- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Intumescent Coatings Market Size, Industry Report, 2033GVR Report cover

![Intumescent Coatings Market Size, Share & Trends Report]()

Intumescent Coatings Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Thick film, Thin film), By Substrate, By Technology, By Application, By Application Technique, By Fire Rating, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-475-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Intumescent Coatings Market Summary

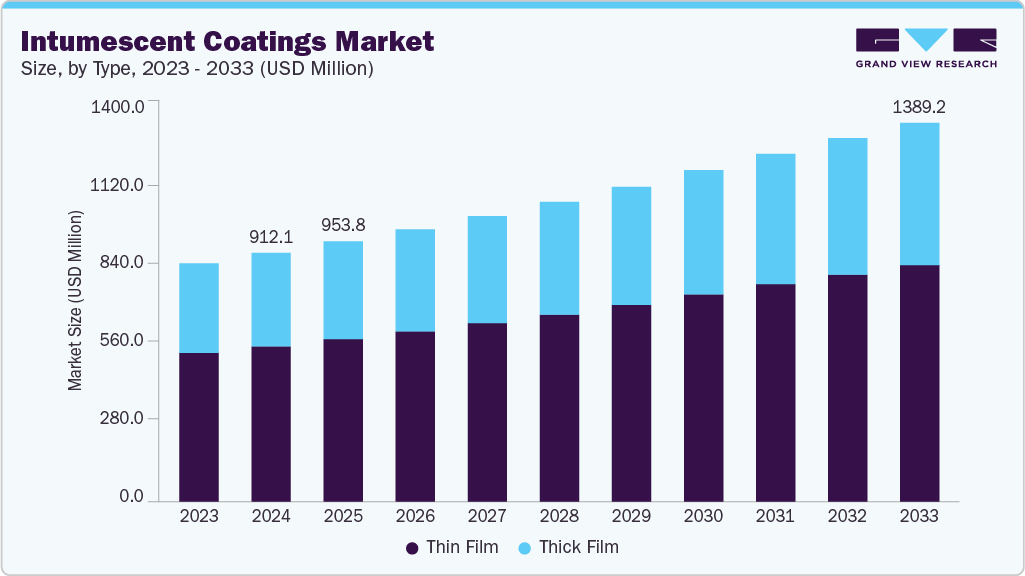

The global intumescent coatings market size was estimated at USD 912.1 million in 2024, and is projected to reach USD 1389.2 million by 2033, growing at a CAGR of 4.8% from 2025 to 2033. The market is primarily driven by the growing emphasis on passive fire protection systems across high-risk industries such as construction, oil & gas, and transportation.

Key Market Trends & Insights

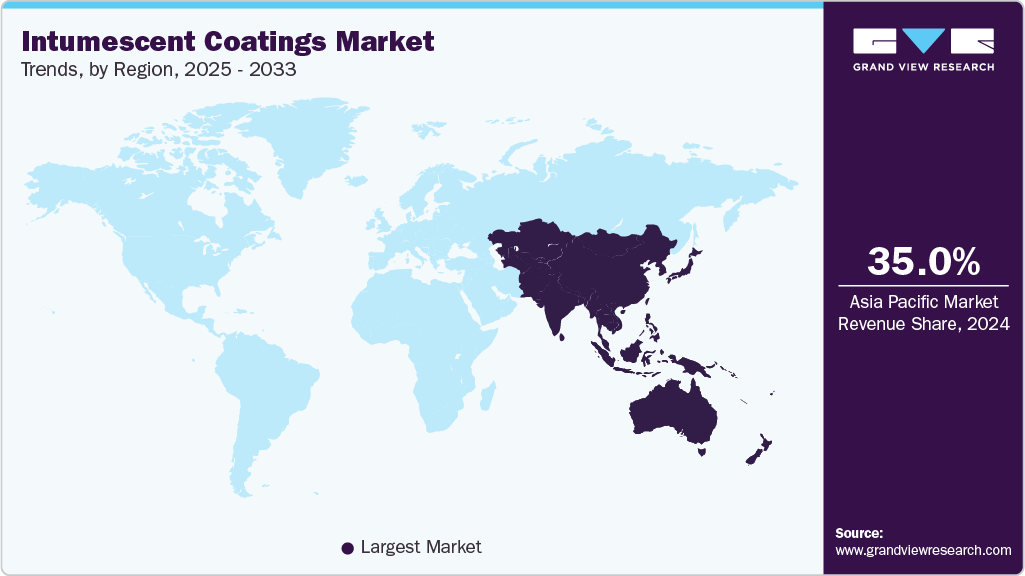

- Asia Pacific dominated the intumescent coatings market with the largest revenue share of 35.0% in 2024.

