- Home

- »

- Medical Devices

- »

-

North America Disposable Endoscopes Market Report, 2030GVR Report cover

![North America Disposable Endoscopes Market Size, Share & Trends Report]()

North America Disposable Endoscopes Market Size, Share & Trends Analysis Report By Application (Bronchoscopy, Urologic Endoscopy, Arthroscopy, GI Endoscopy, ENT Endoscopy), By End Use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-919-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

Report Overview

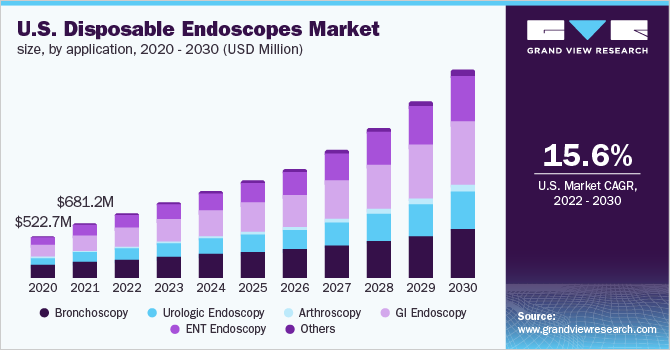

The North America disposable endoscopes market size was valued at USD 721.4 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 15.8% from 2022 to 2030. Growing respiratory and chronic disorders in the U.S. have increased the adoption of endoscopic procedures which in turn is expected to boost the disposable endoscopes market growth in this region. Increasing gastrointestinal disorders and different cancer cases in the North American region also accelerates the disposable endoscopes adoption and market growth.

For instance, according to the American cancer society, colorectal cancer is the second most common cause of cancer death in the United States and the lifetime risk of developing this disease is 4.3 % for men and 4.0% for women. American cancer society estimated about 52,580 deaths in 2022 due to colorectal cancer in the U.S. The growing fear of cross-contamination due to reusable endoscopes is also supporting the high adoption of the disposable endoscope and its accessories for diagnostic procedures.

Furthermore, to eliminate the risk of pathogen contamination from the reusable endoscopes, the clinical staff undergo lengthy sterilization steps which are tedious and become more time-consuming. For instance, according to Boston Scientific, more than 100 series of manual steps are required for the cleaning of endoscopes during ERCP procedures to reuse and this is also susceptible to manual errors. In addition, the increasing recommendation by the regulatory authorities such as the U.S FDA for the development of disposable endoscopic devices and components to improve cleaning and reduce the risk of patient infection is also supporting market growth.

COVID19 North America Disposable Endoscopes Estimates market impact: 30.6% increase in revenue growth from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The North America disposable endoscopes market increased by around 30.6% from 2020 to 2021

The market is projected to witness a year on year growth of approximately 15% to 20% in the coming 5 years

Growing preference for the use of disposable endoscopic devices to eliminate cross-contamination chances and related infections is driving the market growth during COVID-19.

The growing burden of chronic and respiratory disorders coupled with an increase in preference for contamination-free, minimally invasive, and cost-effective, endoscopic procedures are anticipated to propel the adoption of disposable endoscopic devices over the forecast years.

Lower infection chances coupled with lower procedure costs and shorter hospital stays are some of the major factors supporting the single-use endoscopes market growth during the pandemic.

Furthermore, increasing strategic initiatives by the manufacturers such as product launches, mergers, acquisitions, and collaborations are anticipated to boost the market during the post-pandemic period.

For instance, the U.S. Food and Drug Administration (FDA) in April 2020, recommended hospitals and endoscopy facilities to innovate disposable components such as caps or distal ends of the duodenoscope to reduce cross-contamination and help improve cleaning. Moreover, the cost-effectiveness of disposable endoscopes over reusable ones is also anticipated to propel single-use device adoption. For example, in 2019, the data published by the Association of Anesthetics stated that the estimated per-patient mean cost of single-use flexible bronchoscopes is £220.00 and a 0% risk of infection.

Similarly, another report published in Chest Journal in 2019, stated that the patients in the hospitals are paying 21% to 155% more per instrument cost than disposable endoscopic devices. Therefore, the advantages of using disposable endoscopes such as the lower chance of cross-contamination, cost-effectiveness, and minimum resource utilization are thereby anticipated to accelerate market growth over the years. Increasing advancement in technology and growing manufacturer investments to innovate and develop new single-use endoscopic devices are some of the major factors further supporting the growth of the market during the forecast period.

For instance, in November 2020, Olympus Corporation and Ruhof Corporation partnered and launched single-use procedure kits for endoscopes to reduce infection risks. Similarly, in November 2020, Omnivision launched multiple imaging subsystem products including camera modules, signal processor boards, and cables for single-use endoscopic devices. Consequently, the continuous product development and launch of imaging systems and components for disposable endoscopes are supporting market growth. COVID-19 pandemic has increased the demand for single-use products to reduce the chance of viral transmission, which in turn supported the growth of the market for disposable endoscopes in North America.

The benefits of using single-use endoscopes over the conventional reusable ones due to their sterility, safety, and lower infection chances properties also drove its adoption during the outbreak of the COVID-19 pandemic. In addition, the low availability of hospital staff due to the pandemic and the fear of cross-contamination also favored the high adoption of disposable endoscopic devices during the COVID-19 period. Moreover, growth promotion and recommendations by the government organizations and the regulatory authorities to use disposable components for endoscopic procedures to reduce the contamination risk are also anticipated to drive the market during the forecast period.

