- Home

- »

- Medical Devices

- »

-

Ocular Implants Market Size, Share, Industry Report, 2030GVR Report cover

![Ocular Implants Market Size, Share & Trends Report]()

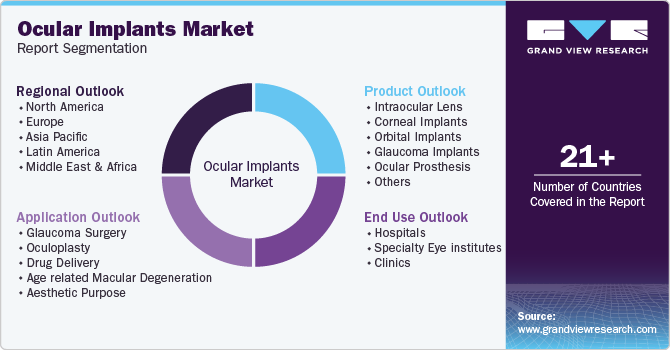

Ocular Implants Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Product (Intraocular Lens, Corneal Implants), By Application (Glaucoma Surgery, Oculoplasty), By End Use (Hospitals, Specialty Eye Institutes, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-647-9

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ocular Implants Market Size & Trends

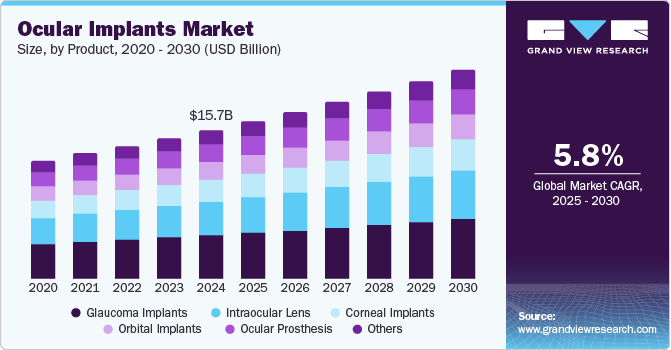

The global ocular implants market size was valued at USD 15.72 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. The growth is driven by several factors, such as the rising prevalence of ophthalmic disorders, the aging global population, technological advancements in implants, growing awareness of corrective eye surgeries, and rising healthcare expenditures. Increasing cases of diabetic retinopathy are also driving the growth of the market. According to the World Health Organization (WHO), over 2.2 billion people globally suffer from some form of near or distance vision impairment, with many of these cases linked to conditions such as cataracts and glaucoma.

The increasing global prevalence of eye diseases is a significant driver of growth in the ocular implants market. For instance, according to a comprehensive study published in The Lancet Global Health, in 2020, it was estimated that 596 million individuals globally suffered from distance vision impairment, including 43 million who were classified as blind. In addition, 510 million people experienced uncorrected near vision impairment due to the lack of access to reading spectacles. A substantial majority of those affected, approximately 90%, reside in low- and middle-income countries (LMICs). By 2050, factors such as population aging, growth, and urbanization are projected to result in approximately 895 million individuals suffering from distance vision impairment, with 61 million of them expected to be blind.

The rising prevalence of eye conditions such as cataracts, glaucoma, and age-related macular degeneration is a key driver of the ocular implants market. For instance, according to World Health Organization (WHO) cataracts are responsible for around 51% of global blindness, affecting 65.2 million people worldwide. Similarly, glaucoma is estimated to impact 80 million people globally, with this number expected to exceed 111 million by 2040. Age-related macular degeneration (AMD) affects 196 million individuals as of 2020 and is projected to rise to 288 million by 2040, particularly driven by the aging population. These growing numbers highlight the increasing demand for advanced ocular implants to restore vision and improve quality of life.

The aging global population is a significant driver of the ocular implants market as age-related eye conditions become more prevalent. For instance, according to World Health Organization (WHO), the global population aged 60 years or older was estimated at 1 billion in 2020, and is projected to nearly double to 2.1 billion by 2050. As people age, the risk of developing conditions such as cataracts, glaucoma, and macular degeneration increases, leading to a higher demand for ocular implants. For instance, over 40% of individuals aged 65 and older are affected by cataracts, and the prevalence of age-related macular degeneration rises sharply after age 50. This demographic shift is expected to significantly impact the demand for vision correction and ocular health solutions globally.

