- Home

- »

- Power Generation & Storage

- »

-

Nuclear Power Plant Equipment Market Size Report, 2030GVR Report cover

![Nuclear Power Plant Equipment Market Size, Share & Trends Report]()

Nuclear Power Plant Equipment Market Size, Share & Trends Analysis Report By Carrier Type (Island Equipment, Auxiliary Equipment), By Reactor Type (Pressurized Water Reactor, Boiling Water Reactor), By Region, And By Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-380-0

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

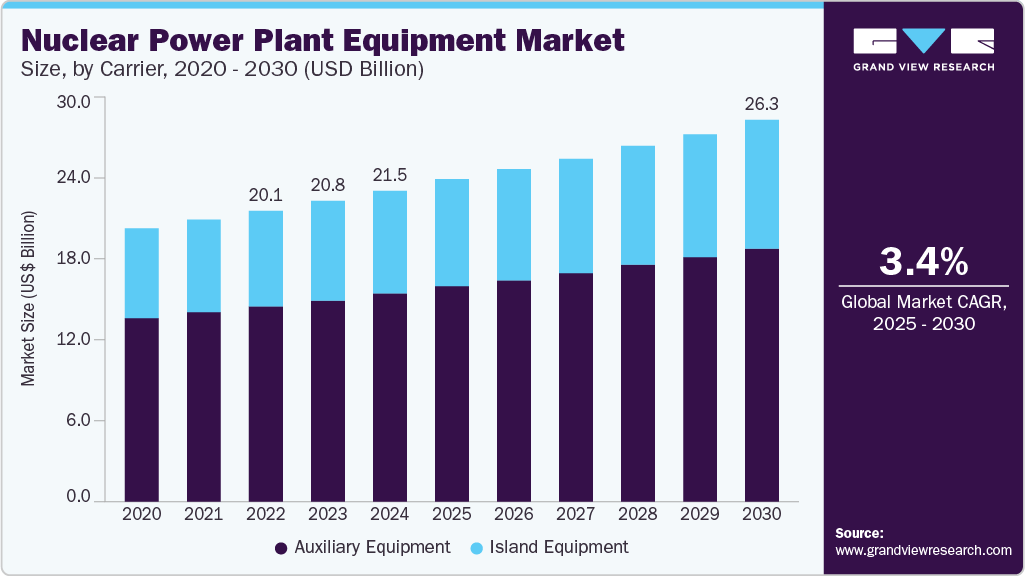

The global nuclear power plant equipment market size was estimated at USD 20.82 billion in 2023 and is forecasted to grow at a CAGR of 3.4% from 2024 to 2030. This growth is attributed to the adoption of low-carbon energy sources to combat climate change, the increasing energy needs of rapidly developing economies, and the modernization and life-extension of existing nuclear power plants. In addition, growing advancements in nuclear technology, including small modular reactors (SMRs) and next-generation reactors, promise enhanced safety, efficiency, and lower costs, further driving the adoption of nuclear energy. This growth is also fueled by governmental policies and incentives aimed at reducing greenhouse gas emissions and ensuring energy security.

The demand for the product is projected to grow significantly due to a combination of various factors including environmental, economic, and technological. As there is the rising need to mitigate climate change, nuclear energy presents a reliable, low-carbon alternative to fossil fuels. Furthermore, governments and international organizations are increasingly recognizing the role of nuclear power in achieving carbon neutrality and are implementing supportive policies, such as subsidies, tax incentives, and streamlined regulatory processes, to encourage its adoption.

Major players in the market are opting for various strategies to gain a market share. They are investing heavily in research and development to innovate advanced technologies such as small modular reactors (SMRs) and next-generation reactors that have improved safety, efficiency, and cost-effectiveness. These companies are also adopting strategic partnerships and joint ventures to enhance their capabilities and expand their global reach.

Moreover, key players are emphasizing upgrades and life-extension services for existing nuclear plants to tap into the growing need for plant modernization. In addition, they are engaging in extensive regulatory compliance and securing certifications to meet stringent safety and performance standards, which can enhance their competitive edge in a highly regulated industry.

