- Home

- »

- Healthcare IT

- »

-

North America Healthcare Analytics Market Size, Report, 2030GVR Report cover

![North America Healthcare Analytics Market Size, Share & Trends Report]()

North America Healthcare Analytics Market Size, Share & Trends Analysis Report By Type (Descriptive, Predictive), By Component (Software, Hardware), By Delivery Mode, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-195-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

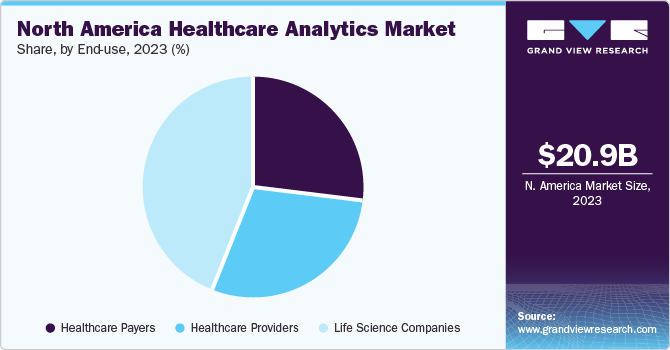

The North America healthcare analytics market size was estimated at USD 20.9 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 19.6% from 2024 to 2030. The healthcare industry faces challenging issues such as the lack of better patient care, skyrocketing costs of treatment, and less patient retention & engagement. As a result, healthcare analytics are being incorporated into every aspect of the industry to give better care to patients and for better industry operations. These factors are key reasons for the growth of the healthcare analytics industry.

COVID-19 caused a significant growth in the industry due to an increase in the need for digital solutions and better analytics tools to manage patient loads in the healthcare industry. The amount of clinical data generated during the pandemic needed proper management. With the help of analytics tools and platforms, researchers and professionals derive better outcomes, predict trends, and understand the dynamics of disease outbreaks much better. An increasing burden on health establishments and professionals has created a need to adopt healthcare analytics platforms for better management and delivery of better care to patients.

In June 2020, National Institute of Health (NIH) launched a healthcare data analytics platform to collect patient data for actionable insights on COVID-19. However, the post-pandemic effect shows healthcare analytics as a part of a larger solution that has much wider implications for understanding clinical data for healthcare professionals. In May 2021, the WHO and a German federal agency established a hub for pandemic data for analyzing the spread of disease, innovation in the field of medicine, and surveillance of patients to mitigate further risks in the future.

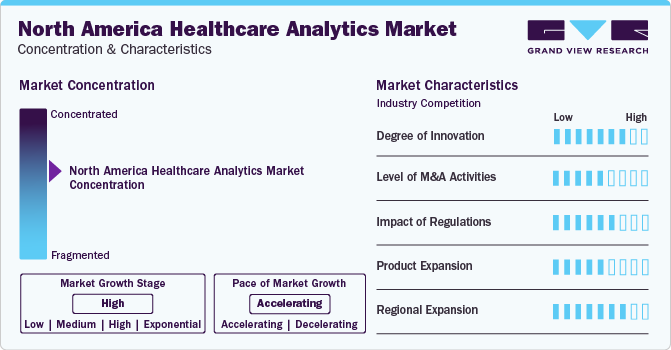

Market Concentration & Characteristics

A rapid rate of degree of innovation and massive investments by the healthcare industry into IT development and digitization have been key factors for the monumental growth of the healthcare analytics industry. In January 2021, Optum, Inc. collaborated with Change Healthcare to advance the technology-enabled healthcare platform. Both companies provide their consumers with data analytics solutions, software, and a technology-advanced healthcare platform. Analytical platforms that are currently being deployed by healthcare institutions across the globe help in patient management, their retention, due to which better care can be delivered.

Mergers and acquisitions among key players and emerging enterprises are expected to contribute to market development and growth. For instance, in March 2021, Accenture announced acquisition plans of Enterprise System Partners for its life sciences business segment. This acquisition would aid Accenture and its goal of digital reinvention of the industry and transformation in the manufacturing facilities of pharmaceutical, medical device, and biopharma companies.

Government initiatives and a massive flux of money in the healthcare industry also drive innovation. They are responsible for the increasing adoption of such analytical platforms by healthcare establishments. Analytical platforms are used by hospitals and other establishments for managing and interpreting clinical data from various studies conducted, studying historical data, and analyzing it to establish trends, and developing methods, tools, and technologies to get optimal results.

Policymakers are also deploying these analytics platforms to study statistics and models for making better decisions and policies regarding healthcare establishments and delivering care to patients. The U.S. government has been taking initiatives in this direction; the HealthData.gov portal has information from several federal databases on topics such as community health performance, clinical data, and medical and scientific knowledge for developers, which is accessible by an application programming interface.

