- Home

- »

- Plastics, Polymers & Resins

- »

-

Polycarbonate Sheet Market Size And Share Report, 2030GVR Report cover

![Polycarbonate Sheet Market Size, Share & Trends Report]()

Polycarbonate Sheet Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Building & Construction, Packaging, Automotive, Aerospace & Defense, Agriculture, Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-468-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polycarbonate Sheet Market Summary

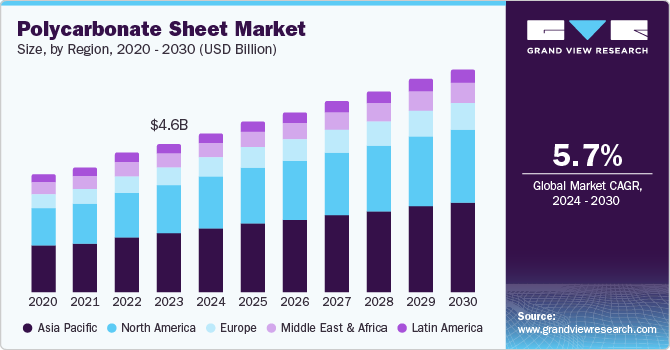

The global polycarbonate sheet market size was estimated at USD 4.64 billion in 2023 and is projected to reach USD 6.93 billion by 2030, growing at a CAGR of 5.7% from 2024 to 2030. The increasing demand for lightweight, durable, and high-performance materials in various industries, including automotive, construction, and electronics, is a significant factor.

Key Market Trends & Insights

- Asia Pacific polycarbonate sheet market held the largest market share of 40.1% in 2023.

- North American polycarbonate sheet market held a significant market share of 31.4% in 2030.

- The building and construction application segment dominated the market in 2023, driven by the durable yet lightweight properties of polycarbonate sheets.

Market Size & Forecast

- 2023 Market Size: USD 4.64 Billion

- 2030 Projected Market Size: USD 6.93 Billion

- CAGR (2024-2030): 5.7%

- Asia Pacific: Largest market in 2023

Additionally, the growing awareness about sustainable and energy-efficient roofing materials is also contributing to the market growth. The rise in infrastructural and construction activities across developing economies further fuels the demand for polycarbonate sheets. Also, technological advancements leading to the development of UV-resistant and flame-retardant polycarbonate sheets are expected to provide lucrative growth opportunities in the coming years.

In addition, the growth of environmental issues such as the adoption of greenhouses, climate change challenges, high proliferation of food needs due to population growth and development, and the expansion of sustainable farming due to the urbanization processes are creating demand for polycarbonate sheets, especially for use in greenhouses. Similarly, polycarbonates are used in the medical field in cardiac surgery, renal dialysis, IV connectors, and surgical instruments. In general, polycarbonate sheet, standing in great demand in the medical industry, bears outstanding mechanical properties, including rigidity, strength, and toughness, to avoid material failure that might be fatal in medical applications.

Furthermore, polycarbonate films offer high impact resistance and good barrier properties, and they are primarily used in the packaging sectors. Due to rising demand for packaged food and beverages, the industry for polycarbonate films for packaging will also continue to rise. Moreover, awareness of sustainability and environmental problems leads to developing trends towards Eco-packaging. These polycarbonate films are reusable, which makes them eco-friendly, and this has increased their demand in the market.

Application Insights

The building and construction application segment dominated the market in 2023, driven by the durable yet lightweight properties of polycarbonate sheets. These characteristics make them suitable for a wide range of applications in building structures, such as windows, roofs, walls, and other architectural components. Advancements in technology and product development have fortified these sheets, enhancing their impact resistance and ability to withstand corrosive environments. As a result, architects and builders are increasingly using them in the construction of warehouses, factories, malls, corporate buildings, and public infrastructure, owing to their aesthetic appeal and innovative designs.

The automotive application segment is anticipated to witness the fastest growth from 2024 to 2030. This surge is fueled by car manufacturers' quest for efficient and lightweight materials that can enhance the performance and durability of automobiles. Polycarbonate sheets offer substantial weight reduction while providing the requisite rigidity and strength, thereby compelling car makers to favor these products over alternative materials. Additionally, the material's deployment in front and rear windshields, side glasses, sunroofs, headlamp lenses, dashboards, instrument clusters, and exterior mirror applications bolsters its safety and versatility in automotive design. For instance, the use of polycarbonate windscreens ensures that broken pieces do not pose a threat of injury to motorists, as they break into larger, safer fragments compared to traditional glass windscreens.

Regional Insights

North American polycarbonate sheet market held a significant market share of 31.4% in 2030. The factors influencing the growth of the market in the region are the growth of various industries that have heavy applications of the products such as automotive, construction, electrical, electronics, and other industries. Moreover, the growing environmental considerations that have spiked the adoption of eco-friendly materials have increased the demand for the products in the region.

