- Home

- »

- Pharmaceuticals

- »

-

North America Legal Marijuana Market Size Report, 2030GVR Report cover

![North America Legal Marijuana Market Size, Share & Trends Report]()

North America Legal Marijuana Market Size, Share & Trends Analysis Report By Product Type (Flower), By Marijuana Type (Adult), By Medical Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-970-8

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

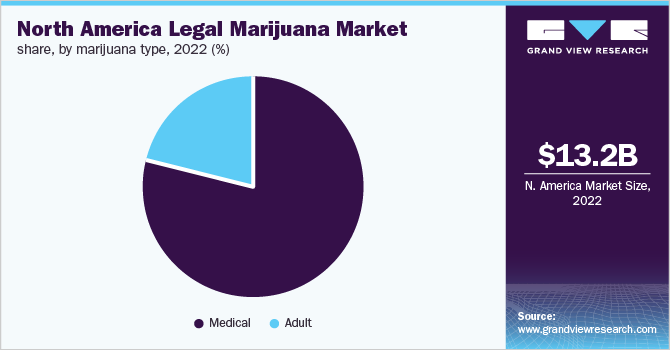

The North America legal marijuana market size was valued at USD 13.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 15.0% from 2023 to 2030. Across North America, cannabis legitimization has brought about a massive change in the market. Due to ease of access, its demand is high which is reflected in the revenue for the region. The legitimization has come due to its varied uses in different medical applications for easing symptoms of diseases like epileptic seizures, chronic pain, Alzheimer’s, Parkinson’s, and other neurological conditions. At present 38 states across the US have legitimized the use of cannabis for medicinal use.

In April 2022, New Jersey legalized recreational and medical marijuana, it is being sold at 13 facilities, New Jersey has become one of the 18 states in the U.S. to have legalized recreational marijuana. The wide acceptance and high demand for cannabis is a primary factors driving the growth of the market. Since its legalization, its use in medical treatments has increased. This has brought about a decrease in the illicit trade of cannabis which is also responsible for the growth. A study conducted by New York University stated that cannabis usage among age groups 50-64 has doubled in the past decade and has reached 9.0%.

Another step to legalize cannabis in the U.S. has been in the form of the MORE (Marijuana Opportunity, Reinvestment, and Expungement) Act. This act has the potential to decriminalize the drug if it is passed, it was introduced in May 2021 in the US House of Representatives. The legitimization will not only create a lot of job opportunities but will also benefit industries like transportation, finance, food, etc.

Various banks provide loans to marijuana businesses and small- and large-scale production and processing industries which will bolster the growth of the legal cannabis market. However, federal banks still shy away from giving out loans or securing banks that give loans for businesses because marijuana is still not federally legal. The stringency around promoting businesses for recreational purposes comes with a risk of possible charges of aiding and abetting and other criminal felonies, this however could change if the government legalizes marijuana at the federal level.

Even though marijuana has been legalized across North America for both medical and recreational purposes the legalized businesses authorized for the production of CBD extracts and other derivatives are still under the federal government. In 2021, Groff North America received schedule 1 authorizations from the federal government for production, extraction, and cultivation of federally, legal cannabis and derivatives. Ever since the states in the U.S. have declared the legitimization of marijuana, medical practitioners have been increasingly supporting its use in the treatment of various conditions, especially chemotherapy-induced nausea.

As per the American Cancer Society, approximately 1.9 million new cases of cancer were detected in the U.S. in 2021. Because of such high prevalence, it is one of the leading causes of death in the U.S. Medical-grade marijuana has been studied extensively to ease chemotherapy-induced nausea in patients. Studies have also shown that it not only helps in combating nausea during cancer treatments but also helps with pain, neuropathy, appetite, and weight loss among cancer patients.

The COVID-19 pandemic caused explosive growth in the cannabis industry. Oregon saw a marginal increase in sales, up to a 30% increase in overall sales observed during COVID. Sales skyrocketed during the pandemic since the stores were operating and people were stocking up on the products; it was considered essential products. The stores were also offering home deliveries which led to further expansion of sales in turn helped the growth of the market. Increased consumption of marijuana is also a concern, according to Canada’s Centre for Addiction and Mental Health, half of the country’s users increased consumption during the first wave of the pandemic.