- The U.S.intumescent coatings industry dominates the North American market.

- By type, the thin film segment held the largest revenue share of 62.4% in 2024 in terms of value.

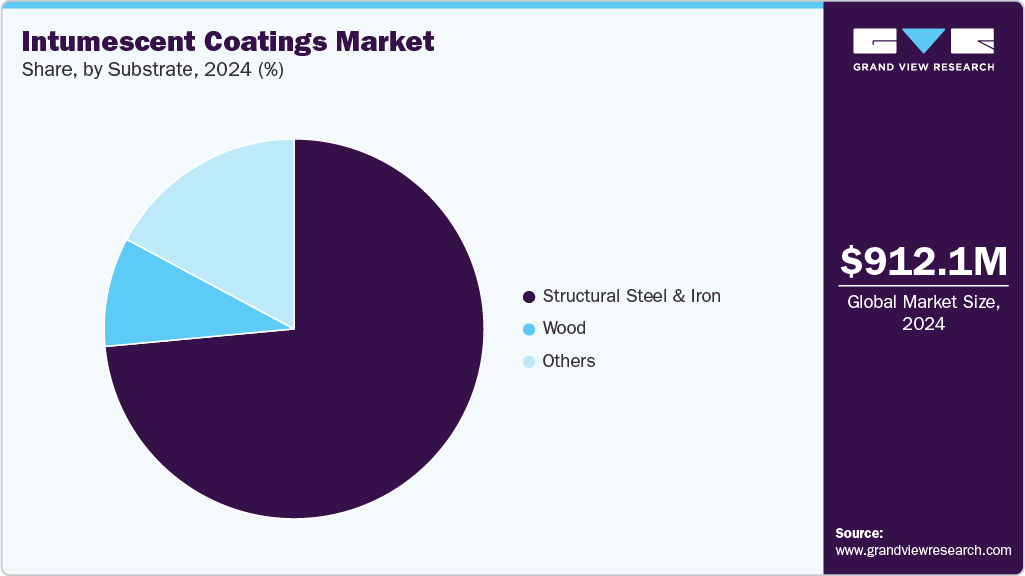

- By substrate, the structural steel & iron segment held the largest revenue share of 73.6% in 2024 in terms of value.

- By technology, the water-based segment held the largest revenue share of 35.3% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 912.1 Million

- 2033 Projected Market Size: USD 1389.2 Million

- CAGR (2025-2033): 4.8%

- Asia Pacific: Largest market in 2024

Stringent fire safety regulations and building codes, particularly in developed regions like North America and Europe, are compelling stakeholders to adopt advanced fireproofing materials. In addition, increasing urbanization and infrastructure development in emerging economies, coupled with heightened awareness regarding occupant safety and asset protection, are fueling the demand for intumescent coatings, especially in structural steel applications.The market presents substantial growth opportunities with the ongoing shift toward eco-friendly, low-VOC, and water-based intumescent coating technologies. Rapid industrialization and increased construction activity in Asia Pacific, Middle East, and Latin America offer untapped potential, particularly in commercial buildings and oil & gas infrastructure. Moreover, advancements in epoxy-based coatings for extreme environments, integration of smart coatings with self-healing and real-time monitoring properties and growing retrofitting activities in aging infrastructure are expected to unlock new revenue streams for manufacturers and solution providers.

Despite strong demand fundamentals, the market faces several challenges, including fluctuating raw material prices and the complex formulation requirements for high-performance fire-resistant coatings. The application process can be labor-intensive and time-consuming, especially for thick film systems, which limit scalability in large-scale projects. Moreover, environmental concerns and regulatory restrictions related to solvent-based formulations are pushing manufacturers toward reformulation, thereby increasing R&D costs and extending time-to-market for new products.

