- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Nutraceutical Packaging Market Size, Industry Report, 2030GVR Report cover

![Nutraceutical Packaging Market Size, Share & Trends Report]()

Nutraceutical Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Paper & Paperboard), By Product Type (Bottles & Jars, Bags & Pouches, Boxes & Cartons), By Application (Dietary Supplements), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-549-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nutraceutical Packaging Market Summary

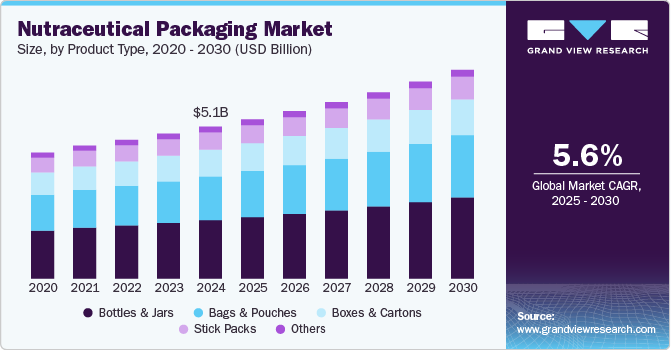

The global nutraceutical packaging market size was estimated at USD 5.05 billion in 2024 and is projected to reach USD 6.95 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. The growing global emphasis on health and wellness is a primary driver of the nutraceutical packaging industry.

Key Market Trends & Insights

- North America dominated the nutraceutical packaging market with the largest revenue share of 34.4% in 2024.

- The nutraceutical packaging market in the U.S. accounted for a substantial share in North America in 2024.

- Based on material, the plastic segment led the market with the largest revenue share of 58.3% in 2024.

- Based on application, the dietary supplements segment led the market with the largest revenue share of 46.2% in 2024.

- Based on product type, the bottles & jars segment led the market with the largest market revenue share of over 38.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.05 Billion

- 2030 Projected Market Size: USD 6.95 Billion

- CAGR (2025-2030): 5.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Consumers are increasingly seeking dietary supplements, functional foods, and fortified beverages to address health concerns such as immunity, gut health, and chronic disease prevention. This trend is further amplified by aging populations, particularly in North America and Europe, where older adults rely on nutraceuticals for joint health, cognitive support, and other age-related needs. The demand for packaging that ensures product integrity-such as tamper-evident seals, child-resistant closures, and moisture-resistant materials-has surged alongside this health-focused shift.In addition, the rapid growth of online retail has transformed packaging requirements, with nutraceutical brands needing solutions that withstand shipping while maintaining product freshness and shelf appeal. Single-serve pouches, resealable bags, and lightweight yet protective materials such as recyclable plastics are gaining traction to meet e-commerce demands. In addition, personalized packaging formats, such as stick packs for on-the-go consumption, cater to convenience-driven consumers, further propelling market growth.

Environmental regulations and consumer preferences for eco-friendly packaging are accelerating innovation in the nutraceutical sector. Brands are adopting biodegradable, compostable, and recyclable materials for instance, Berry Global introduced clarified polypropylene (PP) bottles, which reduce carbon emissions by 71%. Stricter policies, such as the EU Packaging Waste Directive and FDA labeling requirements, also drive the adoption of compliant, high-barrier packaging that balances sustainability with product safety 410. This dual focus on ecological responsibility and regulatory adherence is reshaping industry standards and fueling market expansion.

However, the high cost of sustainable and advanced packaging materials limits product adoption, particularly among small and mid-sized brands. While eco-friendly options like biodegradable films and recyclable composites are in demand, their production expenses and complex manufacturing processes often result in higher retail prices, making them less accessible for budget-conscious consumers. In addition, stringent regulatory compliance-such as child-resistant and tamper-evident requirements-adds to packaging costs and development timelines, further challenging manufacturers to balance affordability with innovation and sustainability. This cost barrier is expected to restrain market penetration, especially in price-sensitive regions.

Material Insights

Based on material, the plastic segment led the market with the largest revenue share of 58.3% in 2024, owing to its versatility, lightweight properties, and cost-effectiveness. Common types include polyethylene (PE), polypropylene (PP), and PET, which are used for bottles, blister packs, and flexible pouches. Plastic offers excellent barrier protection against moisture and oxygen, extending shelf life, while innovations like recycled and bio-based plastics address sustainability concerns. However, environmental regulations and consumer pushback against single-use plastics are driving demand for greener alternatives.

The paper and paperboard segment is expected to grow at the fastest CAGR of 5.9% from 2025 to 2030, as sustainable alternatives, particularly for dry nutraceuticals like powder supplements and tablets. These materials are biodegradable, recyclable, and often made from renewable sources, aligning with eco-conscious consumer preferences. Laminated paperboard is used for cartons and boxes, while molded fiber trays provide cushioning for delicate products. However, limitations in moisture and oxygen resistance restrict their use for liquid or sensitive formulations unless combined with protective coatings.