Market Concentration & Characteristics

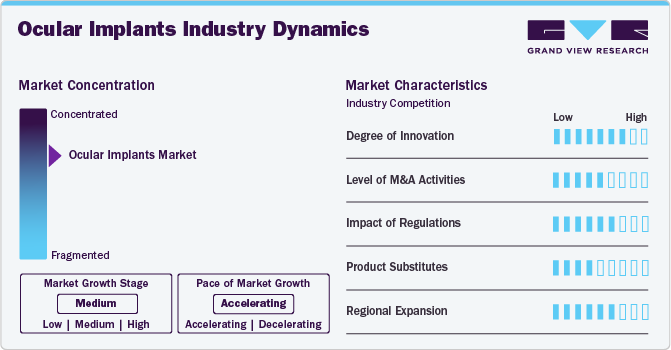

The market is characterized by a moderate level of industry concentration, with a blend of established multinational companies and emerging players competing for market share. Major players in the market dominate through their advanced technological offerings, expansive distribution networks, and significant investments in research and development. Leading companies such as Alcon, Inc., Bausch + Lomb, Carl Zeiss AG, Johnson & Johnson Services, Inc., STAAR Surgical, MORCHER GmbH, and Glaukos Corporation are at the forefront of innovation, driving the development of cutting-edge ocular implant solutions, including intraocular lenses, glaucoma implants, and retinal prosthetics. These industry leaders benefit from strong brand recognition, extensive product portfolios, and global reach, enabling them to maintain a competitive edge. At the same time, emerging players are introducing novel technologies, focusing on specialized solutions to address unmet patient needs, contributing to the market’s dynamic growth.

The market exhibits a high degree of innovation, with continuous advancements aimed at enhancing patient outcomes and vision restoration. Innovations include the development of premium intraocular lenses (IOLs), such as ReSTOR IOL by Alcon Inc., which offer correction for cataracts and refractive errors such as presbyopia and astigmatism. Minimally invasive glaucoma surgery (MIGS) devices, such as the iStent inject by Glaukos Corporation., represent a significant rise in glaucoma management, providing effective treatment with less invasiveness. In addition, retinal prosthetics, such as the Argus II Retinal Prosthesis System, are pushing the boundaries of technology by restoring partial vision to individuals with retinitis pigmentosa. These innovations are revolutionizing ocular care, offering more precise treatments, quicker recovery times, and expanded solutions for vision impairment.

The impact of regulations on the market is significant, as stringent standards ensure the safety, efficacy, and quality of these medical devices. Regulatory bodies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and Health Canada enforce rigorous approval processes, including clinical trials and post-market surveillance, before ocular implants can be introduced to the market. These regulations ensure that products meet high safety standards and perform effectively, fostering patient trust. While these regulatory requirements can slow the time to market and increase costs for manufacturers, they also provide a framework for innovation, ensuring that only safe and reliable devices are available to consumers.

The level of mergers and acquisitions (M&A) activities in the ocular implants market has been steadily increasing as companies seek to expand their product portfolios, enter new markets, and gain access to advanced technologies. Large multinational corporations often acquire smaller, innovative firms to strengthen their R&D capabilities and broaden their offerings in areas such as glaucoma implants, retinal prosthetics, and advanced intraocular lenses. For instance, in May 2022, Alcon Inc. completed its acquisition of Aerie Pharmaceuticals, Inc., a move that strengthens Alcon's ophthalmic pharmaceutical business. The acquisition, valued at approximately USD 770 million, enables Alcon Inc. to expand its portfolio of glaucoma treatments. These M&A activities allow companies to leverage synergies, streamline production, and enhance their competitive positioning, all of which are crucial in an industry driven by technological advancements and an aging global population. In addition, M&A helps companies gain a foothold in emerging markets where the demand for ocular implants is growing rapidly.

