- Home

- »

- Medical Devices

- »

-

North America And Europe Pharmaceutical Stability & Storage Services Market Report, 2030GVR Report cover

![North America And Europe Pharmaceutical Stability & Storage Services Market Size, Share & Trends Report]()

North America And Europe Pharmaceutical Stability & Storage Services Market Size, Share & Trends Analysis Report By Services (Stability, Storage), By Molecule (Large Molecule, Small Molecule), By Mode, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-123-7

- Number of Report Pages: 133

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

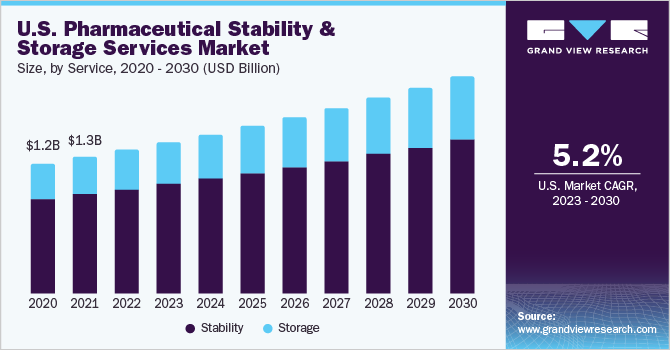

The North America and Europe pharmaceutical stability & storage services market size was valued at USD 2.10 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. The growing biopharmaceutical sector, rising outsourcing trends, and increasing pharmaceutical R&D spending are some of the major factors driving market growth in these regions.

The COVID-19 pandemic has significantly increased the demand for biological medicines, which require major pharmaceutical expenditure as they provide treatment for complex conditions. According to data published by AJMC (The Centers for Biosimilars), in 2022, biologics accounted for 35% of the total pharmaceutical expenditure. Despite biosimilars contributing USD 10.9 billion annually to spending in Europe, the wide-ranging impact of these drugs on patients, payers, and the healthcare system is substantial. This expenditure on medicine can be attributed to an increase in stability testing, as medicines are tested in different climatic conditions inside a chamber. This is expected to aid in the growth of the pharmaceutical stability and storage services market.

Pharmaceutical and biotechnology companies heavily invest in R&D to ensure the safety, efficacy, and regulatory compliance of their products. Stability testing and storage services are integral to this process, as they provide critical data on the stability profile and shelf life of pharmaceutical products. Robust stability studies are conducted to evaluate the effects of environmental factors on drug substances & formulations, and storage conditions are optimized to maintain product integrity throughout their shelf life.

Furthermore, increasing demand for biosimilars is expected to drive market growth. Biosimilars gained significant popularity in treating cancer, autoimmune diseases, and other chronic diseases. As biosimilars are cheaper than biologics, the demand for biosimilars has significantly increased in the past few years.The director of biosimilars at AmerisourceBergen has stated that the cost of biosimilars is expected to further decrease by 30% if its demand continues to grow. The rising demand for biosimilars is expected to increase the need for stability and storage over the forecast period.

Service Insights

The stability testing services segment dominated the pharmaceutical stability & storage services market in North America and Europe, accounting for 72.63% of the overall revenue share in 2022. Stability testing provides data on the changes in the quality of a drug product or drug substance over time, as influenced by various environmental factors including temperature, humidity, and light. Its objective is to determine a re-test period for the drug substance or shelf life for the drug product, along with the recommended storage conditions for it.

On the other hand, the storage segment is expected to witness a higher CAGR of 6.1% over the forecast period. Most players outsource their drug stability and storage management function, as it offers several advantages such as cost reduction, risk mitigation, and operational efficiency, which can drive segment growth. By partnering with companies with GMP-compliant facilities and experienced staff, organizations can streamline their stability studies and focus on their core competencies.

Molecules Insights

The small molecules segment dominated the North America and Europe pharmaceutical stability & storage services market, with 63.28% of the revenue share in 2022. Most pharmaceutical medications comprise small molecules, amounting to about 90% of all drugs. These medications treat fever, migraines, cancer, diabetes, and other common disorders. Small-molecule medications are used to treat numerous illnesses and disorders, which increases the need for stable testing and storage.

On the other hand, the large molecules segment is expected to show significant growth during the forecast period. The increasing demand for biological products such as tissues, recombinant therapeutic proteins, blood & blood components, allergens, somatic cells, and vaccinations drives segment growth. FDA states that biologics, despite being difficult and time-consuming to develop, may eventually prove to be the most effective means of treating a variety of medical illnesses and diseases for which no other medicines are available.

