Nursing Products Market Size & Trends

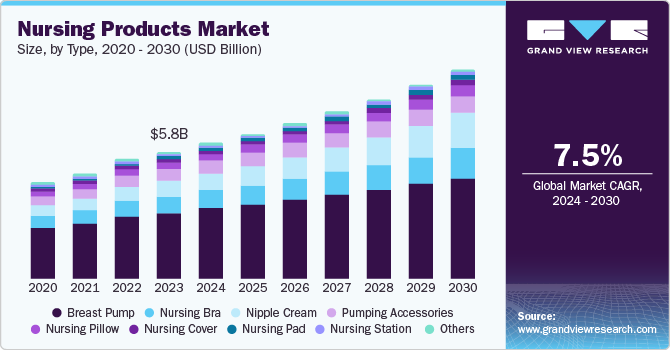

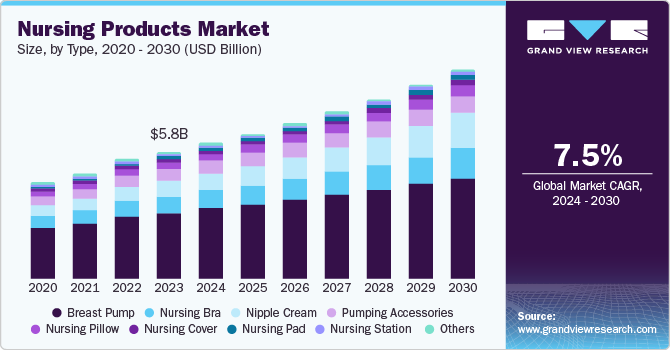

The global nursing products market size was valued at USD 5.82 billion in 2023 and is expected to witness a CAGR of 7.5% from 2024 to 2030. The rising awareness regarding maternity care and various innovations to help nursing mothers are some of the key factors contributing to the market growth. Nursing products make breastfeeding easier and more comfortable for new mothers. In addition, products such as nipple creams, nursing pillows, and nursing stations, among others, are essential items in case new mothers encounter challenges with breastfeeding.

With urbanization in developed countries and enhancement in healthcare infrastructure in most of the developing nations, consumer behavior has been shaping demand for premium quality products over inexpensive, low-quality products.

The baby and mother care sector are witnessing growing demand in segments including food and beverages, personal care products, furniture, and nursing or feeding products. Population growth and emerging economies are contributing to the rising demand for nursing products, especially in countries of Asia Pacific, Latin America, and Africa. In addition, the demand for premium quality products over cheap prices is rising significantly.

The millennial generation and Gen Z population are entering the parenthood phase. Millennial and Generation Z parents are more independent financially and keen on striking a balance between their careers and parenting. This can put pressure on new moms. Hence, many manufacturers of nursing products have introduced innovative products to cater to the requirements of new mothers.

Type Insights

The breast pump segment dominated the market and accounted for a revenue share of 51.9% in 2023. The demand for electric breast pumps is growing among working women due to the ease and convenience of usage. Women, especially working women, are conscious of the nutritional requirements of their babies and choose to feed breast milk to babies. Breast pumps are useful options for mothers as it is easier to balance their careers, by also taking care of their babies on the go. Per capita expenditure by women and growth in disposable income also have influenced this segment. Availability of products such as wearable pumps is expected to fuel growth for the breast pumps segment.

The nipple cream segment is anticipated to witness a CAGR of 16.2 % from 2024 to 2030. Growing adoption of natural and organic products, especially during times of pregnancy, availability of products with characteristics such as fragrance-free formulations and increasing accessibility through online platforms and local pharmacies is expected to drive growth for this segment.The presence of well-established healthcare infrastructure, technological advancements for the new mothers and infants’ segment, rise in women employment, and increasing customer awareness about these accessories are expected to augment the region’s growth. According to the CDC, around 3.6 million babies were born in the U. S. in 2023.