In the market, product substitutes can impact demand, with alternatives such as glasses, contact lenses, and pharmaceutical treatments commonly used for vision correction and managing eye conditions. For instance, contact lenses can replace intraocular lenses (IOLs) for correcting refractive errors such as myopia and hyperopia. Similarly, pharmaceutical therapies for conditions such as glaucoma, such as eye drops, provide an alternative to surgical implants for managing intraocular pressure. In addition, laser eye surgeries such as LASIK offer a non-invasive alternative to IOLs for vision correction. Despite these substitutes, ocular implants remain a preferred solution, especially for cataract surgery, retinal implants, and patients who cannot use contact lenses or undergo laser treatments. The availability and affordability of these substitutes can influence demand, particularly in regions with limited access to advanced surgical care.

Regional expansion plays a crucial role in the growth of the market, with companies targeting emerging markets to meet the increasing demand for eye care solutions. For instance, in Asia-Pacific, particularly in India, Alcon Inc. has strengthened its presence by launching initiatives to enhance cataract surgery rates by providing affordable intraocular lenses (IOLs) to cater to the large aging population. In China, Johnson & Johnson Vision has expanded its footprint by establishing partnerships with local hospitals to offer advanced glaucoma implants and improve patient access to high-quality eye care. In Latin America, Bausch + Lomb has seen growth through the introduction of its iStent glaucoma implant in countries such as Brazil, addressing the rising prevalence of glaucoma with minimally invasive treatments. In Africa, where cataracts are a leading cause of blindness, MORCHER GmbH has been working with non-governmental organizations (NGOs) to distribute affordable ocular implants in countries such as Kenya, aiming to reduce the burden of vision impairment.

Product Insights

The glaucoma implants segment dominated the market, accounting for over 29% of the revenue share in 2024. This dominance is attributed to the increasing incidence of glaucoma, a condition that is one of the leading causes of blindness globally. For instance, according to the World Health Organization (WHO), glaucoma affects approximately 80 million people worldwide, and it is projected that this number is expected to rise to 112 million by 2040. The disease primarily impacts individuals over the age of 60, which is a growing demographic as the global population ages. The increasing prevalence of glaucoma is driving demand for effective treatment options, including glaucoma implants, which are designed to lower intraocular pressure and prevent optic nerve damage. In addition, the American Academy of Ophthalmology estimates that glaucoma is expected to affect 3.5 million Americans by 2025, making it a significant healthcare concern that further drives the growth of the market.

The intraocular lens segment is expected to register significant growth over the forecast period due to the rising incidence of cataracts and the increasing demand for cataract surgeries worldwide. Cataracts are a leading cause of vision impairment, particularly among the aging population, and the need for surgical intervention to replace cloudy lenses with intraocular lenses is growing. For instance, according to the American Society of Cataract and Refractive Surgery (ASCRS), more than 24 million people in the United States alone are affected by cataracts, and this number is expected to rise as the population ages. In addition, the World Health Organization (WHO) estimates that globally, more than 50 million cataract surgeries are performed each year, with intraocular lenses being the primary solution for restoring vision post-surgery. The growing preference for premium intraocular lenses, which offer benefits such as reducing the need for glasses after surgery, is also contributing to the segment’s growth.

Application Insights

The glaucoma surgery segment dominated the market with a revenue share of around 33.92% in 2024, driven by the rising prevalence of glaucoma and the increasing adoption of surgical treatments to manage intraocular pressure (IOP). Glaucoma, a leading cause of blindness, affects millions of individuals globally, particularly in aging populations. For instance, according to the World Health Organization (WHO), approximately 80 million people worldwide are affected by glaucoma, and the number is expected to rise to 112 million by 2040. The growth in glaucoma surgery is attributed to the demand for effective surgical interventions, such as trabeculectomy, tube shunts, and minimally invasive glaucoma surgeries (MIGS), which offer safer and less invasive options compared to traditional procedures. The ongoing advancements in surgical technologies and the increasing global focus on improving vision care are expected to drive continued growth in the glaucoma surgery segment.

The age-related macular degeneration segment is expected to witness exponential growth over the forecast period, driven by the increasing aging population and the rising prevalence of the condition globally. Age-related macular degeneration, a leading cause of vision loss, primarily affects individuals over the age of 50, and as the global elderly population expands, the number of cases is expected to rise. For instance, the World Health Organization estimated that the global population aged 60 and older is expected to reach 2.1 billion by 2050, nearly double the number in 2020. In the United States, the National Eye Institute reported that approximately 2.1 million people aged 50 and older are affected by age-related macular degeneration, with this number expected to increase to 5.4 million by 2050. The market for age-related macular degeneration is also being boosted by technological advancements, which are expected to expand the treatment options available. These factors are expected to significantly contribute to the exponential growth of the age-related macular degeneration segment over the forecast period.