Mode Insights

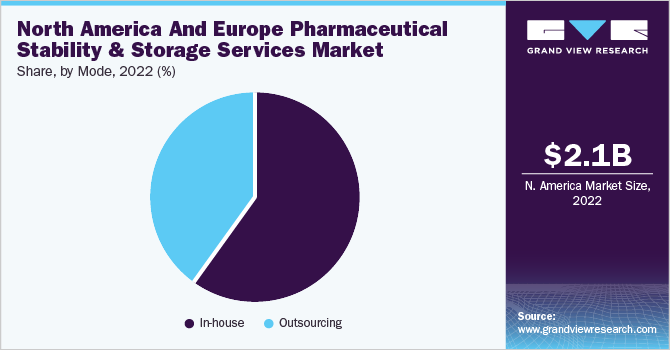

The in-house segment led the North America and Europe market for pharmaceutical stability & storage services, accounting for 60.0% of the revenue share in 2022. Conducting stability testing in-house can be more cost-effective than outsourcing it to external laboratories. It gives companies greater control over the testing process, reduces turnaround times, and allows for more efficient resource allocation. These factors collectively drive the need for in-house stability testing, enabling companies to meet regulatory requirements, ensure product quality & safety, optimize formulations, and enhance customer satisfaction.

On the other hand, the outsourcing segment is expected to show significant market growth in the coming years. Stability testing is crucial to product development and quality control, especially in the pharmaceutical & healthcare industries. Outsourcing allows access to specialized expertise and experience in stability testing. External laboratories or CROs often have dedicated teams with in-depth knowledge of regulatory requirements, testing methodologies, and data analysis techniques, which drives their demand.

Regional Insights

North America dominated the market for pharmaceutical stability & storage services between North America and Europe, contributing with a revenue share of 71.51% in 2022. The pharmaceutical industry in North America has been witnessing significant growth due to various factors such as a rapidly aging population, increasing prevalence of chronic diseases, and advancements in drug development. This growth leads to a higher demand for stability testing and storage services to ensure the quality and efficacy of pharmaceutical products.

The European market for pharmaceutical stability & storage services is expected to witness a CAGR of 6.3% over the forecast period. Europe has robust regulations governing the storage and stability of pharmaceutical products, such as Good Manufacturing Practices (GMP) and Good Distribution Practices (GDP). Compliance with these regulations is essential for pharmaceutical companies to ensure the quality, efficacy, and safety of their products. This drives the demand for specialized stability and storage services that can meet these regulatory requirements in this region.

Key Companies & Market Share Insights

Key players in the market undertake various strategic initiatives to maintain their position. For instance, in January 2022, Catalent announced the expansion of its large-scale isolator unit manufacturing facilities at Malvern, Pennsylvania, and Dartford, U.K. This is expected to help the company in its drug development process and the production of drug compounds. Moreover, in December 2022, Alcami constructed a new 65,000 sq. ft. cGMP biostorage facility. The company expanded its production space to strengthen its position in the market. Some prominent players in the North America and Europe pharmaceutical stability & storage services market include:

-

Eurofins Scientific

-

Intertek Group plc

-

Lucideon Limited

-

Element Materials Technology

-

Q1 Scientific

-

Reading Scientific Services Ltd.

-

Catalent, Inc.

-

Quotient Sciences

-

Recipharm AB

-

Almac Group

-

Alcami Corporation

-

BioLife Solutions, Inc.

-

Sampled (Roylance Stability Storage Limited)

-

Precision Stability Storage

-

Broughton

North America And Europe Pharmaceutical Stability & Storage Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.22 billion

Revenue forecast in 2030

USD 3.22 billion

Growth rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service,molecules, mode, region

Regional scope

North America; Europe

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

Eurofins Scientific; Intertek Group plc; Lucideon Limited; Element Materials Technology; Q1 Scientific; Reading Scientific Services Ltd.; Catalent, Inc.; Quotient Sciences; Recipharm AB; Almac Group; Alcami Corporation; BioLife Solutions, Inc.; Sampled (Roylance Stability Storage Limited); Precision Stability Storage; Broughton

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America And Europe Pharmaceutical Stability & Storage Services Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America and Europe pharmaceutical stability & storage services market report on the basis of service, molecule, mode, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Stability

-

Drug Substance

-

Stability indicating method validation

-

Accelerated stability testing

-

Photostability Testing

-

Other stability testing methods

-

-

Storage

-

Cold

-

Non-cold

-

-

-

Molecules Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Molecule

-

Research Products

-

Commercial Products

-

-

Large Molecule

-

Research Products

-

Commercial Products

-

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourcing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Frequently Asked Questions About This Report

b. The North America & Europe pharmaceutical stability and storage market size was estimated at USD 2.10 billion in 2022 and is expected to reach USD 2.22 billion in 2023.

b. The North America & Europe pharmaceutical stability and storage market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 3.22 billion by 2030.

b. North America dominated the North America & Europe pharmaceutical stability and storage market with a share of 71.51% in 2022. This is attributable to a rapidly aging population, increasing prevalence of chronic diseases, and advancements in drug development.

b. Some key players operating in the North America & Europe pharmaceutical stability and storage market include Eurofins Scientific, Intertek Group plc., Lucideon Limited., Element Materials Technology, Q1 Scientific, Reading Scientific Services Ltd., Catalent, Inc., Quotient Sciences Recipharm AB, Almac Group, Alcami Corporation, BioLife Solutions, Inc., Sampled (Roylance Stability Storage Limited), Precision Stability Storage, Broughton

What are the factors driving the North America & Europe pharmaceutical stability and storage market?b. Key factors that are driving the market growth include the growing biopharmaceutical sector, rising outsourcing trends, and increasing pharmaceutical R&D spending.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."