Healthcare analytics can be deployed for various functions in an establishment, for management of grants and donations given to the hospital, patient records, making appointments, insurance claims, etc. It can improve the quality of care delivered to patients and give insights for managing overall business establishments, better patient outreach, management of the spread of diseases, etc. Grainger College of Engineering, Illinois, developed the Health Data Analytics Initiative as a hub connecting clinical investigators, engineers, AI experts, and data scientists, which helps deliver better solutions by improving research quality via deploying AI platforms and analytical tools.

The market is experiencing significant geographic expansion due to several key factors such as the rising demand for cost-efficiency, government initiatives, technological advancements, and rising focus on population health. Recently, Alibaba collaborated with AstraZeneca to expand the latter’s market in China. Both companies would work together to deliver health services driven by AI, which is expected to improve the country’s healthcare system along with the company’s geographic expansion.

Type Insights

Descriptive analysis held the largest market share of 45.7% in 2023. Descriptive analytics has been widely used during the pandemic to study historical data and patient histories to study the spread of the virus, which has been a key factor driving growth in this segment. Descriptive analytics has proved to be a valuable tool for understanding what happened by accessing historical data and turning it into actionable insights. In addition, hospitals are using it to monitor the performance of insurance claims by detecting irregularities and errors in the claims. Many organizations are using descriptive analysis tools to increase market growth potential.

Predictive analysis is the fastest-growing analytics type segment since it uses data sets created by descriptive analytics to analyze data for actionable future insights. More and more companies are adopting analytics for better growth prospects, which has been a key propellant for the growth of this segment. It has become necessary to adopt these platforms to predict future trends in the market for the company to take appropriate measures that foster the overall growth of this segment.

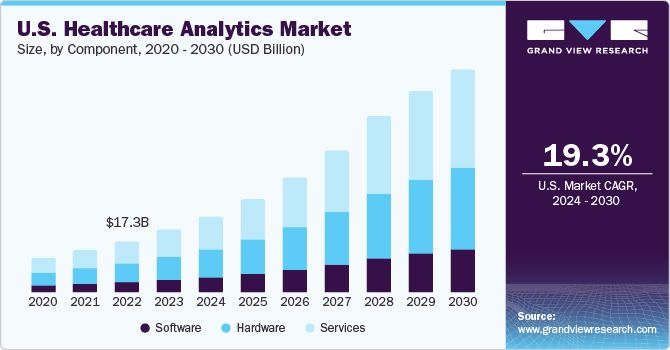

Component Insights

Services dominated the market with a share of 42.2% in 2023. The healthcare industry has been investing a substantial amount of capital in the IT industry to develop platforms and digitize data for analytics. Most companies need a data analytics component, so they are outsourcing the data analytics aspect of their IT. This has resulted in the growth of data analytics companies offering a complete set of services to companies. An increase in services offered by data analytics companies has been responsible for segment growth.

The services segment is anticipated to register fastest growth rate during the forecast period, due to an increase in patient load in the health industry and a rise in disease prevalence, which has resulted in massive amounts of clinical data generated, insurmountable pressure on the industry to give better care, better results and cost-effective treatments to patients is further propelling this market towards growth. The need to adopt analytical methods and tools for better patient monitoring and delivering better treatments are key factors for the growth of this segment.

Delivery Mode Insights

On-premises dominated the market with a revenue share of 47.8% in 2023. Currently, many institutions are opting to install software and tools for data storage on their own premises, owing to the advantages of easy access and security, leading to a significant market share for this delivery type. While the existing systems in smaller organizations are efficient, scaling them up to handle larger datasets can be time-consuming and labor-intensive. This could entail substantial capital investment in data storage and security.

The cloud-based segment is projected to grow at the fastest growth rate during the forecast period, owing to ease of storage, less capital investment, and increased flexibility and efficiency; these factors also add up to continuous growth in this delivery mode. Cloud-based storage isn’t limited to off-site services; it can be implemented on-premises as well. However, scalability can be a challenge in this setup. Public cloud storage solutions, despite their rapid growth and contribution to the expansion of cloud-based storage, come with their own drawbacks. These include reduced privacy and heightened security risks, particularly data loss.

Application Insights

Financial applications held the largest market share of 36.3% in 2023. Healthcare institutions and organizations are continually striving to minimize cost of treatment yet deliver better care to patients, attributed to the growth of this segment. This segment is anticipated to grow at the fastest rate over the forecast period. Thus, companies perform better by reducing costs and preventing fraud.

Healthcare institutions incur costs in the form of insurance claims, which can also be fraudulent. To mitigate such risks and minimize such occurrences, healthcare organizations deploy analytical tools for predictive and descriptive analysis to deliver better care to patients, reduce overall costs of operations, and minimize fraud in insurance claims. The need to perform financially well has been a key driver for adopting this application type.

End-use Insights

Life science companies dominated the market with a revenue share of 44.3% in 2023. Currently, life-science companies are the primary users of analytical tools and platforms, utilizing them to decrease product costs, enhance profit margins, improve product quality, and accelerate adoption and growth in the sector. These companies continually strive to enhance their product range and services to reach a broader audience, necessitating the use of analytical tools for better market understanding and prediction, and to facilitate value-based decision-making.

