- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Oats Market Size, Share, Growth And Trends Report, 2030GVR Report cover

![Oats Market Size, Share & Trends Report]()

Oats Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Whole Oats, Rolled Oats), By Application (Food & Beverages, Animal Feed), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-325-9

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oats Market Summary

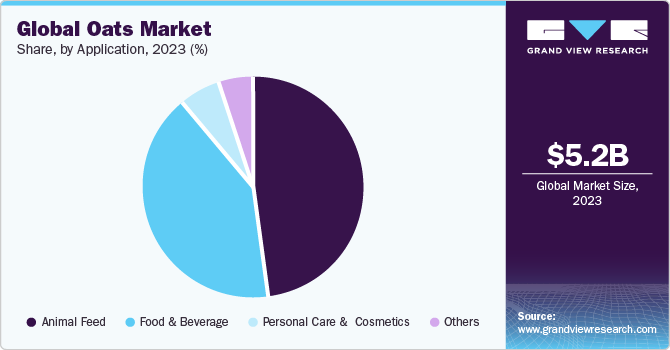

The global oats market size was estimated to be USD 5.16 billion in 2023 and is projected to reach USD 8.24 billion by 2030, growing at a CAGR of 7.0% from 2024 to 2030. Factors such as rising health consciousness, the growing popularity of plant-based diets, and the versatility and convenience of oat-based products are driving the global oats market.

Key Market Trends & Insights

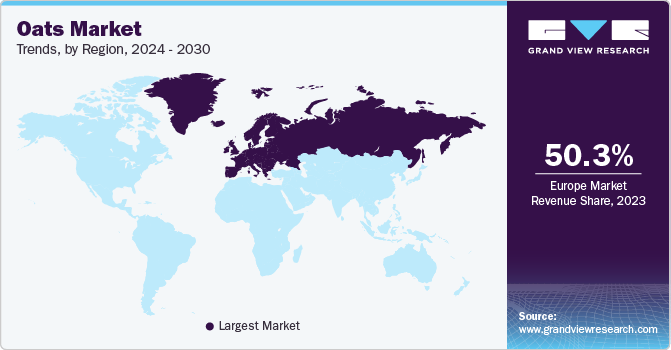

- Europe dominated the oats market in 2023, with a revenue share of 50.34%.

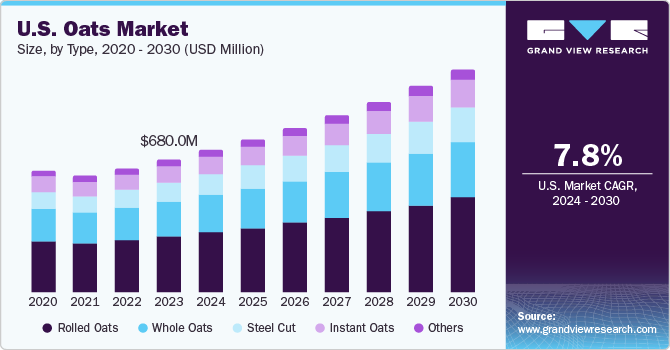

- The oats market in U.S. is anticipated to grow at a CAGR of 7.8% from 2024 to 2030.

- Based on type, the rolled oats accounted for the largest revenue share of 39.7% in 2023.

- Based on application, the animal feed application accounted for the largest revenue share of 48.3% in 2023.

- Based on distribution channels, supermarkets and hypermarkets accounted for a market share of 44.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.16 Billion

- 2030 Projected Market Size: USD 8.24 Billion

- CAGR (2024-2030): 7.0%

- Europe: Largest market in 2024

As consumers become more aware of the health benefits of oats, including their high fiber and nutrient content, the demand for products such as oat milk, breakfast cereals, and snacks increases. The market is further supported by the demand for gluten-free options, continuous product innovations, and the expansion of e-commerce platforms, making oats more accessible. Oats are a rich source of fiber, protein, vitamins, and minerals, making them an ideal food for maintaining good health. As people become more health-conscious, there is a growing demand for products that are both nutritious and convenient. Oats are easy to prepare and can be consumed in a variety of ways, such as oatmeal, granola bars, and smoothies. Food manufacturers are continuously innovating to introduce new and appealing oat-based products. This includes flavored oats, oat-based snacks, beverages such as oat milk, and even oat-infused personal care products. Such innovations attract a wider consumer base and drive market expansion.

With the rising prevalence of gluten intolerance and celiac disease, there is an increasing demand for gluten-free food products. Oats, naturally gluten-free, are gaining popularity as a safe and nutritious alternative for those who need to avoid gluten, further boosting market growth. In addition to their nutritional value, oats are also gaining popularity among consumers who are looking to reduce their meat consumption or adopt a plant-based diet. As concerns about the environmental impact of animal agriculture grow, many people are turning to plant-based alternatives, including oats.

