- Home

- »

- Homecare & Decor

- »

-

North America Retail Cooler Market, Industry Report, 2030GVR Report cover

![North America Retail Cooler Market Size, Share & Trends Report]()

North America Retail Cooler Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (High-Sided Coolers, Soft-Sided Coolers), By Price Range, By Capacity, By End Use, By Distribution Channels, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-561-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Retail Cooler Market Trends

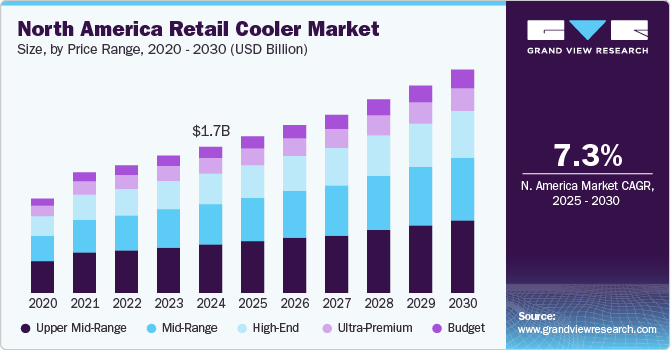

The North America retail cooler market size was estimated at USD 1.65 billion in 2024 and is expected to expand at a CAGR of 7.3% from 2025 to 2030. The interest in retail coolers is growing due to an increase in outdoor activities, rising disposable incomes, and an increasing focus on family-centered experiences. The surge in participation in outdoor recreational pursuits in both the U.S. and Canada is also contributing to market expansion in the region.

The increase in first-time participants in outdoor recreation highlights the rising demand for camping coolers. In 2023, 7.7 million Americans experienced outdoor activities for the first time, indicating a broader shift towards outdoor lifestyles. Since casual and novice participants typically look for high-quality, dependable gear, coolers with innovative features such as enhanced ice retention and convenient portability options meet the needs of this changing consumer demographic. This trend creates opportunities for camping cooler manufacturers to capture new markets while addressing diverse consumer needs.

In addition, the popularity of weekend getaways, van life, and off-grid adventures has fueled demand for durable, compact, and multi-day cooling solutions. Premium brands like YETI and RTIC are capitalizing on this trend by offering customizable and highly efficient models, while mid-range players are gaining ground by balancing price and performance.

Consumer Surveys & Insights

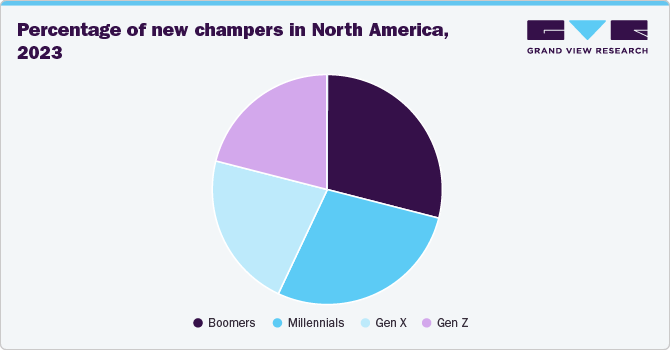

The demand for retail coolers is increasing among all age groups in North America countries. Post-pandemic camping has become hugely popular amongst the younger generation, with 45% of Millennials and 44% of Gen Z having the highest interest among prospective new campers.

According to a CamperChamp survey published in 2023, over 87.99 million North America campers participated in camping in 2023, of which nearly 50% were Millennials and Gen Zers and 5.5 million were new campers. One-third of first-time campers in 2023 were aged between 18 and 34. Thus, the surging number of new campers is driving growth of the North America camping cooler market.

Type Insights

Hard-sided retail coolers accounted for a revenue share of 73.52% of the North America retail cooler industry in 2024. The demand for hard-sided coolers in North America has grown significantly in recent years, driven by outdoor activities, a growing interest in adventure travel, and a rising preference for high-quality, durable products. Hard coolers are good at sustaining low temperatures for prolonged periods because of their higher insulating qualities. During long outings, they can withstand intense heat while maintaining the temperature of food and drinks.

Demand for soft-sided coolers is expected to grow at a CAGR of 8.0% from 2025 to 2030. The increasing demand for soft-sided coolers in North America, particularly in the U.S. and Canada, can be attributed to changing consumer preferences prioritizing portability, convenience, and multifunctionality. As outdoor activities like picnics, beach outings, and hiking grow, soft-sided coolers have become a go-to choice for consumers seeking a blend of practicality and performance.

Price Range Insights

Upper mid-range cooler accounted for a revenue share of 33.12 % in 2024 in North America retail cooler industry. These coolers are designed for avid campers, hunters, tailgaters, and fishermen who need reliable cold storage for multi-day trips. High-performance features like rotomolded construction (used in many high-end coolers) and thick insulation allow these coolers to freeze ice for several days, even in warm temperatures.

