- Home

- »

- Electronic & Electrical

- »

-

North America Tankless Water Heater Market Report, 2030GVR Report cover

![North America Tankless Water Heater Market Size, Share & Trends Report]()

North America Tankless Water Heater Market Size, Share & Trends Analysis Report By Product (Electric, Gas), By Application (Residential, Commercial), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-150-5

- Number of Report Pages: 88

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

The North America tankless water heater market size was estimated at USD 767.1 million in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 10.2% from 2023 to 2030. The market growth is primarily driven by a strong growth in product adoption in the regional commercial and residential sectors on account of its cost-saving and energy-efficient features. Consumers also prefer tankless water heaters over traditional ones owing to their sleek and compact design. Tankless water heating units operate without a storage tank. Since they heat water only on demand, there is reduced exposure to corrosive elements, resulting in lesser wear & tear and thus an extended operational life. Moreover, the demand for smart home solutions has been growing among consumers, which is also pushing the demand for these products to be integrated into smart homes and connected ecosystems.

The growing trend of adopting the smart home concept has increased smart home listings in the U.S. According to an article published by American Home Shield Corporation, Florida has 2,242 smart homes for sale, the highest in the U.S. as of December 2021. Furthermore, increasing awareness among consumers about tankless water heaters is favoring the growth of the market. In June 2021, as per a research study sponsored by the California Public Utilities Commission administered by five Program Administrators (PAs), such as Berkeley Gas & Electric Company (SDG&E), Southern California Edison (SCE), Pacific Gas & Electric Company (PG&E), and Marin Clean Energy (MEC), are a few examples of PAs that offered incentives for various water heater technologies to around 8,000 individuals living in single-family homes and 1,000 property managers of multifamily properties.

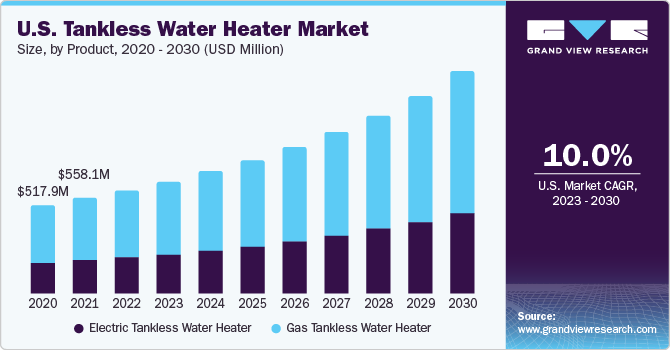

Product Insights

The gas product segment accounted for a share of over 65% in 2022. Gas tankless water heaters require fewer home service upgrades than electric ones, offering higher flow rates. They also use pilot lights, making them preferable among consumers. Gas tankless heaters find large-scale applications in the commercial sector, further contributing to the segment’s high share in the overall market. Various commercial operations have experienced substantial cost savings by adopting propane-powered tankless gas water heaters. An illustrative use case is the U.S.-based Bolo Beer Company, a brewery that witnessed a remarkable reduction in operating costs of over 25% by transitioning to propane water heaters. The electric product segment is projected to register a CAGR of 10.9% over the forecast period.

The segment growth is driven by the beneficial features of electric units, such as ease of installation, high energy efficiency, compact design, and low maintenance. The deployment of electric units is high, owing to the on-demand heating approach that they employ, resulting in reduced energy consumption and substantial savings on utility bills in the long run. For instance, as per Eemax, a U.S.-based manufacturer of electric water heaters, tankless electric water heaters can reach a remarkable thermal efficiency rating of 99%, which means that 99% of the electricity utilized for heating is efficiently transformed into heat. This exceptional level of efficiency can lead to substantial reductions in electricity consumption, potentially resulting in users cutting their water heating bills by as much as 50%.

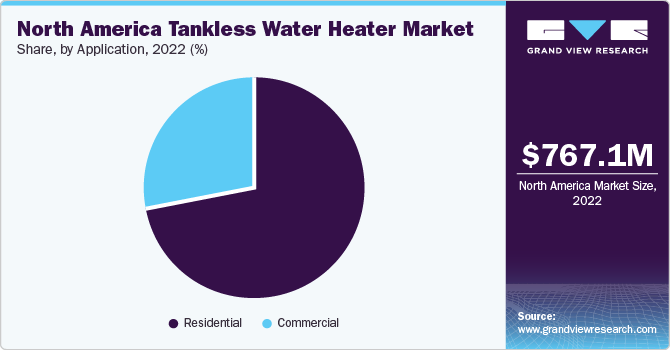

Application Insights

The residential segment accounted for a share of over 72% in 2022. The increasing demand for energy-efficient and environmentally friendly home appliances, including tankless water heaters, is primarily fueling their adoption in the residential sector. The compact product design offers space-saving benefits in homes, especially in urban areas with limited square footage. The growing popularity of energy-efficient and environmentally friendly products is driving the demand further. According to the U.S. Department of Energy, tankless water heaters exhibit an impressive 24% to 34% higher energy efficiency compared to conventional storage tank water heaters when daily hot water consumption averages around 41 gallons.

