- Home

- »

- Medical Devices

- »

-

North America Individual Health Insurance Market Report 2030GVR Report cover

![North America Individual Health Insurance Market Size, Share & Trends Report]()

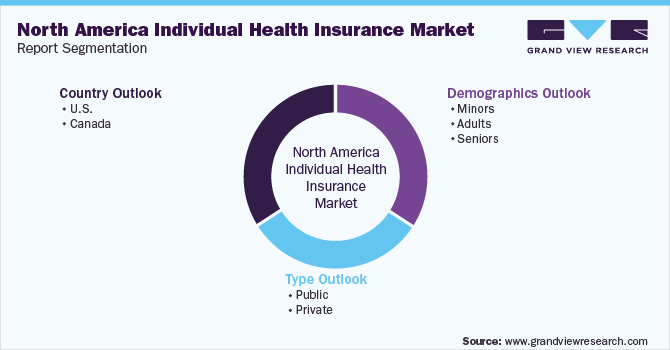

North America Individual Health Insurance Market Size, Share & Trends Analysis Report By Type (Public, Private), By Demographics (Minors, Adults, Seniors), By Country (Canada, U.S.), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-048-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

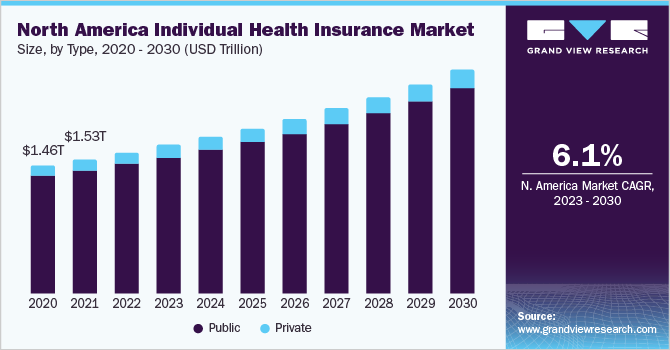

The North America individual health insurance market was valued at USD 1.61 trillion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. The increasing prevalence of chronic disorders is a major factor contributing to the growth of the market. It can be very challenging for people to receive treatment for chronic conditions like cancer and heart disease. Many individuals, thereby, choose health insurance to prevent the sudden weight of having to pay a large sum of money for hospitals and other medical bills. More than half of Canadian adults reported having one or more chronic illnesses in the 2018 Health Care in Canada (HCIC) survey, with the most prevalent diagnoses being Cardiovascular Diseases (CVDs), arthritis, lung disease, and mental health problems, either separately or in combination.

The majority of people in North America rely on government health insurance or employer-sponsored health insurance schemes; however, these schemes only offer limited coverage to individuals. The need for individual health insurance is rising as a result of rising healthcare costs. Also, compared to the family floater or group health insurance, individual health insurance is advantageous as each person has their sum insured, as opposed to other plans where the sum insured is split among all individuals covered in the policy.

According to an article published by BDO USA, during the COVID-19 pandemic, more than 20 million people lost their jobs in April alone as the unemployment rate in the U.S. jumped drastically from 3.5% in January 2020 to 14.7% in April 2020. Since jobs are the primary source of health insurance for Americans, the loss of jobs resulted in millions of workers losing their job-based health insurance coverage. This resulted in a detrimental effect on group health insurance and increased adoption of individual health insurance by people. The market is also anticipated to expand as a result of the increased insurer engagement and new product introductions.

Type Insights

Based on types, the public segment dominated the market in 2022 and accounted for the maximum share of 90.0% of the overall revenue. The majority of people in the U.S. and Canada have access to government-sponsored health insurance. The universal health care system in Canada is financed by taxes. Each province and territory have a unique health plan that includes various services. In the U.S., Medicare is a federal government program that provides health insurance for individuals aged 65 years or older. The program also covers people under the age of 65 years, who have certain disorders or disabilities. This scheme covers about 55 million beneficiaries.

The private segment is anticipated to register the fastest growth rate over the forecast period. Although the majority of health care in Canada is covered by the government, private health insurance is a significant supplemental source, especially for prescription medications, dental work, and eye care. Also, many people are making investments to better safeguard themselves from the financial problems brought on by healthcare due to the rising expense of healthcare. Private insurance frequently provides more options as compared to government schemes like Medicare. Furthermore, the advantages of private health insurance include shorter wait times, more specialized care, and state-of-the-art facilities.

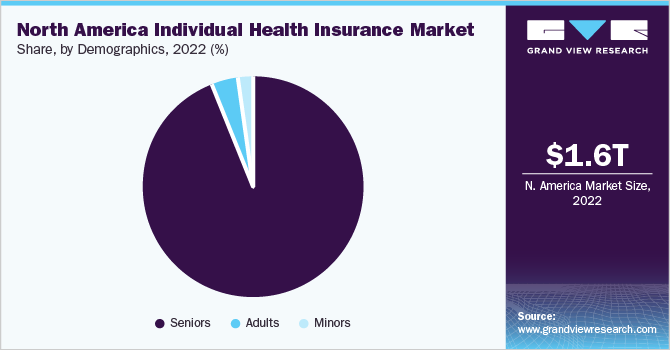

Demographics Insights

Based on demographics, the industry has been segmented into seniors, adults, and minors. The seniors segment dominated the industry in 2022 and accounted for the maximum share of over 94.0% of the overall revenue. Seniors are more likely to buy individual health insurance to cover the rising costs of medical treatments, as they are at a higher chance of contracting several chronic conditions. In addition, all individuals aged 65 years and older are covered by the government-sponsored Medicare health insurance program in the U.S. A small percentage of this population also has access to additional private health insurance plans.

