- Home

- »

- Advanced Interior Materials

- »

-

North America Dispensing Pumps Market Report, 2022-2030GVR Report cover

![North America Dispensing Pumps Market Size, Share & Trends Report]()

North America Dispensing Pumps Market Size, Share & Trends Analysis Report By Product, By Application (Cosmetics & Personal Care, Food & Beverages), By End Use, By Region, And Segment Forecast, 2022 - 2030

- Report ID: GVR-4-68038-663-9

- Number of Report Pages: 82

- Format: PDF, Horizon Databook

- Historical Range: 2017 – 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

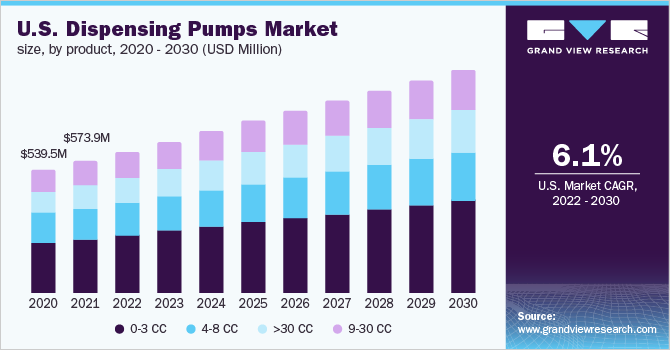

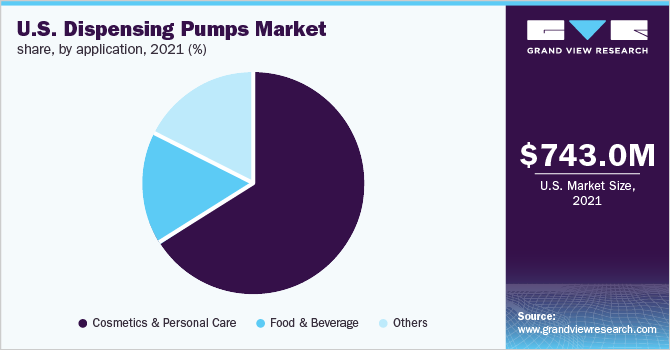

The North America dispensing pumps market size was estimated at USD 743.0 million in 2021 and is expected to expand at a compounded annual growth rate (CAGR) of 6.0% from 2022 to 2030. Growth in the production of perishable products coupled with high production of packaged food is anticipated to contribute to the ascending demand for packaging materials. The market witnessed a severe decline during the pandemic. However, the products such as sanitizers and related antibacterial witness an exponential demand during 2020, thus creating growth opportunities for the dispensing pumps manufacturers in the particular segment.

However, the measures to mitigate the spread of COVID-19 such as strict restrictions on the population mobility and suspension of flights during the pandemic led to a brief halt in the tourism operations. This in turns impacted the demand for food and beverage products in the HORECA end-use, thus negatively influencing the dispensing pumps market during 2020. The market in the U.S. is expected to be driven by, rising establishment of new restaurants and eateries across the country would escalate growth of dispensing pumps used for packaging of food products on account of growth in the number of foodservice units, which in turn, is likely to fuel the demand for dispensing pumps in the country.

Fluctuating raw material prices and costly manufacturing process for the production of dispensing pumps are the factors restricting the players to grow in the market. These also act as entry barriers for the new entrants. Moreover, changing the machine dimensions for the production of varied pumps, concerning outflow dosage, is a costly process. Increasing concerns about personal care and hygiene and growing demand for natural skincare products in North America are expected to have a positive impact on the demand for dispensing pumps, thereby influencing the growth of the product.

Product Insights

The 0-3 CC dispensing pumps segment led the market and accounted for about 40.0% share of the revenue in 2021. The product is increasingly used in kitchen cleaners, multi-purpose cleaners, glass cleaners, air/room fresheners, car care products, personal hygiene products, home and garden, liquid soap, handwash, hand sanitizers, body wash, shampoo, lotions, oils, ketchups, food condiments, and others.0-3 CC dispensing pumps are small in size and can be installed on small to medium-sized pet bottles and metal containers. On account of their small size and handy operations, these products are widely accepted in personal care and cosmetic product packaging applications.

The 4-8 CC dispensing pumps are widely used in the packaging of food, personal care, and cosmetic, and pharma-grade products. The outflow of these pumps offers a higher dosage as compared to the pumps ranging from 0 cc to 3 cc, which makes them widely suitable for use in household products such as ketchup, sauces, concentrates, syrups, liquid handwash, and liquid sanitizers among others. The 9 cc–30 cc dispensing pumps are used for large-sized pet bottles and containers. Major applications of these pumps are food products, personal care products, cosmetics, and medicines and pharmaceutical products. As these pumps are used in large-sized bottles, they are accepted in hotels, restaurants, cafes, and commercial places like salons, spas, car care centers, medical camps, and hospitals among other places.

End-use Insights

The non-commercial dispensing pumps segment dominated the market and accounted for the largest revenue share of about 46.0% in 2021. Non-commercial end-use segment includes the uses of dispensing pumps in household products such as lotions, sanitizers, liquid handwash, oils, creams, and food items including ketchup, sauces, syrups, and fresh creams.The introduction of personal grooming products in smaller-sized bottles is supporting the demand for dispensing pumps. To gain a higher market share, the manufacturers of the aforementioned products are introducing medium- and small-sized containers for residential end use, thereby increasing the demand for dispensing pumps.