End Use Insights

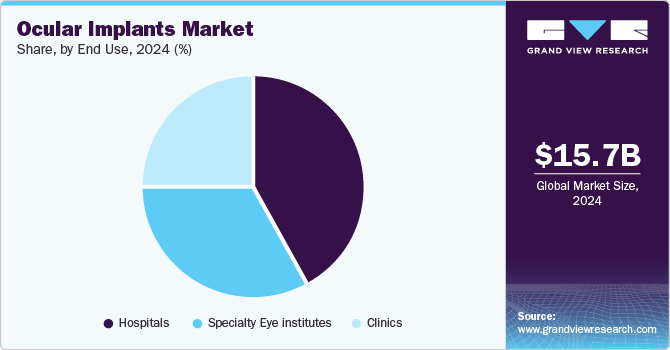

The hospitals segment held the largest revenue share in 2024, accounting for more than 42.29% of the market share, driven by the increasing demand for specialized ocular implant procedures and the growing number of patients seeking treatment for conditions such as cataracts, glaucoma, and age-related macular degeneration. Hospitals are typically the primary healthcare settings for complex eye surgeries due to their advanced infrastructure, skilled medical professionals, and access to state-of-the-art technology. For instance, in the United States, the American Academy of Ophthalmology reports that more than 4 million cataract surgeries are performed annually, the majority of which take place in hospitals. In addition, in regions such as Asia-Pacific, where the healthcare infrastructure is rapidly improving, hospitals are expected to see significant growth in ocular implant procedures, driven by the increasing prevalence of eye diseases and greater access to advanced treatment options. The concentration of advanced medical technologies, specialized surgical expertise, and patient safety protocols in hospitals are expected to continue to fuel the dominance of this segment in the ocular implants market.

The specialty eye institutes segment is expected to experience significant growth during the forecast period due to the increasing demand for eye care services in remote areas and the need for specialized treatments for various eye conditions. As access to advanced eye care remains limited in many rural and underserved regions, specialty eye institutes play a crucial role in delivering high-quality care. For instance, in India, Aravind Eye Care System, one of the largest networks of eye care hospitals, serves millions of patients annually, providing affordable cataract surgeries and other treatments. Similarly, in Africa, the African Eye Institute is addressing the shortage of eye care services by offering specialized treatments and outreach programs in rural areas. In addition, the growing awareness of eye health and the increasing demand for complex procedures such as glaucoma implant surgeries and retinal implants are expected to drive the growth of these institutes. The focus of specialty eye institutes on personalized care and cutting-edge treatments, and their expansion into underserved areas is expected to significantly contribute to their growth in the ocular implants market.

Regional Insights

North America ocular implants market dominated the overall global market and accounted for 36.78% of revenue share in 2024, driven by the high prevalence of eye diseases and advanced healthcare infrastructure. The region's strong market position is attributed to the increasing incidence of conditions such as cataracts, glaucoma, and age-related macular degeneration. For instance, the American Academy of Ophthalmology reports that over 24 million people in the United States are affected by cataracts, a number expected to grow as the population ages. Similarly, the Centers for Disease Control and Prevention (CDC) estimates that more than 3 million people in the U.S. have glaucoma, and this number is expected to rise in the coming decades. North America also benefits from access to state-of-the-art medical technologies, which enables the widespread adoption of advanced ocular implants. The presence of leading market players, such as Alcon, Inc., Bausch + Lomb, and Johnson & Johnson Services, Inc., further strengthens the region's market dominance.

U.S. Ocular Implants Market Trends

The ocular implants market in the U.S. held a significant share in 2024. The growth is driven by the country's aging population and the availability of cutting-edge medical technologies. With a large portion of the population aged 65 and older, the demand for treatments related to conditions like cataracts and age-related macular degeneration continues to rise. For instance, the American Academy of Ophthalmology reports that 24 million people in the U.S. are affected by cataracts, a number expected to grow as the elderly population increases. The U.S. also benefits from its strong healthcare system, offering access to the latest ocular implants and surgical options. In addition, the presence of top market players such as Alcon, Inc., Bausch + Lomb, and Johnson & Johnson Services, Inc., which are at the forefront of innovation, further drives the U.S. ocular implants market, ensuring the availability of advanced treatments and therapies for eye diseases.