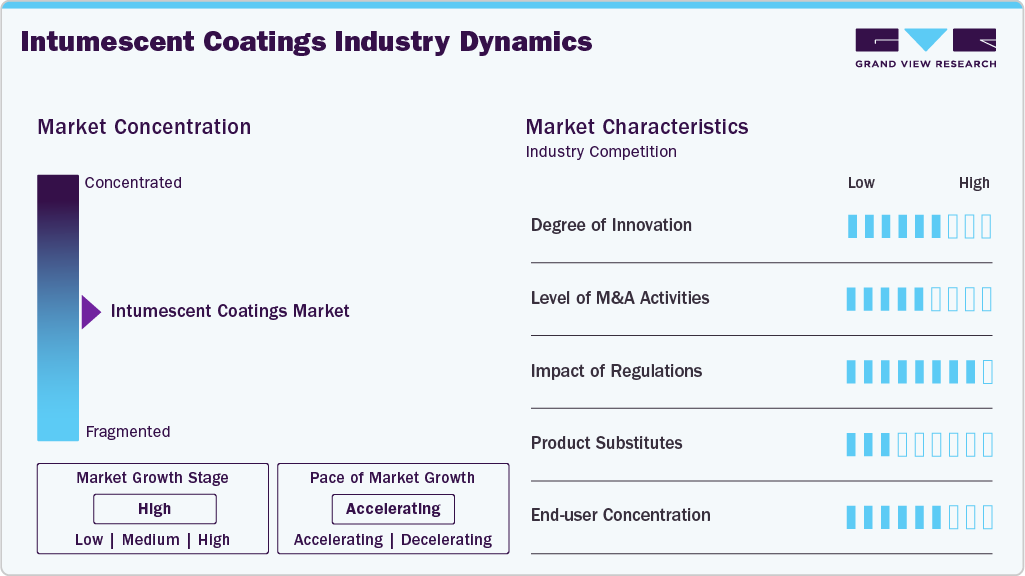

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Akzo Nobel N.V., Jotun, and Contego International Inc., dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the global intumescent coatings industry are pursuing a combination of strategic initiatives to strengthen their competitive position, including product innovation, regional expansion, and strategic partnerships. Companies such as AkzoNobel, Sherwin-Williams, Jotun, and PPG Industries are heavily investing in R&D to develop advanced coatings with improved fire resistance, faster drying times, and environmentally friendly formulations to meet evolving regulatory standards. Mergers and acquisitions are also being leveraged to expand technological capabilities and enhance market capabilities, particularly in high-growth regions like Asia Pacific and the Middle East.

Type Insights

Thin film intumescent coatings held the largest revenue share of 62.4% in 2024, primarily due to their widespread use in commercial and residential construction projects where aesthetics, ease of application, and compliance with fire safety standards are critical. These coatings are specifically designed for cellulosic fire protection, commonly required in structures built with materials like wood, drywall, or structural steel. Thin film coatings offer a smooth architectural finish and are compatible with spray or brush application techniques, making them a cost-effective and labor-efficient solution. Their growing adoption is also supported by increasingly stringent building codes in developed economies and the demand for passive fire protection in modern infrastructure.

On the other hand, thick film intumescent coatings are predominantly used in high-risk industrial environments, particularly in the oil & gas and petrochemical sectors where protection against hydrocarbon fires is essential. These coatings are engineered to withstand extreme temperatures and provide extended fire resistance, often applied in off-site fabrication yards or heavy-duty facilities. Although thick-film coatings command higher price points and performance capabilities, their adoption is limited by longer application times, higher curing requirements, and project-specific customization. As a result, their market share is lower than thin film coatings, though the segment continues to show steady growth driven by critical safety demands in energy-intensive industries.

Fire Rating Insights

The R60 (60 minutes) fire rating segment held the largest revenue share of 46.7% in 2024, owing to its widespread adoption in commercial buildings, residential complexes, and industrial facilities where fire codes typically mandate a minimum one-hour fire resistance for structural components. This rating provides an optimal balance between performance, cost-efficiency, and ease of application, making it the preferred standard across multiple end use industries. In addition, R60-rated coatings align well with modern construction timelines, allowing faster project execution while ensuring compliance with international building safety standards such as EN 13381, UL 263, and ASTM E119. The segment’s dominance is further supported by its compatibility with thin-film technologies, which are commonly used on structural steel in cellulosic fire scenarios.

Other fire ratings such as R30 and R90 cater to projects with lighter or moderately higher fire protection requirements, typically seen in smaller buildings or industrial assets with variable risk profiles. Meanwhile, R120 and R180 coatings are used in critical infrastructure such as power plants, petrochemical refineries, and tunnels, where extended fire resistance is crucial for asset protection and emergency response. However, these higher-rated systems involve thicker film builds, more complex application processes, and higher costs, which limit their widespread use. As a result, while they are essential for specialized applications, they collectively account for a smaller portion of the market compared to the more versatile and cost-effective R60-rated solutions.

