- Home

- »

- Medical Devices

- »

-

Pharmaceutical Stability And Storage Services Market, 2030GVR Report cover

![Pharmaceutical Stability And Storage Services Market Size, Share & Trends Report]()

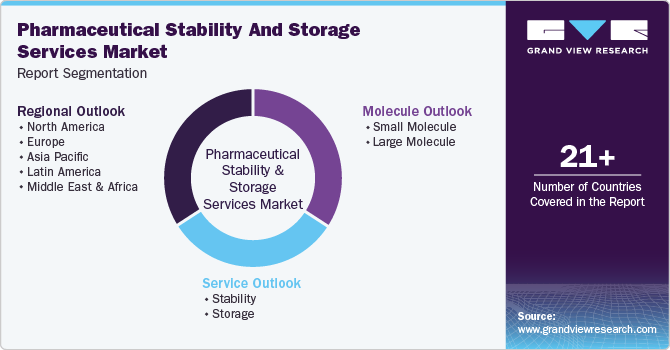

Pharmaceutical Stability And Storage Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Stability, Storage), By Molecule (Large Molecule, Small Molecule), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68039-936-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Stability And Storage Services Market Summary

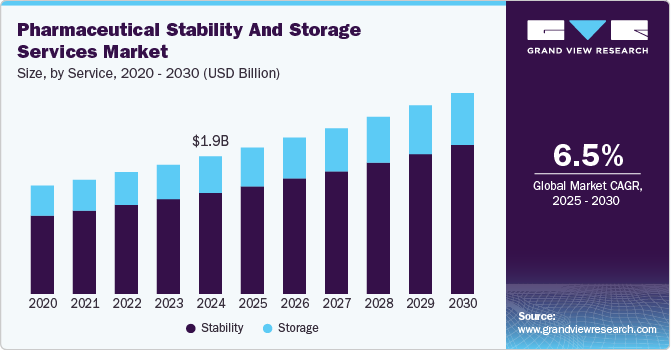

The global pharmaceutical stability and storage services market size was estimated at USD 1.92 billion in 2024 and is projected to reach USD 2.80 billion by 2030, growing at a CAGR of 6.48% from 2025 to 2030. The growth of the market is mainly due to continuous technological advancements, increasing R&D expenditure by pharmaceutical companies coupled with the growing drug pipeline.

Key Market Trends & Insights

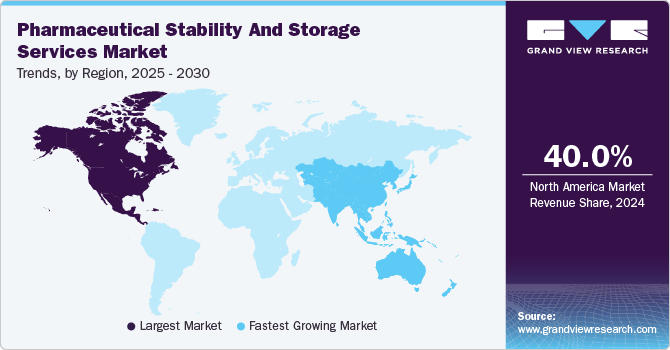

- The North America pharmaceutical stability and storage services market dominated the market and accounted for a 40.0% share in 2024.

- The Asia Pacific pharmaceutical stability & storage services market is expected to grow at the highest CAGR over the forecast period.

- Based on service, the Stability testing services segment dominated the pharmaceutical stability and storage industry with a share of 73.5% in 2024.

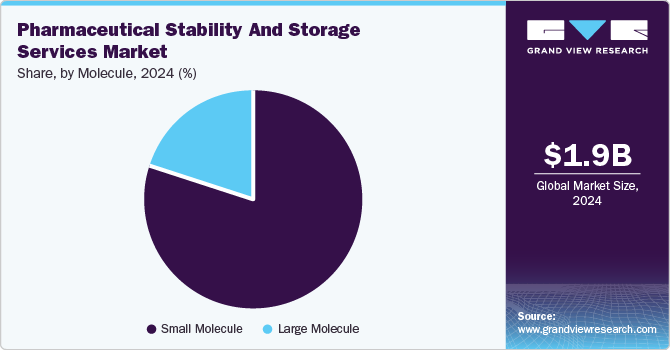

- Based on molecule, the small molecule segment dominated the services market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.92 Billion

- 2030 Projected Market USD 2.80 Billion

- CAGR (2025-2030): 6.48%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Pharmaceutical organizations are increasingly focusing on their R&D activities to stay competitive & flexible. According to the data published by Forbes in August 2023, over the past year pharmaceutical companies increased its research and development spending by 6% annually.

