- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Coroplast Market Size, Industry Report, 2030GVR Report cover

![North America Coroplast Market Size, Share & Trends Report]()

North America Coroplast Market Size, Share & Trends Analysis Report By Material (PE, PP), By Application (Graphic Arts, Signage), By Country (U.S., Canada), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-276-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

North America Coroplast Market Trends

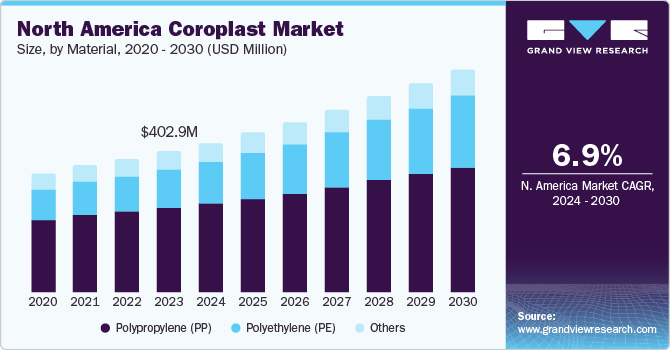

The North America coroplast market size was estimated at USD 402.90 million in 2023 and is expected to expand at a CAGR of 6.9% from 2024 to 2030. Coroplast refers to a type of lightweight, fluted plastic sheet majorly composed of polypropylene and polyethylene resins. Properties of coroplast, such as resistance to corrosion, chemicals, and weather conditions, coupled with reusable product adoption graphics and signage applications, are expected to contribute to the market growth.

According to the National Association of REALTORS, U.S. housing sales are forecast to rise by 13% in 2024. Rising population in U.S. inclusive of citizens as well as immigrants is significantly influencing housing sales and contributing to real estate sector growth. According to United States Census Bureau data, building permits for January 2024 were 1,470,000 housing units. This was 8.6% above the January 2023 value. With a rise in building permits, demand for signage boards for real estate advertisement is expected to rise, thereby influencing demand for coroplast.

Key players in the market are implementing various strategies to enhance their presence and competitiveness. These strategies are launching new products to cater to growing consumer requirements for coroplast material, engaging in mergers & acquisitions to consolidate market share, forming partnerships, and expanding geographically to tap into new areas and distribution channels. For instance, in October 2023, Baystar, a division of Bayport Polymers LLC, introduced its Bay 3 polyethylene unit in Pasadena, TX, signaling a new era in high-performance PE production. Utilizing proprietary Borstar technology from Borealis, the facility marks the first of its kind in North America and doubles Baystar's production capacity.

Consumers and businesses in the U.S. have become more environmentally conscious, thus contributing to the demand for eco-friendly packaging materials like coroplast. Coroplast can be recycled and offers a more sustainable alternative to traditional cardboard packaging.

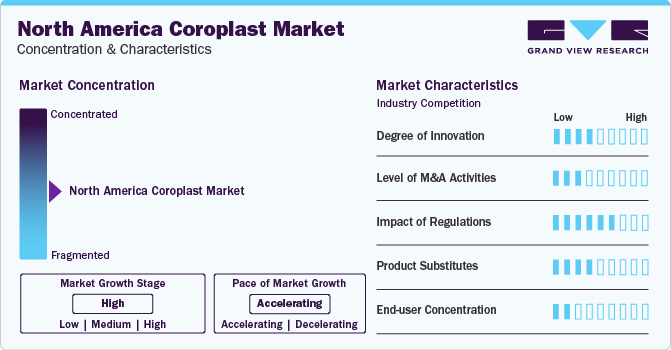

Market Concentration & Characteristics

The market is highly fragmented, with a significant presence of global and local companies offering various types of coroplast. Prominent players operating in the market include Coroplast (Inteplast Group), SABIC, Liberty Plastics Inc, CoolSeal USA, Emco Industrial Plastics, Laminacorr Industries Inc, New-Tech Packaging, Minnesota Diversified Industries (MDI), and Commercial Plastics Depo.

The regulatory landscape can be influenced by several factors such as recyclability and fire safety. Regulations promoting recycling and sustainability could indirectly impact coroplast market. As coroplast is recyclable, highlighting this aspect and ensuring compliance with recycling regulations might be important for manufacturers.

Corrugated board, PET sheet, and polycarbonate sheet among others are product substitutes to coroplast. However, versatility, machinability, durability offered by coroplast positions impact of product substitutes at low to moderate level.

Material Insights

Based on material, the market is segmented into polyethylene (PE), polypropylene (PP), and others. Polypropylene (PP) segment dominated the market and accounted for the largest revenue share of 59.57% in 2023. PP is recognized for its low density and versatility. According to Singhal Industries Pvt. Ltd article published in March 2023, polypropylene sheets are widely used in different industries due to their versatility and benefits.

Polyethylene (PE) is expected to progress with the fastest CAGR of 9.5% during the forecast period. PE offers improved flexibility compared to PP. This could be desirable for applications where some degree of bending is required without compromising overall strength. According to the Liberty Plastics, Inc. article published in May 2023, high-density polyethylene (HDPE), recognized for its strength and resistance to high temperatures, finds prevalent use in packaging, construction, and automotive sectors where durability is critical. On the other hand, low-density polyethylene (LDPE) and linear low-density polyethylene (LLDPE), known for their flexibility and moisture resistance, are favored options in packaging and agricultural applications. The adaptability of PE allows manufacturers to customize corrugated plastic sheets to meet the varying requirements of different industries, offering lightweight, cost-efficient, and durable solutions across various industries.

