- Home

- »

- Homecare & Decor

- »

-

North America Traditional Toilet Seat Market, Report, 2030GVR Report cover

![North America Traditional Toilet Seat Market Size, Share & Trends Report]()

North America Traditional Toilet Seat Market Size, Share & Trends Analysis Report By Bowl Shape (Elongated And Round), By Raw Material, By Application, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-130-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

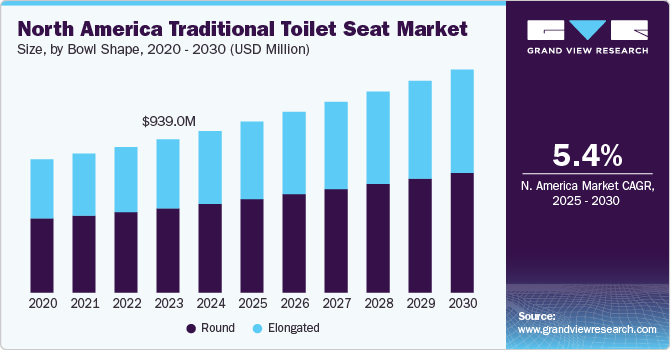

The North America traditional toilet seat market size was estimated at USD 991.1 million in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2030. The market is anticipated to experience substantial growth in the coming years, driven by robust real estate expansion and an increase in commercial construction activities. Since the COVID-19 pandemic, the market has demonstrated resilience and is witnessing elevated demand in the post-pandemic landscape. This demand surge is further supported by a rising trend among consumers, particularly in developing countries, who are increasingly investing in home remodeling and restroom upgrades.

The growing emphasis on sustainability in North America is catalyzing the development of eco-friendly toilet seats made from renewable materials. Manufacturers are increasingly adopting resources such as bamboo, reclaimed wood, and recycled plastics to produce durable, biodegradable options. For example, in January 2023, Bemis Manufacturing Company, a leading North American producer of bidet and toilet seats, introduced “Greenleaf,” a pioneering product made entirely from 100% recycled plastic. This environmentally-conscious seat and cover are crafted from post-industrial recycled materials, offering enhanced durability while reducing environmental impact.

The expanding commercial sector in North America is set to drive demand for traditional toilet seats, particularly in high-traffic institutional environments such as schools, offices, and similar facilities where restroom usage is frequent and hygiene is paramount. Durable toilet seat options are highly preferred in these settings, as they help reduce the frequency of replacements and minimize maintenance costs. The extensive network of educational institutions in 2019-2020, with 98,577 public schools, 30,492 private schools, and 3,982 post-secondary institutions, underscores the substantial demand for reliable, cost-effective toilet seats that meet diverse user needs.

Simultaneously, rising housing costs and mortgage rates are prompting North American homeowners to undertake remodeling projects aimed at modernizing traditional home layouts. According to the 2022 U.S. Houzz Bathroom Trends report, the median expenditure for primary bathroom renovations nationwide rose by nearly 13% from 2021, reaching $9,000. Notably, individuals undertaking major bathroom upgrades, including toilet replacements, invested three times as much on their projects compared to those making minor improvements ($15,000 versus $5,000, respectively).

The growth of the real estate and commercial construction sectors in North America is projected to drive the expansion of the bathroom fittings market over the coming years. According to Redfin Corporation, a prominent residential real estate brokerage, the value of the U.S. housing market reached $46.8 trillion in June 2023. The rise in infrastructure development and issuance of new building permits across the region is expected to fuel demand for traditional toilet seats across both commercial and residential applications.

Meanwhile, advancements in design, functionality, and sustainability are creating significant opportunities for market players to broaden their product offerings, thereby supporting growth in North America’s traditional toilet seat market. Kohler Co., for instance, offers an innovative manual bidet toilet seat made from plastic, equipped with dual functions that provide ambient water for both front and rear cleansing. This product also features a manually operated handle, eliminating the need for batteries or electricity, aligning with both convenience and eco-friendly market trends.

Bowl Shape Insights

The round-shaped toilet seats accounted for a market share of 54.9% in 2024. A primary advantage of round toilets is their capacity to optimize limited bathroom space, making them particularly effective for compact areas. This design is well-suited for children’s bathrooms, as many households specifically select round toilets for such applications. Owing to their space-efficient construction, round toilets are predominantly found in residential settings, where there is a growing preference among consumers for sustainable and eco-friendly solutions in bathroom fixtures.

The demand for elongated-shaped bowls is anticipated to rise at a CAGR of 5.9% from 2025 to 2030. The elongated design is valued for its aesthetic appeal and is often preferred by taller individuals. Additionally, elongated bowls enhance accessibility, providing improved comfort for people with disabilities; as a result, the Americans with Disabilities Act (ADA) mandates the use of elongated toilets in public restrooms. In residential settings, consumers focused on sustainability increasingly seek toilet seats made from environmentally friendly materials.

