalt pavement structures. The increased need for road maintenance and repair operations in North America is projected to promote the demand for asphalt paving geotextile over the forecast period.

Asphalt pavements are stressed by increased traffic frequency, passenger load, and surface temperature variations. These forces induce the development and propagation of cracks in asphalt pavements. The cracks further lead to precipitation and enable penetration of oxygen into the underlying structure, thereby deteriorating bitumen binders and asphalt. Hence, the demand for asphalt paving geotextile is expected to rise over the forecast period with the increased need for road maintenance and repair operations.

Reflective cracking in asphalt pavements caused by shrinkage and brittleness can severely deteriorate an asphalt overlay before it reaches the end of its intended life. Asphalt paving geotextile was employed to prevent the new overlay from reflecting existing transverse cracks. They are designed to reduce the tension transferred from an old pavement to the overlay.

Large cracks appear regularly in asphalt pavements owing to shrinkage and brittleness caused by shallow temperatures. The cracks cause a bumpy ride, further deteriorating the roadway surface. In addition, when the old road surface is replaced, the same transverse cracks quickly reflect through the new overlay, allowing water to reach the base and subgrade, thereby shortening the life of the road surface. As a result, the demand for asphalt paving geotextile for reflective crack treatments is projected to witness a rise in North America over the forecast period to delay the degradation process.

Regional Insights

The U.S. dominated the North America asphalt paving geotextile market in 2022 with the highest revenue share of 76.3%. This is owing to growing instances of soil erosion from rainfall and drainage issues on roads. Asphalt paving geotextiles are commonly utilized in road construction projects as they strengthen the soil by increasing the tensile strength of the pavement.

In addition, these geotextiles can be applied to roadbeds as a quick dewatering layer. The surging number of road maintenance and repair operations, along with several favorable government initiatives to enhance road connectivity and carry out infrastructure development projects in the U.S., is expected to fuel the growth of the market.

Canada is expected to register the fastest CAGR of 5.5% from 2023 to 2030. This can be attributed to the flourishing construction industry and the ongoing infrastructure development projects in the country. The pandemic resulted in economic instability and slowed down development projects as the funds of the Government of Canada were devoted to ensuring proper healthcare and wage protection for the masses. As a result, the lack of funds for infrastructure affected the market demand for asphalt paving geotextile as well in Canada.

However, with continuous programs being carried out for the development and maintenance of roads in Canada, the consumption of asphalt paving geotextile is anticipated to grow in the country in the coming years.The Mexico asphalt paving geotextile market is projected to grow significantly over the forecast period owing to considerable expenditures by the government of the country on various infrastructure development projects.

Key Companies & Market Share Insights

The key players and the majority of industry participants are working on enhancing their distribution networks to strengthen their market position. The regional industry is characterized by the presence of a large number of players with a highly competitive rivalry for a higher market share. Multiple investments in infrastructural development projects in the U.S., Canada, and Mexico are fueling the competition among the players. Some prominent players in the North America asphalt paving geotextiles market include:

-

SKAPS Industries

-

Carthage Mills, Inc.

-

GSI Geo-Synthetics Systems LLC

-

Road Fabrics Inc

-

TenCate Geosynthetics Americas.

-

Global Synthetics.

-

GeoSolutions, Inc.

-

Thrace Group.

-

Fibertex Nonwovens A/S

-

US Fabrics, Inc.

North America Asphalt Paving Geotextile Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 349.5 million

Revenue forecast in 2030

USD 562.4 million

Growth Rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million square meters, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

SKAPS Industries; Carthage Mills, Inc.; Global Synthetics; GeoSolutions, Inc.; Thrace Group; TenCate Geosynthetics Americas; GSI Geo-Synthetics Systems LLC; Road Fabrics Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Asphalt Paving Geotextile Market Report Segmentation

This report forecasts volume and revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America asphalt paving geotextile market report based on application and country:

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Paved Surface Rehabilitation

-

Reflective Crack Treatment for Pavements

-

Separation and Reinforcement

-

-

Country Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The U.S. asphalt paving geotextile market segment led the market and accounted for a revenue share of 76.3% in 2022, due to the growing infrastructural development projects in North America.

b. Some of the key players operating in the North America asphalt paving geotextile market include SKAPS Industries, Carthage Mills, Inc., Global Synthetics., GeoSolutions, Inc., Thrace Group., TenCate Geosynthetics Americas., GSI Geo-Synthetics Systems LLC , and Road Fabrics Inc.

b. The growing infrastructural development & construction activities along with road restoration activities in North America is propelling the demand for asphalt paving geotextile in the market.

b. The North America asphalt paving geotextile market size was estimated at USD 331.3 million in 2022 and is expected to reach USD 349.5 million in 2023.

b. The North America asphalt paving geotextile market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 562.4 million by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."