- Home

- »

- Consumer F&B

- »

-

North America Healthy Snack Chips Market, Report, 2030GVR Report cover

![North America Healthy Snack Chips Market Size, Share & Trends Report]()

North America Healthy Snack Chips Market Size, Share & Trends Analysis Report By Product (Tortilla Chips, Pop Chips, Popcorn Chips, Puff Chips, Potato Chips, Tapioca Chips, and Others), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-828-2

- Number of Report Pages: 88

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

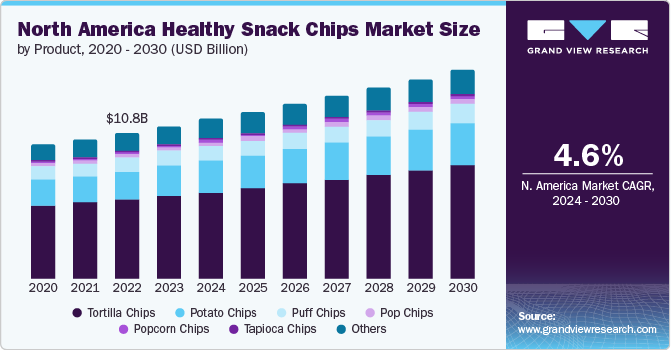

The North America healthy snack chips market size was valued at USD 11.24 billion in 2023 and is expected to grow at a CAGR of 4.6% from 2024 to 2030. The market is mainly driven by factors such as increasing consumer awareness of health and wellness and changing dietary preferences toward nutritious snacking options.

In the recent past, the branded salty snacks available in the market mostly included potato chips. However, over a period of time, the market players have innovated new products like kettle-cooked potato chips besides expanding their traditional snack offerings that have seen several consumers upgrade from unbranded to branded products. Also, given the increasing concerns surrounding ‘unhealthy’ snacking, players have positioned brands and products around ‘health’ with baked, roasted, multigrain, and low-fat variants to reach out to the health-conscious segments. This has helped them target a larger consumer base across North America.

The rising research activities related to new flavors made of natural ingredients are expected to drive the demand for these products in the future. Major manufacturers are targeting consumer habits such as snacking timings and flavor preferences to improve their products and provide consumers with completely healthy snacks. The future of healthy snack chips revolves around the introduction of new flavors rather than the inclusion of new ingredients.

The growing competition among manufacturers and an emphasis on product differentiation and innovation have led to the production of different healthy snack chips at a variety of price points. Healthy snack chips are required to comply with stringent guidelines.

The ability to meet the necessary rating criteria in terms of regulations, depending on the product, is likely to pose a challenge to market growth over the next eight years. In addition, rising consumer pressure for good-quality healthy snack products has led to a rise in product costs. The cost is mainly affected by the raw materials used, and the manufacturer has to bear additional raw material prices.

New entrants need to determine the most effective distribution channels to reach their target audience. They should explore partnerships with supermarkets, health food stores, specialty retailers, online platforms, and direct-to-consumer channels to expand market reach and accessibility.

For instance, in February 2022, Lola Snacks, a company specializing in better-for-you energy bars, entered into a distribution agreement with consumer brands agency CA Fortune. With this partnership, the company aimed to expand its distribution from 3,000 to 15,000 points within the next year. Concurrently, Lola Snacks also initiated a StartEngine crowdfunding campaign with the goal of raising USD 1 million by 2023.

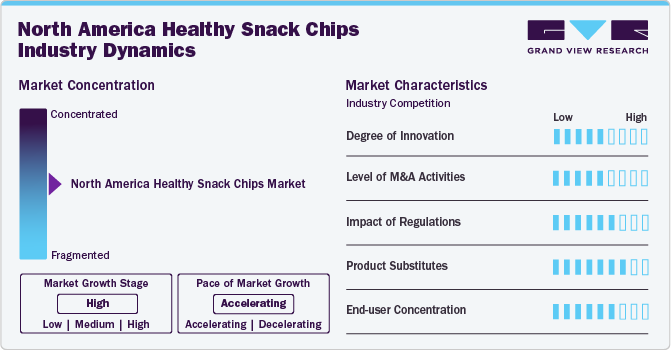

Market Concentration & Characteristics

The North America healthy snack chips market is characterized by a high degree of innovation, with companies continually developing new flavors, ingredients, and processing techniques to meet consumer demand for healthier options. Innovations such as baked chips, vegetable-based chips, and the use of alternative oils are becoming prevalent, catering to the growing health-conscious consumer base.

The level of merger and acquisition (M&A) activities in the market is robust and growing, fueled by increasing consumer demand for healthier snack options and the desire of established food companies to expand their product portfolios. Major food corporations are actively acquiring smaller, innovative brands that specialize in healthy, organic, and non-GMO snack chips to enhance their market presence and cater to health-conscious consumers.

Regulatory frameworks significantly impact the healthy snack chips industry, particularly regarding nutritional labeling, health claims, and ingredient usage. Compliance with food safety standards and guidelines set by organizations like the FDA ensures product safety and transparency, influencing product formulation and marketing strategies.

In the healthy snack chips industry, product substitutes include a wide range of alternative snacks that cater to health-conscious consumers. These substitutes encompass vegetable sticks, fruit chips, nuts and seeds, whole grain crackers, popcorn, rice cakes, and protein bars.