Market Concentration & Characteristics

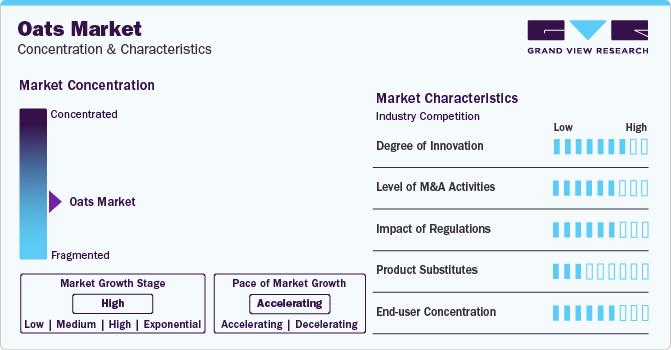

The oats market has witnessed a significant degree of innovation in recent years. Manufacturers and food companies are constantly introducing new and innovative oat-based products to meet the evolving consumer demands and preferences. One area of innovation in the oats market is product diversification. Oats are no longer limited to traditional oatmeal or porridge. Companies have introduced a wide range of oat-based products such as oat milk, oat bars, oat-based snacks, and even oat-based meat alternatives. These innovative products cater to different consumer needs and provide alternatives to traditional dairy or meat-based products.

Several market players such as The Scoular Company, Quaker Oats Company, Morning Foods, General Mills are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

The primary regulations affecting the oats market is food safety regulations. Oats, similar to all food products, must meet certain safety standards to ensure that they are free from harmful contaminants. These standards are enforced by government agencies such as the FDA in the U.S. and the European Food Safety Authority in Europe.

The common substitute for oats is other grains such as wheat, barley, or rice. These grains can be used as alternatives in recipes that call for oats, such as in baking or as a base for breakfast cereals. While they may not have the exact same nutritional profile as oats, they provide similar texture and versatility in cooking. Another substitute for oats is quinoa, a pseudocereal that has gained popularity due to its high protein content and gluten-free nature. Quinoa can be used in place of oats in dishes such as porridge or granola and provides a unique nutty flavor and a slightly different texture.

Type Insights

The rolled oats accounted for the largest revenue share of 39.7% in 2023, due to their versatility and convenience. They are easy to prepare and can be used in a wide variety of food products, including breakfast cereals, baked goods, and snacks. Their relatively quick cooking time compared to steel-cut oats makes them a preferred choice for consumers seeking nutritious and easy-to-prepare meals. In addition, rolled oats retain much of the nutritional value of whole oats while offering a more palatable texture, appealing to a broad consumer base.

Steel cut oats are anticipated to witness significant market growth of 7.8% from 2024 to 2030 due to growing consumer awareness of their health benefits. They are minimally processed, retaining more of their natural nutrients and fiber compared to other types of oats. As health-conscious consumers increasingly seek whole, less-processed foods, steel cut oats are becoming more popular. Their hearty texture and rich, nutty flavor also appeal to those looking for a more substantial and satisfying meal.

Application Insights

Animal feed application accounted for the largest revenue share of 48.3% in 2023, due to oats' high nutritional value for livestock. Oats are rich in essential nutrients and fiber, making them a valuable feed ingredient for horses, poultry, and other animals. They are also relatively easy to grow and harvest, providing a cost-effective and nutritious feed option for farmers. The robust demand from the agricultural sector, where oats are used extensively in animal feed, ensures a steady market.

Food & beverage application has been anticipated to grow at a CAGR of 7.5% from 2024 to 2030 due to the increasing demand for healthy and natural food products. As consumers become more health-conscious, the popularity of oats in breakfast cereals, snacks, bakery products, and oat-based beverages is rising. Innovations in oat-based products, such as oat milk and gluten-free oat snacks, are expanding their appeal. The trend towards plant-based and sustainable food options also supports growth in this sector. The versatility of oats in various food applications and their recognized health benefits drive the rapid expansion of the food and beverage market.

Distribution Channel Insights

Supermarkets and hypermarkets accounted for a market share of 44.9% in 2023 as they offer a wide variety of oat products under one roof, providing consumers with convenience and choice. These large retail formats have extensive distribution networks and the ability to purchase in bulk, often translating to competitive pricing for consumers. The availability of different oat brands and types in supermarkets/hypermarkets attracts a diverse customer base, from those looking for budget-friendly options to those seeking premium health products. Their prominent shelf space and frequent promotional activities also contribute to their dominant position in the oats market.

