- Home

- »

- Advanced Interior Materials

- »

-

North America Industrial Insulation Market Share Report, 2030GVR Report cover

![North America Industrial Insulation Market Size, Share & Trends Report]()

North America Industrial Insulation Market Size, Share & Trends Analysis Report By Material (Glass Wool, Stone Wool, CMS Fibers), By Product, By End-use, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-726-1

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Report Overview

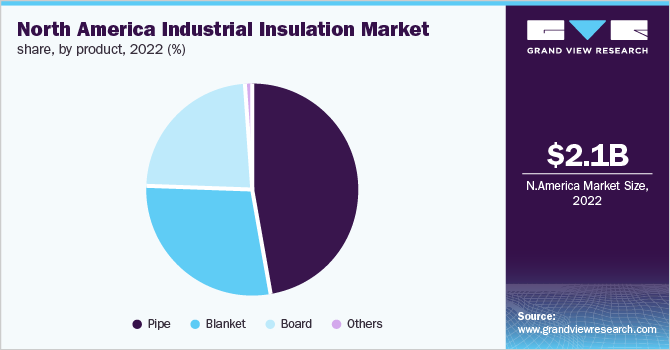

The North America industrial insulation market size was estimated at USD 2.14 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 3.7% from 2023 to 2030. This growth is attributed to the rising awareness regarding energy conservation in North America and growing energy costs in the market. Insulation systems provide long-term as well as immediate benefits to the industry, including protection of equipment, personnel, system, and budget. In addition, it is also responsible for enhancing the efficiency of the machinery and process performance in the system, which results in a reduction of manufacturing and energy costs. Moreover, insulation materials improve product performance by making manufacturing processes more efficient and offering the exposed equipment and piping a finished and durable appearance.

The acoustic performance of insulation in large-scale factories helps to curb high-frequency noises made by machines on the job floor. Furthermore, it protects all industrial appliances from fire, prevents the condensation of moisture on the equipment, and protects the equipment at extremely low or high temperatures, leading to reduced accidental risks.

Insulation is one of the most secure and least expensive methods of conserving energy. Plating industrial equipment, such as continuously operated brick wall furnaces, with external coatings, increases their heat storage capacity and regulates their average temperature. Other benefits of industrial insulation include frost protection of pipes at low ambient temperatures, acoustic protection in large-scale factories to curb high-frequency noises made by machines, and reduction of mechanical damage to pipework & other components. It also protects equipment and helps achieve extremely high or low temperatures with reduced accident risks.

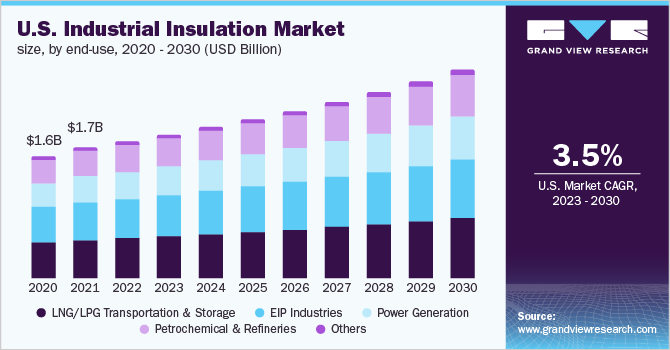

The U.S. industrial insulation market is expected to benefit from recovering non-residential building construction expenditures, particularly in the office and commercial segments. Rising awareness regarding environment-friendly construction practices is forecasted to propel insulation use, with an aim to reduce energy consumption. Industrial insulation demand is poised to propel in North America due to rising industrial construction spending in the region.

Material Insights

Based on material, the North America industrial insulation market was dominated by glass wool in 2022. It offers energy-efficient thermal and acoustic protection, as well as fire safety. Glass wool also helps to reduce energy consumption and fluctuation in temperature. The material provides extremely high-temperature tolerances, as the material itself is flame-resistant. In addition, it is cost-effective, versatile, and easily customizable, thereby accounting for a notable demand for industrial insulation in North America.

The calcium silicate segment is the fastest-growing material segment in industrial insulation applications in North America. Calcium silicate is commonly used as a safe alternative to asbestos for high-temperature insulation materials since it acts as an excellent barrier to infrared radiation. High-temperature piping and industrial-grade equipment are common applications of calcium silicate. The application of calcium silicate is recommended in petrochemical, power generation, and other process industries, where operating temperatures are excessively high.