Raw Material Insights

In the North American market, polypropylene emerged as the leading raw material in 2024, capturing 42.4% of the revenue share. Recognized for its affordability and resilience against scratches and stains, polypropylene is a popular choice for consumers prioritizing easy maintenance and long-lasting performance, making it particularly suitable for residential applications as a budget-friendly option.

The wooden traditional toilet seat segment is projected to grow at a CAGR of 6.4% from 2025 to 2030. Distinguished by their robustness, polished aesthetics, and warm tactile quality, wooden seats are often preferred for their enhanced durability and design versatility. Available in various finishes and styles, these seats align well with consumers seeking a rustic or traditional bathroom design, adding a touch of warmth and refinement to the space.

Application Insights

In 2024, the residential sector led the North America traditional toilet seats market for, capturing 64.6% of revenue. This dominance is partly attributed to prevalent housing configurations in the U.S., where most bedrooms come equipped with en-suite bathrooms. Data from the U.S. Census Bureau indicates that, of the 368,000 multi-family units built in 2022, 139,840 were designed with two bedrooms and 40,480 with three or more bedrooms. An increase in bedroom count generally corresponds with additional bathrooms, thereby driving demand for traditional toilet seat installations within residential applications.

The commercial segment for traditional toilet seats in North America is projected to expand at a CAGR of 6.2% from 2025 to 2030. This growth is fueled by the rapid development within the hospitality sector. According to the U.S. Hotel Construction Pipeline Trend Report by Lodging Econometrics, the hotel construction pipeline at the close of Q2 2023 encompassed 5,572 projects and 660,061 rooms, reflecting year-over-year growth of 7% in projects and 6% in rooms. These positive trends in hotel construction are anticipated to further propel the demand for high-quality traditional toilet seats across the commercial landscape in the coming years.

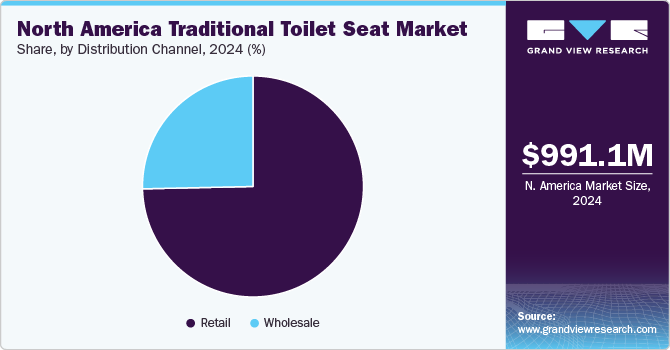

Distribution Channel Insights

In 2024, the retail channel held a commanding presence in the North American market, representing 74.7% of distribution. This dominance is largely attributed to big-box retailers, whose extensive product variety and discount incentives substantially shape consumer purchasing decisions. Major retail chains appeal to a broad consumer base by combining wide-ranging product selections with competitive pricing. A 2023 CNBC supply chain survey found that nearly 67% of consumers actively seek discounts at retail locations like Walmart before making purchase decisions.

The wholesale channel is anticipated to expand at a CAGR of 6.3% from 2024 to 2030. The rise in commercial establishments across the region is a key driver of wholesale demand, particularly in products such as toilet seats. Manufacturers frequently engage with local specialty stores to facilitate bulk orders, especially those adhering to ADA (Americans with Disabilities Act) standards, which mandate accessibility in commercial spaces. Bwanaz, a prominent wholesale distributor in the United States, partners with leading retail chains, including Walmart, and collaborates with top-tier American manufacturers, enhancing the availability of high-quality products to local enterprises.

Regional Insights

U.S. Traditional Toilet Seat Market Trends

In 2024, the U.S. dominated the North American traditional toilet seat market, securing a share of 78.19%. This market leadership is attributed to heightened consumer awareness regarding hygiene, coupled with a growing preference for enhanced comfort and convenience, which has spurred innovation and design advancements within the sector. A notable example of this progress occurred in June 2023, when Cleana, a Boston-based technology firm, in collaboration with engineering teams from Boston University and the Massachusetts Institute of Technology, unveiled a semi-automatic toilet seat that autonomously adjusts its position to promote improved hygiene.

Mexico Traditional Toilet Seat Market Trends

Mexico is poised to experience the highest growth rate in the North American traditional toilet seat market, with a CAGR of 6.9% from 2025 to 2030. This growth is driven by the increasing demand for bathroom fixtures, including traditional toilet seats. In response, Bemis Manufacturing Co., a Wisconsin-based manufacturer, has strategically expanded its operations in Mexico to better meet this rising demand. The company completed the expansion of its Monterrey facility in July 2017, positioning itself to serve its growing customer base in the region. Bemis, renowned for its expertise in bathroom products, continues to emphasize toilet seats as one of its core offerings.

