- Home

- »

- Advanced Interior Materials

- »

-

North America, Europe, And Asia Pacific Air Compressor Market Report 2030GVR Report cover

![North America, Europe, And Asia Pacific Air Compressor Market Size, Share & Trends Report]()

North America, Europe, And Asia Pacific Air Compressor Market Size, Share & Trends Analysis Report By Type, By Product, By Lubrication, By Operating Mode, By Power Range, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-135-9

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

The North America, Europe, and Asia Pacific air compressor market size was estimated at USD 21.0 billion in 2022 and is anticipated to grow at a compounded annual growth rate (CAGR) of 4.7% from 2023 to 2030. Stringent environmental regulations and a growing emphasis on sustainability have led industries to adopt more environmentally friendly air compressors. Various industries in the Asia Pacific countries, such as manufacturing, oil & gas, food & beverage, energy & medical, and home appliances have been enjoying significant growth through rising investments from public and private entities. China and India remain the most promising countries for upcoming sales and demand of air compressors owing to the presence of manufacturing hubs.

Various factors such as environmental concerns, strict regulations, industrialization, and the need for high-quality air in an industrial application have been prompting the growth of the demand for air compressors in the U.S. Air compressors are widely used in industries such as food & beverage, pharmaceuticals, electronics, automotive, and healthcare.

In various industries, the quality of compressed air is crucial for maintaining product integrity and quality and ensuring operational efficiency. The food and beverage industry, pharmaceutical production, and semiconductors fabrication are examples of the industry where air quality standards are high and the use of air compressors is a must to comply with various regulations, which is also anticipated to drive the growth of the market over the forecast period.

Technological advancements in product performance, design, and enhanced features are also expected to have a positive impact on the growth of the market. For instance, in March 2023, Elgi North America announced the launch of a new GP35FP portable air compressor. The company showcased the new product in CONEXPO-CON/AGG 2023 at the Las Vegas Convention Center.

The air compressors are becoming more connected through the Internet of Things (IoT). IoT sensors and data analytics are used to monitor compressor performance in real time. Furthermore, the rising crude oil prices amid the Ukraine crisis are making the raw materials more costly for the steel industry, which is impacting the cost of the compressor.

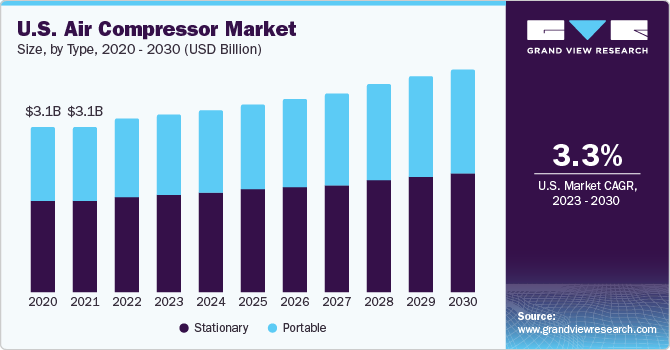

Type Insights

Based on type, the stationary air compressor segment led the market and accounted for the highest revenue share of 58.9% in 2022. The stationary air compressors are ideal for use in manufacturing plants, industrial plants, and auto repair shops. Furthermore, stationary air compressors are typically larger and more powerful than portable ones, which are suitable for heavy-duty applications.

Stationary air compressors can run continuously without frequent refueling or recharging, which is essential for industrial processes. Moreover, stationary air compressors often have more efficient motors and components compared to other air compressors. These factors are further expected to increase product demand over the forecast period.

Portable air compressors are available in various sizes and shapes. Smaller models are easy to transport whereas larger models are equipped with wheels for mobility. They are ideal for small-scale applications such as job sites and homes. The increasing concerns about environmental sustainability and reducing carbon footprints have led consumers and businesses to seek energy-efficient solutions, including portable air compressors, to lower energy consumption and emissions.

In July 2022, ELGi launched a line of high-performance, energy-efficient, and dependable electric and diesel portable air compressors. The diesel-powered PG 330-100, PG 500-185, and the electric-powered PG 90E & PG 55E trolley-mounted portable compressors joined forces with the diesel-powered PG 110E-13.5 and PG 575-225.