Metal packaging, primarily aluminum, and tinplate, is valued for its superior barrier properties, durability, and ability to preserve product integrity. Aluminum cans and tubes are commonly used for liquid supplements, probiotics, and effervescent tablets, offering airtight protection against light and contaminants. Metal is also infinitely recyclable, supporting circular economy goals. However, higher production costs and weight compared to plastic limit its widespread adoption, making it more suitable for premium or long-shelf-life products.

Product Type Insights

The bottles & jars segment led the market with the largest market revenue share of over 38.5% in 2024. They are among the most common packaging formats for nutraceuticals, particularly for liquid supplements, soft gels, and powdered formulations. Made from plastic (HDPE, PET), glass, or metal, they offer excellent protection against moisture, oxygen, and contamination while ensuring easy dispensing. Translucent or amber-colored variants help shield light-sensitive ingredients. Resealable caps and child-resistant closures enhance convenience and safety.

The bags and pouches are projected to grow at the fastest CAGR of 6.1% over the forecast period, owing to their increasing use in single-serve and bulk nutraceutical packaging, offering portability, flexibility, and reduced material usage. Stand-up pouches with zip locks are ideal for powders, gummies, and granola-based supplements, as they offer resealability and extended freshness. High-barrier laminated films protect against moisture and oxygen, while eco-friendly options like compostable films cater to sustainability demands. Their lightweight nature lowers shipping costs, making them a preferred choice for e-commerce and direct-to-consumer brands.

Boxes and cartons are widely used for premium and multi-component nutraceutical products, such as vitamin bundles or subscription-based supplements. Folding cartons made from paperboard offer a sustainable, customizable, and visually appealing solution, often featuring tamper-evident seals and informative labeling. Blister packs within boxes provide unit-dose convenience for tablets and capsules. While not as moisture-resistant as plastic or metal, coated and lined cartons can enhance product protection. Their eco-friendly image and branding potential make them a favorite for organic and clean-label nutraceuticals.

Application Insights

Based on application, the dietary supplements segment led the market with the largest revenue share of 46.2% in 2024 and is projected to grow at the fastest CAGR of 6.0% during the forecast period. Dietary supplements, including vitamins, minerals, and protein powders, require packaging that ensures stability, tamper resistance, and precise dosing. Bottles with child-resistant caps are common for tablets and capsules, while stick packs and single-serve pouches cater to powdered supplements. High-barrier materials with UV protection are essential to prevent degradation of sensitive ingredients. Clear labeling for dosage instructions and regulatory compliance (e.g., FDA, EFSA) is critical, driving demand for smart packaging with QR codes for traceability and consumer engagement.

Functional foods, such as fortified cereals, protein bars, and probiotic yogurts, require packaging that balances convenience with extended shelf life. Flexible pouches with resealable zippers are popular for snacks, while vacuum-sealed trays preserve freshness in refrigerated products. Sustainable materials like compostable films and paper-based wrappers align with these products' health-conscious image.

Herbal nutraceuticals, including Ayurvedic, traditional Chinese, and botanical extracts, often use packaging that conveys natural and holistic branding. Glass bottles and amber jars protect light-sensitive oils and tinctures, while biodegradable pouches suit dried herbs and teas. Tamper-evident seals and airtight closures are crucial to maintain potency and prevent contamination. Labels with detailed ingredient sourcing and traditional usage claims enhance consumer trust.

Functional beverages, such as energy drinks, enhanced waters, and probiotic juices, demand packaging that ensures product safety and portability. Aluminum cans and PET bottles dominate due to their durability and recyclability, while aseptic cartons are used for dairy-based probiotic drinks. Lightweighting and tethered caps (per EU regulations) are trends reducing environmental impact. Smart labels with NFC tags provide real-time information on hydration benefits or ingredient origins.

Region Insights

North America dominated the nutraceutical packaging market with the largest revenue share of 34.4% in 2024, driven by high consumer health awareness and a well-established supplement industry. The region shows strong demand for sustainable and convenient packaging formats, with the U.S. accounting for the majority of market share. Stringent FDA regulations push manufacturers toward child-resistant and tamper-evident solutions, while e-commerce growth fuels innovation in protective yet lightweight packaging. Premiumization trends favor glass and smart packaging for high-end supplements.

U.S. Nutraceutical Packaging Market Trends

The nutraceutical packaging market in the U.S. accounted for a substantial share in North America in 2024. The country leads in adopting smart packaging technologies like NFC tags for product authentication. Sustainability initiatives are driving shifts toward PCR plastics and compostable materials, particularly in states with extended producer responsibility laws. The booming direct-to-consumer supplement sector demands e-commerce optimized designs that combine branding appeal with shipping durability.

Europe Nutraceutical Packaging Market Trends

The nutraceutical packaging market in Europe is characterized by strict EU regulations and strong sustainability mandates. The region shows high adoption of recyclable mono-materials and paper-based solutions to comply with circular economy principles. Germany and France lead in pharmaceutical-grade packaging for supplements, with emphasis on barrier protection and dosage accuracy. The EU's Single-Use Plastics Directive is accelerating the development of bio-based alternatives across the region.