Key North America Traditional Toilet Seat Company Insights

The competitive landscape of the market is characterized by a dynamic mix of established industry leaders, regional players, and emerging innovators. Dominated by key manufacturers with a significant presence in both the United States and Mexico, the market benefits from strong brand recognition and extensive distribution networks. Leading companies such as Bemis Manufacturing Co., Kohler Co., and American Standard Brands have a commanding influence, leveraging their robust product portfolios, advanced manufacturing capabilities, and strategic partnerships to maintain market share.

These established players continually drive market growth through ongoing product innovation, emphasizing design improvements, durability, and enhanced hygiene features. The introduction of technologically advanced solutions, such as self-adjusting toilet seats and smart features, has further intensified competition, compelling companies to differentiate through product performance and value-added features.

Additionally, the market is witnessing increased competition from local manufacturers and specialty players who focus on niche segments, such as eco-friendly or ADA-compliant toilet seats, catering to evolving consumer preferences for sustainability and accessibility. The presence of these specialized firms has diversified the competitive landscape, creating opportunities for both global and regional players to tailor their offerings to specific consumer demands.

Key North America Traditional Toilet Seat Companies:

- LIXIL Corporation

- Kohler Co.

- TOTO USA

- Centoco

- Delta Faucet Company

- Bemis Manufacturing Company

- Ginsey Home Solutions

- Ferguson (PROFLO)

- Topseat

- Jones Stephens

- Plumbing Technologies, LLC

Recent Developments

-

In October 2024, Kohler, a globally recognized leader in kitchen and bathroom solutions, entered into a strategic, multi-year partnership with the Dallas Cowboys, two brands renowned for their legacies of excellence, innovation, and leadership. This collaboration harnessed the widespread influence of the Cowboys' brand and its dedicated fan base to significantly enhance Kohler's visibility in the Dallas-Fort Worth (DFW) region. The partnership further solidified Kohler's standing as a distinguished lifestyle brand, reinforcing its commitment to quality and innovation within the market.

-

In January 2023, Bemis Manufacturing Company, a prominent manufacturer of bidets and toilet seats, unveiled its new Assist premium toilet seat as part of the Bemis Independence line at the 2023 Kitchen & Bath Industry Show (KBIS) held in Las Vegas, NV, from January 31 to February 2. This innovative plastic toilet seat, designed with a standard height, incorporated two integrated support arms, eliminating the need for wall-mounted brackets typically placed near the toilet. It was compatible with both round and elongated toilet bowls, simplifying the selection process and reducing the uncertainty in choosing the correct seat size. Additionally, the Assist seat featured Bemis’s renowned Commercial STAY TITE Installation System, which ensured a secure, never-loosening fit, providing reliable stability for users across various settings.

North America Traditional Toilet Seat Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,049.0 million

Revenue forecast in 2030

USD 1,367.1 million

Growth rate

CAGR of 5.4% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Bowl shape, raw material, application, distribution channel, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

LIXIL Corporation; Kohler Co.; TOTO USA; Centoco; Delta Faucet Company; Bemis Manufacturing Company; Ginsey Home Solutions; Ferguson (PROFLO); Topseat; Jones Stephens; and Plumbing Technologies, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Traditional Toilet Seat Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America traditional toilet seat market on the basis of bowl shape, raw material, application, distribution channel, and region.

-

Bowl Shape Outlook (Revenue, USD Million, 2018 - 2030)

-

Elongated

-

Round

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic (Other than Polypropylene)

-

Polypropylene

-

Wood

-

Urea Molding Compound

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Hospitality & Spa

-

Institutional

-

Commercial Spaces

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Wholesale

-

Retail

-

Big Box Retail Stores

-

Specialty Retail Stores

-

Home Improvement Stores

-

Department Stores

-

Online

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North American traditional toilet seat market was estimated at USD 991.1 million in 2024 and is expected to reach USD 1,049.0 million in 2025.

b. The North American traditional toilet seat market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030, reaching USD 1,367.1 million by 2030.

b. U.S. region dominated the North America traditional toilet seat market with a share of around 78.19% in 2024. The demand for traditional toilet seats is expected to grow in the U.S. due to ongoing residential construction and renovation projects, as well as the enduring popularity of cost-effective and familiar bathroom fixtures among American consumers.

b. Some key players operating in the North American traditional toilet seat market include LIXIL Corporation, Kohler Co., TOTO USA, Centoco, Delta Faucet Company, Bemis Manufacturing Company, Ginsey Home Solutions, Ferguson (PROFLO), Topseat, Jones Stephens, and Plumbing Technologies, LLC.

b. Key factors driving the North American traditional toilet seat market growth include growing consumer demand for enhanced bathroom aesthetics and comfort, increased awareness about hygiene and sanitation standards, technological advancements in toilet seat designs, and rising environmental concerns leading to the adoption of water-saving and sustainable options.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."