Product Insights

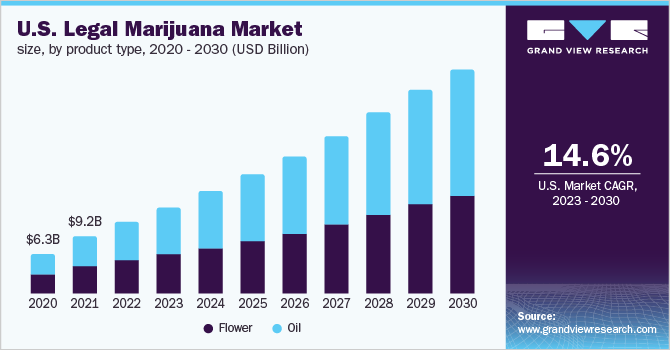

Marijuana can be used as whole flowers (dried) or as extracted oil, mostly containing CBD. The legalization has allowed CBD oil to be used extensively in different medical applications, due to which it had the largest revenue share of 53.7% in 2022 and is anticipated to register the fastest growth rate of 15.4%. Flowers are generally used for recreational purposes. The legalization in the U.S. is primarily for medicinal use which majorly uses CBD oil, a common extract or derivative from marijuana. CBD oil is extensively used in easing epileptic seizures, chronic pain, arthritic pain, nausea, etc., contributing significantly to the growth of the market.

Due to its prowess in varied applications, it is also the fastest-growing product type over the forecast period. The attitude of the medical fraternity toward legal cannabis has brought about a huge change in the market, which has resulted in more prescriptions with less skepticism, resulting in growth. North America is the forerunner in setting out clear regulations on the use and business surrounding marijuana. People are increasingly using CBD oils and other extracts for skincare products as well as the medical applications resulting in the growth of the market.

Medical Use Insights

The legal marijuana market has been extensively used for treating chronic pain, and thus has the largest revenue share of 25.5% as of 2022. Medical use has prompted physicians and medical practitioners to prescribe cannabis-based products for various medical conditions. CBD oil an extract from marijuana has been used for the treatment of various conditions.

Chronic pain treatment through CBD oil. For people suffering from chronic pain, rather than using regular pain medications, opioids which are both habit-forming, CBD oil provides an alternative to these providing better benefits by reducing pain perception and improving mood, thus driving the growth of the market.

Tourette's syndrome is expected to register the fastest growth over the forecast period. In a study conducted on 4 subjects, in contrast to its usual effects of euphoria, CBD help alleviates symptoms of Tourette’s. Cannabidiol which ideally should have exacerbated the symptoms was in contrast able to reduce tics in patients with Tourette’s.

The Tourette Association of America found that more than 45% of parents with children suffering from Tourette’s syndrome feel that the current medication for the symptoms is not adequate and additional research for better medication needs to be done. The association has funded 5 large-scale studies on the controlled use of medical marijuana in Canada, Israel, and the U.S.

Marijuana Type Insights

Medical use with a revenue share of 78% in 2022, emerged to be the largest category. The high rate of legalization across the U.S. and Canada has resulted in the growth of the market. According to New York Times, the sales of legal cannabis increased by 46% in 2020, in comparison to 2019, despite lockdowns. Several studies evaluating the benefits of marijuana have been conducted studying benefits in movement disorders in Huntington’s, Tourette's syndrome, and Parkinson’s disease. Apart from these, its use in relieving stress and anxiety has seen a jump in recent years.

Adult use is anticipated to register the fastest growth rate of 19.7% during the forecast years. The attitudes toward the use of cannabis have been changing, with more and more states across the U.S. granting legalization to recreational or adult-use marijuana, the growth has been substantial. The demand for the same has grown multi-fold. According to a survey done by the Pew Research Center, 60% of adults are in favor of legalizing recreational use, and a total of 91% of adults across the U.S. are in favor of legalizing marijuana for either medicinal use or recreational use.

The popularity of marijuana use varies according to age, an average of 7 in 10 adults under 30 are in favor of legalizing marijuana, whereas only 32% of adults above the age of 75 say it should be legal. All of these factors have been fueling the growth of the market in North America.

