- Home

- »

- Advanced Interior Materials

- »

-

North America HVAC Compressor Market Size Report, 2030GVR Report cover

![North America HVAC Compressor Market Size, Share & Trends Report]()

North America HVAC Compressor Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (2-stage Scroll Compressor, Variable Speed Scroll Compressor), By Country (U.S., Canada, Mexico), And Segment Forecasts

- Report ID: GVR-4-68040-068-6

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

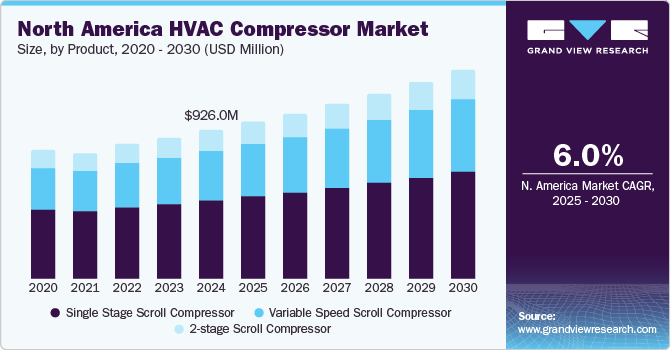

The North America HVAC compressor market size was valued at USD 926.0 million in 2024 and is expected to grow at a CAGR of 6.0% from 2025 to 2030. The growth is driven by the growing demand for highly energy-efficient compressors in air conditioning and heat pump applications. In addition, the scroll compressor offers higher cooling than the rotary compressor, and the 2-stage & variable-speed scroll compressors are highly energy-efficient compared to fixed-speed scroll compressors. This is expected to boost the adoption of scroll compressors in commercial and residential applications.

HVAC compressor is a vital component of heating, ventilation, and air conditioning systems, often referred to as the heart of these systems. Its primary function is to compress refrigerant gas, increasing its pressure and temperature before circulating it throughout the system. This procedure lets the refrigerant to absorb heat from indoor air and discharge it outside, effectively cooling the interior environment. Without an appropriately operational compressor, the entire cooling and heating processes would fail, leading to discomfort in residential and commercial spaces. The demand for variable-speed air compressors is anticipated to increase in the country owing to the escalating demand for energy-efficient and power-saving products. With the advent of technologies such as inverter-based systems, the market is anticipated to witness a wide array of new product developments and innovations.

The rapid use of new technologies, such as AI, IoT, blockchain, machine learning, and others, is having a significant positive impact on HVAC system growth in the U.S. Moreover, integrating IoT with HVAC systems is expected to allow companies to examine exterior data such as the number of occupants in the room, each occupant's comfort preferences, humidity level, and outside temperature. HVAC systems employ this data to set optimal temperatures, modify fan speeds, and improve overall system energy efficiency.

The HVAC systems market is expected to witness an increase in sales with the benefit of allowance programs and tax credits as well as extra monetary benefits allied with the purchase of energy-efficient systems. Furthermore, governments at various levels, namely state governments and federal, have established standards to improve the operation of HVAC systems.

Governments have established several regulations to encourage the production of energy-efficient equipment, thereby lowering risks to the environment and carbon footprints. Numerous governments also offer incentives for encouraging energy efficiency products through low power consumption or the use of renewable energy products, which would increase product demand in addition to tax and rebate programs.

Product Insights

Single-stage scroll compressors led the North America HVAC compressor industry and market accounted for the largest revenue share of 52.7% in 2024. The majority of household heating and cooling systems use single-stage scroll compressors. They have just one speed and are the most basic and cost-effective product. Furthermore, Increased demand for energy-efficient, quieter, and reliable cooling solutions, along with advancements in technology, are propelling its adoption in residential and commercial sectors.

Variable-speed compressors are expected to grow at a CAGR of 6.9% over the forecast period. In this the compressor capacity is managed via variable-speed technology, which alters the speed of the compressor in short intervals and over a broad operating range. Furthermore, the variable speed scroll compressor offers dependability and enhanced performance and is ideal for variable refrigerant flow (VRF) systems, thereby driving the demand for variable speed compressors in the coming years. Moreover, the rising focus on sustainability, government regulations, and the need for precise temperature control are further accelerating its market demand.