Healthcare providers is expected to show highest growth rate in the forecast period, as the pandemic has placed a significant burden on hospitals and healthcare professionals to deliver cost-effective care and improved patient management, leading to this segment’s expansion. The necessity to manage patient records, monitor diseases, and provide cost-effective patient care has been instrumental in the widespread adoption of healthcare analytics, and are projected to drive segment growth.

Country Insights

North America, with its advanced healthcare infrastructure, has welcomed various platforms and technologies, leading to a significant market share. The growing prevalence of chronic diseases and an aging population have necessitated the use of analytics tools by hospitals and other entities. The presence of major industry players also contributes to the region’s substantial market revenue. For instance, in March 2022, Microsoft introduced the Microsoft Cloud for Healthcare, a cooperative effort between patients and providers to enhance patient care insights. This significantly increased market growth.

U.S. Healthcare Analytics Market Trends

The healthcare analytics market in U.S. accounted for around 83.0% of the total North America healthcare analytics market. The usage of big data and related services in the U.S. is extensive. In addition, various initiatives being undertaken by government and nongovernment organizations have led to an increase in penetration of analytics in the U.S. For instance, the National Health Information Technology (HIT) initiative in the U.S. promotes the adoption of healthcare IT that includes interoperability, privacy & security, and collaborative governance.

Canada Healthcare Analytics Market Trends

The healthcare analytics market in Canada is anticipated to witness the fasted growth over the forecast period. Canada’s healthcare sector is facing increased demand resulting from the growing chronic diseases and an aging population. These both factors are anticipated to boost demand on health systems and showcases increasing need for technological advancements and adoption. Increased healthcare spending is expected to boost the development and adoption of analytics in the country’s healthcare market, thereby propelling the overall growth of the market.

Key North America Healthcare Analytics Company Insights

Key industry players are adopting different strategies, constantly innovating, and bringing up new technologies to understand better data derived from patient information, understand the spread and containment of disease, to deliver better care solutions to healthcare providers and institutions. Using big data analytics and AI has also given rise to new platforms to better understand and analyze data. Swedish Health Services, a U.S.-based healthcare organization, has developed a platform for healthcare workers to report real-time data on COVID-19 patient volumes and other parameters to track the status of facilities across hospitals.

Key North America Healthcare Analytics Companies:

- McKesson Corporation

- Optum, Inc.

- IBM

- Oracle

- SAS Institute, Inc.

- IQVIA

- Verisk Analytics, Inc.

- Elsevier

- Medeanalytics, Inc.

- Truven Health Analytics, Inc.

- Allscripts Healthcare Solutions, Inc

- Cerner Corporation

Recent Developments

-

In August 2022, Syntellis Performance Solutions acquired Stratasan, an advanced healthcare market intelligence and data analytics company. This acquisition helps Syntellis Performance Solutions expand its solution or software portfolio for healthcare organizations with data and intelligence solutions to improve financial, strategic, and operational growth planning.

-

In June 2022, Oracle acquired Cerner Corporation. This acquisition combines Cerner’s clinical capabilities with Oracle’s analytics, automation expertise, and enterprise platform.

North America Healthcare Analytics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 25.4 billion

Revenue forecast in 2030

USD 74.5 billion

Growth rate

CAGR of 19.6 % from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, component, delivery mode, application, end-use, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

McKesson Corporation; Optum, Inc.; IBM; Oracle; SA Institute, Inc.; IQVIA; Verisk Analytics Inc.; Elsevier; Medeanalytics Inc.; Truven Health Analytics; Allscripts Healthcare Solutions Inc.; Cerner Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Healthcare Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For of this study, Grand View Research, Inc. has segmented the North America healthcare analytics market report based on type, component, delivery mode, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Descriptive Analysis

-

Predictive Analysis

-

Prescriptive Analysis

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Web-hosted

-

Cloud-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Financial

-

Operational and Administrative

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Payers

-

Healthcare Providers

-

Life Science Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America healthcare analytics market was valued at USD 20.9 billion in 2023 and is expected to reach USD 25.4 billion in 2024.

b. The North America healthcare analytics market is expected to grow at a compound annual growth rate of 19.61% from 2024 to 2030 to reach USD 74.5 billion by 2030.

b. Descriptive analysis held the largest market share of 45.7% in 2023. Descriptive analytics has been widely used during the pandemic to study historical data and patient histories to study the spread of the virus, which has been a key factor driving growth in this segment.

b. Key companies operating in this market include McKesson Corporation; Optum, Inc.; IBM; Oracle; SA Institute, Inc.; IQVIA; Verisk Analytics Inc.; Elsevier; Medeanalytics Inc.; Truven Health Analytics; Allscripts Healthcare Solutions Inc.; Cerner Corporation

b. The healthcare industry faces challenging issues such as the lack of better patient care, skyrocketing costs of treatment, and less patient retention & engagement. As a result, healthcare analytics are being incorporated into every aspect of the industry to give better care to patients and for better industry operations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."