The commercial application segment is expected to register a significant growth rate of 9.8% during the forecasted period. A rise in the number of green commercial spaces and the growing emphasis on energy efficiency are compelling several commercial building owners to adopt the usage of energy-efficient products. Tankless water heaters in commercial settings help reduce valuable square footage by offering a space-saving design. Furthermore, the ease of installation can result in cost savings and increased efficiency, making tankless units a practical and convenient choice for commercial spaces.

Regional Insights

The U.S. held the largest share of around 78% of the overall revenue in 2022. Tankless water heating systems are becoming popular among the country's consumers as they save energy and space. As per the U.S. Energy Information Administration (EIA), water heating is the second-biggest energy end-use area in the residential sector. This is likely to compel consumers to opt for tankless water heaters to reduce their energy consumption. The rising product demand in the U.S. is fueled by collaborative efforts from federal and state governments to promote energy-efficient solutions.

This growing emphasis on improved efficiency harmonizes with the increasing adoption of decarbonization strategies within the country. For example, in 2022, the Chicago City Council enacted the Energy Transformation Code, surpassing the 2021 International Energy Conservation Code and highlighting the city's strong commitment to decarbonization. It includes a pivotal requirement for new buildings to incorporate the electrical infrastructure and wiring capacity necessary to support all-electric appliances for water heating, cooking, and laundry.

Strongly influenced by the evolving landscape of regulations, climate change concerns, and government policies, the market in Canada is likely to grow at a CAGR of 10.9% over the forecast period. In recent years, the Canadian Federal Government has placed significant emphasis on aligning regulations with those of the U.S. This drive for synchronization is particularly evident in the updates made to the Natural Resources Canada (NRCan) Energy Efficiency Regulations, which have been revised for numerous products to align with the standards set by the U.S. Department of Energy (DOE).

Key Companies & Market Share Insights

Key players are adopting various strategies to strengthen their presence in the market. These strategies include new product launches, partnerships, mergers & acquisitions, regional expansions, and others. Some of the initiatives include:

-

In October 2023, Rheem Manufacturing Company opened its innovation center in Fort Smith, Arkansas. This center is equipped with cutting-edge technology to conduct seminars, workshops, training sessions, conferences, and other events for its employees

-

In September 2023, A.O. Smith acquired Water Tec of Tucson, a water-treatment equipment manufacturer for commercial and residential use. The acquisition will help expand the company’s presence on the West Coast, thereby aiding its growth strategy

-

In May 2023, Bradford White partnered with Bartle & Gibson, a Canada-based distributor of heating, electrical, and plumbing products. This partnership is expected to further strengthen the company’s position in Canada

Key North America Tankless Water Heater Companies:

- A.O. Smith

- Rheem Manufacturing Company

- Rinnai Corporation

- Bradford White Corporation

- Robert Bosch LLC

- Stiebel Eltron Inc.

- Noritz America

- Navien Inc.

- Eccotemp Systems, LLC

- Chronomite Laboratories Inc.

North America Tankless Water Heater Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 833.7 million

Revenue forecast in 2030

USD 1,671.5 million

Growth rate

CAGR of 10.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

A.O. Smith; Rheem Manufacturing Company; Rinnai Corporation; Bradford White Corporation; Robert Bosch LLC; Stiebel Eltron Inc.; Noritz America; Navien Inc.; Eccotemp Systems, LLC; Chronomite Laboratories Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Tankless Water Heater Market Report Segmentation

This report forecasts growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the North America tankless water heater market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Electric Tankless Water Heater

-

Gas Tankless Water Heater

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America tankless water heater market size was estimated at USD 767.1 million in 2022 and is expected to reach USD 833.7 million in 2023.

b. The North America tankless water heater market is expected to grow at a compounded growth rate of 10.2% from 2023 to 2030 to reach USD 1,671.5 million by 2030.

b. The gas tankless water heater segment dominated the North American tankless water heater market with a share of 65.69% in 2022. Gas tankless water heaters require fewer home service upgrades than electric ones, offering higher flow rates

b. Some key players operating in the North America tankless water heater market include A.O. Smith; Rheem Manufacturing Company; Rinnai Corporation; Bradford White Corporation; Robert Bosch LLC

b. Key factors that are driving the market growth include increasing consumer spending on home renovations in the region and the growing trend of adopting smart home concept.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."