The budget cooler segment in the market is projected to grow at a CAGR of 8.4% from 2025 to 2030. Consumers in this category primarily value affordability, though they still expect reasonable insulation performance for short-term use. These coolers are typically constructed from molded plastic and offer adequate cooling for day trips or weekend outings. While they lack the advanced ice retention or rugged durability of premium models, budget coolers fulfill essential needs, making them especially popular among families, occasional campers, and budget-conscious buyers.

Capacity Insights

Retail coolers with a capacity between 50 to 100 quarts accounted for a revenue share of 31.06% of the North America retail cooler industry in 2024. Coolers in the 50-100 quart capacity are particularly popular among outdoor enthusiasts, campers, and those who need large-capacity coolers for extended trips or large gatherings. These coolers are ideal for people who require substantial storage for multiple days of food and drink, making them essential for longer camping trips, fishing excursions, and tailgating events.

Below 20 quarts capacity coolers are expected to grow at a CAGR of 8.3% from 2025 to 2030. Coolers below 20 quarts are considered small and personal coolers. The demand for small or personal camping coolers has seen steady growth in the North America camping cooler market. These compact coolers cater to individuals or small groups looking for a convenient, portable option for short trips or daily use. Popular among consumers who enjoy casual outings like picnics, tailgating, or single-day beach trips, these coolers are favored for their lightweight and compact design.

End Use Insights

Camping and hiking accounted for a market share of 43.55% in 2024. The demand for coolers in camping and hiking has significantly increased, driven by several key factors. According to the study conducted by Camper Champ, over 87.99 million people engaged in camping activities in North America in 2023, with 5.5 million new campers. Camping participation has increased by 23% since 2014.

Retail coolers for fishing and marine activities are expected to grow at a CAGR of 8.4% from 2025 to 2030. The increasing interest in marine-based recreation, including boating and sailing, has also played a pivotal role in driving demand. Boaters and sailors rely on marine coolers to preserve provisions for extended trips. With advancements in cooler technology, such as improved insulation, durability, and capacity, consumers are now more inclined to invest in high-quality coolers designed for harsh marine environments.

Distribution Channel Insights

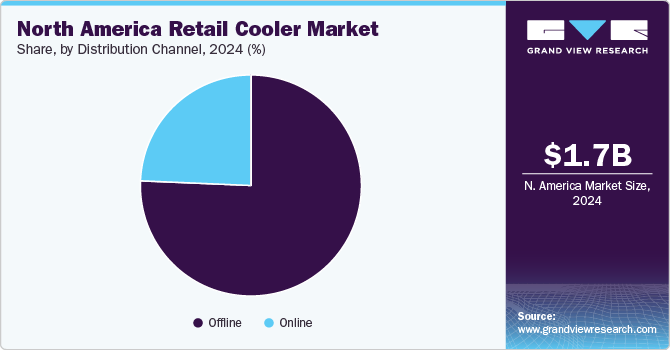

Offline sales held a share of 75.67% of the market in 2024. Despite the growth of online shopping, many consumers still prefer to purchase coolers in physical stores due to the ability to inspect the product, gauge its durability, and receive personalized advice from sales associates. Traditional brick-and-mortar retailers such as REI, Walmart, Dick’s Sporting Goods, and Canadian Tire are key players in the offline market, offering a wide range of retail coolers that cater to different needs, from budget options to premium models.

Online sales are expected to grow at a CAGR of 8.2% from 2025 to 2030. Online shopping offers a wide selection of coolers, allowing consumers to compare prices, read reviews, and access expert advice without the pressure of in-store sales. Brands like YETI, Coleman, and Igloo have capitalized on this trend by enhancing their online presence and marketing directly to outdoor enthusiasts through their websites and platforms like Amazon, REI, and Walmart. The ease of delivery to homes or campgrounds further appeals to the convenience-driven shopper.

Country Insights

The U.S. retail cooler market is set to grow at a CAGR of 7.2% from 2025 to 2030. The retail cooler market in the U.S. is primarily driven by evolving consumer lifestyles and increasing outdoor engagement. Consumers seek reliable and high-performing coolers for storing food and beverages and as essential equipment that enhances their overall outdoor experience. Traditional coolers have become sophisticated products with advanced insulation technology, portability, and multifunctionality. This shift reflects the growing expectation for coolers that can meet both recreational and practical needs, from weekend trips to full-scale outdoor adventures.

Canada Retail Cooler Market Trends

The retail cooler market in Canada is set to grow at a CAGR of 7.7% from 2025 to 2030. The rising popularity of camping and outdoor recreational activities drives the demand for retail coolers in Canada. As Canadians increasingly seek experiences rooted in nature, especially during the warmer months, products that support outdoor living have gained significant traction. Once seen primarily as camping essentials, retail coolers are being embraced more broadly for their versatility in various outdoor settings, including hiking trips, fishing excursions, beach outings, and backyard gatherings.

