- Home

- »

- Advanced Interior Materials

- »

-

North America Industrial Duct For Dust Collection Market, 2030GVR Report cover

![North America Industrial Duct For Dust Collection Market Size, Share & Trends Report]()

North America Industrial Duct For Dust Collection Market Size, Share & Trends Analysis Report By Diameter (Up to 24”, 24” to 48”), By Application (Food, Cement, Batteries), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-096-4

- Number of Report Pages: 540

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Report Overview

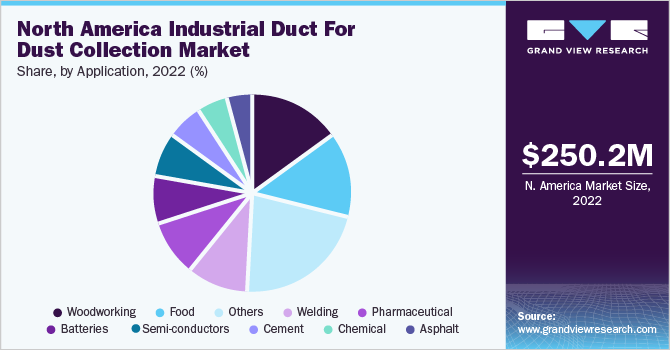

The North America industrial duct for dust collection market size was valued at USD 250.2 million in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 2.5% from 2023 to 2030. The increasing fire incidents related to wood dust and the growing stringency of regulations such as NFPA and OSHA are expected to propel the demand for industrial ducts for the dust collection market in the coming years. The industrial duct for dust collection is crucial for various industries for worker safety. Uncontrolled dust from the machinery can cause a variety of issues, including sanitation concerns, microbial contamination, worker health issues, and slip-and-fall incidents. These factors are expected to drive the demand for North America industrial ducts for the dust collection market over the forecast period.

In 2020, Quebec, British Columbia, and Alberta generated 81% of Canada's softwood timber. While Alberta gained 8 percentage points of the Canadian market, British Columbia lost 13 percentage points, which can be seen from 2023. Similarly, sawmill manufacturing was the largest manufacturing industry in British Columbia in 2020, accounting for 12% of the overall income from goods manufactured in the province, whereas Ontario became the largest sawmill manufacturer by April 2023 as per Statistics Canada.

Furthermore, woodworking facilities are particularly vulnerable to fire because they produce a lot of sawdust, which burns much more readily than full pieces of timber. Also, the majority of wood dust is flammable and explosive. Controlling and managing airborne pollutants in the woodworking application is expected to decrease fire-related risks and prevent loss of life and property damage. Thus, the increasing fire incidents related to wood dust and growing stringent regulations such as NFPA and OSHA are expected to propel the industrial duct for dust collection market demand in Canada in the coming years.

The growing food manufacturing facilities and rising government initiatives taken by the Canadian government necessitate the demand for industrial ducts for dust collection. For instance, in January 2023, the Canadian Food Innovation Network (CFIN) invested USD 2,545,030 in eight projects totaling more than USD 5 million through food innovation challenges and innovation booster programs. Thus, rising food manufacturing facilities are anticipated to drive the North America industrial duct for dust collection market over the forecast period.