Furthermore, growing technological advancement such as advanced temperature-controlled storage systems, real-time monitoring, and data analytics in the pharmaceutical industry is also one of the factors driving the market growth. These technologies have improved the ability to maintain optimal storage conditions and track the stability of pharmaceutical products. Moreover, several companies are focusing on expanding their existing business in new locations to strengthen their regional presence by offering innovative services. For instance, July 2024, Cambrex expanded its stability storage business by opening a new facility in North Carolina. The expansion aims to meet the increasing demand for outsourced drug development and manufacturing services. Thus, the aforementioned factors are further contributing to the market growth.

Moreover, growing pipeline of new pharmaceutical drugs is also one of the key drivers of the market. Increasing product pipelines, including biologics and specialty drugs would increase the need for specialized stability testing and storage solutions. These new drugs have unique storage requirements and shorter shelf lives, necessitating advanced services to maintain their quality and efficacy. According to the data published by the Government of Canada in May 2023, the global drug pipeline contained more than 9,000 new drugs in several stages of clinical development in 2022 compared to the year before which was approximately 8,500.

The demand for biosimilars has increased significantly over the past few years, as they are generally cheaper than biologics and mostly similar to biologics. Moreover, adoption of biosimilars has significantly increased in treating autoimmune diseases, cancer, and other chronic diseases. The increasing cases of diseases globally is projected to drive the demand for biosimilars, consequently boosting the demand for these services. Several regulatory authorities have different testing rules and data requirements for testing stability, which makes it difficult for pharmaceutical companies to commercialize their products, especially across different regional markets. This is anticipated to drive the demand for outsourcing services in the market.

In addition, increasing awareness and emphasis on patient safety and quality assurance, pharmaceutical companies are increasingly prioritizing the integrity of their products. Ensuring that pharmaceuticals maintain their intended potency and safety throughout their shelf life is critical for protecting patient health and avoiding costly recalls. This focus on quality assurance will drive the need for rigorous stability testing and reliable storage solutions. Growing focus towards patient safety would drive the demand for these services.

Service Insights

Stability testing services segment dominated the pharmaceutical stability and storage industry with a share of 73.5% in 2024. The growth of the segment is mainly due to its important role in regulatory compliance, product safety, and efficacy. Moreover, the complexity of modern pharmaceuticals, globalization of the market, technological advancements, and risk management needs are also some of the factors contributing to the segment’s dominance. Stability testing determines the quality of a pharmaceutical product changes over time under the influence of various environmental conditions such as temperature, humidity, and light. By ensuring that products remain effective and safe for use throughout their intended shelf life, stability testing is crucial for maintaining high standards of patient safety and product efficacy. According to the data published by contract pharma, in July 2024, outsourcing can be an effective solution for companies lacking in-house expertise in method development and validation, especially when working with complex drug products.

The storage segment is projected to witness considerable growth during the forecasted period owing to the growing pipeline of complex drug products, including biologics, biosimilars, and temperature-sensitive drugs. These products often require specialized storage conditions to maintain their efficacy and safety. The growing diversity and complexity of pharmaceuticals are driving demand for advanced solutions that can meet specific temperature, humidity, and environmental requirements.

Molecule Insights

Small molecule segment dominated the services market in 2024. There have been significant advancements in small molecule drug development. Small molecules account for around 90% of all pharmaceutical drugs and are used to treat a range of conditions, including fever, migraines, cancer, diabetes, and other prevalent diseases. The widespread use of small-molecule drugs for treating these common conditions is driving the demand for stability testing and storage solutions.

The large molecule segment is projected to witness the fastest growth in the coming years owing to the growing number of large molecule drug approvals, especially from the FDA. According to the data published by NCBI, in February 2024, the FDA has approved 55 drugs in 2023 out of which 17 were large molecule drugs. Moreover, increasing incidence of infectious diseases is driving the demand for new therapeutic solutions and higher capital investments by pharmaceutical and biotech companies to develop new drugs. These investments are also facilitating partnerships with outsourcing firms to reduce the drug development costs.

Regional Insights

North America pharmaceutical stability and storage services market dominated the market and accounted for a 40.0% share in 2024. The growth in the region is attributed to the presence of several pharmaceutical and biotech companies in the region, coupled with increasing research and development activities are driving the regions market growth. The region has a highly developed infrastructure for pharmaceutical stability and storage. This includes state-of-the-art facilities equipped with advanced technologies for monitoring, testing, and maintaining optimal storage conditions. The region's infrastructure supports the complex needs of modern pharmaceuticals, including biologics and temperature-sensitive products.