Lubrication Insights

Based on lubrication, the oil-filled air compressor segment led the market and accounted for the highest revenue share of 62.0% in 2022. An oil-filled air compressor, also known as an oil-lubricated air compressor, uses oil as a lubricant and coolant for its internal components, including the compressor pump. Oil-filled air compressors are commonly used in various industrial and commercial applications where clean, dry, and oil-free compressed air is not a strict requirement.

Oil-filled air compressors are widely used in the energy, manufacturing, and chemical industries. They are more robust and make less noise than oil-free compressors. Atlas Copco offers oil-lubricated rotary/screw compressors that provide consistent, energy-efficient, and smart AIR solutions. They also incur a lower overall lifecycle cost, which drives the market demand.

Over the forecast period, oil-free air compressors are expected to register lucrative growth with a CAGR of 5.1%. Oil-free mobile air compressors offer a wide range of advantages such as low risk of contamination, reduced maintenance and replacement cost, low energy cost, and minimal environmental impact, which is expected to drive the segment growth.

Leading players are developing low-maintenance and eco-friendly oil-free mobile air compressors to persuade consumers to choose advanced and energy-efficient mobile air compressors. To distinguish their products in an incredibly competitive sector, companies such as Ingersoll Rand; Atlas Copco; and BAUER COMP Holding GmbH have developed advanced technologies with high-performance capabilities.

End-use Insights

Based on end-use, the manufacturing end-use segment led the market and accounted for the highest revenue share of 40.7% in 2022. The growth of the manufacturing sector has indeed played a significant role in the expansion of the market. Manufacturing processes often require compressed air for various applications, such as operating pneumatic tools, controlling valves, powering machinery, and more.

As the manufacturing sector expands, the demand for compressed air also grows. In addition, modern manufacturing facilities increasingly use automation and robotics to improve efficiency and productivity. These automated systems often rely on compressed air for their operation, which is driving the need for reliable and efficient air compressors.

Oil-free air compressors have gained popularity in the food & beverage industry owing to their ability to provide clean, contaminant-free compressed air. Since oil can contaminate products and compromise their quality, the food & beverage industry requires compressed air that is free of oil and other contaminants, resulting in a growing demand for oil-free air compressors in this industry.

The semiconductor and electronics segment is expected to witness a CAGR of 6.8% over the forecast period. In the semiconductor industry, the growth has indeed contributed to the expansion of the market. Semiconductor manufacturing takes place in highly controlled cleanroom environments where air quality is crucial. Air compressors are used to supply clean, dry, and oil-free compressed air.

Operating Mode Insights

Based on operating mode, the electric-operated air compressor segment led the market and accounted for the highest revenue share of 53.2% in 2022. Electric air compressors are versatile in terms of their energy efficiency, and it is one of the driving factors for use in various industries. Compared to their gasoline or diesel counterparts, electric compressors tend to be more energy-efficient, resulting in cost savings over time.

As environmental regulations become more stringent, companies are increasingly turning to electric air compressors to reduce emissions and comply with environmental standards. Electric compressors produce fewer greenhouse gasses and pollutants compared to internal combustion engine-driven compressors, contributing to a cleaner and greener operation. Hence, the demand for the electric-operated compressor segment is expected to grow over the forecast period.

The internal combustion engine (ICE) segment is expected to witness the highest CAGR of 4.8% over the forecast period. ICE air compressors are commonly used in various industries and applications, and several factors drive their adoption and use. ICE air compressors are often mounted on portable trailers or vehicles, allowing them to be easily transported to job sites. ICE air compressors are often used in emergency response situations, such as roadside assistance and disaster relief efforts, where access to electricity may be limited or non-existent.

In addition, ICE air compressors can serve dual roles as both air compressors and power generators. They can power tools and equipment on job sites that lack access to electrical grids, increasing their utility. ICE air compressors can run continuously for extended periods, making them suitable for tasks that require uninterrupted air supply, such as sandblasting, rock drilling, and pile driving.