Key North America Retail Cooler Company Insights

The North America retail cooler industry is fragmented primarily due to the presence of several globally recognized players as well as regional/local players. Some prominent companies in this market are YETI COOLERS, LLC., RTIC Outdoors LLC, Pelican Products, Inc., Igloo Products Corp., The Coleman Company Inc., ORCA (Outdoor Recreation Company of America), and others.

-

YETI COOLERS, LLC is a premium outdoor products company headquartered in Austin, Texas, renowned for its high-performance, durable coolers and lifestyle gear designed for outdoor enthusiasts. The company operates across multiple business units, including Hard Coolers, Soft Coolers, Drinkware, Bags, and Outdoor Accessories. The company offers a wide range of products, such as the iconic Tundra hard coolers, Roadie personal coolers, Hopper soft-sided coolers, and compact Trip lunch bags.

-

The Coleman Company Inc., a subsidiary of Newell Brands, is a well-established American manufacturer specializing in outdoor recreation products. The company operates through multiple business units in Chicago, including outdoor gear, camping equipment, and recreational products. Its product portfolio encompasses tents, sleeping bags, lanterns, stoves, and portable appliances.

Key North America Retail Cooler Companies:

- YETI COOLERS, LLC

- RTIC Outdoors LLC

- Pelican Products, Inc.

- Igloo Products Corp.

- The Coleman Company Inc.

- ORCA (Outdoor Recreation Company of America)

- Chilly Moose Ltd.

- Grizzly Coolers

- California Innovations Inc. (Arctic Zone Products)

- Engel Coolers

Recent Developments

-

In April 2025, Coleman launched its Pro Cooler series, designed to offer rugged performance and ease of transport. These coolers feature thick insulation and sealed lids, allowing them to keep ice for up to five days. Despite their toughness, they're up to 30% lighter than similar rotomolded models. Built for versatility, they include oversized wheels, one-handed latches, a large drain plug, anti-slip feet, tie-down points, and a lockable lid. The line consists of hard coolers in 25, 45, and 55-quart sizes, priced from USD 159 to USD 299, along with soft cooler options for 16 or 24 cans, ranging from USD 59 to USD 79. A 10-year warranty backs each model.

-

In April 2025, YETI unveiled a limited-edition Spring Color Collection featuring pastel shades such as Big Sky Blue, Sandstone Pink, Lowcountry Peach, and Key Lime. This seasonal lineup includes the Tundra 45 Hard Cooler, known for its durability and ice retention capabilities. The collection is available for a limited time, and customers are encouraged to act quickly to secure items in their preferred colors.

-

In October 2024, Igloo partnered with Minecraft to release two exclusive cooler and drinkware collections designed for game fans. The first launch featured a limited-edition Mystery Box Little Playmate cooler, sold in just 150 units and including surprise designs inspired by Minecraft themes like TNT, Diamonds, and Mobs. Shortly after, a larger nine-piece collection was introduced, showcasing iconic characters such as the Creeper, Enderman, and Pig. This second wave included coolers, softside bags, and insulated stainless steel drinkware, blending Minecraft’s visual style with Igloo’s practical outdoor gear.

North America Retail Cooler Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 1.76 billion

Revenue forecast in 2030

USD 2.51 billion

Growth rate (revenue)

CAGR of 7.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, price range, capacity, end use, distribution channel, region

Regional scope

North America

Country scope

U.S; Canada

Key companies profiled

YETI COOLERS, LLC.; RTIC Outdoors LLC; Pelican Products, Inc.; Igloo Products Corp.; The Coleman Company Inc.; ORCA (Outdoor Recreation Company of America); Chilly Moose Ltd.; Grizzly Coolers; California Innovations Inc. (Arctic Zone Products); Engel Coolers

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Retail Cooler Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America retail cooler market based on type, price range, capacity, end use, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hard-Sided Coolers

-

Soft-Sided Coolers

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Budget

-

Mid-Range

-

Upper Mid-Range

-

High-End

-

Ultra-Premium

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 20 Quarts

-

Between 20-50 Quarts

-

Between 50-100 Quarts

-

Above 100 Quarts

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Camping & Hiking

-

Fishing & Marine

-

Sports & Tailgating

-

Overlanding & Off-Roading

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America retail cooler industry was valued at USD 1.65 million in 2024 and is expected to reach USD 1.76 billion by 2025.

b. The North America retail cooler industry is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2025 to 2030 to reach USD 2.51 billion by 2025.

b. Offline sales held a share of 75.67% of the North America retail cooler market in 2024. Despite the growth of online shopping, many consumers still prefer to purchase coolers in physical stores due to the ability to inspect the product, gauge its durability, and receive personalized advice from sales associates.

b. Some prominent companies in this market are YETI COOLERS, LLC., RTIC Outdoors LLC, Pelican Products, Inc., Igloo Products Corp., The Coleman Company Inc., ORCA (Outdoor Recreation Company of America), and others.

b. The interest in retail coolers is growing due to increase in outdoor activities, rising disposable incomes, and an increasing focus on family-centered experiences. The surge in participation in outdoor recreational pursuits in both the U.S. and Canada is also contributing to market expansion in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.