Online channels are expected to have the highest CAGR of 8.9% from 2024 to 2030 due to the growing trend of e-commerce and the increasing consumer preference for the convenience of online shopping. The COVID-19 pandemic accelerated the shift towards digital platforms, with more consumers purchasing groceries and health foods online. Online retailers offer a wider range of products, easy price comparisons, and the convenience of home delivery, which appeals to busy consumers. In addition, the ability to access customer reviews and detailed product information online enhances consumer confidence and satisfaction, further driving the growth of online oat sales.

Regional Insights

The North America oats market is anticipated to grow at a CAGR of 7.6% from 2024 to 2030. The region's well-developed food processing industry supports the extensive use of oats in a variety of products, from breakfast cereals to snacks and beverages. Increasing consumer demand for organic and non-GMO products has also driven the market, as oats are often seen as a natural and wholesome ingredient. Moreover, the growing popularity of gluten-free diets has led to an increased consumption of oats, which are naturally gluten-free, albeit requiring careful processing to avoid cross-contamination.

U.S. Oats Market Trends

The oats market in U.S. is anticipated to grow at a CAGR of 7.8% from 2024 to 2030 and is driven by a strong consumer focus on health and wellness. The increasing prevalence of lifestyle-related health issues such as obesity and diabetes has prompted consumers to seek out healthier dietary options, with oats being a popular choice due to their heart health benefits and ability to aid in weight management. The rise of the plant-based diet trend has also boosted the demand for oat-based products, including oat milk and oat snacks. Furthermore, the U.S. market benefits from a well-established supply chain and advanced agricultural practices that ensure a steady supply of high-quality oats.

Europe Oats Market Trends

Europe dominated the oats market in 2023, with a revenue share of 50.34%. The primary driver of the market is the increasing awareness of the health benefits of oats. Oats are a rich source of fiber, protein, and other essential nutrients, making them an ideal food for maintaining good health. As consumers become more health-conscious, there is a growing demand for products that are both nutritious and convenient, and oats fit this demand perfectly.

Russia Oats Market Trends

Russia oats market accounted for the largest share of the oats market in Europe in 2023. The increasing demand for convenience foods is also contributing to the growth of the oat market. Oats can be easily incorporated into various ready-to-eat products such as breakfast cereals, granola bars, and oat milk, which are gaining popularity among busy urban consumers and driving the market in Russia.

Asia Pacific Oats Market Trends

The Asia Pacific region is expected to grow at a significant rate of 8.1% during the forecast period. The rising demand for plant-based protein alternatives is driving the market in this region. As the population grows and incomes rise, there is a growing demand for protein-rich foods that are sustainable and environmentally friendly. Oats are a versatile ingredient that can be used in a wide range of plant-based products, such as oat milk, oat-based meat alternatives, and oat-based snacks.

The oats market in India is projected to grow at a CAGR of 8.5% from 2024 to 2030. As more Indians adopt healthier lifestyles, oats are being integrated into traditional diets due to their high fiber, protein, and essential nutrient content. The rise in disposable income and the expansion of the middle class further supports the consumption of oats, especially in urban areas where time-constrained consumers seek convenient and nutritious breakfast options. In addition, the proliferation of modern retail channels and e-commerce platforms has improved the accessibility and availability of a variety of oat products, fueling market growth.

Central and South America Oats Market Trends

The oats market in Central and South America is projected to grow at a CAGR of 6.7% from 2024 to 2030. The market is driven by increasing awareness of the health benefits associated with oats, particularly in urban areas where lifestyle diseases are on the rise. Countries such as Brazil and Argentina are seeing growing demand for healthy breakfast options and functional foods, which includes oat-based products. The influence of Western dietary trends and the expanding middle class with greater purchasing power also support market growth. Moreover, the region's agricultural potential allows for the local production of oats, which can cater to both domestic and export markets, enhancing market dynamics. n and advanced agricultural practices that ensure a steady supply of high-quality oats.

Middle East And Africa Market Trends

The Middle East and Africa (MEA) oats market is expanding due to increasing urbanization and the growing middle class, which is leading to a shift towards more Western dietary habits. Oats are being incorporated into diets as a healthy breakfast option, especially in the form of cereals and porridge. Health awareness campaigns and the promotion of healthy eating by governments and health organizations are also playing a crucial role.

Key Oats Company Insights

The Kellogg Company and Quaker Oats Company are some of the dominant players operating in oats market.

-

Kellogg's adapts its product offerings to suit the preferences and dietary habits of consumers in different regions. Oats, in particular, are often used as an ingredient in various Kellogg's products to provide fiber and nutritional benefits.

-

The Quaker Oats Company, which is a subsidiary of PepsiCo, has a diverse product portfolio that includes a range of oat-based products along with other food and beverage offerings. Their geographical presence is global, and they operate in numerous countries around the world.

B&G Foods is one of the emerging market players functioning in the oats market.