U.S. Polycarbonate Sheet Market Trends

The U.S. dominated the North American polycarbonate sheet market in 2023 due to technological advancements that have enhanced the performance and quality of the products compared to the alternatives. The increasing investment in research and development within the U.S. market has resulted in the development of new formulations with enhanced properties such as fire resistance, thermal insulation, and UV resistance, among others. Consequently, this has driven consumer adoption of polycarbonate sheets.

Canada polycarbonate sheet market is expected to grow significantly in the North American region from 2024 to 2030. The market's growth can be attributed to the increased demand within the construction and automotive sectors, technological development in improving the sheets, and the environment that advocates for environmentally friendly products. Additionally, the specific policies encourage energy preservation, increased usability of the sheets in many segments of the economy, and growth on a macroeconomic level, which also play a vital role in propelling the country's market.

Europe Polycarbonate Sheet Market Trends

Europe polycarbonate sheet market is expected to grow significantly at a CAGR of 5.5% from 2024 to 2030. The growth of the market in the region is influenced by the increasing adoption of the products over traditional materials due to their lightweight properties, UV protection, high impact resistance, eco-friendly build-up, and other properties. Moreover, the increasing number of applications of the product in electrical industries is also shaping the market in the region significantly.

The UK polycarbonate sheet market held a significant market share in Europe in 2023. This growth is driven by demand from the automotive and construction industries, improvement in product quality through technological innovation, growing awareness of energy efficiency advantages, expanding application potential, and government support of green technologies.

Asia Pacific Polycarbonate Sheet Market Trends

Asia Pacific polycarbonate sheet market held the largest market share of 40.1% in 2023 attributed to the increasing industrialization and urbanization in emerging economies, which has subsequently fueled the construction and automotive industries in the region, leading to higher demand for polycarbonate sheets. Furthermore, the integration of advanced technologies such as AI and IoT has optimized the production process, resulting in cost reduction and increased consumer adoption.

China polycarbonate sheet market held the largest market share in 2023 owing to government regulations aimed at improving the manufacturing sector, which promoted the usage of polycarbonate sheets in various industries. Furthermore, the growing number of EV vehicles and other electronic devices in the country has played a vital role in shaping the demand for the products and propelling the market in the country.

The polycarbonate sheet market in India is projected to experience consistent growth in the coming years. This growth is primarily driven by factors such as the expanding construction industry, the increasing automotive sector, rising demand for medical applications, and a growing awareness of energy efficiency. Additionally, the market is being significantly boosted by changing preferences for aesthetic appeal in both commercial and residential construction sectors.

Key Polycarbonate Sheet Company Insights

Some of the key companies in the polycarbonate sheet market include SABIC, Covestro AG, MITSUBISHI, EVONIK, and many others. Organizations focus on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Mitsubishi Gas Chemical Company, Inc. (MGC) is a Japanese chemical company with a wide product portfolio comprising specialty chemicals, plastics, and advanced materials. MGC deals in high-quality polycarbonate sheets with features such as durability and clear optic lens look and feel with flexibility in usage in construction, automobiles, and electrical industries.

-

SABIC is a Saudi Arabian-based company, also known as Saudi Basic Industries Corporation, which specializes in Diversified chemicals. Among its products, the company specializes in polycarbonate sheets with high mechanical characteristics such as strength, transparency, and flexibility, which can be used in construction, automotive, and electronics industries.

Key Polycarbonate Sheet Companies:

The following are the leading companies in the polycarbonate sheet market. These companies collectively hold the largest market share and dictate industry trends.

- SABIC

- Covestro AG

- Trinseo.

- TEIJIN LIMITED.

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Evonik Industries AG

- Suzhou Omay Optical Materials Co., Ltd.

- Palram Industries Ltd.

- APSX LLC.

- Emco Industrial Plastics

- Kapoor Plastics

Recent Developments

-

In June 2024, Lexan Industries introduced LEXAN, a new line of polycarbonate sheets specifically designed for building and construction applications. These sheets are LEED-certified, emphasizing sustainable building designs and eco-friendly materials.

-

In December 2023, Brett Martin Limited announced a partnership with Novalite Products LLP to increase its market share in INDIA for the polycarbonate sheet market. This partnership will enhance their distribution of products in the country by leveraging Novalite distribution channels.

Polycarbonate Sheet Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.97 billion

Revenue forecast in 2030

USD 6.93 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilo Tons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; The Netherlands; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

SABIC; Covestro AG; Trinseo.; TEIJIN LIMITED.; MITSUBISHI GAS CHEMICAL COMPANY, INC.; Evonik Industries AG; Suzhou Omay Optical Materials Co., Ltd.; Palram Industries Ltd.; APSX LLC.; Emco Industrial Plastics; Kapoor Plastics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polycarbonate Sheet Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polycarbonate sheet market report based on application and region:

-

Application Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Packaging

-

Automotive

-

Aerospace & Defense

-

Agriculture

-

Others

-

-

Regional Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.