In HORECA end-use segment, medium to large-sized pet bottles and metallic containers are used to serve the food items. Dispensing pumps of outflow range from 4 cc to 8 cc and 9 cc to 30 cc are widely used for this purpose. The hotels, restaurants, and café establishments in the region majorly procure the food items in bulk quantity; thus, the penetration of these dispensing pumps is expected to be moderate in HORECA segment. The other end uses of dispensing pumps include commercial products such as automotive lubricants, oils, cleaning creams, and personal care products used in massage centers and spas such as oil, creams, lotions, liquid soaps, and liquid sanitizers. Growing trend of outsourcing healthcare, automotive cleaning, and other services would further bolster the demand for the products.

Application Insights

The cosmetics and personal care application segment led the market and accounted for about 64.0% share of the revenue in 2021, which can be attributed to high demand from end users for cosmetic products. Major demand was generated from the U.S. on account of the changing lifestyle of the consumers and rising demand for beauty products.The market growth in food and beverage applications is expected to be driven by declining trend of cooking food and increasing consumption of readily available items on account of hectic lifestyle are likely to augment the growth of food and beverage industry. In addition, Inclination toward the consumption of healthy organic food and a rise in the demand for vegan food are also projected to support the growth of food and beverage industry in North America

The other applications of dispensing pumps comprise automotive car cleaning products, medicinal products, pharmaceutical products, home cleaning products, lubricants and creams, and cleaning agents used in commercial places. The automotive car care trend is growing in the North American countries, especially in the U.S., on account of growing trend for maintaining the vehicles. This is likely to have a positive impact on the demand for automotive sprays and cleaning agents, thereby fueling the demand for dispensing pumps.

Regional Insights

The U.S. dominated the North America dispensing pumps market and accounted for revenue share of about 77.0% in 2021, owing to presence of well-established manufacturing industries in the U.S. coupled with favorable regulations for trade operations has led the country to export food, cosmetic, and personal care products.The rapid growth in the in the number of restaurants, cafes, and hotels owing to the increasing footfall of international tourists in the country is raising demand for dispensing pumps used for packaging of food products on account of growth in the number of foodservice units in the country.

The market in Canada is witnessing growth due to rising market for cosmetics and food products. Moreover, the demand from commercial applications such as pharmaceutical, medical, and automotive sectors is anticipated to increase. The need for household cleaning products is increasing in the country on account of a rise in the number of constructions in residential and commercial sectors.Mexico dispensing pumps market is expected to progress at the highest growth rate over the forecast period. Growing demand for dispensing pumps from cosmetics and personal care industry is expected to be a major factor driving the market in the country.

Key Companies & Market Share Insights

The players in this industry are following a mix that includes both the conventional and the modern unconventional strategies. The major players in the industry are focusing on growing the company through appropriate business acquisition opportunities along with the development of partnerships to enhance geographic presence, technologies, and product offerings.

The players are also focusing on localizing the production capacity for the respective markets. To expand the capacities and to maximize the internal capacity utilization the companies are using subcontractors for the uninterrupted supply of certain plastic, rubber, and metal components. Some of the prominent players in the North America dispensing pumps market include

-

Aptar Group, Inc.

-

Mitani Valve Co., Ltd.

-

Silgan Dispesning Systems

-

Rieke Packaging Systems

-

Guala

-

RAEPAK Ltd.

-

TAPLAST S.r.l

-

Berry Bramlage

-

Precision Valve Corporation

-

Tekni-Plex

North America Dispensing Pumps Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 797.4 million

Revenue forecast in 2030

USD 1259.5 million

Growth Rate

CAGR of 6.0% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in million units, revenue in USD million and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, country

Regional scope

North America

Country

U.S.; Canada; Mexico

Key companies profiled

Aptar Group, Inc.; Mitani Valve Co., Ltd.; Silgan Dispesning Systems; Rieke Packaging Systems; Guala; RAEPAK Ltd.; TAPLAST S.r.l; Berry Bramlage; Precision Valve Corporation; Tekni-Plex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the North America dispensing pumps market report on the basis of product, application, end use, and country:

- Product Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

0-3 CC

-

4-8 CC

-

9-30 CC

-

>30 CC

-

- Application Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Cosmetics & Personal Care

-

Food & Beverage

-

Others

-

- End-use Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

HORECA

-

Non-commercial

-

Others

-

- Country Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America dispensing pumps market size was estimated at USD 743.0 million in 2021 and is expected to reach USD 797.4 million in 2022.

b. The North America dispensing pumps market is expected to grow at a compound annual growth rate of 6.0% from 2022 to 2030 to reach USD 1,259.5 million by 2030.

b. Cosmetics & personal care applications led the market and accounted for about 64% share of the revenue in 2021, which can be attributed to high demand from end-users for cosmetic products. Major demand was generated from the U.S. on account of the changing lifestyle of the consumers and rising demand for beauty products.

b. Some of the key players operating in the North America dispensing pump market include Aptar Group, Inc., Mitani Valve Co., Ltd., Silgan Dispesning Systems, Rieke Packaging Systems, Guala, RAEPAK Ltd., TAPLAST S.r.l, Berry Bramlage, Precision Valve Corporation, Tekni-Plex

b. The key factors that are driving North America dispensing pump market include the growing demand for skincare products. The rising trend of the majority population toward maintaining personal hygiene is expected to drive the market. Increase in the demand for personal care and multifunctional beauty products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."