Europe Ocular Implants Market Trends

The ocular implants market in Europe is experiencing significant growth, driven by factors such as an aging population, increasing awareness of eye health, and advancements in healthcare infrastructure. The region is facing a rising prevalence of conditions such as cataracts, glaucoma, and age-related macular degeneration, which are contributing to the demand for ocular implants. For instance, the European Eye Epidemiology (E3) Consortium reported that more than 50 million people in Europe are living with uncorrected vision impairment, with a substantial portion requiring advanced surgical treatments, such as intraocular lenses and retinal implants. The increasing focus on specialized eye care centers and the availability of cutting-edge medical technologies are also fueling market growth. In addition, European countries benefit from strong healthcare systems and public health initiatives that promote early detection and treatment of eye diseases, further driving the demand for ocular implants.

The UK ocular implants market is experiencing steady growth, driven by an aging population and increasing prevalence of eye conditions, such as cataracts and diabetic retinopathy. For instance, according to The Royal National Institute of Blind People, nearly 2 million people in the UK are living with sight loss, and this number is expected to rise. In addition, the UK’s strong healthcare infrastructure and the National Health Service (NHS) programs that support eye care contribute to the widespread availability of ocular implants. Advanced technologies in eye surgery and the growing adoption of intraocular lenses (IOLs) further fuel market growth.

The ocular implants market in France is expanding due to rising eye disease incidence, such as cataracts and glaucoma, among the elderly population. The French Ministry of Health reports that approximately 1.5 million people in France are affected by cataracts, with this number expected to grow as the population ages. In addition, the French healthcare system supports access to advanced eye care, with a strong emphasis on specialized eye centers and ophthalmology services. France’s adoption of cutting-edge technology in eye care and the growing number of surgeries, such as glaucoma implant surgeries, contribute significantly to the market's growth.

Germany ocular implants market is primarily driven by the increasing demand for advanced eye care technologies. Germany’s aging demographic has led to a higher incidence of age-related macular degeneration and other ophthalmic disorders. For instance, according to the German Ophthalmological Society, approximately 5 million people in Germany suffer from age-related macular degeneration, increasing the demand for ocular implants. The country's strong healthcare infrastructure, in addition to its continuous investment in medical technology, enables the widespread adoption of cutting-edge eye care treatments.

Asia Pacific Ocular Implants Market Trends

The ocular implants market in Asia-Pacific is experiencing rapid growth, primarily due to the rising prevalence of ophthalmic disorders in countries such as China, India, and Japan. For instance, India faces a high incidence of cataracts, with approximately 12 million affected people, which drives the demand for intraocular lenses. Moreover, advancements in eye surgery technologies and growing awareness about corrective eye surgeries in the region are increasing the adoption of ocular implants. Rising healthcare expenditures in countries such as China and India further support market growth by improving access to specialized eye care services.

Japan ocular implants market is benefiting from technological advancements in implants and an aging population. With one of the oldest populations globally, Japan has a growing number of people suffering from cataracts and age-related macular degeneration, leading to an increased demand for intraocular lenses and retinal implants. For instance, according to the Japan Ophthalmological Society, about 6 million people in Japan suffer from cataracts. The country’s healthcare system provides access to advanced medical technologies and high-quality ophthalmic care, supporting the growth of the ocular implants market.

The ocular implants market in China is expected to grow rapidly, driven by rising healthcare expenditures. With increasing government investment in healthcare infrastructure and access to advanced treatments, the demand for ocular implants is expanding. For instance, over 30 million people in China are affected by cataracts, as reported by the World Health Organization, contributing to the growing need for intraocular lenses. In addition, improvements in healthcare accessibility, particularly in rural areas, are expected to boost the adoption of advanced eye care technologies. The increasing affordability and availability of eye surgeries, fueled by government initiatives and rising healthcare spending, support market growth in China.

