- Home

- »

- Advanced Interior Materials

- »

-

North America Property Management Services Market Report 2033GVR Report cover

![North America Property Management Services Market Size, Share & Trends Report]()

North America Property Management Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Rent Collection, Leasing) By Property Type (Residential, Commercial, Industrial), By End User, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-688-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Property Management Services Market Summary

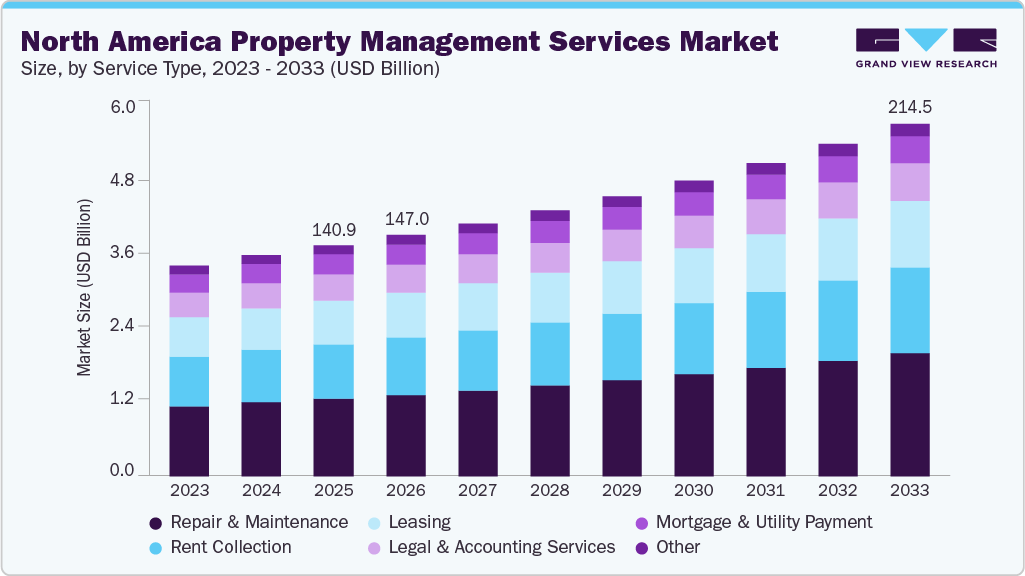

The North America property management services market size was estimated at USD 5,105.6 million in 2024 and is projected to reach USD 8,919.3 million by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The market is driven by increasing rental demand, urban expansion, and the integration of digital technologies. Enhanced operational efficiency and a shift toward professional management solutions are further fueling market expansion.

Key Market Trends & Insights

- Property management services in the U.S. is expected to grow at a substantial CAGR of 6.6% from 2025 to 2033.

- By service, rent collection segment is expected to grow at a considerable CAGR of 7.0% from 2025 to 2033 in terms of revenue.

- By property type, commercial segment is expected to grow at a considerable CAGR of 7.2% from 2025 to 2033 in terms of revenue.

- By end user, housing association segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 5,105.6 Million

- 2033 Projected Market Size: USD 8,919.3 Million

- CAGR (2025-2033): 6.7%

Technology is increasingly important in transforming the North American property management landscape. Service providers are adopting cloud-based platforms, AI-driven maintenance scheduling, mobile tenant portals, and IoT-enabled property monitoring tools to enhance operational efficiency and customer satisfaction. These innovations are not only helping to reduce operating costs but also offering more transparency and responsiveness to both property owners and tenants.

Market Concentration & Characteristics

The North America property management services industry is moderately fragmented, with a mix of large national players and numerous regional and niche firms. While major companies such as Greystar, Lincoln Property, and FirstService Residential hold significant market share, a large portion of the industry is served by smaller, locally focused firms offering specialized or community-based services. This structure allows for healthy competition but limits market dominance by a few players. The fragmentation gradually decreases as consolidation trends grow, driven by technology integration, service standardization, and demand for full-service property management solutions across residential and commercial real estate sectors.

The industry exhibits a high degree of innovation, driven by the integration of PropTech solutions. Companies are adopting AI-powered tools, IoT-based maintenance systems, mobile apps, and cloud-based platforms to streamline operations, improve tenant experiences, and enhance decision-making. Automating rent collection, virtual tours, and smart building features is becoming standard. These innovations are helping firms reduce costs, increase scalability, and offer more data-driven, efficient, and transparent services in a competitive market.

Mergers and acquisitions in the North America property management services industry have increased over the years as larger firms acquire regional players to expand their geographic presence and service offerings. The need for scale, technology integration, and access to diverse real estate segments drives strategic consolidation. Recent deals involve residential and commercial property managers seeking to enhance portfolios and streamline operations. This consolidation trend is expected to continue, fostering more standardized services and increasing competitive pressure on smaller, independent property management firms.

