- Home

- »

- Consumer F&B

- »

-

North America Chocolate Market Size Report, 2030GVR Report cover

![North America Chocolate Market Size, Share & Trends Report]()

North America Chocolate Market Size, Share & Trends Analysis Report By Type (Dark, Milk, White), By Distribution Channel (Online, Offline), By Country, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-068-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

The North America chocolate market size was valued at USD 39.4 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2022 to 2030. Impulse purchases and increased interest in luxury and premium chocolates are two key elements driving the market.Chocolate manufacturers are increasingly investing in the creation of reduced sugar or sugar-free goods as customers become more health conscious, particularly as the number of instances of obesity and diabetes have been rising.

COVID-19 had an influence on the chocolate industry when it first appeared in 2020. However, with the relaxation of limitations on both imports and exports across North America, the market has become more stable. The premium segment of the chocolate industry was severely impacted by low sales volume as a result of the COVID-19 epidemic, which was caused in part by supply-side concerns related to quality and certification. Following the relaxation of prohibitions, chocolate demand increased in the U.S., particularly during festive seasons such as Halloween and Christmas. This is likely to have a significant contribution to the market's revival.

The bakery and confectionery sectors in North America are expected to increase throughout the projected period, owing to growing customer desire for low-sugar sweets. Due to increased demand for organic and cocoa-rich chocolates and bakery items, chocolate products are likely to dominate the region. Premium bakers utilize chocolate cups to increase the visual value of their products. These establishments cater to affluent customers by serving puddings, mousse, custards, and other chocolate-based treats. This trend is likely to drive the demand in North America throughout the projection period.

Cocoa product regulations are anticipated to have a significant impact on the North American sector. Regulations enforced by the FDA in the U.S. are projected to provide customers with assurance of safe and enhanced quality cocoa, cocoa products, confectioneries, and related items, which is predicted to stimulate demand in the region. Due to the sheer continuous fitness movement in North America, health concerns about excessive sugar content are stifling development in the chocolate business. It does, however, provide a chance for entrepreneurs to develop low-sugar and natural ingredients-based chocolates.

The health and wellness movements are also driving up purchases of dark chocolate, moving the North American confectionery sector ahead. Dark chocolate contains a variety of minerals and fiber. It also functions as an antioxidant and may help to reduce the risk of heart disease. These are made from a variety of ingredients, the most important of which is cocoa. Other substances used in dark chocolate manufacturing include sugar, dairy products, nuts, and maize sweeteners. All of the aforementioned raw materials' pricing is determined by the commodity market.

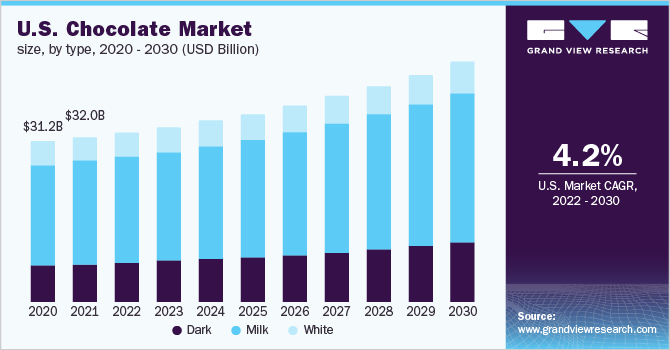

Type Insights

The milk segment led the market and accounted for a 62.2% share of the revenue in 2021. Milk chocolates have a low cocoa concentration and a high milk content, making them sweet and creamy with a refined taste. Over the projected period, this is likely to emerge as a primary growth driver for the product. Growing demand for the product as an addition in frosting on cakes, cupcakes, puddings, and other sweets will also drive growth. Also, chocolate consumption boosts memory and decreases the risk of cardiac strokes and attacks, and strengthens the immune system. It is also abundant in flavonoids, which are antioxidants that eliminate free radicals while increasing blood flow.

The dark segment is anticipated to expand at the fastest CAGR of 5.1% from 2022 to 2030. Dark chocolate's demand is predicted to rise as its application in the confectionery and bread industries expands. This can be linked to its premium and rich flavor, as well as the related health advantages. Furthermore, the rising consumer desire for sugar-free and healthier baked products is likely to drive demand throughout the projection period.Also, growing health advantages associated with cocoa-rich dark chocolates, increasing online sales, players launching more limited-edition chocolates, and expanding marketing strategies are expected to boost the worldwide dark chocolate market over the projected period.

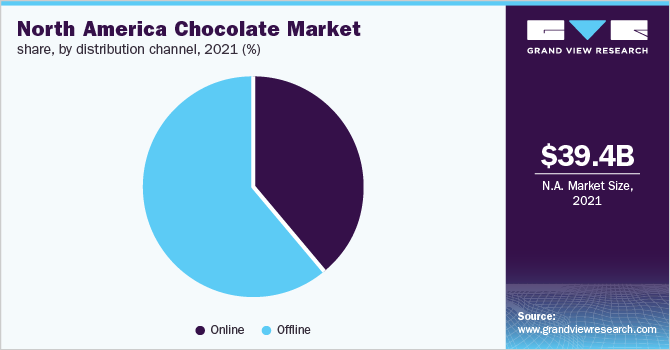

Distribution Channel Insights

The offline segment made a larger contribution to the global market of over 61.1% in 2021. The offline stores offer significant advantages to consumers, such as freedom of selection, lower prices, and high visibility of international brands, which makes them a suitable platform for all types of customers.The success and growing acceptance of premium chocolates, are driven by both consumers' desire to indulge in this "affordable luxury" and the influence of foodie culture, as well as the growth of chocolate retailers, both through franchise expansion and by successful independent shops looking to expand their footprints, are expected to drive the growth of chocolate sales in the offline distribution channel.