India ocular implants market is experiencing significant growth, driven by technological advancements in implants. With a large population affected by conditions such as cataracts, the introduction of innovative intraocular lenses and retinal implants is transforming treatment options in the country. For instance, 12 million people in India suffer from cataracts, creating a high demand for advanced intraocular lenses. The ongoing development of cutting-edge technologies, including more precise surgical tools and improved implant materials, is expected to drive the adoption of ocular implants across India. As a result, the market is poised for continued expansion, with increasing access to advanced eye care solutions.

Latin America Ocular Implants Market Trends

The ocular implants market in Latin America is experiencing significant growth, driven by growing awareness of corrective eye surgeries. With an increasing focus on eye health education and greater availability of information, more people in countries such as Brazil and Mexico are seeking treatments for conditions such as cataracts and glaucoma. For instance, Brazil has approximately 3.5 million people affected by cataracts, leading to a higher demand for intraocular lenses. In addition, improved public and private healthcare initiatives are making corrective eye surgeries more accessible to the population, further driving the market’s expansion in the region.

Middle East & Africa Ocular Implants Market Trends

The ocular implants market in the MEA region is growing rapidly due to the aging population and increasing healthcare investments aimed at enhancing eye care services. For instance, according to the Saudi Ophthalmological Society, cataracts are one of the leading causes of vision impairment in the country, which drives the demand for intraocular lenses. In addition, Saudi Arabia's rising healthcare expenditures support the availability of advanced medical technologies, such as glaucoma implants and retinal prosthetics, thereby contributing to the growth of the ocular implants market.

Key Ocular Implants Company Insights

The scenario in the ocular implants market is highly competitive, with key players such as Alcon, Inc., and Bausch + Lomb. and others. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Ocular Implants Companies:

The following are the leading companies in the ocular implants market. These companies collectively hold the largest market share and dictate industry trends.

- Alcon, Inc.

- Bausch + Lomb.

- Carl Zeiss AG

- Johnson & Johnson Services, Inc.

- STAAR SURGICAL

- MORCHER GmbH

- Glaukos Corporation.

Recent Developments

-

In December 2023, Glaukos Corporation. received regulatory approval for its next-generation iStent Infinite, aimed at treating glaucoma by improving intraocular pressure control. The company continues to innovate in the micro-invasive glaucoma surgery (MIGS) segment, with new implants expected to hit the market soon.

-

In August 2022, Alcon Inc. completed the acquisition of Aerie Pharmaceuticals to expand its ophthalmic pharmaceutical portfolio, strengthening its market position in advanced eye treatments, particularly for glaucoma and retinal diseases.

-

In April 2021, Bausch + Lomb. launched the ClearVisc Ophthalmic Viscosurgical Device to enhance cataract surgery outcomes. This innovation aims to improve surgical efficiency and patient safety, which is vital in the growing cataract implant segment.

Ocular Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.64 billion

Revenue forecast in 2030

USD 22.09 billion

Growth Rate

CAGR of 5.8% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Alcon, Inc., Bausch + Lomb., Carl Zeiss AG, Johnson & Johnson Services, Inc., STAAR SURGICAL, MORCHER GmbH and Glaukos Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ocular Implants Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ocular implants market report on the basis of product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Intraocular Lens

-

Corneal Implants

-

Orbital Implants

-

Glaucoma Implants

-

Ocular Prosthesis

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Glaucoma Surgery

-

Oculoplasty

-

Drug Delivery

-

Age related Macular Degeneration

-

Aesthetic Purpose

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Eye institutes

-

Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ocular implants market size was estimated at USD 15.73 billion in 2024 and is expected to reach USD 16.65 billion in 2025.

b. The global ocular implants market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 22.09 billion by 2030.

b. North America dominated the ocular implants market with a share of 36.8% in 2024. This is attributable to growing geriatric population and favorable reimbursement in the region.

b. Some key players operating in the ocular implants market include Bausch & Lomb, Alcon, Carl Zeiss, Johnson & Johnson, MORCHER GmbH, and STAAR surgical.

b. Key factors that are driving the market growth include the increasing prevalence of ophthalmic disorders such as glaucoma, scleritis, and Age-Related Macular Degeneration (AMD), higher acceptance of vision correction procedures, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.