Power Range Insights

Based on power range, the 51-250kW segment led the market and accounted for the highest revenue share of 35.1% in 2022, and is likely to grow at a significant CAGR over the forecast period. Air compressors in the 51 kW to 200 kW range offer several benefits due to their increased power and capacity. These compressors can provide a higher volume of compressed air, making them suitable for applications that require a significant amount of air, such as industrial manufacturing, large-scale construction, and mining.

The GR 110-200kW oil-injected rotary screw compressors from Atlas Copco, for instance, are ideal for high-pressure applications requiring a consistent air supply of 13 and 20 bar. They operate as efficiently as possible at higher pressure due to their two-stage design.

Up to 20 kW segment is projected to grow at a robust growth with a CAGR of 4.9% over the forecast period. These compressors are considered medium-sized and are often used in various industrial and commercial applications where a moderate amount of compressed air is required. These compressors are versatile and can be used in various applications, including manufacturing, automotive repair, construction, and more.

Using an air compressor with a power output of over 500kW can offer several benefits, especially in large-scale industrial applications. Compressors in this power range can deliver a significant volume of compressed air at high pressures. This makes them suitable for demanding applications that require substantial airflow, such as heavy manufacturing or mining.

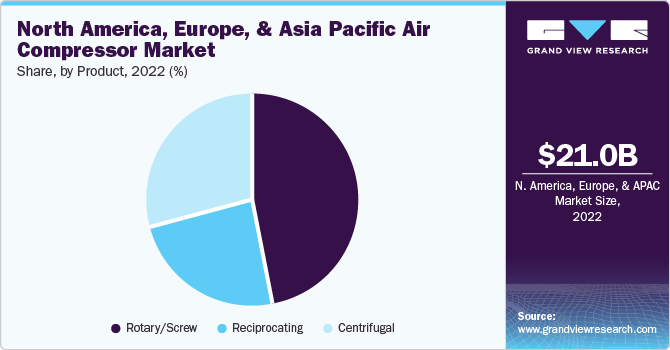

Product Insights

Based on product, the rotary/screw compressor segment led the market and accounted for the highest revenue share of 47.0% in 2022. The features of rotary/screw air compressors, such as low noise output, high energy efficiency, good performance, easy maintenance, and uninterrupted operation, are anticipated to attract more and more customers over the forecast period resulting in an increasing demand for rotary/screw air compressors.

Rotary/screw air compressors have a compact design, suitable for installations with limited space. This space-saving feature is beneficial for businesses with space constraints. Additionally, rotary/screw air compressors can provide a continuous supply of compressed air, which is essential for applications requiring a steady and uninterrupted air source.

Reciprocating air compressors are made for intermittent duty applications in challenging settings and have a low installation cost. They work best for applications where the compressor is often turned on and off. The factors influencing the growth of the reciprocating air compressors segment are their increasing demand in industries where air quality is critical, such as food & beverage, pharmaceutical, and electronics.

The centrifugal compressor segment is expected to witness the highest CAGR of 5.3% over the forecast period. The centrifugal air compressors reduce operating costs by eliminating the need for downstreaming filters and the replacement of compressor oil separators, making them a viable option in both consumer and industrial applications. In applications requiring clean and oil-free compressed air, centrifugal air compressors are a suitable choice, ensuring product quality and process integrity.

Regional Insights

Asia Pacific led the market and accounted for the highest revenue share of 48.6% in 2022. China has a significant industrial sector with diverse applications that may drive demand for air compressors in the country. China is a major hub for electronics manufacturing, including the production of semiconductors, microchips, and other electronic components.

Japan is known for its advanced industrial sector and stringent regulations for product quality and safety. The Japanese food and beverage industry is known for its high-quality products and strict regulations for food safety. Air compressors are commonly used in food and beverage processing for applications such as packaging, bottling, and food preservation to ensure compressed air purity and prevent oil contamination.

The European market is anticipated to grow at a lucrative CAGR of 3.8% over the forecast period owing to the strong emphasis on energy efficiency and sustainability placed by the European countries. Stricter environmental regulations and climate change concerns drove industries to adopt energy-efficient air compressor solutions.

Manufacturers in Europe are increasingly offering compressors with advanced features such as variable speed drives, which optimize energy consumption by adjusting compressor output to match demand. Further, many industries in Europe are switching to oil-free air compressors to meet their compressed air needs while also addressing environmental and safety concerns.