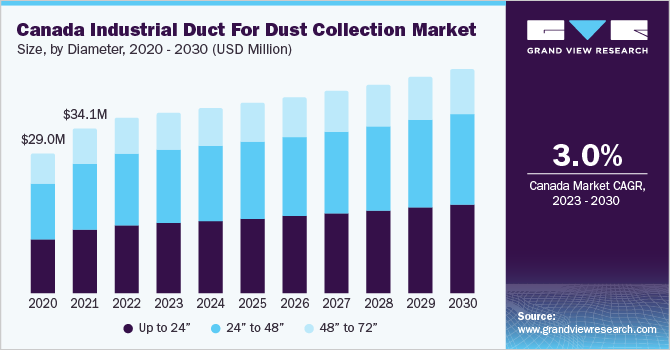

Diameter Insights

The 24” to 48” diameter segment dominated the market in 2022 with a revenue share of 40.8%. The demand for 24" to 48" diameter industrial ducts for dust collection is rising owing to their increased demand for handling high-pressure, low-pressure loss, and effective airflow. In the recycling industry, where the material being carried is likely to be very abrasive, an industrial duct for dust collection in diameters ranging from 24" to 48" duct offers an ideal solution for dust collection. These aforementioned factors are anticipated to propel the demand for 24" to 48" diameter ducts for dust collection in the coming years.

The up to 24” diameter segment is expected to grow at a CAGR of 2.8% from 2023 to 2030. Diameter of up to 24" can be advantageous for industrial operations that involve the grinding of metals, processing of wood, handling of chemicals, or food preparation. A correctly sized duct system is useful for any procedure that generates dust in a closed space. Furthermore, improperly sized duct systems might impair dust-collecting systems and airflow levels. Generic systems may cost less upfront, but they degrade more quickly than systems that are appropriately sized and well-made. These factors are anticipated to drive the demand for industrial ducts for dust collection applications in the coming years.

Application Insights

The woodworking segment dominated the market in 2022 with a revenue share of 14.9%. Woodworking facilities are particularly vulnerable to fire because they produce a lot of sawdust, which burns much more readily than full pieces of timber. Sanders, routers, and shapers produce particularly significant volumes of fine dust.In addition, the majority of wood dust is flammable and explosive. Controlling and managing airborne pollutants in woodworking applications is expected to decrease fire-related risks and prevent loss of life and property damage. Thus, the increasing fire incidents related to wood dust and growing stringent regulations such as NFPA and OSHA are expected to propel the demand for industrial ducts for the dust collection market in the coming years.

The food segment was valued at USD 34.7 million in 2022. Industrial ducts for dust collection in the food industry prevent cross-contamination in food, as the food industry transports huge volumes of grains, sugar, and dairy products. Furthermore, the food industry necessitates a hygienic environment, for which, industrial ducts for dust collectors play a significant role in food industry hygiene. In addition, industrial ducts for dust collection in the food industry are commonly utilized at the sites of bulk and material handling, transportation, and packing. This is expected to drive the demand for Industrial ducts for dust collection in the food industry.

The semi-conductors segment is likely to grow at a CAGR of 3.5% over the forecast period. Grinding dust can increase the chance of an electrical discharge in sectors that utilize electrical components, such as semiconductors or electronics manufacturing. Dust that contains conductive particles can cause a short circuit or harm delicate components, resulting in subpar goods or equipment failure. The need for industrial ducts for dust collection in semiconductor application is anticipated to increase due to the expansion of the semiconductor manufacturing industries and the need to prevent rising amount of dust.

Regional Insights

The U.S. held an 85.4% share of the North America industrial duct for dust collection market in 2022, owing to increasing food product manufacturing and woodworking facility. For instance, in 2022, according to the U.S. census bureau over 500 wood product manufacturing and over 2,000 food manufacturing company opened in the U.S. The growth of these manufacturing facilities, investments, and government initiatives is expected to boost the industrial duct for dust collection demand in the U.S.

Asphalt is used to create hard surfaces like streets, sidewalks, and even driveways due to its long-lasting, tough, and low-maintenance properties. The growing demand for asphalt in the U.S. is expected to drive the demand for industrial ducts for dust collection in the coming years.

Canada is anticipated to grow at a CAGR of 3.0% over the forecast period owing to rising growing food manufacturing facilities and rising government initiatives taken by the Canadian government necessitate the demand for industrial ducts for dust collection. For instance, in January 2023, the Canadian Food Innovation Network (CFIN) invested USD 2,545,030 in eight projects totaling more than USD 5 million through Food Innovation Challenge and Innovation Booster Programs.These factors are expected to drive the demand for industrial ducts for the dust collection market over the forecast period.