U.S. Pharmaceutical Stability And Storage Services Market Trends

The U.S. pharmaceutical stability and storage services market is projected to be driven by significant investment in expanding stability and storage facilities and services. Companies are building new facilities, upgrading existing infrastructure, and expanding their service offerings to meet the growing demand for pharmaceutical stability and storage solutions. This expansion is driven by the increasing complexity and volume of pharmaceutical products. For instance, in July 2024, Alcami Corporation enhanced its cold, stability, and custom storage capabilities with the opening of its new state-of-the-art pharmaceutical storage facility in Garner.

Europe Pharmaceutical Stability And Storage Services Market Trends

Europe pharmaceutical stability and storage services market is anticipated to witness lucrative growth over the projected period. European regulatory authorities, such as the European Medicines Agency (EMA), enforce rigorous standards for pharmaceutical stability and storage. Compliance with these stringent regulations necessitates advanced stability testing methods and sophisticated storage solutions. Companies operating in the region are investing in high-quality stability and storage services to meet these regulatory requirements and ensure product safety and efficacy.

Pharmaceutical stability and storage services market in the UK is anticipated to experience considerable growth over the forecast period. The biopharmaceutical sector in the UK is expanding, with increased development and commercialization of biologics, biosimilars, and advanced therapies. These large molecules require specialized stability and storage solutions due to their complex nature and specific storage requirements. The growth of the biopharmaceutical sector is driving demand for enhanced stability and storage services in the UK.

Germany pharmaceutical stability and storage services market is expected to grow at a considerable rate over the forecast period. Technological advancements are significantly impacting the stability and storage services market in Germany. Advancements such as real-time monitoring systems, automated stability testing equipment, and smart storage solutions are enhancing the efficiency and accuracy of stability and storage operations. The integration of these technologies is improving the management and preservation of pharmaceutical products.

Asia Pacific Pharmaceutical Stability And Storage Services Market

Asia Pacific pharmaceutical stability & storage services market is expected to grow at the highest CAGR over the forecast period.Asia Pacific is becoming a major center for clinical trials due to its large and diverse patient population and favorable regulatory environments. The expansion of clinical trials in the region requires precise stability and storage conditions to maintain the integrity of investigational products. This trend is driving demand for stability and storage services to support clinical research.

China pharmaceutical stability and storage services market is projected to witness significant growth in the coming years.The trend towards personalized medicine is gaining momentum in China, with a focus on developing therapies tailored to individual patient profiles. Personalized medicines often require precise storage conditions, including controlled temperature and environmental parameters. This trend is increasing the need for customized stability and storage solutions to support these advanced therapies. Moreover, growing number of clinical trials in the country is also contributing to the country’s market growth. According to the data published by Clinical Trials Arena in January 2023, China accounted for approximately 27.7% of global clinical trial activity in 2022.

The pharmaceutical stability and storage services market in Japan is expected to witness lucrative growth over the forecast period. The country faces high level of competition, with numerous local and international players operating in the space. This competitive environment drives innovation and improvements in stability and storage services. Companies are focusing on differentiating themselves through technology, service quality, and geographical reach.

The India pharmaceutical stability and storage services market is poised to grow in the coming years. India’s pharmaceutical industry is one of the largest and fastest-growing globally, driven by rising healthcare needs, increased investments in drug development, and a strong domestic and international market presence. This growth is leading to a higher demand for pharmaceutical stability and storage services to manage and preserve a growing volume of drug products.

MEA Pharmaceutical Stability And Storage Services Market Trends

The MEA pharmaceutical stability & storage services market is projected to grow at a lucrative rate. Pharmaceutical companies in the MEA region are increasingly outsourcing stability testing and storage services to specialized providers. Outsourcing offers cost efficiency, access to specialized expertise, and allows companies to focus on their core activities. This trend is contributing to the growth of the outsourcing segment within the stability and storage services market.

The Saudi Arabia Pharmaceutical Stability And Storage Services Market

The pharmaceutical stability & storage services market in Saudi Arabia is projected to witness the fastest growth rate owing to the emergence of a rapidly expanding pharmaceutical sector. Saudi Arabia’s regulatory environment is becoming more stringent, with the Saudi Food and Drug Authority (SFDA) enforcing stricter guidelines and standards for pharmaceutical stability and storage. Compliance with these regulations is essential for ensuring product safety and efficacy. Pharmaceutical companies in Saudi Arabia are focusing on adhering to these regulatory requirements, which drives the demand for high-quality services.