Carrier Type Insights

Based on carrier type, the market is segmented into island equipment, auxiliary equipment. Among these, auxiliary equipment dominated the market with a revenue share of 66.9% in 2023 and is further expected to grow at a significant rate over forecast period. This growth is attributed to the critical role these systems play in ensuring the safe and efficient operation of nuclear facilities. Auxiliary equipment encompasses a wide variety of systems including emergency core cooling systems (ECCS), and cooling systems, and instrumentation and control systems. As existing nuclear plants are upgraded and modernized, the demand for advanced and reliable auxiliary systems to support new technologies is further expected to increase, thereby fueling the market growth.

Demand for island equipment is expected to grow at the fastest CAGR over the period of 2024 to 2030. The focus on extending the operational life of existing reactors through modernization and refueling programs creates ongoing needs for island equipment. Higher investments in the sector, coupled with government incentives and policies supporting nuclear energy, further stimulate the demand for these essential components, ensuring their critical role in the continued viability and expansion of nuclear power.

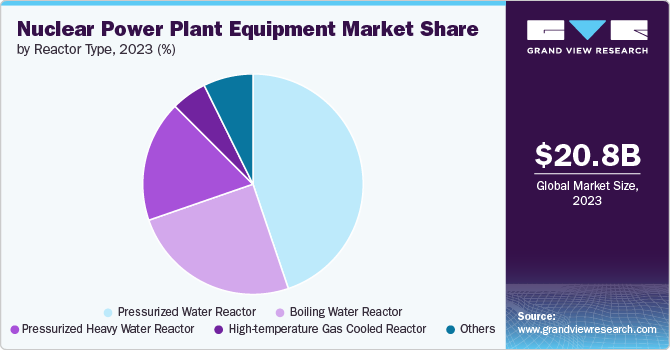

Reactor Type Insights

Based on reactor type, the market is segmented into pressurized water reactor, pressurized heavy water reactor, boiling water reactor, high-temperature gas cooled reactor, and others. Pressurized water reactor (PWR) type accounted for the largest revenue share of 44.8% in 2023. This is due to its high preference for safety, reliability, and efficiency. PWRs are the most commonly used reactor type worldwide, and their design offers several advantages including stable operation and proven safety features. In addition, ongoing advancements in PWR technology, such as improved fuel efficiency and enhanced safety systems, continue to make them attractive for both new installations and upgrades of existing reactors.

The boiling water reactor segment is anticipated to grow at the fastest CAGR over the forecast period. Boiling water reactors (BWRs) generate steam directly in the reactor core, which can lead to higher thermal efficiency and reduced operational costs. As countries start focusing on improving the efficiency of their nuclear fleets and expanding their nuclear energy capacity, BWRs can emerge a preferable option due to their operational advantages and lower capital costs.

Regional Insights

North America dominated the nuclear power plant equipment market with a revenue share of 23.4% in 2023. The market is driven by the aging fleet of nuclear reactors and the need for modernization and life extension of existing facilities. Many reactors in the U.S. and Canada are reaching the end of their original operational licenses, creating a significant market for upgrades and replacement equipment. This is likely to benefit the market growth in the region over the forecast years.

U.S. Nuclear Power Plant Equipment Market Trends

The nuclear power plant equipment market in the U.S. is growing at a CAGR of 3.6% over the forecast period. There is an increasing focus on reducing greenhouse gas emissions and enhancing energy security in the country, which is expected to drive the investments in new projects and technology innovations. U.S. is also seeing a push towards advanced reactor designs, such as small modular reactors (SMRs), which require cutting-edge equipment and systems to support their deployment and operation.

Europe Nuclear Power Plant Equipment Market Trends

The nuclear power plant equipment market in Europe is growing at a CAGR of 3.2% from 2024-2030. This is due to the region’s commitment to reducing carbon emissions and transitioning to low-carbon energy sources. Many European countries such as France, Finland, and Slovakia are investing in the refurbishment and life extension of their existing nuclear fleets to ensure they continue to meet stringent safety and environmental standards.

Asia Pacific Nuclear Power Plant Equipment Market Trends

The nuclear power plant equipment market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. This is due to urbanization, rapid industrialization, and rising energy consumption across key countries like China, India, and Japan. Many of these countries are expanding their nuclear energy capacity to meet growing electricity needs. Economies including China and India in particular are highly investing heavily in new projects and advanced reactor technologies to enhance their energy infrastructure to support economic growth.