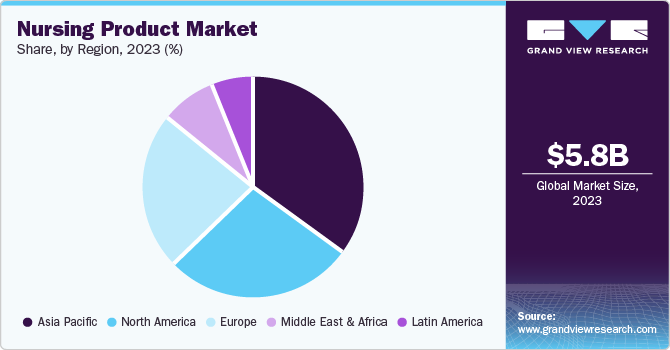

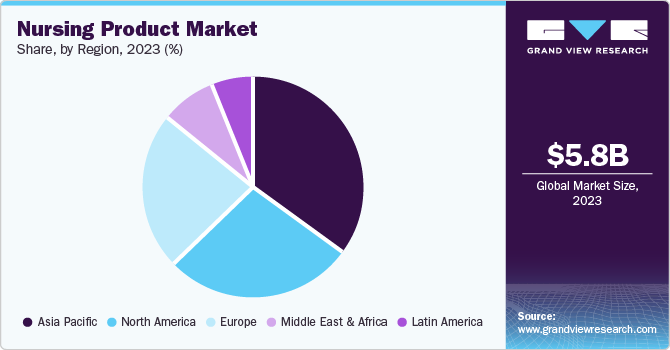

Regional Insights

North America nursing products market held significant revenue share in 2023. The presence of well-established healthcare infrastructure, technological advancements for the new mothers and infants’ segment, rise in women employment, and increasing customer awareness about these accessories are expected to augment the region’s growth.

U.S. Nursing Product Market Trends

The U.S. nursing products market is projected to experience lucrative CAGR from 2024 to 2030. The market growth is fueled by presence of numerous key market participants in industry, easier availability, large number of working women in the country, and accessibility to premium products through online platforms and more.

Asia Pacific Nursing Product Market Trends

Asia Pacific nursing product market held the largest revenue share of 35.2% in 2023. This can be attributed to various factors including, the presence of highly populated countries such as China and India and technological advancements. The rising awareness regarding maternity care among lactating women, and the growth in working women is creating opportunities for the adoption of innovative products such as breast pumps to help working women deal with challenges that might occur during the breastfeeding phase.

The China nursing products market is expected to grow at lucrative CAGR during the forecast period. This is primarily due to increasing awareness regarding the benefits of nursing products and growing availability of products through online platforms.

Europe Nursing Product Market Trends

The nursing products market in Europe is identified as a major region in 2023. Rising number of working women, presence of multiple manufacturers, growing geriatric population in the region, and increasing adoption of technology driven solutions drives the market growth.

Key Nursing Product Company Insights

Some of the key companies in the global nursing products market include Ameda (Magento, Inc., Pigeon Corporation, Koninklijke Philips N.V., and others. Customers are demanding premium quality products over cheap pricing due to growing disposable incomes. Hence, manufacturers are taking into consideration the factors such as purchasing history and the shopping mentality of new parents. The manufacturers are also focusing on improving their online presence to grow their market outreach driven by digital transformation. Digital transformation has become a key for businesses to keep growing, especially during the pandemic.

The development of easier accessible e-commerce platforms, brand websites available on-click, and social media promotions are likely to drive the demand for nursing products. Moreover, the acquisition of new customers and providing a better customer experience for existing customers is a key to market growth. The market is growing due to the rising focus on product innovations, increasing affordability, attractive product designs & packaging, and better quality of products. The introduction of dual breast pumps is becoming popular among breastfeeding mothers as it saves a lot of time.

-

Ameda Inc. is one of the prominent manufacturers of breast pumps. In addition, the company delivers products related to breast milk storage, breast care, and accessories. The company also provides educational and support for breastfeeding mothers.

Key Nursing Products Companies:

The following are the leading companies in the nursing products market. These companies collectively hold the largest market share and dictate industry trends.

- Ameda (Magento, Inc.)

- Pigeon Corporation

- Koninklijke Philips N.V.

- DaVinci Baby

- Bravado Designs USA

- Spectra Baby USA

- Earth Mama Organics

- Medela

- NuAngel, Inc.

- The Honest Company, Inc.

Recent Developments

-

In May 2024, eufy introduced technologically advanced and new product line of wearable breast pumps. It expanded into lactation support with the launch of the S1, S1 Pro, and E10 breast pumps.

-

In May 2024, Nike, one of the key brands in sports accessories and athleisure industry, launched wearable pump-compatible sports bra. Newly introduced, Nike (M) Swoosh Bra is designed in way that it stays on and stays put for pumping even in the middle of workout.

-

In November 2023, Pigeon announced the highly predicted launch of GoMini Plus Electric Breast Pump. This redefines comfort and convenience for breastfeeding mothers.

Nursing Products Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 6.21 billion

|

|

Revenue forecast in 2030

|

USD 9.50 billion

|

|

Growth Rate

|

CAGR of 7.5% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company share, competitive landscape, growth factors and trends

|

|

Segments covered

|

Type, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

|

|

Key companies profiled

|

Ameda; Pigeon Corporation; Koninklijke Philips N.V.; Davinci Baby; Bravado Designs USA; Spectra Baby USA, Earth Mama Organics, Medela, NuAngel, Inc., The Honest Company, Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Nursing Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global nursing products market report based on type and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Pump

-

Nursing Bra

-

Nipple Cream

-

Pumping Accessories

-

Nursing Pillow

-

Nursing Cover

-

Nursing Pad

-

Nursing Station

-

Others

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Latin America

-

Middle East & Africa

-

South Africa

-

South Arabia

-

UAE

-

Kuwait