Key Companies & Market Share Insights

Key players actively focus on Power Range innovation, joint ventures, mergers & acquisitions. Innovations in compressor design and the adoption of new technologies have been contributing to an increase in the quality of the market offerings by the companies.

In August 2023, FS Elliot Co., LLC introduced the P400HPR Centrifugal Air Compressor. The P400HPR ensures energy efficiency and dependability while meeting any high-pressure application with improved features and exceptional performance. Some prominent players in the North America, Europe, and Asia Pacific air compressor market include:

-

Atlas Copco

-

BAUER COMP Holding GmbH

-

Hitachi Industrial Equipment Systems Co. Ltd.

-

Ingersoll Rand

-

KAESER KOMPRESSOREN

-

MAT Holding, Inc

-

Hanwha Power Systems CO., LTD.

-

Sullair LLC

-

Doosan Portable Power

-

Sullivan-Palatek, Inc.

-

ELGi

-

FS-ELLIOT CO., LLC

-

ZEN AIR TECH PRIVATE LIMITED

-

Frank Technologies Private Limited

-

Oasis Manufacturing

North America, Europe, And Asia Pacific Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 21.9 billion

Revenue forecast in 2030

USD 30.2 billion

Growth rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, volume in units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Power range, end-use, region, type, product, lubrication, operating mode

Regional scope

North America; Europe; Asia Pacific

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; Spain; UK; China; India; Japan; South Korea; Australia

Key companies profiled

Atlas Copco; BAUER COMP Holding GmbH; Hitachi Industrial Equipment Systems Co. Ltd.; Ingersoll Rand; KAESER KOMPRESSOREN; MAT Holding, Inc; Hanwha Power Systems CO., LTD.; Sullair LLC; Doosan Portable Power; Sullivan-Palatek, Inc.; ELGi, FS-ELLIOT CO.; LLC, ZEN AIR TECH PRIVATE LIMITED; Frank Technologies Private Limited; Oasis Manufacturing

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America, Europe, And Asia Pacific Air Compressor Market Segmentation

This report forecasts revenue growth at all three regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America, Europe, and Asia Pacific air compressor market report based on type, product, lubrication, operating mode, power range, end-use, and region:

-

Type Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Stationary

-

Portable

-

-

Product Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Reciprocating

-

Rotary/Screw

-

Centrifugal

-

-

Lubrication Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Oil Free

-

Oil Filled

-

-

End-use Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Manufacturing

-

Food & Beverage

-

Semiconductor & Electronics

-

Healthcare & Medical

-

Oil & Gas

-

Home Appliances

-

Energy

-

Others

-

-

Operating Mode Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Electric

-

Internal Combustion Engine

-

-

Power Range Outlook (Revenue, USD Billion; Volume, Units; 2018 - 2030)

-

Up to 20 kW

-

21-50kW

-

51-250 kW

-

251-500 kW

-

Over 500kW

-

-

Regional Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Frequently Asked Questions About This Report

b. The North America, Europe, and Asia Pacific air compressor market size was estimated at USD 21.0 billion in 2022 and is expected to be USD 21.9 billion in 2023.

b. The North America, Europe, and Asia Pacific air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 30.2 billion by 2030.

b. Asia Pacific accounted for the largest region holding 48.6% of market share and also growing at a fastest CAGR of 5.6% over the forecast period.

b. Some of the key players operating in the North America, Europe, and Asia Pacific Air Compressor market include: Atlas Copco, BAUER COMP Holding GmbH, Hitachi Industrial Equipment Systems Co. Ltd., Ingersoll Rand, KAESER KOMPRESSOREN, MAT Holding, Inc, Hanwha Power Systems CO., LTD., Sullair LLC, Doosan Portable Power, Sullivan-Palatek, Inc., ELGi, FS-ELLIOT CO., LLC, ZEN AIR TECH PRIVATE LIMITED, Frank Technologies Private Limited, Oasis Manufacturing.

b. Key factors that are driving the North America, Europe, and Asia Pacific Air Compressor market growth include growing demand for energy efficient compressors for use in different industries, rising adoption of air compressors in food and beverage processing and packaging industry and increasing investments in semiconductor industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."