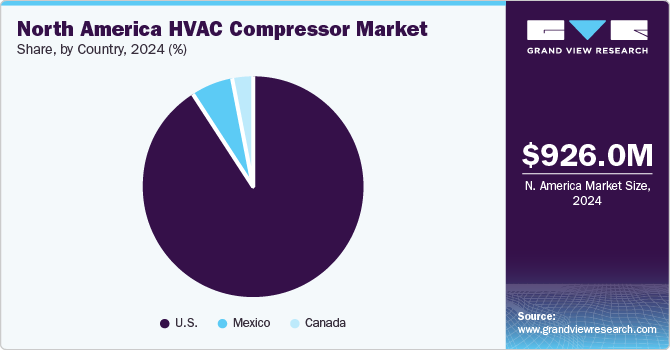

Country Insights

U.S. HVAC Compressor Market Trends

The U.S. HVAC compressor market dominated the North American market and accounted for the largest revenue share of 91.1% in 2024. This growth can be attributed to a strong demand for energy-efficient solutions driven by environmental regulations. In addition, technological advancements, along with the rise of smart HVAC systems, further contribute to this expansion. The construction and renovation sectors' growth also plays a significant role, as commercial and residential buildings increasingly require sophisticated HVAC systems. Furthermore, government incentives for energy-efficient products and the rising awareness of sustainability among consumers support market growth.

Mexico HVAC Compressor Market Trends

The HVAC compressor market in Mexico is expected to grow at a CAGR of 8.2% over the forecast period, owing to rapid industrialization and urban development, with increasing demand for air conditioning and refrigeration in both residential and commercial applications. In addition, the expansion of the construction sector and the rise of energy-efficient technologies support market growth. Furthermore, the growing focus on sustainability and lower energy consumption is encouraging the adoption of advanced HVAC solutions. Mexico's proximity to the U.S. also benefits it, as it aligns with North American trends toward greener and more efficient HVAC systems.

Canada HVAC Compressor Market Trends

Canada HVAC compressor market is expected to grow significantly, driven by a combination of cold climate needs and growing urbanization. As demand for efficient heating and cooling solutions rises in both residential and commercial sectors, compressors designed for extreme temperatures gain popularity. Furthermore, energy-saving initiatives, backed by federal and provincial policies, encourage the adoption of advanced HVAC technologies.

Key North America HVAC Compressor Company Insights

Key companies in the North America HVAC compressor industry include Danfoss Group, Mitsubishi Electric Corporation, LG Electronics, and others. These companies focus on innovation, emphasizing energy-efficient, environmentally friendly products. In addition, they invest in R&D for advanced technologies, expand product portfolios, form strategic partnerships, and enhance customer service to meet growing demand for sustainable and high-performance solutions.

-

Emerson Electric Co. offers a wide range of solutions, including scroll, reciprocating, and screw compressors. The company primarily operates in the residential, commercial, and industrial HVAC segments, providing products that enhance system efficiency, reduce energy consumption, and ensure reliable performance in heating, ventilation, and air conditioning systems across various applications.

-

Daikin Industries Ltd. offerings include scroll, rotary, and screw compressors tailored for air conditioning and refrigeration systems. The company operates in both residential and commercial segments, providing energy-efficient and sustainable solutions. Its product portfolio is widely recognized for incorporating cutting-edge technology to optimize HVAC system performance while addressing the growing demand for environmentally responsible and cost-effective solutions.

Key North America HVAC Compressor Companies:

- Danfoss Group

- Emerson Electric Co.

- Daikin Industries Ltd.

- Mitsubishi Electric Corporation

- LG Electronics

- Hitachi Ltd.

- Tecumseh Products Company LLC.

- Panasonic Group

Recent Developments

-

In February 2025, Hitachi Scroll Compressor unveiled a groundbreaking low-displacement compressor at the AHR Expo, marking its North American debut. The new HVAC compressor, designed to enhance energy efficiency and reduce environmental impact, showcased advanced technology that promises improved performance in cooling and heating systems. This innovation is expected to meet the increasing demand for eco-friendly solutions in HVAC applications, highlighting Hitachi's commitment to sustainable and cutting-edge technology. The product attracted significant attention from industry professionals at the event.

-

In December 2024, Mitsubishi Electric announced a significant USD 143.5 million investment to retrofit a U.S. factory in Maysville, Kentucky, for manufacturing variable-speed HVAC compressors. This move aims to meet the rising U.S. demand for energy-efficient HVAC solutions. The factory, under Mitsubishi Electric Automotive America, targets a production start in October 2027 with an initial annual capacity of 1,000,000 HVAC compressors. MELCO HVAC US also secured a USD 50 million award from the U.S. Department of Energy for this project. This initiative marks the first U.S. production of twin rotary technology compressors for ductless heat pumps.

North America HVAC Compressor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 975.6 million

Revenue forecast in 2030

USD 1.30 billion

Growth Rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Thousand Units, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, country.

Regional scope

North America

Country scope

U.S., Canada, and Mexico

Key companies profiled

Danfoss Group; Emerson Electric Co.; Daikin Industries Ltd.; Mitsubishi Electric Corporation; LG Electronics; Hitachi Ltd.; Tecumseh Products Company LLC.; Panasonic Group.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America HVAC Compressor Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, View Research has segmented the North America HVAC compressor market report based on product and country.

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Single Stage Scroll Compressor

-

2-stage Scroll Compressor

-

Variable Speed Scroll Compressor

-

-

Country Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.