Regulations play a crucial role in shaping the North America property management services industry by enforcing compliance in areas such as tenant rights, fair housing, data protection, and maintenance standards. State and municipal laws vary widely, requiring firms to stay updated and adapt operations accordingly. Increasing focus on ESG compliance and energy efficiency mandates is pushing property managers to adopt sustainable practices.

Drivers, Opportunities & Restraints

A key driver of the North America property management services industry is the growing volume of rental properties and multifamily housing units, particularly in urban and suburban areas. The rise of institutional investors in the residential rental market and shifting consumer preferences toward renting over homeownership have increased the need for professional management services. These services ensure efficient operations, regulatory compliance, and enhanced tenant experiences, prompting property owners to outsource to specialized firms.

Integrating advanced technologies to improve efficiency, scalability, and customer engagement is a major opportunity in the North American property management services industry. Adopting cloud-based platforms, AI-powered analytics, mobile tenant portals, and IoT-based smart property systems presents significant potential for differentiation and operational cost reduction. In addition, there is growing demand for value-added services such as energy management, financial planning, and digital leasing platforms, especially from institutional clients and owners of mixed-use developments.

Varying state and local regulations pose a significant challenge. Property management firms must navigate an evolving legal landscape involving rent control laws, eviction policies, tenant rights, and licensing requirements. Failure to comply can lead to legal liabilities and reputational damage. Keeping pace with these regulatory complexities increases administrative burden and operating costs, especially for smaller firms.

Service Insights

The rent collection segment is expected to grow at a considerable CAGR of 7.0% from 2025 to 2033 in terms of revenue. Repair & maintenance dominated the market in 2024, accounting for the highest revenue share at 35.0%. The market is growing significantly due to increasing demand for well-maintained, safe, and compliant properties. Aging building infrastructure, rising tenant expectations, and stricter building codes drive consistent service needs.

The rent collection segment is expected to grow significantly during the forecast period due to the increasing adoption of digital payment platforms and automation tools. Property managers leverage mobile apps, online portals, and automated reminders to streamline rent collection, reduce delays, and improve cash flow.

Property Type Insights

The commercial segment is expected to grow at a considerable CAGR of 7.2% from 2025 to 2033 in terms of revenue. Residential dominated the market in 2024, accounting for the highest revenue share at 59.5% due to increasing rental housing demand, urban population growth, and investor interest in multi-family properties. Property owners rely on professional managers for tenant screening, rent collection, and maintenance, driving steady expansion and innovation in residential property management solutions.

The commercial segment is expected to witness significant growth during the forecast period due to rising demand for professional management of office spaces, retail centers, and industrial properties. Businesses seek expert services for lease management, maintenance, and compliance, while investors prioritize asset value, tenant retention, and operational efficiency through outsourced property management.

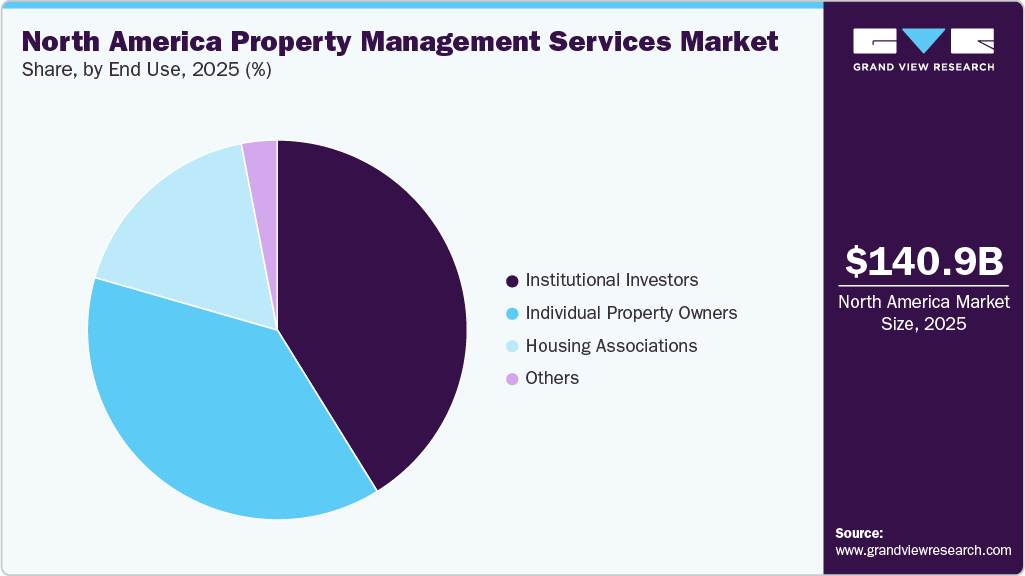

End User Insights

The housing association and medical segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033 in terms of revenue. The property managers or agents segment dominated the market in 2024, holding the largest revenue share at 45.8% due to rising demand for specialized, outsourced services in both residential and commercial sectors. As portfolios expand, managers increasingly adopt digital tools to streamline operations, improve tenant relations, and ensure regulatory compliance, driving growth in professional property management adoption.