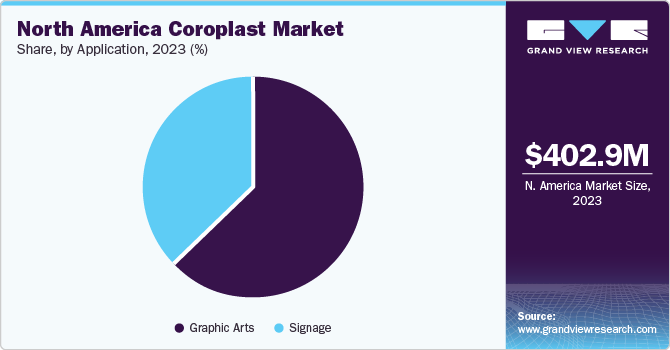

Application Insights

Based on application, the market is segmented intographic arts and signage. Graphic art dominated the market and accounted for a share of over 62.0% in 2023. Graphic arts represent a crucial application area, encompassing various uses such as printing, advertising, and promotional displays. Coroplast, renowned for its versatility, boasts properties, such as durability, lightweight construction, and moisture resistance, which makes it an optimal choice for various graphic arts and design applications.

Signage application is expected to grow with the fastest CAGR of 8.5% over forecast period. Corrugated plastic sheets offer durability, lightweight, and customization options, making them versatile for indoor and outdoor signage needs. These sheets can withstand exposure to adverse environments, ensuring long-lasting signage solutions.

Country Insights

U.S. Coroplast Market Trends

U.S. dominated North America coroplast market, accounting for largest revenue share of 92.39% in 2023. U.S. has a larger overall market for various goods and services compared to Canada and Mexico. This translates to a potentially higher demand for PE and PP corrugated sheets used in various applications like signage, packaging, and industrial sectors.

Canada Coroplast Market Trends

Coroplast market in Canada is expected to progress with a CAGR of 19.6% over the forecast period. Corrugated plastic sheets, known as coroplast that are available under various other brand names, are widely used across Canada for diverse indoor and outdoor industrial, commercial, and residential applications. According to an article by Canada Plastics & Belting in July 2023, corrugated plastic sheets have compiled layers of polypropylene, including smooth exterior layers and a ribbed middle layer. They are lightweight, durable, and adaptable in terms of packaging, making them popular across different industries in Canada.

Key North America Coroplast Company Insights

Major players operating in the market undertake various strategies such as expansion, joint ventures, and mergers & acquisitions to strengthen their market presence.

Key North America Coroplast Companies:

- Coroplast (Inteplast Group)

- SABIC

- Liberty Plastics Inc.

- CoolSeal USA

- Emco Industrial Plastics

- Laminacorr Industries Inc.

- New-Tech Packaging

- Minnesota Diversified Industries (MDI)

- Commercial Plastics Depot

- US Plast Inc.

- Melmat, Inc.

- All Weather Products LLC (AW Substrates)

- Primex Plastics Corporation

- L-S Industries, Inc.

- Ward & Kennedy Co.

- Amatech Inc.

- Matra Plast, Inc.

- Mills Industries

- VYCOM

- Plaskolite

- Con-Pearl North America Inc.

- Plastic-Craft Products

- SUREPAK INDUSTRIES

- Palram Industries Ltd.

- Lundell Plastics Corp.

- Global Plastic Sheeting, Inc.

- Polymershapes Mexico

Recent Developments

-

In March 2023, Inteplast Group renewed its lease for 79,000 square feet facility in Delta, British Columbia where plastic films and coroplast sheet are manufactured.

-

In July 2023, U.S. Plast Inc. was acquired by Isik Plastik AS. This acquisition will help Isik Plastik AS to penetrate the North American coroplast market space.

North America Coroplast Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 426.59 million

Revenue forecast in 2030

USD 635.14 million

Growth rate

CAGR of 6.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in tons; revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, application, country

Regional scope

North America

Country Scope

U.S.; Canada; Mexico

Key companies profiled

Coroplast (Inteplast Group); SABIC; Liberty Plastics Inc.; CoolSeal USA; Emco Industrial Plastics; Laminacorr Industries Inc.; New-Tech Packaging; Minnesota Diversified Industries (MDI); Commercial Plastics Depot; US Plast Inc.; Melmat, Inc.; All Weather Products LLC (AW Substrates); Primex Plastics Corporation; L-S Industries, Inc.; Ward & Kennedy Co.; Amatech Inc.; Matra Plast, Inc.; Mills Industries; VYCOM; Plaskolite; Con-Pearl North America Inc.; Plastic-Craft Products; SUREPAK INDUSTRIES; Palram Industries Ltd.; Lundell Plastics Corp.; Global Plastic Sheeting, Inc.; Polymershapes Mexico

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Coroplast Market Report Segmentation

This report forecasts volume & revenue growth regional, and country levels and provides an analysis of latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented North America coroplast market report based on material, application, and country:

-

Material Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Graphic Arts

-

Signage

-

-

Country Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America coroplast market was estimated at USD 402.90 million in the year 2023 and is expected to reach USD 426.59 million in 2024.

b. The North Ameria coroplast market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 635.14 million by 2030.

b. U.S. accounted for largest country share of North America coroplast market in 2023 and accounted for a share of over 92.0%.The U.S. has a larger overall market for various goods and services compared to Canada and Mexico, translating into higher demand for PE and PP corrugated sheets used in various applications like signage, packaging, and industrial sectors.

b. Some of the key players in North America coroplast market include Coroplast (Inteplast Group), SABIC, Liberty Plastics Inc, CoolSeal USA, Emco Industrial Plastics, Laminacorr Industries Inc, New-Tech Packaging, Minnesota Diversified Industries (MDI), and Commercial Plastics Depo

b. Increasing demand for promotional and advertising signage in retail, real estate, events, and other sectors is driving the demand for coroplast sheets.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."