- Home

- »

- Consumer F&B

- »

-

North America Spirits Market Size, Industry Report, 2030GVR Report cover

![North America Spirits Market Size, Share & Trends Report]()

North America Spirits Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Whiskey, Vodka, Gin, Rum, Brandy), By Distribution Channel (On-trade, Liquor Stores), By Caps & Closure, By Caps & Closure Material, By Country, And Segment Forecasts

- Report ID: GVR-4-68039-707-3

- Number of Report Pages: 117

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Spirits Market Size & Trends

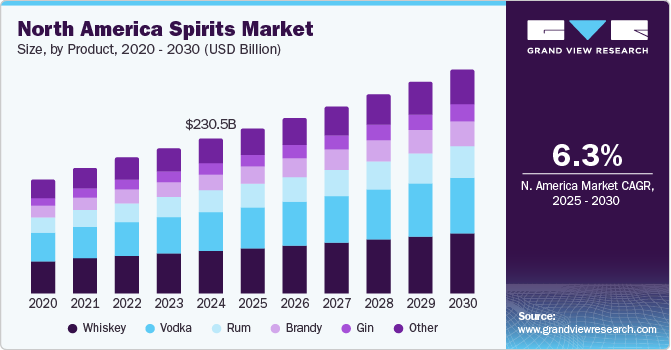

The North America spirits market size was valued at USD 230.49 billion in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030. Rising disposable income levels in North America are enabling increased consumer spending on premium and artisanal spirits. Financial freedom and evolving consumer preferences are driving the demand for unique and high-quality beverages.

Evolving consumer preferences, including rising demand for craft cocktails, flavored spirits, and low-alcohol options, are significantly impacting market trends. Health-conscious consumers are opting for low-calorie, antioxidant-rich, and low-alcohol options. A rise in the value consumers place on experiences is contributing to the growth of bars, tasting events, and home bars, consequently expanding the North American spirits industry.

Growing demand for premium products and improved standard of living are also expected to favor market growth. Consumers are shifting their preferences toward high-quality, aged, and craft spirits, reflecting a growing desire for luxury and exclusive experiences. Rising disposable incomes, particularly among younger generations, enable more spending on premium alcoholic beverages. This transition toward prioritizing quality over quantity and a heightened focus on craftsmanship and unique flavors are expected to significantly enhance the growth of the region's spirits industry over the forecast period.

Product Insights

The whiskey segment dominated the market with the largest revenue share of 27.6% in 2024, fueled by its rich heritage, broad consumer appeal, and versatility. Both bourbon and Canadian whiskey have experienced increased demand, driven by a growing preference for premium and craft whiskey options. The segment benefits from strong brand loyalty and a rising trend of whiskey-based cocktails. In addition, the popularity of whiskey-tasting events and aged and limited-edition bottles have enhanced the status of whiskey among enthusiasts, further solidifying its dominance in the market.

The gin segment is anticipated to register the fastest CAGR of 7.8% over the forecast period, attributed to shifting consumer preferences toward unique and refreshing flavors. The growing popularity of craft cocktails and gin-based drinks, such as gin and tonics, has contributed to its increased demand. Increased consumer interest in botanical, artisanal, and low-alcohol beverages further supports this trend. Moreover, distilleries are innovating with diverse flavor profiles and limited-edition releases, which appeal to adventurous drinkers. These factors position gin for significant growth, attracting both traditional whiskey drinkers and younger, trend-driven consumers.

By Caps & Closure Insights

The screw-top segment held the largest share in 2024 due to its convenience, cost-effectiveness, and appeal to a broader consumer base. With increasing demand for portability and ease of use, screw-top bottles offer an attractive alternative to traditional cork closures. Moreover, modern consumers prioritize practicality, and screw-tops align with this trend by providing quick access while preserving product freshness. This shift has increased the popularity of screw-top bottles among younger, on-the-go drinkers, ultimately securing the largest market share in the region.

The bar-top/cork segment is set to experience significant growth during the forecast period, driven by the increasing demand for premium and luxury products. Cork closures are often linked to high-quality craftsmanship, enhancing the overall experience and appeal of spirits. This segment is gaining traction among consumers who value authenticity, tradition, and the preservation of flavor and aging potential. Various spirit brands are embracing the trend of sealing their bottles with cork stoppers. For instance, the tequila brands Patrón and Don Julio, vodka producers Chase and Belvedere, and gin brands Hendrick’s, Elephant, and Caorunn use cork closures in their bottles.