Technology Insights

The water-based segment held the largest revenue share of 35.3% in 2024, primarily due to increasing regulatory pressure to reduce VOC emissions and the global push toward environmentally sustainable construction materials. Water-based intumescent coatings are widely used in commercial and residential construction for cellulosic fire protection on structural steel, drywall, and wood. Their advantages include low toxicity, ease of application, fast drying time, and compliance with green building certifications such as LEED and BREEAM. In addition, advancements in water-based formulations have significantly improved their durability, adhesion, and fire resistance, making them a preferred choice in urban infrastructure projects and public buildings across North America and Europe.

In contrast, solvent-based and epoxy-based coatings continue to serve niche, performance-critical applications. Solvent-based coatings, while offering robust protection and excellent adhesion in high-humidity environments, are facing declining adoption due to increasingly stringent environmental regulations and disposal challenges. Epoxy-Based coatings, on the other hand, are essential in hydrocarbon fire scenarios, particularly in the oil & gas, marine, and chemical sectors, due to their exceptional thermal and chemical resistance. However, their usage is largely confined to specialized industrial environments and offshore platforms, limiting their overall market share. Despite this, both segments are expected to grow steadily as industrial fire safety requirements become more stringent, especially in emerging markets.

Application Insights

The cellulosic segment held the largest revenue share of 56.4% in 2024, driven by the growing application of intumescent coatings in commercial, residential, and institutional buildings where protection against cellulosic fires, caused by burning wood, paper, or other organic materials, is required. These coatings are applied to structural steel, wood, and drywall to comply with international building safety codes such as EN 13381, ASTM E119, and UL 263. The segment’s dominance is further supported by increasing urbanization, modernization infrastructure, and the rise in mixed-use developments globally. In addition, the compatibility of cellulosic coatings with thin-film water-based systems, which offer superior aesthetics and low environmental impact, has accelerated their adoption in modern architectural projects.

In contrast, the hydrocarbon segment is focused on high-risk environments such as oil & gas refineries, offshore platforms, petrochemical plants, and energy infrastructure, where rapid temperature escalation in a fire event demands high-performance protection. Hydrocarbon intumescent coatings, typically thick-film or epoxy-based, provide longer fire resistance and thermal insulation under extreme conditions. While critical to operational safety, their use is limited to specialized industrial applications and is subject to complex installation processes and higher costs. As a result, although this segment is essential for asset integrity in high-hazard sectors, its market share remains lower than the more broadly applicable cellulosic segment.

Application Technique Insights

The spray application technique dominated the market with a revenue share of 79.5% in 2024, primarily due to its widespread use in large-scale construction, infrastructure, and industrial projects where speed, efficiency, and uniformity of coating are critical. Spray application enables fast coverage of large surface areas, especially on structural steel frameworks and complex geometries, ensuring consistent thickness and optimal fire protection performance. It is particularly favored for both thin film and thick-film systems across high-rise buildings, oil & gas facilities, and manufacturing plants. The compatibility of spray techniques with automated equipment and high-volume throughput also makes it ideal for off-site modular construction and prefabricated components, driving its adoption in modern construction practices.

On the other hand, brush/roller applications are more commonly used in small-scale projects, detailed touch-ups, or confined spaces where spray applications are impractical. While it offers precision and control, especially in decorative or residential settings, the method is time-consuming and labor-intensive, making it less suitable for high-volume or industrial applications. In addition, brush/roller application often leads to variability in film thickness, which can compromise fire protection performance if not properly monitored. As a result, although this technique continues to serve niche applications, it holds a smaller share of the overall market compared to the efficiency and scalability offered by spray application methods.

End Use Insights

The construction segment led the market with a revenue share of 44.6% in 2024, driven by the widespread adoption of intumescent coatings in commercial, residential, and institutional buildings for passive fire protection. Increasing urbanization, stringent building fire safety codes, and the global push for safer, more resilient infrastructure have made fire-resistant coatings a critical requirement in construction projects, particularly for structural steel frameworks. In addition, the rise of sustainable construction practices and the growing preference for water-based thin-film coatings that meet both safety and environmental standards have reinforced their usage in modern architectural designs.

The oil & gas segment represents a high-value but more specialized market, where epoxy-based thick-film coatings are essential for protecting assets in high-risk hydrocarbon fire scenarios, such as offshore rigs, refineries, and LNG terminals. Meanwhile, the automotive segment is emerging due to increasing safety standards, especially in electric vehicles (EVs), where thermal insulation and fire protection for battery enclosures are becoming more critical. The others category includes sectors such as marine, aerospace, and warehousing, which rely on fireproofing for asset integrity and compliance. However, these segments collectively account for a smaller share due to either niche applications or limited surface area requirements compared to the expansive needs of the construction sector.