The stone wool segment also accounted for a significant revenue share in North American industrial applications. Stone wool is one of the most environmentally robust insulation materials. It is a widely used material for thermal protection in several industries as it helps in maintaining energy efficiency and provides fire protection, with good acoustics. It is generally available in various forms with different characteristics and properties to suit a wide range of applications, including ovens, boilers, and others.

Product Insights

Based on product, the pipe segment accounted for the largest revenue share in 2022 in North America. It is also forecasted to expand at the fastest CAGR of 4.1% over the coming years in industrial applications in North America. Pipe insulation is a vital part of industrial insulation, whose main purpose is to provide a protective barrier between the contents of the pipe and the outside environment, in order to improve the efficiency of the various industrial processes.

Pipe insulation aids in increasing the energy efficiency of the process or plant, thereby reducing operating expenses. It controls and stabilizes the process temperatures, prevents the formation of condensation, and limits pipe corrosion in extreme temperatures in North America. Pipe insulation provides protection against freeze damage and pipe breaks, and prevents exposure to extreme temperatures. It also offers acoustic protection by lowering the noise and vibration along the pipeline.

Blanket insulation is designed to provide excellent handling characteristics, thermal performance, and dimensional stability in industrial applications. These products are specifically used in high-temperature applications, operating up to 538ºC. Typical applications include heat exchangers, storage tanks, stack installations, cooling towers, air conditioning ductwork, and large-diameter piping, among others.

Board insulation is used on vessels, equipment, chillers, heat and air conditioning duct and acoustical wall panels, hot and cold equipment, power and process equipment, and specialized ceiling applications. Materials used in board insulation generally differ depending upon the temperature range of the application.

End-use Insights

Based on end-use, the LNG/LPG transportation & storage accounted for the highest revenue share in the industrial insulation market. The demand for natural and petroleum gas across North America has led to the establishment of an extensive storage and transportation infrastructure for the same. High risk involved in transportation and storage leads to the usage of extensive insulation products by the players in the industry. The demand for LNG and LPG is expected to register sustained growth across the major consuming economies, which is expected to drive the growth of industrial insulation in North America over the forecast period.

The power generation segment is expected to expand at the highest CAGR of 4.1% by 2030 in industrial insulation applications. The demand for insulation materials in the thermal power generation industry to minimize energy losses is one of the primary reasons driving the industry's growth. The market for industrial insulation is also expected to rise on account of increasing energy requirements by the economies across North America.

The demand for industrial insulating materials in the petrochemical and refinery segment accounts for a significant revenue share. The oil & gas industry in North America is involved in the continuous high-volume production of crude oil and natural gas. This calls for a higher demand for insulating materials across North America. Furthermore, the demand for industrial insulation for the crude oil refining industry is also to remain one of the major contributors to the industrial insulation market growth in North America.

Regional Insights

The U.S. accounted for the largest revenue share of 85.5% of the North American market. The market in the U.S. is expected to witness increased demand for insulating materials for industrial applications, such as machinery, boilers, pipes, and storage tanks; and in linings of heat exchangers, cooling towers, and ventilation & air conditioning systems, among others.

The U.S. market growth is not uniform across all segments. The industry experienced minor fluctuations in the past, owing to minor drops in oil prices, reduced activity in the manufacturing sector, and economic slow-down, resulting in hampered growth of the industrial sector. However, the current boom in shale gas and tight oil extraction is expected to boost the insulation demand in the oil & gas industry throughout the region.

The demand for industrial insulation in Canada is forecast to expand at the fastest CAGR of 4.4% by 2030. Rising demand for the product from the oil & gas sector is expected to drive the overall market growth over the forecast period. The Canadian industrial insulation market is to benefit from the burgeoning industrial construction expenditures. Growing awareness regarding environmentally friendly construction materials is expected to propel insulation applications in North America with an aim to reduce energy consumption over the coming years.

The oil & gas production in Mexico is undertaken by both private and national companies in the economy and is expected to increase over the forecast period, which in turn is likely to spur the infrastructure development for oil & gas production and downstream product manufacturing. In addition, growing efforts undertaken by companies to ensure adequate insulation so as to minimize energy wastage are expected to drive the demand for industrial insulation in North America over the forecast period.