By Caps & Closure Material Insights

The plastic segment dominated the North America spirits industry with the largest revenue share in 2024, attributed to its affordability, durability, and lightweight nature. Plastic packaging offers a cost-effective solution for mass production and distribution, making it an attractive option for both producers and consumers. In addition, its resistance to breakage and ability to preserve product quality during transport has further boosted its popularity. The versatility of plastic packaging has also allowed it to cater to a wide range of consumer preferences, driving its continued dominance in the market.

The metal segment is anticipated to witness the fastest CAGR over the forecast period, fueled by increasing demand for sustainability and premium aesthetics. Metal packaging, particularly aluminum, is seen as an eco-friendly alternative to traditional options, appealing to environmentally conscious consumers. Its sleek and modern look enhances the premium image of spirits, making it popular in high-end products. Moreover, metal's durability and ability to protect the product from light and air contribute to longer shelf life. These factors are expected to aid the segment growth over the forecast period.

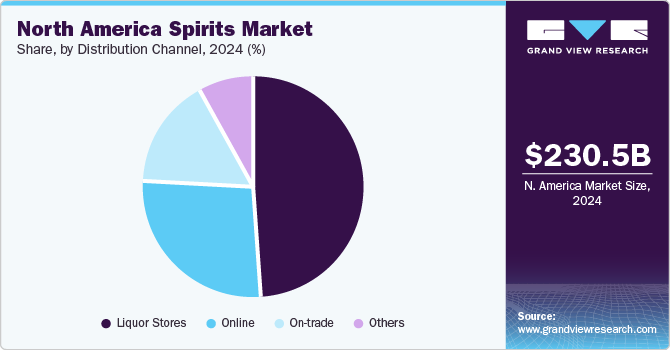

Distribution Channel Insights

The liquor stores segment accounted for the largest revenue share in 2024, propelled by its widespread accessibility and established consumer trust. These stores offer a wide variety of spirits, catering to diverse consumer preferences and providing a convenient shopping experience. Their physical presence allows customers to explore different brands and products in person, enhancing the buying experience. Furthermore, the steady growth of local and international brands within liquor stores and attractive promotions and discounts have strengthened their dominance in the retail space across the region.

The online segment is projected to grow at the fastest CAGR during the forecast period, owing to the growing demand for convenience and a shift in consumer purchasing habits. E-commerce platforms provide easy access to a wide variety of spirits, often at competitive prices, and offer the added benefit of home delivery. Virtual events, personalized recommendations, and exclusive online deals are further expected to boost consumer engagement. With expanding digital channels and evolving regulations, the online channel is expected to have a critical share in the sales of spirits in North America over the forecast period.

Country Insights

U.S. Spirits Market Trends

The U.S. spirits market led the North America spirits industry with the largest share of 79.3% in 2024, owing to its production of some of the popular spirits such as whiskey, vodka, and rum. The country’s diverse consumer base with evolving choices fuels constant demand for mainstream and craft options. The rise of cocktail culture, home bartending, and premium product consumption has further contributed to market expansion. Strong distribution channels and extensive retail presence ensure easy and wide availability. The country’s rich history in spirit production and growing interest in unique, artisanal offerings have strengthened its position in the market.

Mexico Spirits Market Trends

Mexico spirits market is projected to grow at the fastest CAGR from 2025 to 2030, propelled by its rich cultural heritage and increasing consumer demand for craft and premium spirits. Mexico’s strong tradition of producing iconic beverages such as tequila and mezcal has gained significant global recognition. With a rising middle-class population and an increasing interest in diverse alcohol experiences, the spirits industry in the country is set for rapid growth. The country's strategic location and expanding export opportunities are further expected to position it for substantial market expansion in the coming years.

Key North America Spirits Company Insights

Some of the key companies in the North America spirits industry include Diageo; Pernod Ricard; Constellation Brands, Inc.; Asahi Group Holdings, Ltd.; Rémy Cointreau; Brown‑Forman; Bacardi Limited; Suntory Holdings Limited.; Davide Campari-Milano N.V.; and William Grant & Sons.

-

Diageo offers a wide range of alcoholic beverages, including premium spirits such as whiskey, vodka, rum, gin, and tequila. Its portfolio features well-known brands including Johnnie Walker, Guinness, Tanqueray, and Don Julio.