Application Insights

The bronchoscopy segment dominated the market for disposable endoscopes in North America and accounted for the highest revenue share of 29.3% in 2021. The growing prevalence of chronic respiratory disorders such as COPD, asthma, acute lower respiratory tract infections, lung cancer, and tuberculosis needs minimally invasive diagnostic procedures, which in turn are anticipated to drive the segment growth over the years. For instance, according to the American lung association, about 37 million Americans are living with chronic lung diseases like COPD and asthma. The lower post-procedural visit due to single-use bronchoscope procedures also increases its adoption and is anticipated to propel the segment growth.

However, the ENT endoscopy segment is expected to behold the fastest growth rate over the forecast years. This growth rate of single-use ENT endoscopes is attributable to its growing adoption, lower service and cleaning cost, and reduction of cross-contamination chances. Moreover, the growing number of nose, ear, and throat infection cases is also expected to propel market growth. In addition, subsequent product launches and advancements in technology are also supporting the fast growth of the segment. For instance, in June 2020, a single-use ENT endoscope “Colibri Micro ENT Scope” was launched by 3NT Medical, in the U.S.

End-use Insights

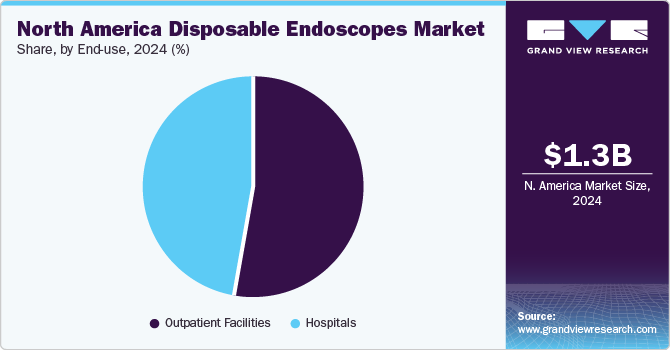

The hospital segment dominated the North America disposable endoscopes market and accounted for the highest revenue share of 47.5% in 2021. This segment share is attributable to the increasing number of patient visits to the hospitals for the diagnosis of chronic disorders. In addition, the high adoption of single-use endoscopes in hospitals reduces the risk of cross-contamination further boosting the segment growth. Moreover, a growing number of hospitals with endoscopy procedure facilities is also supporting the growth of the segment. Favorable reimbursement policies provided by the hospitals also accelerated their market share over the years.

Furthermore, the highest CAGR is expected from the clinics segment during the forecast period owing to the growing adoption of disposable endoscopes due to their cost-effectiveness and low chance of cross-contamination. In addition, short clinical stays, low post-procedural complications, and quick recovery time of single-use endoscopic procedures increase its adoption by the clinics. Moreover, the growing number of clinics with next-generation healthcare facilities is also anticipated to drive the growth rate of the segment over the forecast period.

Key Companies & Market Share Insights

The competition is increased among the top market players due to the high demand for disposable endoscopes due to the COVID-19 pandemic. The key players are looking forward to developing innovative low-cost single-use endoscopes and their components as per the patient's need to hold their strong position in the market. Key strategies followed by the market players such as collaboration, merger, acquisition, and new product launches to increase their portfolio are also anticipated to drive the market growth over the years. For instance, in April 2021, Olympus launched and added five premium disposable bronchoscopes to its U.S. bronchoscopy portfolio. Similarly, in December 2019, Boston Scientific Corporation launched “EXALT Model D” a Single-Use Duodenoscope for endoscopic retrograde cholangiopancreatography procedures. Some of the prominent players in the North America disposable endoscopes market include:

-

Ambu A/S

-

Prosurg Inc. (Neoscape, Inc.)

-

AirStrip Technologies

-

Boston Scientific Corporation

-

Parburch Medical

-

OBP Medical Corporation

-

Welch Allyn (Hill-Rom Services Inc.)

-

Allscripts Healthcare Solutions

-

Flexicare Medical Limited

-

Timesco Healthcare Ltd.

-

Sunmed

North America Disposable Endoscopes Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 859.1 million

Revenue forecast in 2030

USD 2.8 billion

Growth Rate

CAGR of 15.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2014 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Ambu A/S; Prosurg Inc. (Neoscape, Inc.); AirStrip Technologies; Boston Scientific Corporation; Parburch Medical; OBP Medical Corporation; Welch Allyn (Hill-Rom Services Inc.); Allscripts Healthcare Solutions; Flexicare Medical Limited; Timesco Healthcare Ltd.; Sunmed

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2030. For this study, Grand View Research, Inc. has segmented the North America disposable endoscopes market report based on application, end use, and region:

-

Application Outlook (Revenue, USD Million, 2014 - 2030)

-

Bronchoscopy

-

Urologic endoscopy

-

Arthroscopy

-

GI endoscopy

-

ENT endoscopy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2014 - 2030)

-

Hospitals

-

Clinics

-

Diagnostics Centers

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America disposable endoscopes market size was valued at USD 721.4 million in 2021 and is expected to reach USD 859.1 million in 2022.

b. The North America disposable endoscopes market is expected to grow at a compound annual growth rate of 15.8% from 2022 to 2030 to reach USD 2.8 billion by 2030.

b. Hospitals dominated the North America disposable endoscopes market with a share of 47.4% in 2021. This is attributable to the high usage of these devices in hospital settings for various diagnostic and therapeutic procedures.

b. Some key players operating in the North America disposable endoscopes market include Boston Scientific Corporation, Inc.; Flexicare Medical Ltd; Ambu A/S; Hill Rom Holdings.; and OBP Medical.

b. The bronchoscopy application segment dominated the North America disposable endoscopes market and held the largest revenue share of 29.3% in 2021.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."