Key Nuclear Power Plant Equipment Company Insights

Some of the key players operating in the market include GE Hitachi Nuclear Energy and Shanghai Electric.

-

GE Hitachi Nuclear Energy is a U.S. based leading global provider of advanced nuclear technology and services. The company focuses on designing, manufacturing, and servicing a range of nuclear reactors and components, while also providing fuel and engineering services to support the safe and efficient operation of nuclear power plants. It provides its products and services under reactor designs, nuclear fuel. services, and engineering and consultancy segments.

-

Shanghai Electric is a leading provider of industrial-grade eco-friendly smart system solutions, intelligent manufacturing, and integration of digital intelligence solutions. The company provides various products for solar power generation, energy storage, wind power, gas power generation, coal-fired power generation, nuclear power, power transmission and distribution, and sea water desalination applications

X Energy, LLC and NuScale Power, LLC are some of the emerging participants in market.

-

X Energy, LLC is a nuclear energy company specializing in the development of small modular reactors (SMRs). The company focuses on providing scalable, safe, and cost-effective nuclear power solutions. The company offers reactors under the name XE-100 and XE-MOBILE

-

NuScale Power, LLC was established in 2007 and headquartered in U.S. It is engaged in developing and manufacturing small modular reactors (SMRs). The company’s flagship technology is NuScale Power Module which is a small modular reactor design that features a compact, scalable, and passive safety system.

Key Nuclear Power Plant Equipment Companies:

The following are the leading companies in the nuclear power plant equipment market. These companies collectively hold the largest market share and dictate industry trends.

- BWX Technologies, Inc.

- ALSTOM SA

- Dongfang Electric Co., Ltd.

- DOOSAN CORPORATION

- GE Hitachi Nuclear Energy

- Shanghai Electric

- NuScale Power, LLC

- X Energy

- EDF

- AVEVA

Recent Developments

-

In November 2022, GE announced to sell parts of its Steam Power division’s nuclear activities to EDF (Électricité de France). This includes business activities for manufacturing conventional island equipment for the new power facilities. This acquisition will allow EDF to strengthen skills and technologies related to conventional island which are important for maintenance of existing nuclear fleet and coming projects.

Nuclear Power Plant Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 21.52 billion

Revenue forecast in 2030

USD 26.35 billion

Growth rate

CAGR of 3.4% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Carrier type, reactor type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

BWX Technologies, Inc.; ALSTOM SA; Dongfang Electric Co., Ltd.; DOOSAN CORPORATION; GE Hitachi Nuclear Energy; Shanghai Electric; NuScale Power, LLC; X Energy; EDF; AVEVA

Customization scope

Free report customization (equivalent up to 8 analysts orking days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nuclear Power Plant Equipment Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nuclear power plant equipment market report based on carrier type, reactor type, and region:

-

Carrier Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Island Equipment

-

Auxiliary Equipment

-

-

Reactor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pressurized Water Reactor

-

Pressurized Heavy Water Reactor

-

Boiling Water Reactor

-

High-temperature Gas Cooled Reactor

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global nuclear power plant equipment market size was estimated at USD 20.82 million in 2023 and is expected to reach USD 21.52 billion in 2024.

b. The global nuclear power plant equipment market is expected to grow at a compound annual growth rate (CAGR) of 3.4% from 2024 to 2030 to reach USD 26.35 billion by 2030

b. Pressurized water reactors accounted for the largest revenue share of over 44.8% in 2023. This is due to its high preference for safety, reliability, and efficiency. PWRs are the most commonly used reactor type worldwide, and their design offers several advantages including stable operation and proven safety features

b. Some key players operating in the nuclear power plant equipment market include BWX Technologies, Inc., ALSTOM SA, Dongfang Electric Co., Ltd., DOOSAN CORPORATION, GE Hitachi Nuclear Energy, Shanghai Electric, NuScale Power, LLC, X Energy, EDF, AVEVA.

b. .The key factors that are driving the market growth are the adoption of low-carbon energy sources to combat climate change, the increasing energy needs of rapidly developing economies, and the modernization and life-extension of existing nuclear power plants.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."