- Home

- »

- Paints, Coatings & Printing Inks

- »

-

North America Hydrocarbon Fire Intumescent Coating Services Market Report, 2020-2027GVR Report cover

![North America Hydrocarbon Fire Intumescent Coating Services Market Size, Share & Trends Report]()

North America Hydrocarbon Fire Intumescent Coating Services Market Size, Share & Trends Analysis Report By End Use (Chemicals, Oil & Gas, Metals & Mining, Lime & Cement, Pulp & Paper), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-530-4

- Number of Report Pages: 38

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

Report Overview

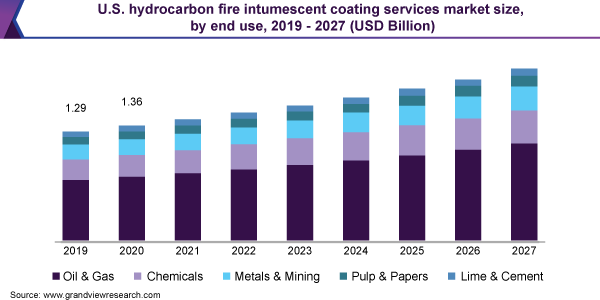

The North America hydrocarbon fire intumescent coating services market size was valued at USD 1.5 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2020 to 2027. Recent developments in the oil and gas and metals & mining industry are likely to drive the demand for the hydrocarbon fire intumescent coats in these application segments. Increasing use of environment-friendly and energy-saving products is also expected to influence the market positively. Hydrocarbon fire intumescent coatings protect steel structures, concrete, divisions (bulkheads, firewalls, decks), process vessels, pipelines, and other equipment in a hazardous environment while meeting the challenges of complex hydrocarbon fire scenarios in the abovementioned end-use industries. Technological breakthroughs, innovations, and studies carried out for expanding the product’s application scope are projected to foster demand.

Rising utilization of hydrocarbon fire intumescent coating services in the oil and gas, chemical, manufacturing, and metals and mining industry is anticipated to push service providers to backward integration in the value chain over the coming years. Greater participation in the value chain is likely to result in time reduction for transforming raw materials into finished products and in gaining cost advantage.

Oil and gas industry offers lucrative opportunities for hydrocarbon fire intumescent coatings as extraction areas are prone to high risks of fires and explosions. To prevent fire casualties at these workstations, these coatings are almost invariably used. In addition, rising focus on capacity expansion and growing mergers and acquisitions, majorly in the U.S., is anticipated to drive the growth of oil and gas industry in North America. Large-scale investments for sustaining oil and gas production levels and enhancing the overall production efficiency are projected to further propel the growth of the oil and gas industry, thereby augmenting fire safety services such as hydrocarbon fire intumescent coatings services.

However, rising demand for active fire protection systems among end-users is expected to hamper the overall market growth. Increasing expenditure on fire safety by end-use industries coupled with technological advancements in fire safety systems and equipment is driving the demand for active fire protection systems. Active fire safety products such as smoke detectors, fire alarms, and fire extinguishers are witnessing increased penetration in various industries including chemical processing, healthcare, metal forming, construction, and oil and gas, thereby hampering the growth of the North America hydrocarbon fire intumescent coating services market.

Country Insights

The U.S. dominated the market and accounted for over 80.0% share of global revenue in 2019. Expanding oil and gas industry in the U.S. is anticipated to potentially drive the market. The U.S. is the world’s largest oil and gas producer on account of the presence of abundant shale oil and gas reserves. According to the U.S. Energy Information Administration, the country accounted for 18% of the total oil produced across the globe in 2018. The global per capita energy requirement is gradually increasing over the years, which portrays growth opportunity for the U.S. oil and gas industry.

Canada is expected to witness substantial growth over the forecast period owing to the huge demand from oil and gas, chemicals, and metals and mining industries. Rising production of shale oil and oil sands is anticipated to significantly drive the oil and gas industry in the country. Oil and gas industry in Canada is characterized by the presence of several producers including Suncor Energy Inc.; Canadian Natural Resources Limited; Imperial Oil; Husky Energy, Inc.; and Cenovus Energy, Inc.