-

Pernod Ricard provides premium spirits, wines, and non-alcoholic beverages. Its portfolio includes iconic brands such as Absolut Vodka, Jameson Whiskey, Chivas Regal, Ballantine’s, and Perrier-Jouët, which are catered to global markets.

Key North America Spirits Companies:

- Diageo Plc

- Pernod Ricard

- Constellation Brands, Inc.

- Asahi Group Holdings, Ltd

- Rémy Cointreau

- Brown-Forman

- Bacardi Limited

- Suntory Holdings Limited

- Davide Campari-Milano N.V.

- William Grant & Sons

Recent Developments

-

In May 2024, Empress 1908, the fastest-growing and top-ranked ultra-premium gin in the U.S., launched a new expression called Empress 1908 Cucumber Lemon Gin. This premium, handcrafted gin is produced in small batches by Victoria Distillers, one of the oldest artisan distilleries in Canada. The new Empress 1908 Cucumber Lemon Gin is crafted with eight unique botanicals, including juniper berries, lemon, jasmine, star anise, cucumber, and fresh lemon zest.

-

In March 2024, Cobblestone Brands launched a new rum brand called Star & Key Rum, a single-estate rum from Mauritius. The rum is made with fresh cane juice to capture the island's unique terroir. The rum is tropically aged on the estate, which accelerates the maturation process and intensifies the flavor drawn from the oak casks.

-

In October 2023, DIAGEO announced its "Spirited Xchange" Special Releases Scotch Whisky Collection, featuring eight rare and collectible single malt expressions. The collection celebrates the journey of Scotch whisky and its cultural exchange with countries and cultures around the world.

-

In September 2023, Bacardi Limited announced the acquisition of Mexico-based ILEGAL Mezcal, a super-premium artisanal mezcal provider. The initiative was aimed at accelerating brand growth within the fast-growing super-premium mezcal category.

North America Spirits Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 245.37 billion

Revenue forecast in 2030

USD 332.59 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, caps & closure, caps & closure material, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Diageo; Pernod Ricard; Constellation Brands, Inc.; Asahi Group Holdings, Ltd.; Rémy Cointreau; Brown‑Forman; Bacardi Limited; Suntory Holdings Limited.; Davide Campari-Milano N.V.; William Grant & Sons.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Spirits Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America spirits market report based on product, distribution channel, caps & closure, caps & closure material, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Whiskey

-

Vodka

-

Gin

-

Rum

-

Brandy

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-trade

-

Liquor Stores

-

Online

-

Other

-

-

Caps & ClosureOutlook (Revenue, USD Billion, 2018 - 2030)

-

Screw-top

-

Bar-top/ Cork

-

Others

-

-

Caps & Closure MaterialOutlook (Revenue, USD Billion, 2018 - 2030)

-

Metal

-

Plastic

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America spirits market size was valued at USD 230.49 billion in 2024 and is expected to reach USD 245.37 billion in 2025.

b. The North America spirits market size is projected to grow at a CAGR of 6.3% from 2025 to 2030 to reach USD 332.59 billion by 2030.

b. The U.S. spirits market led the North America spirits industry with the largest share of 79.3% in 2024, owing to its production of some of the popular spirits such as whiskey, vodka, and rum. The country’s diverse consumer base with evolving choices fuels constant demand for mainstream and craft options. The rise of cocktail culture, home bartending, and premium product consumption has further contributed to market expansion. Strong distribution channels and extensive retail presence ensure easy and wide availability. The country’s rich history in spirit production and growing interest in unique, artisanal offerings have strengthened its position in the market.

b. Key North America Spirits Companies Diageo; Pernod Ricard; Constellation Brands, Inc.; Asahi Group Holdings, Ltd.; Rémy Cointreau; Brown‑Forman; Bacardi Limited; Suntory Holdings Limited.; Davide Campari-Milano N.V.; William Grant & Sons.

b. Evolving consumer preferences, including rising demand for craft cocktails, flavored spirits, and low-alcohol options, are significantly impacting market trends. Health-conscious consumers are opting for low-calorie, antioxidant-rich, and low-alcohol options. A rise in the value consumers place on experiences is contributing to the growth of bars, tasting events, and home bars, consequently expanding the North American spirits industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.