The Germany nutraceutical packaging market is largely driven bythepresence of high-performance barrier packaging solutions, particularly for sensitive probiotics and omega-3 products. German consumers favor apothecary-style glass packaging for premium supplements, while the discount retail sector drives demand for efficient, minimalistic plastic solutions. The country's dual system (Grüner Punkt) heavily influences recycling-focused packaging designs.

Asia Pacific Nutraceutical Packaging Market Trends

The nutraceutical packaging market in Asia Pacific is expected to grow at the fastest CAGR of 6.1% from 2025 to 2030, fueled by rising middle-class health awareness. Diverse market needs range from Japan's sophisticated single-dose pouches to India's affordable sachet packaging. China's manufacturing capabilities drive packaging innovation, while Southeast Asian countries show strong demand for traditional herbal medicine packaging. The region presents unique challenges in balancing cost-effectiveness with increasingly stringent quality expectations.

The China nutraceutical packaging market is experiencing rapid transformation, with domestic brands upgrading from basic to premium packaging solutions. The e-commerce boom has created a demand for visually striking yet protective packaging for cross-border supplement sales. Government quality control measures are raising packaging standards, particularly for imported products. Local manufacturers are innovating with smart packaging features like anti-counterfeit QR codes to build consumer trust in domestic brands.

Middle East & Africa Nutraceutical Packaging Market Trends

The nutraceutical packaging market in Middle East & Africa is growing steadily, with emphasis on product protection in hot climates. The region shows a preference for blister packs and aluminum packaging that can withstand high temperatures. Islamic compliance requirements influence packaging designs, particularly for halal-certified products. South Africa and Gulf countries lead in adopting international packaging standards, while North African markets remain more price sensitive.

The Saudi Arabia nutraceutical packaging market represents a high-growth in the GCC, driven by government health initiatives and rising diabetes awareness. The market favors premium packaging with Arabic/English bilingual labeling, particularly for imported supplements. Temperature-resistant materials are essential for product stability in extreme heat. Recent sustainability initiatives under Vision 2030 are beginning to influence packaging material choices, though plastic still dominates due to cost considerations.

Key Nutraceutical Packaging Company Insights

The nutraceutical packaging industry is highly competitive, with key players focusing on sustainability, innovation, and regulatory compliance to gain market share. Leading companies like Amcor, Berry Global, and Gerresheimer are investing in eco-friendly materials and smart packaging technologies to enhance consumer engagement and product traceability. In addition, the market is also witnessing consolidation through mergers and acquisitions to strengthen its pharmaceutical and nutraceutical presence.

Key Nutraceutical Packaging Companies:

The following are the leading companies in the nutraceutical packaging Market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor

- Berry Global

- Gerresheimer AG

- Constantia Flexibles

- Huhtamaki Oyj

- Comar Packaging

- Glenroy Inc.

- ProAmpac

- TricorBraun

- Mondi plc

Recent Development

-

In January 2025, TricorBraun announced the acquisition of Veritiv Containers, which aimed to grow the primary packaging offering and provide customers with expanded services and supply chain options. TricorBraun's acquisition significantly expands its North American presence, enhancing its distribution capabilities with seven new warehouses and over 500,000 square feet of additional storage space. This strategic move is expected to bolster the company's extensive supply chain network, reinforcing its position as an industry leader in packaging solutions.

Nutraceutical Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.30 billion

Revenue forecast in 2030

USD 6.95 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product type, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Amcor; Berry Global; Gerresheimer AG; Constantia Flexibles; Huhtamaki Oyj; Comar Packaging; Glenroy Inc.; ProAmpac; TricorBraun; Mondi plc

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nutraceutical Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nutraceutical packaging market report based on material, product type, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Paper & Paperboard

-

Metal

-

Glass

-

Others

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles & Jars

-

Bags & Pouches

-

Boxes & Cartons

-

Stick Packs

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dietary Supplements

-

Functional Foods

-

Herbal Products

-

Functional Beverages

-

Other Applications

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global nutraceutical packaging market was estimated at around USD 5.05 billion in 2024 and is expected to reach around USD 5.30 billion in 2025.

b. The global nutraceutical packaging market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030, reaching around USD 6.95 billion by 2030.

b. The plastic segment recorded the largest market revenue share of over 58.3% in 2024 owing to its versatility, lightweight properties, and cost-effectiveness.

b. The key players in the nutraceutical packaging market include Amcor, Berry Global, Gerresheimer AG, Constantia Flexibles, Huhtamaki Oyj, Comar Packaging, Glenroy Inc., ProAmpac, TricorBraun, Mondi plc.

b. The nutraceutical packaging market is driven growing global emphasis on health and wellness, along with that consumers are increasingly seeking dietary supplements, functional foods, and fortified beverages to address health concerns such as immunity, gut health, and chronic disease prevention

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.