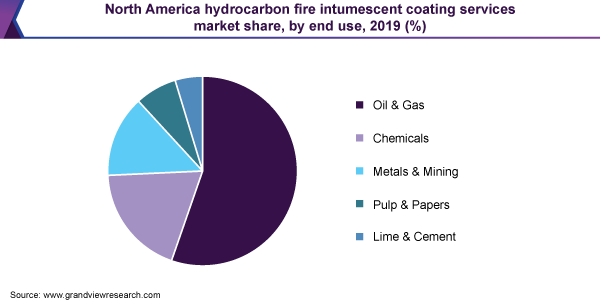

End-Use Insights

Oil & Gas end-use segment led the market and accounted for more than 55% share of the global revenue in 2019. The growing chemical industry is significantly propelling market growth in the U.S. and Canada. Rising demand for petrochemical-based products, plastics, and agrochemicals among various end-use industries, such as construction, automotive, consumer goods, agriculture, packaging, and medical devices, is expected to fuel the growth of the chemical industry over the forecast period, which, in turn, is anticipated to create demand for hydrocarbon fire intumescent coating services.

In addition, the growing use of the coatings owing to capacity expansion projects and setting up of new refining capacities in North America is expected to boost the market growth over the forecast period. In the mining industry, intumescent coatings find applications in columns, steel beams, tubes, vessel skirts, pipes, underdeck, bulkheads, and electrical raceways and others. The growing metal and mining industry in the U.S. and Canada is anticipated to create lucrative opportunities for the market over the forecast period.

Key Companies & Market Share Insights

Most of the key players compete on the basis of service quality and maintaining a vigorous relationship with end-use industries. This provides companies a competitive advantage in the form of cost benefits thus increasing the profit margin. Companies are undertaking research and development activities to develop new products to sustain market competition and changing end-user requirements. Research activities focused on new application development, which combine several properties, are projected to gain wide acceptance in this industry in the forthcoming years. Some of the prominent players in the North America hydrocarbon fire intumescent coating services market include:

-

Painters USA, Inc.

-

Performance Painting

-

Hempel A/S

-

Contego International, Inc.

-

US Coatings

-

Donalco

-

Aries Contracting

North America Hydrocarbon Fire Intumescent Coating Services Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.6 Billion

Revenue forecast in 2027

USD 2.4 Billion

Revenue growth rate

CAGR of 5.9% from 2020 to 2027

Base year for estimation

2019

Forecast period

2020 - 2027

Quantitative units

Revenue in USD Million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, country

Regional scope

North America

Country Scope

U.S. ; Canada

Key companies profiled

Painters USA, Inc.; Performance Painting; Hempel A/S; Contego International, Inc.; US Coatings; Donalco; Aries Contracting

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2027. For the purpose of this study, Grand View Research has segmented the North America hydrocarbon fire intumescent coating services market report on the basis of end use and country:

-

End-Use Outlook (Revenue, USD Million, 2019 - 2027)

-

Chemicals

-

Oil & Gas

-

Metals & Mining

-

Lime & Cement

-

Pulp & Paper

-

-

Regional Outlook (Revenue, USD Million, 2019 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The global North America hydrocarbon fire intumescent coatings services market size was estimated at USD 1.5 billion in 2019 and is expected to reach USD 1.6 billion in 2020.

b. The global North America hydrocarbon fire intumescent coatings services market is expected to grow at a compound annual growth rate of 5.9% from 2020 to 2027 to reach USD 2.4 billion by 2027.

b. Oil & gas segment dominated the North America hydrocarbon fire intumescent coatings services market with a share of 55.4% in 2019. This is attributed to growing government emphasis to conform to stringent fire safety regulations and rising exploration activities in North America.

b. Some key players operating in the North America hydrocarbon fire intumescent coatings services market include Painters USA, Performance Painting, Hempel A/S, Contego International Inc., Fire Barrier Experts, US Coatings, Donalco, Techno Building Materials, Aries Contracting, and Brand Industrial Services.

b. Expanding oil & gas and chemical industry in the region, and presence standards to have a fire safety plan across North American provincial, state, and national fire codes as per the occupancy type or building use, are the key factors driving the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."