Substrate Insights

Structural steel & iron held the largest revenue share of 73.6% in 2024, driven by their dominant use in commercial, industrial, and high-rise infrastructure where fire protection is a regulatory mandate. Intumescent coatings applied to steel structures provide critical passive fire protection by insulating the steel during high-temperature exposure, maintaining structural integrity and allowing evacuation and emergency response time. With growing investments in smart cities, urban infrastructure, industrial facilities, and energy projects, especially in Asia Pacific and the Middle East, the demand for fireproofing steel structures has surged. In addition, the increasing preference for exposed steel architecture in modern building design has fueled the need for aesthetically compatible, high-performance thin-film coatings.

While wood substrates represent a smaller share of the market, they are gaining traction in residential and interior architectural applications, especially with the rising popularity of engineered wood in sustainable construction. Intumescent coatings help enhance fire resistance in wooden components, supporting compliance with building safety codes. The ‘Others’ segment, which includes materials such as composites, plastics, and concrete, is still an emerging category, primarily driven by specialized applications such as transportation interiors, industrial equipment, and storage facilities. However, due to their limited volume and infrequent use in large-scale structures, these substrates contribute only marginally to the overall revenue compared to structural steel.

Regional Insights

North America intumescent coatings industry captured 23.3% of the global market in 2024, with strong demand from the commercial construction and oil & gas sectors. The region's regulatory framework, including NFPA standards and UL certifications, mandates passive fire protection in both new and existing structures, particularly for high-rise buildings and industrial facilities. Moreover, the growing focus on retrofitting old infrastructure and the surge in electric vehicle manufacturing are also contributing to increased use of intumescent coatings for both structural and component-level fire safety.

US Intumescent Coatings Market Trends

The U.S. intumescent coatings industry dominates the North American market, driven by rising investments in infrastructure, commercial real estate, and energy production. Building safety codes such as the International Building Code (IBC) and adoption of UL 263-rated fireproofing systems are fueling demand for intumescent coatings. The country is also seeing notable adoption of epoxy-based coatings in oil & gas and chemical processing sectors, while green building initiatives and LEED-certified projects are driving an interest in water-based solutions.

Asia Pacific Intumescent Coatings Market Trends

Asia Pacific intumescent coatings industry led globally with a 35.0% revenue share in 2024, driven by rapid urbanization, infrastructure development, and industrial growth across countries such as China, India, and Southeast Asian nations. Significant investments in commercial buildings, transportation networks, and energy projects have accelerated the demand for passive fire protection systems, particularly for structural steel. In addition, rising awareness of building safety and the enforcement of modern fire codes in emerging economies are boosting the adoption of water-based and thin-film coatings. The construction boom and increasing oil & gas activities in the region continue to drive market expansion.

China intumescent coatings industry remains the largest contributor to Asia Pacific’s market share, supported by its massive real estate and industrial sectors. Government initiatives focused on green and fire-safe urban development, coupled with strict implementation of building codes such as GB51249, have spurred demand for fire-retardant coatings. Moreover, domestic manufacturers are scaling up production of cost-effective intumescent solutions, while international players are expanding their local presence to cater to high-volume infrastructure projects, including airports, high-speed rail, and petrochemical plants.

Europe Intumescent Coatings Market Trends

Europe intumescent coatings industry accounted for 30.2% of the global market in 2024, anchored by its stringent regulatory landscape and mature construction and industrial sectors. The enforcement of Eurocode standards for fire protection, coupled with growing demand for sustainable and low-VOC coatings, has accelerated the use of water-based and hybrid intumescent solutions across the region. In addition, widespread retrofitting of aging infrastructure and green building initiatives under the EU Green Deal are further fueling the adoption of advanced intumescent coatings, particularly in commercial and public buildings.

Germany intumescent coatings industry leads the European market, supported by a robust manufacturing base, strict fire safety norms, and strong emphasis on energy-efficient, sustainable construction. The country has seen increased deployment of intumescent coatings in both new builds and refurbishment projects, especially in commercial offices, airports, and public transit infrastructure. Innovation-led growth from domestic coating manufacturers and partnerships with architectural firms have also driven market penetration, particularly in high-performance thin-film systems.