The market exhibits a diverse end-user concentration, with health-conscious individuals, fitness enthusiasts, and those with dietary restrictions forming a significant portion of the consumer base. The demand is particularly strong among millennials and Generation Z, who prioritize health and wellness in their dietary choices, driving market growth and product diversification.

Product Insights

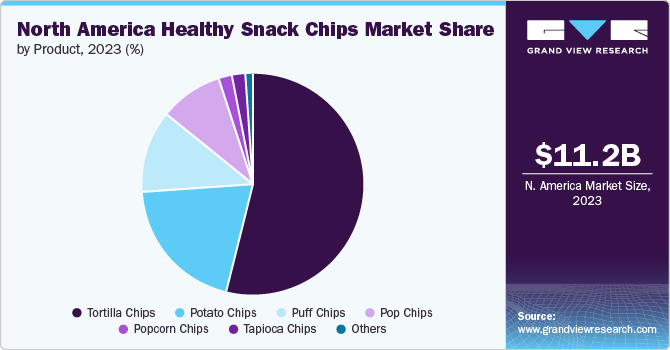

The tortilla chips accounted for the largest revenue share of around 54% in 2023. Healthy tortilla chips are convenient and portable and offer a crunchy delivery system for a variety of salsas, dips, and guacamoles. These chips are gluten-free and are a great source of digestive health-promoting fiber. Healthy tortilla chips, usually manufactured using wheat flour and ground maize, were the largest product segment in the North America market as of 2023. The demand for tortilla chips is projected to increase significantly in the region on account of the growing consumption of organic and non-GMO-based tortilla chips in countries such as Canada, the U.S., and Mexico.

The potato chips industry is projected to grow at a CAGR of 5.5% from 2024 to 2030.Potato chips are rapidly emerging as the industry's preferred choice of snack when it comes to developing ‘better-for-you snack’ products. Innovations in the healthy potato chips market specialize in kettle cooked and baked potato chips manufacturing technology, wherein this technological advancement provides a wide range of snacks in a variety of shapes, grains, and sizes. Healthy potato chips are offered in a wide range of seasonings, such as savory, sweet, salty, and tangy flavors.

Growing customer inclination toward gluten-free products is a key factor responsible for the rising demand for healthy potato chips. The product also provides an advantage in terms of consumer outreach, as it can be sold through a variety of sales channels. The market for healthy snack chips in North America witnessed consolidation in recent years, which is likely to have positive implications on the demand for potato chips in the coming years.

Country Insights

U.S. Healthy Snack Chips Market Trends

The healthy snack chips market in the U.S. is expected to grow at a CAGR of 4.4% from 2024 to 2030. Increasing awareness of consumers in the U.S. regarding the benefits of a healthy diet has led to an increase in the consumption of healthy snack chips. The lifestyle of the working population in the country is expected to propel the market growth over the forecast period. The convenience and easy-to-carry options offered by the product are an additional factor boosting the market growth.

Key North America Healthy Snack Chips Company Insights

The market features both established regional firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key North America Healthy Snack Chips Companies:

- General Mills, Inc.

- BFY Brands

- Frito-Lay North America, Inc.

- Deep River Snacks

- The Kellogg Company

- Mission Foods

- Tastemorr Snacks

- Shearer’s Foods

- Herr’s Food, Inc.

- Snyder’s-Lance, Inc.

Recent Developments

-

In June 2024, Jackson’s Chips, a renowned sweet potato chips brand that uses premium avocado oil, announced the expansion of its brand presence across 800 Walmart stores across the U.S.

-

In January 2024, Our Home, a U.S.-based snack brand, announced an agreement with Utz Brands, Inc. to acquire subsidiaries such as R.W.Garcia and Good Health and establish two new manufacturing facilities across the country. The initiative is part of Our Home's plan to diversify the brand across various salty snack categories.

North America Healthy Snack Chips Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.76 billion

Revenue forecast in 2030

USD 15.38 billion

Growth Rate

CAGR of 4.6% from 2024 to 2030

Historical Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, country

Regional scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

General Mills, Inc.; BFY Brands; Frito-Lay North America, Inc.; Deep River Snacks; The Kellogg Company; Mission Foods; Tastemorr Snacks; Shearer’s Foods; Herr’s Food, Inc.; Snyder’s-Lance, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Healthy Snack Chips Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America healthy snack chips market based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tortilla Chips

-

Pop Chips

-

Popcorn Chips

-

Puff Chips

-

Potato Chips

-

Tapioca Chips

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America healthy snack chips market was estimated at USD 11.24 billion in 2023 and is expected to reach USD 11.76 billion in 2024.

b. The North America healthy snack chips market is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030 to reach USD 15.38 billion by 2030.

b. U.S. dominated the North America healthy snack chips market with a share of around 80% in 2023. Increasing awareness of consumers in the U.S. regarding the benefits of healthy diet has led to an increase in the consumption of healthy snack chips.

b. Some of the key players operating in the North America healthy snack chips market include General Mills, Inc.; BFY Brands; Frito-Lay North America, Inc.; Deep River Snacks; The Kellogg Company; Mission Foods; Tastemorr Snacks; Shearer’s Foods; Herr’s Food, Inc.; Snyder’s-Lance, Inc.

b. Key factors that are driving the North America healthy snack chips market growth include increasing consumer awareness of health and wellness and changing dietary preferences toward nutritious snacking option.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."