The housing association segment is expected to grow fastest from 2025 to 2033 as these organizations seek professional management to efficiently handle maintenance, rent collection, and compliance. Increasing affordable housing projects and government support drive demand for structured property services, prompting housing associations to adopt modern, scalable solutions for better tenant service and asset management.

Country Insights

The property management services market in the U.S. is expected to grow at a CAGR of 6.6% from 2025 to 2033 due to its large real estate base, high rental activity, and strong demand for digital property solutions. Increasing institutional investments in multi-family and commercial properties are boosting reliance on professional management for efficiency, compliance, and tenant satisfaction.

Canada Property Management Services Market Trends

The property management services market in Canada is growing steadily, driven by urban population growth, rising rental housing demand, and increased focus on sustainability. Housing affordability issues are pushing renters toward professionally managed units. In addition, evolving tenant laws and the need for high service standards are prompting property owners to adopt tech-enabled management services across residential and commercial sectors.

Mexico Property Management Services Market Trends

The property management services market in Mexico is witnessing gradual growth, supported by expanding urban centers, tourism-driven real estate, and foreign investment in residential and commercial developments. Demand for professional management is rising in gated communities, resorts, and office parks. However, market growth is tempered by regulatory challenges and uneven technology adoption among local service providers.

Key North America Property Management Services Company Insights

Some of the key players operating in the market include Greystar, FirstService Residential, Lincoln Property Company, and Asset Living.

-

Greystar is a prominent property management company in the U.S., managing a broad portfolio of multifamily, student, and senior housing units. It offers integrated services including property operations, development, and investment management. The company operates across global markets with a strong focus on technology and resident experience.

-

FirstService Residential manages a wide range of residential communities across the U.S. and Canada, including condominiums, homeowner associations, and master-planned developments. The company provides property maintenance, financial services, and administrative support, emphasizing enhancing community living, ensuring compliance, and delivering tailored management solutions to property owners and boards.

Key North America Property Management Services Companies:

- Greystar

- Lincoln Property

- Asset Living

- FPI

- Alliance Residential

- FirstService Residential

- Evernest

- Darwin Homes

- HomeRiver Group

- Northpoint

- Realstar

- Boardwalk

- CAPREIT

- Pinnacle

Recent Developments

-

In May 2025, Lincoln Property Company expanded its property management services in Southern California through a strategic investment in Unire Real Estate Group. This move strengthened its regional presence, enhanced service capabilities, and supported growth in the competitive Southern California real estate market.

-

In February 2024, Asset Living launched a centralized business intelligence platform that enhances overall operations by improving property performance and optimizing business growth. This technology-driven approach enables better decision-making, increases efficiency, and supports the company’s goal of delivering enhanced services to clients and residents.

North America Property Management Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,315.2 million

Revenue forecast in 2033

USD 8,919.3 million

Growth rate

CAGR of 6.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, property type, end user, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

Greystar; Lincoln Property; Asset Living; FPI; Alliance Residential; FirstService Residential; Evernest; Darwin Homes; HomeRiver Group; Northpoint; Realstar; Boardwalk; CAPREIT; Pinnacle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Property Management Services Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the North America property management services market report based on service, property type, end user, and country:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Rent Collection

-

Mortgage & Utility Payment

-

Leasing

-

Legal & Accounting Services

-

Repair & Maintenance

-

Other

-

-

Property Type Outlook (Revenue, USD Million; 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

Others

-

-

End User Outlook (Revenue, USD Million; 2021 - 2033)

-

Property Managers or Agents

-

Housing Association

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America property management services market size was estimated at USD 5,105.6 million in 2024 and is expected to be USD 5,315.2 million in 2025.

b. The North America property management services market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2033 to reach USD 8,919.3 million by 2033.

b. Repair & maintenance dominated the market in 2024, accounting for the highest revenue share at 35.0% and is growing significantly due to increasing demand for well-maintained, safe, and compliant properties. Aging building infrastructure, rising tenant expectations, and stricter building codes are driving consistent service needs.

b. Some of the key players operating in the North America property management services market include Greystar, Lincoln Property, Asset Living, FPI, Alliance Residential, FirstService Residential, Evernest, Darwin Homes, HomeRiver Group, Northpoint, Realstar, Boardwalk, CAPREIT, Pinnacle

b. Key factors driving the North America property management services market include urbanization, rising real estate investments, demand for efficient property operations, technological advancements, regulatory compliance, and increasing outsourcing by property owners to improve tenant satisfaction and asset value.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.