Key Companies & Market Share Insights

The key players adopt various strategies such as the novel expansion of production facilities, additional investments in manufacturing facilities, product launches, and collaboration to maintain a competitive edge in the market. Furthermore, key service providers of pipe fabrication opt for partnerships or collaborations with other companies or authorities to increase product penetration in desired regions or countries and increase brand awareness. For instance, in April 2022, Oneida Air Systems introduced the Super Dust Deputy 4/5, a separator that is compatible with 1HP- 3HP single-stage dust collector. The product is designed to accommodate 5", 4", or 6" flex hose, but it may also be linked to ducting using additional adapters.

Manufacturers are also undertaking other strategies, such as investment in new manufacturing facility or plant expansion, to strengthen their foothold in the market. For instance, in April 2023, Nordfab completed the construction of 54,000 ft2 of production and warehouse space, which was the part of Nordfab Now project. This strategy aimed to reduce the company shipping time to 2-3 days. Some prominent players in the North America industrial duct for dust collection market include:

-

Spiral MFG

-

US Duct

-

Nordfab

-

Carolina Air Systems

-

Donaldson Company, Inc.

-

Penn American Inc.

-

Oneida Air Systems, Inc.

-

Imperial Systems, Inc.

-

The Blastgate Co.

-

Fab-Tech Inc.

-

Air Handling Systems

-

Sisneros Bros. Mfg.

-

CaptiveAire

-

Boss Products LLC.

-

LaPine Metal Products

-

US Metal Crafters

-

Flexaust

-

Superior Duct Fabrication

North America Industrial Duct For Dust Collection Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 255.05 million

Revenue forecast in 2030

USD 305.9 million

Growth rate

CAGR of 2.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Diameter, application, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Spiral MFG; US Duct; Nordfab; Carolina Air Systems; Donaldson Company, Inc.; Penn American Inc.; Oneida Air Systems, Inc.; Imperial Systems, Inc.; The Blastgate Co.; Fab-Tech Inc.; Air Handling Systems; Sisneros Bros. Mfg.; CaptiveAire; Boss Products LLC.; LaPine Metal Products; US Metal Crafters; Flexaust; Superior Duct Fabrication

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Industrial Duct For Dust Collection Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America industrial duct for dust collection market report based on diameter, application, and region:

-

Diameter Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 24”

-

24” to 48”

-

48” to 72”

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food

-

Pharmaceutical

-

Cement

-

Welding

-

Woodworking

-

Steel

-

Semi-conductors

-

Batteries

-

Asphalt

-

Chemical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America industrial duct for dust collection market size was estimated at USD 250.2 million in 2022 and is expected to be USD 255.05 million in 2023.

b. North America industrial duct for dust collection market, in terms of revenue, is expected to grow at a compound annual growth rate of 2.5% from 2023 to 2030 to reach USD 305.9 million by 2030.

b. U.S. dominated the industrial duct for dust collection market with a revenue share of 85.4% in 2022. This is attribute to owing to the rapid expansion of the semiconductor manufacturing industries.

b. Some of the key players operating in the industrial duct for dust collection market include: Spiral MFG; US Duct; Nordfab; Carolina Air Systems; Donaldson Company, Inc.; Penn American Inc.; Oneida Air Systems, Inc.; Imperial Systems, Inc.; The Blastgate Co.; Fab-Tech Inc.; Air Handling Systems; Sisneros Bros. Mfg.; CaptiveAire; Boss Products LLC.; LaPine Metal Products; US Metal Crafters; Flexaust; Superior Duct Fabrication.

b. Key factors that are driving the North America industrial duct for dust collection is stringent government regulations coupled with environmental concerns associated with dust generated from the woodworking & steel industries are anticipated to drive the demand for industrial ducts for the dust collection market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."