The online segment is projected to register a CAGR of 4.6% from 2022 to 2030. The pandemic caused consumers to reassess their life priorities, which resulted in new values and spending criteria. The increasing reliance on technology, technical performance, and the online payments sector is driving consumer behavior away from traditional methods. The shift to online models has shifted consumer demand from physical stores to online retail, a trend that existed before the COVID-19 pandemic. However, accelerated earlier during the crisis. This shift to online retail also affected the types of products purchased, with consumers opting for more basic clothing at the expense of fashion and luxury items.

Country Insights

The U.S. made the largest contribution to the global market of over 81.2% in 2021. Rising obesity and depression have been among the most difficult concerns confronting the U.S. healthcare business. Chocolate consumption causes the release of endorphins in the body, which are known to improve mood. Its use also aids in weight loss, which would boost the North America chocolate market further during the forecast period.Chocolate festivals are common in the U.S., where they promote restaurants, bakeries, and chocolatier innovations and recipes. Furthermore, these events serve to define new trends in the chocolate business, stimulating demand for cocoa-based products.Furthermore, the growing demand for organic chocolate due to its health advantages raises the country's need for cocoa.

Canada is expected to witness a CAGR of 5.2% from 2022 to 2030. Rising health awareness in this area, together with rising per capita spending, is likely to fuel demand and growth for dark chocolates. The food and beverage business in Canada generates a substantial amount, making it Canada’ssecond-largest manufacturing industry. Furthermore, the country has a large number of bakeries, cafés, and restaurants, which increases the need for cocoa goods. Also, in September 2020, according to the Inter-American Institute for Cooperation on Agriculture, Canada was one of the world's largest chocolate consumers and the rank was the ninth-largest consumer of chocolate in the world.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches in retail about chocolate products to enhance their portfolio offering in the market.

-

In May 2021, The Hershey Company signed a binding deal to buy Lily's, a high-growth, better-for-you (BFY) candy brand. Dark and milk chocolate style bars, as well as other confection goods that meet Hershey's approach, are among Lily's low-sugar offerings

-

In November 2020, Ferrero North America, a division of the Ferrero Group, expanded its chocolate manufacturing capacity at its Bloomington facility. According to the corporation, the expansion would cost roughly USD 75 million, and the building will begin in the spring of 2021.

-

In November 2020, Mars Wrigley U.S., the worldwide confectionery leader, unveiled a new range of goods from some of America's favorite brands, including SKITTLES, M&M'S, and ORBIT. These items will be added to Mars Wrigley's portfolio of successful chocolate, fruity confections, and gum brands, bringing customers greater experiences and more smiles today and into 2021.

Some of the key playersoperating in the North America Chocolate market include: -

-

The Hershey Company

-

Mars, Incorporated

-

Nestlé

-

Ferrero

-

Chocoladefabriken Lindt & Sprüngli AG

-

Godiva

-

Ghirardelli Chocolate Company

-

Mondelēz International

-

General Mills Inc.

-

Clif Bar & Company

North America Chocolate Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 40.6 billion

Revenue forecast in 2030

USD 57.4 billion

Growth Rate

CAGR of 4.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

The Hershey Company; Mars, Incorporated; Nestlé; Ferrero; Chocoladefabriken Lindt & Sprüngli AG; Godiva; Ghirardelli Chocolate Company; MondelÄ“z International; General Mills Inc.; Clif Bar & Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the North America chocolate market based on type, distribution channel, and country.

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Dark

-

Milk

-

White

-

-

Distribution Channel Outlook (Revenue, USD Million; 2017 - 2030)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The north North America Chocolate Market size was estimated at USD 39.4 billion in 2021 and is expected to reach USD 40.6 billion in 2022.

b. The North America Chocolate Market is expected to grow at a compound annual growth rate of 4.3% from 2022 to 2030 to reach USD 57.4 billion by 2030.

b. The milk segment led the North America Chocolate Market and accounted for a 62.2% share of the revenue in 2021. Milk chocolates have a low cocoa concentration and a high milk content, making them sweet and creamy with a refined taste

b. Some key players operating in the North America Chocolate Market include The Hershey Company, Mars, Incorporated, Nestlé, Ferrero, Chocoladenfabriken Lindt & Sprungli AG, Godiva, Ghiradelli Chocolate Company, Mondelēz International, General Mills Inc., and Clif Bar & Company

b. Key factors that are driving the North America Chocolate Market growth include impulse purchases and increased interest in luxury and premium chocolates.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."