The adult segment is estimated to register the fastest growth rate over the forecast period. This is due to the fact that lifestyle disorders in adults are becoming more prevalent. According to the International Diabetes Federation, in 2021, there were about 32.2 million diabetes cases in the U.S. and this number is projected to reach 36.2 million by 2045. Moreover, the majority of working people are covered by employer-sponsored health insurance plans. However, the level of protection provided by these plans may sometimes be insufficient, which reduces the value of the protection, thus boosting the adoption of individual health insurance plans.

Regional Insights

Based on geographies, the industry has been bifurcated into the U.S. and Canada. The U.S. dominated the total market in 2022. The South region in the U.S. dominated the U.S. market in 2022 and accounted for the largest share of 37.5% of the overall U.S. market revenue, as a substantial population is covered by individual health insurance in the region. Furthermore, the market is expected to expand on account of the increased adoption of individual health insurance in the U.S.

Canada is expected to register a lucrative growth rate during the forecast period. Increased revenue-sharing contributions from the governments of Ontario (ON) and Québec (QC) are contributing to the market growth in the country. For instance, according to the 2022 edition of Canadian Life & Health Insurance Data, Ontario contributed C$ 1615 million in individual health premium revenue in 2021, demonstrating a significant revenue contribution compared to other provinces and territories.

Key Companies & Market Share Insights

Major companies are focusing on implementing a number of strategies, including joint ventures and collaborations, the introduction of new products, and investments in regional insurance firms, in an effort to expand their presence and service offerings. For instance, in November 2022, Cigna expanded its Medicare Advantage (MA) plan in Connecticut. This plan is beneficial for people who qualify for Medicare due to the fact that they cover benefits that original Medicare does not. Some of the prominent players in the North America individual health insurance market include:

-

Cigna

-

United Health Group Inc.

-

Elevance Health (formerly Anthem, Inc.)

-

Health Care Service Corp.

-

Kaiser Foundation Health Plan, Inc

-

Independence Holding Company (IHC Group)

-

Manulife Financial Corp.

-

Sun Life Financial Inc.

-

The Canada Life Assurance Company

-

Scotia Insurance

-

Green Shield Canada

North America Individual Health Insurance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,696.0 billion

Revenue forecast in 2030

USD 2.56 trillion

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, demographics, country

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Cigna; United Health Group Inc.; Elevance Health (formerly Anthem, Inc.); Health Care Service Corp.; Kaiser Foundation Health Plan, Inc; Independence Holding Company (IHC Group); Manulife Financial Corp.; Sun Life Financial Inc.; The Canada Life Assurance Company; Scotia Insurance; Green Shield Canada

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Individual Health Insurance Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America individual health insurance market report based on type, demographics, and country:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

Private

-

-

Demographics Outlook (Revenue, USD Billion, 2018 - 2030)

-

Minors

-

Adults

-

Seniors

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Northeast

-

Connecticut

-

Massachusetts

-

Pennsylvania

-

New Jersey

-

New York

-

Others

-

Maine

-

New Hampshire

-

Rhode Island

-

Vermont

-

-

-

Midwest

-

Illinois

-

Indiana

-

Michigan

-

Ohio

-

Wisconsin

-

Iowa

-

Minnesota

-

Missouri

-

Others

-

Kansas

-

Nebraska

-

North Dakota

-

South Dakota

-

-

-

South

-

Michigan

-

Florida

-

Georgia

-

Maryland

-

North Carolina

-

South Carolina

-

Virginia

-

Alabama

-

Kentucky

-

Tennessee

-

Louisiana

-

Texas

-

Others

-

Delaware

-

West Virginia

-

Mississippi

-

Arkansas

-

Oklahoma

-

-

-

West

-

Arizona

-

Colorado

-

Nevada

-

California

-

Oregon

-

Washington

-

Others

-

Idaho

-

Montana

-

New Mexico

-

Utah

-

Wyoming

-

Alaska

-

Hawaii

-

-

-

-

Canada

-

Newfoundland and Labrador (NL)

-

Prince Edward Island (PE)

-

Nova Scotia (NS)

-

New Brunswick (NB)

-

Quebec (QC)

-

Ontario (ON)

-

Manitoba (MB)

-

Saskatchewan (SK)

-

Alberta (AB)

-

British Columbia (BC)

-

Others

-

-

Frequently Asked Questions About This Report

b. The North America individual health insurance market size was estimated at USD 1.61 trillion in 2022 and is expected to reach USD 1,697.0 billion in 2023.

b. The North America individual health insurance market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 2.56 trillion by 2030.

b. The seniors segment dominated the North America individual health insurance market in 2022 by capturing a share of about 94.1%. Seniors are more likely to buy individual health insurance to cover the rising cost of medical treatments, as they are at a higher chance of contracting a number of chronic conditions.

b. Some key players operating in the North America individual health insurance market include Cigna; United Health Group Incorporated; Elevance Health (formerly Anthem, Inc.); Health Care Service Corporation; Kaiser Foundation Health Plan, Inc; Independence Holding Company (IHC Group); Manulife Financial Corporation; Sun Life Financial Inc.; The Canada Life Assurance Company; Scotia Insurance; Green Shield Canada

b. Key factors that are driving the market growth include increasing prevalence of chronic disorders, increase in insurer participation and new product offerings.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."