- B&G Foods operates primarily in North America, with a focus on the U.S. Their products are widely distributed across the U.S. and are available in various grocery stores, supermarkets, and online retailers.

Key Oats Companies:

The following are the leading companies in the oats market. These companies collectively hold the largest market share and dictate industry trends.

- Quaker Oats Company

- Morning Foods

- General Mills

- Richardson International

- Grain Millers

- Avena Foods

- Blue Lake Milling

- B&G Foods, Inc.

- The Kellogg Company

- Marico Limited

Recent Developments

-

In April 2023, Tirlán expanded its oat portfolio to include Organic Oat-Standing Functional Oat Flour. This flour is made using organic oats grown in Ireland without synthetic pesticides, herbicides, or fertilizers. It offers consistent viscosity during heating and cooling cycles and provides functional properties, clean labeling, whole grain benefits, and a clean oaty flavor. The flour helps manufacturers meet the demand for organic and natural oat products and improve the taste and texture of plant-based food and beverage products. It is particularly useful in dairy alternative applications.

-

In June 2023, SunOpta and Seven Sundays partnered to launch a new cereal made with upcycled oat protein powder. The cereal, called Oat Protein Cereal, is made with SunOpta's OatGold, which is a byproduct of oat milk production. The partnership aims to reduce food waste and provide a sustainable solution for oat protein powder. The cereal is available in four flavors and is gluten-free and Non-GMO Project Verified. It can be found nationwide at major retailers and ordered directly from the Seven Sundays website.

-

In November 2023, Quaker, the official oatmeal sponsor of the NFL, has teamed up with and NFL Legend Eli Manning and chef Carla Hall to promote food security among children. They have launched the Quaker Pregrain Tour, featuring a tailgate truck visiting select NFL stadiums and a digital Quaker Playbook with 32 team-inspired recipes. Quaker is a part of PepsiCo and offers various products, including Quaker Oats and Quaker Chewy Granola Bars. GENYOUth is dedicated to promoting youth health and wellness.

Oats Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.49 billion

Revenue forecast in 2030

USD 8.24 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Actuals

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Russia; China; India; Japan; Indonesia; Australia & New Zealand; Brazil; South Africa

Key companies profiled

The Scoular Company; Quaker Oats Company; Morning Foods; General Mills; Richardson International; Grain Millers; Avena Foods

Blue Lake Milling; B&G Foods, Inc.; The Kellogg Company; Marico Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

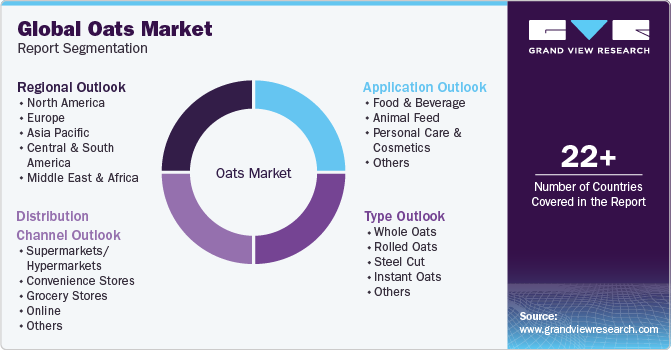

Global Oats Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global oats market report on the basis of type, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Whole Oats

-

Rolled Oats

-

Steel Cut

-

Instant Oats

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverage

-

Animal Feed

-

Personal Care and Cosmetics

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global oats market size was estimated at USD 5.16 billion in 2023 and is expected to reach USD 5.49 billion in 2024.

b. The global oats market is expected to grow at a compounded growth rate of 7.0% from 2024 to 2030 to reach USD 8.24 billion by 2030.

b. The rolled oats accounted for the largest revenue share of 39.7% in 2023, due to their versatility and convenience. They are easy to prepare and can be used in a wide variety of food products, including breakfast cereals, baked goods, and snacks. Their relatively quick cooking time compared to steel-cut oats makes them a preferred choice for consumers seeking nutritious and easy-to-prepare meals. Additionally, rolled oats retain much of the nutritional value of whole oats while offering a more palatable texture, appealing to a broad consumer base

b. Some key players operating in oats market include The Scoular Company, Quaker Oats Company, Morning Foods, General Mills, Richardson International, Grain Millers, Avena Foods Blue Lake Milling, B&G Foods, Inc., The Kellogg Company, Marico Limited, among others

b. Key factors that are driving the market growth include rising health consciousness, the growing popularity of plant-based diets, and the versatility and convenience of oat-based products. As consumers become more aware of the health benefits of oats, including their high fiber and nutrient content, the demand for products like oat milk, breakfast cereals, and snacks increases. The market is further supported by the demand for gluten-free options, continuous product innovations, and the expansion of e-commerce platforms, making oats more accessible.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.