Key Pharmaceutical Stability And Storage Services Company Insights

Key players operating in the pharmaceutical stability & storage services market are undertaking various initiatives to strengthen their market presence and increase the reach of their services. Companies such as Catalent Inc., Charles River Laboratories International, Inc. are providing extensive service offerings and an established global presence. These companies benefit from their ability to provide high-quality, reliable services that meet stringent regulatory standards. For instance, in July 2024, Catalent, Inc.announced the completion of a USD 25 million expansion of its clinical supply facility in Germany. The facility includes expanded temperature-controlled storage further enhancing its comprehensive offerings in clinical supply services including packaging, storage, and distribution.

Key Pharmaceutical Stability And Storage Services Companies:

The following are the leading companies in the pharmaceutical stability and storage services market. These companies collectively hold the largest market share and dictate industry trends.

- Catalent, Inc

- Almac Group

- Charles River Laboratories

- Eurofins Scientific

- Intertek Group plc

- Lucideon Limited

- Alcami Corporation

- Element Materials Technology

- BioLife Solutions Inc.

- Q1 Scientific

- Reading Scientific Services Ltd.

- Roylance Stability Storage Limited

- ALS

- Q Laboratories

- Auriga Research Private Limited

- PD Partners

- Precision Stability Storage

- SGS Société Générale de Surveillance SA.

Recent Developments

-

In January 2024, Alcami Corporation opened its Pharma Storage and Services facility in California. This expansion is part of Alcami’s plan to enhance its pharma storage and services operations, providing key locations to better serve biotech and pharmaceutical clients. The site will gradually introduce stability storage and aliquoting services, with cold storage

-

In April 2023, Alcami Corporation announced the completion of the Phase III expansion of its cGMP bio storage facility in Amherst, New Hampshire. This expanded capacity is fully operational and ready to meet diverse cGMP client storage requirements.

-

In June 2022, Cambrex announced its acquisition of Q1 Scientific. The acquisition aims to strengthen the company’s regional presence and service offerings.

Pharmaceutical Stability And Storage Services Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.04 billion

Revenue forecast in 2030

USD 2.80 billion

Growth rate

CAGR 6.48% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, molecule, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China, India, South Korea, Thailand, Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Catalent, Inc, Almac Group, Charles River Laboratories, Eurofins Scientific, Intertek Group plc, Lucideon Limited, Alcami Corporation, Element Materials Technology, BioLife Solutions Inc., Q1 Scientific, Reading Scientific Services Ltd., Roylance Stability Storage Limited, ALS, Q Laboratories, Auriga Research Private Limited, PD Partners, Precision Stability Storage,SGS Société Générale de Surveillance SA.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Stability And Storage Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical stability and storage services market report based on service, molecule, and region.

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Stability

-

Drug Substance

-

Stability Indicating Method Validation

-

Accelerated Stability Testing

-

Photostability Testing

-

Other Stability Testing Methods

-

-

Storage

-

Cold

-

Non-cold

-

-

-

Molecule Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Molecule

-

Research Products

-

Commercial Products

-

-

Large Molecule

-

Research Products

-

Commercial Products

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical stability and storage services market size was estimated at USD 1.92 billion in 2024 and is expected to reach USD 2.04 billion in 2025.

b. The global pharmaceutical stability and storage services market is expected to grow at a compound annual growth rate of 6.48% from 2025 to 2030 to reach USD 2.80 billion by 2030.

b. North America region dominated the global pharmaceutical stability and storage services market in 2024 with a largest market share of 40.06% since the most of pharmaceutical companies are located in the U.S. Increasing funding for clinical trials by the public organizations is further promoting the regional market growth.

b. Some key players operating in the pharmaceutical stability and storage services market include Catalent Inc.; Almac Group; Charles River Laboratories International, Inc.; Eurofins Scientific SE; Intertek Group plc; Lucideon Limited; Alcami Corporation; Element Materials Technology; BioLife Solutions; Q1 Scientific; Masy BioServices; Reading Scientific Services Ltd.; Roylance Stability Storage Limited; ALS Ltd.'s; Q Laboratories; Auriga Research Private Limited; PD Partners; Precision Stability Storage

b. Significant R&D investments by the pharmaceutical and biopharmaceutical companies and growing demand for pharmaceutical stability and storage outsourcing are the prime factors driving the market growth. The introduction of biosimilars and a significant number of biosimilar approvals in the past years have further strengthened the pharmaceutical stability and storage services market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.