Key Companies & Market Share Insights

The industry is competitive in nature, owing to the presence of a large number of major players in the market. Companies such as Rockwool Technical insulation, Paroc Group, and Knauf Gips KG hold the majority of revenue share, due to their vast product portfolio and wider geographical reach. These companies develop a strong business model in order to adapt to market volatility and any technological & geographical change. The players in the North American region prefer to maintain strategic relationships with their raw material suppliers to ensure a steady supply.

Unlike other regions, the players focus on increasing their market presence through organic growth, rather than mergers and acquisitions. North American companies focus on expanding their product portfolio by developing cost-effective products with enhanced properties. Manufacturers are also focusing on expanding their capabilities in order to cater to the ascending product demand in North America. Some prominent players in the North America industrial insulation market include:

-

ROCKWOOL Insulation A/S

-

Knauf Insulation

-

NICHIAS Corporation

-

Anco Products, Inc.

-

Aspen Aerogels, Inc.

-

Cabot Corporation

-

Morgan Advanced Materials plc

-

Unifrax

-

RATH Group

-

Armacell International Holding GmbH

-

L'ISOLANTE K-FLEX S.p.A.

-

Kaimann

-

Pittsburgh Corning Europe N.V.

-

Duna-Corradini S.p.A.

-

Polyguard Products, Inc.

North America Industrial Insulation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.23 billion

Revenue forecast in 2030

USD 2.85 billion

Growth Rate

CAGR of 3.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, end-use, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

ROCKWOOL Insulation A/S; Knauf Insulation; NICHIAS Corporation; Anco Products, Inc.; Aspen Aerogels, Inc.; Cabot Corporation; Morgan Advanced Materials plc; Unifrax; RATH Group; Armacell International Holding GmbH; L'ISOLANTE K-FLEX S.p.A.; Kaimann; Pittsburgh Corning Europe N.V.; Duna-Corradini S.p.A.; Polyguard Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Industrial Insulation Market Segmentation

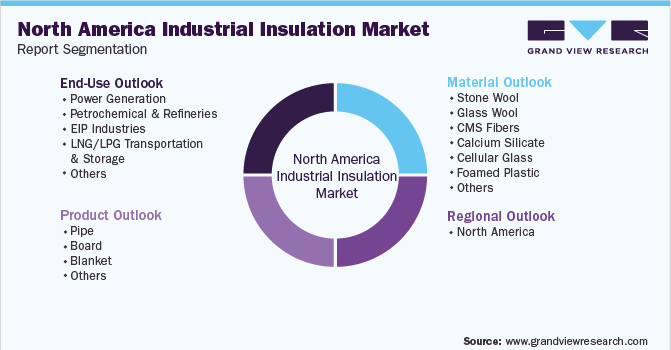

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America industrial insulation market report based on material, product, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Stone Wool

-

Glass Wool

-

CMS Fibers

-

Calcium Silicate

-

Cellular Glass

-

Foamed Plastic

-

Elastomeric Foam

-

Perlite

-

Aerogel

-

Cellulose

-

Micro Silica

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pipe

-

Board

-

Blanket

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Power Generation

-

Petrochemical & Refineries

-

EIP Industries

-

LNG/LPG Transportation & Storage

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America industrial insulation market size was estimated at USD 2.14 billion in 2022 and is expected to reach USD 2.23 billion in 2023.

b. The North America industrial insulation market is expected to grow at a compound annual growth rate a CAGR of 3.7 % from 2023 to 2030 to reach USD 2.85 billion by 2030.

b. The U.S building industrial insulation segment accounted for the largest revenue share in 2022 and this is due to the growth of construction sector and increased demand for energy-efficient construction solutions in the U.S.

b. Some key players operating in the North America industrial insulation market include ROCKWOOL Insulation A/S, Knauf Insulation, NICHIAS Corporation, Anco Products, Inc., Aspen Aerogels, Inc., Cabot Corporation, Morgan Advanced Materials plc, Unifrax, RATH Group, Armacell International Holding GmbH, L'ISOLANTE K-FLEX S.p.A., Kaimann, Pittsburgh Corning Europe N.V., Duna-Corradini S.p.A., Polyguard Products, Inc.

b. The increasing demand for energy-efficient buildings, owing to the stringent government regulations and rising awareness regarding environmental degradation, is anticipated to fuel the demand for industrial insulation in North America.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."