Country Insights

The changes in attitudes of government and people have helped the legal marijuana industry flourish in the U.S. and Canada. Both the countries have legalized marijuana for medical as well as recreational use, it is still a federally regulated drug. In 2022, U.S. accounted for the largest revenue share of 86.7%. One of the major factors driving the growth of the market is the presence of cannabis cultivators, and producers, which has created a steady supply chain as per the increasing demand for both medical as well as recreational use marijuana. The opening of several federally regulated retail outlets has also contributed to the market growth to a great extent.

During the forecast period, Canada is anticipated to register the fastest growth rate of 17.2%. Since its legalization recreational use has contributed a significant amount to the country’s GDP, a total of USD 43.5 billion. The booming industry has created upwards of 98,000 jobs and more than USD 15 billion in government taxes. The number of government-approved stores has to a great extent limited the use of illicit trade in marijuana buying and selling business across Canada. Above mentioned factors have had a lasting impact on the Canadian legal marijuana market and will continue to drive growth in this segment in the forecast period.

Key Companies & Market Share Insights

The legal marijuana business across North America has been proliferating at a fast pace, in line with recent legitimization, the growth of this industry has gained a lot of momentum. Government initiatives have led the small industry players to make space for themselves in this highly fragmented market. The presence of large and small players in the industry has given rise to a lot of competition and in turn has resulted in several mergers and acquisition activities, resulting in the positive growth of the overall market.

Furthermore, the introduction of new product categories has also gained a lot of traction and people across the region are using these products with unmatched enthusiasm, be it gummies, oils, tinctures, and pet food among others. This has resulted in massive growth across all segments of the legal marijuana market. Companies like Canopy Growth Corporation, Aphira, Inc. Tilray, and Lexaria Bioscience Corp. have dominated the industry. Some prominent players in the North America legal marijuana market include:

-

Canopy Growth Corporation

-

Aphria, Inc.

-

Aurora Cannabis

-

Tilray

-

Organigram Holdings, Inc

-

Lexaria Bioscience Corp.

-

ABcann Medicinals, Inc. (Part of Vivo Cannabis)

-

The Cronos Group

-

Wayland Group Corp. (Maricann Group Inc.)

-

CannTrust Holdings

North America Legal Marijuana Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.9 billion

Revenue forecast in 2030

USD 42.3 billion

Growth Rate

CAGR of 15.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, marijuana type, medical use, country

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Canopy Growth Corporation; Aphria, Inc.; Aurora Cannabis; Tilray; Organigram Holdings, Inc.; Lexaria Bioscience Corp.; ABcann Medicinals, Inc. (Part of Vivo Cannabis); The Cronos Group; Wayland Group Corp. (Maricann Group Inc.); CannTrust Holdings

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

North America Legal Marijuana Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research, Inc. has segmented the North America legal marijuana market report based on product, marijuana type, medical use, and country:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Flower

-

Oil

-

-

Marijuana Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Adult

-

Medical

-

-

Medical Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Cancer

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Post-Traumatic Stress Disorder (PTSD)

-

Alzheimer’s

-

Parkinson’s

-

Tourette’s

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America legal marijuana market size was estimated at USD 13.2 billion in 2022 and is expected to reach USD 15.9 billion in 2023.

b. The North America legal marijuana market is expected to grow at a compound annual growth rate of 15.0% from 2023 to 2030 to reach USD 42.3 billion by 2030.

b. Oils dominated the North America legal marijuana market with a share of 53.7% in 2022. This is attributable to the increased legalization of medical cannabis and the growing adoption of cannabis for the treatment of chronic diseases.

b. Some key players operating in the telemedicine market include Canopy Growth Corporation; Aphria, Inc.; Aurora Cannabis; Maricann Group, Inc.; Tilray; The Cronos Group; Organigram Holding, Inc.; ABcann Medicinals, Inc.; GW Pharmaceuticals, plc.; and Lexaria Corp.

b. Key factors driving the North America legal marijuana market growth include liberal government regulations and legalization of cannabis for medical as well as adult-use in the U.S. and Canada.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."