Middle East & Africa Intumescent Coatings Market Trends

The Middle East & Africa intumescent coatings industry is emerging, supported by growing infrastructure and oil & gas projects, especially in GCC countries. Mega projects like NEOM (Saudi Arabia) and Expo-related construction (UAE) are driving demand for advanced fire protection systems, including thick-film intumescent coatings suited for hydrocarbon fire exposure. While regulatory enforcement is still evolving across many parts of the region, increasing safety awareness and foreign investment are expected to stimulate long-term market growth.

Latin America Intumescent Coatings Market Trends

Latin America intumescent coatings industry is gradually expanding, led by Brazil and Mexico, where infrastructure modernization and fire safety regulations are gaining traction. While economic volatility and limited industrial scale remain challenges, demand is growing in commercial construction, oil refineries, and transportation sectors. Foreign direct investment in industrial facilities and rising public sector infrastructure upgrades are expected to support steady adoption of passive fire protection materials in the coming years.

Key Intumescent Coatings Company Insights

Key players, such as Akzo Nobel N.V., Jotun, Contego International Inc., and Hempel A/S are dominating the market.

-

Akzo Nobel N.V. is a leading global manufacturer of paints and coatings, with a strong footprint in the market through its International brand portfolio. The company offers a comprehensive range of fire protection solutions for both cellulosic and hydrocarbon applications, targeting sectors such as construction, oil & gas, and industrial infrastructure. Akzo Nobel continues to invest heavily in R&D and sustainable innovation, focusing on low-VOC, water-based, and high-performance epoxy-based formulations to meet evolving regulatory and environmental standards. With a robust global distribution network and strategic presence in high-growth regions such as Asia Pacific and the Middle East, the company leverages its technical expertise, product certifications, and collaborative partnerships with architects and engineers to solidify its competitive position in the passive fire protection industry.

Key Intumescent Coatings Companies:

The following are the leading companies in the intumescent coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel N.V.

- Jotun

- Contego International Inc.

- Hempel A/S

- No-Burn Inc.

- Nullifire

- The Sherwin-Williams Company

- Carboline

- Albi Protective Coatings

- Isolatek International

- Rudolf Hensel GmbH

- PPG Industries, Inc.

- 3M

- Sika AG

- Tor Coatings

Intumescent Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 953.8 million

Revenue forecast in 2033

USD 1389.2 million

Growth rate

CAGR of 4.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, substrate, technology, fire rating, application, application technique, end use, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; Belgium; Russia; China; India; Japan; South Korea; Singapore; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

Akzo Nobel N.V.; Jotun; Contego International Inc.; Hempel A/S; No-Burn Inc.; Nullifire; The Sherwin-Williams Company; Carboline; Albi Protective Coatings; Isolatek International; Rudolf Hensel GmbH, PPG Industries, Inc., 3M, Sika AG, Tor Coatings

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intumescent Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global intumescent coatings market report based on type, substrate, technology, fire rating, application, application technique, end use, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Thick film

-

Thin film

-

-

Substrate Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Wood

-

Structural Steel & Iron

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Water-Based

-

Solvent-Based

-

Epoxy-Based

-

-

Fire Rating Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

(R30) 30 Minutes

-

(R60) 60 Minutes

-

(R90) 90 Minutes

-

(R120) 120 Minutes

-

(R180) 180 Minutes

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Hydrocarbon

-

Cellulosic

-

-

Application Technique Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Brush/Roller

-

Spray

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Construction

-

Oil & Gas

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Belgium

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global intumescent coatings market size was estimated at USD 912.1 million in 2024 and is expected to reach USD 953.8 million in 2025.

b. The global intumescent coatings market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2033 to reach USD 1,389.2 million by 2033.

b. Thin-film intumescent coatings held the largest revenue share of 62.4% in 2024 due to their widespread use in commercial and residential construction, offering an ideal balance of fire protection, aesthetic finish, and ease of application. Their compatibility with water-based systems and compliance with stringent building codes further accelerated adoption across global infrastructure projects.

b. Some of the key players operating in the intumescent coatings market include Akzo Nobel N.V., Jotun, Contego International Inc., Hempel A/S, No-Burn Inc., Nullifire, The Sherwin-Williams Company. and Carboline.

b. The market is primarily driven by stringent fire safety regulations and growing demand for passive fire protection in commercial, industrial, and residential infrastructure. Additionally, rising urbanization and increased investments in high-rise and energy-related construction projects are fueling the adoption of intumescent coatings globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.