- Home

- »

- Petrochemicals

- »

-

Offshore Lubricants Market Size, Industry Report, 2030GVR Report cover

![Offshore Lubricants Market Size, Share & Trend Report]()

Offshore Lubricants Market (2024 - 2030) Size, Share & Trend Analysis Report By Application (Engine Oil, Hydraulic Oil, Gear Oil, Grease), By End Use (Offshore Rigs, FPSOs, OSVs), By Region, and Segment Forecasts

- Report ID: 978-1-68038-535-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Offshore Lubricants Market Size & Trends

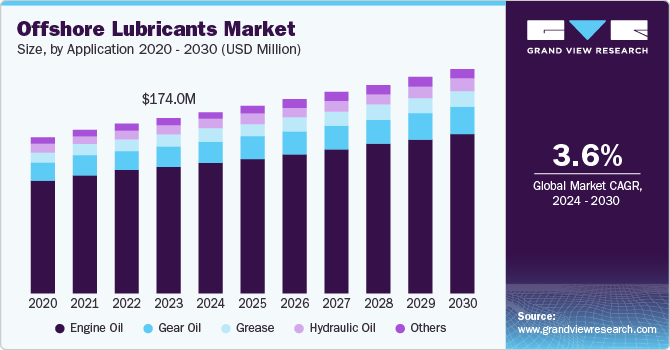

The global offshore lubricants market size was valued at USD 174.0 million in 2023 and is anticipated to grow at a CAGR of 3.6% from 2024 to 2030. The market growth is driven by the increasing rate of offshore oil and gas exploration and production projects, particularly in regions such as the Gulf of Mexico, the Arabian Sea, the Caspian Sea, and the Red Sea. These activities necessitate specialized lubricants to enhance the performance and longevity of machinery and equipment.

Offshore operations are subject to stringent environmental laws aimed at protecting marine ecosystems, so manufacturers are compelled to develop lubricants that meet these regulations. For instance, international agreements such as the International Convention for the Prevention of Pollution from Ships (MARPOL) impose strict controls on discharges and spillages, which has led to an increased demand for biodegradable and environmentally acceptable lubricants.

Moreover, regulatory bodies such as the U.S. EPA have established guidelines that specify using environmentally acceptable lubricants (EALs) in offshore applications, further incentivizing manufacturers to innovate and produce lubricants that minimize environmental impact. While compliance with these regulations can lead to higher production costs, it also opens up opportunities for companies that invest in developing advanced lubricant formulations that align with performance needs and environmental standards.

Application Insights

The engine oil segment accounted for 72.2% of the market revenue in 2023 attributed to engine oils' critical role in maintaining the efficiency and longevity of engines used in offshore operations. Engine oils are essential for reducing friction, preventing wear and tear, and ensuring smooth operation under extreme conditions. The extensive use of heavy-duty machinery and equipment in offshore drilling, production, and support vessels drives the high demand for engine oils. In addition, the increasing number of offshore exploration and production activities further boosts the demand for engine oils.

The gear oil segment is expected to grow at a CAGR of 4.3% from 2024 to 2030, driven by the increasing complexity and sophistication of offshore machinery, which requires high-performance lubricants to ensure reliability and efficiency. The expansion of offshore wind farms and the rising investments in renewable energy projects also contribute to the growing demand for gear oils. Furthermore, developing advanced gear oil formulations that offer extended service life and improved performance under harsh marine conditions is expected to drive the segment growth.

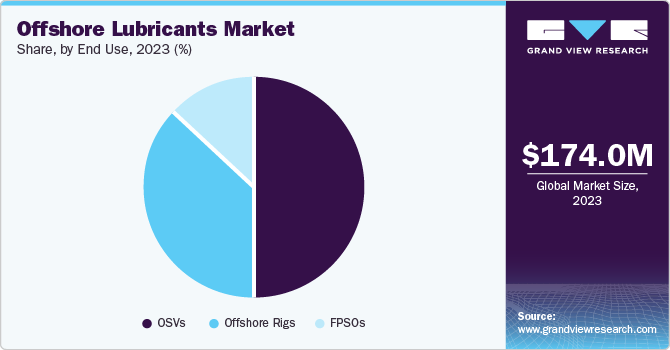

End Use Insights

The Offshore Support Vessels (OSVs) segment dominated the global market in 2023 as OSVs are essential for transporting supplies, equipment, and personnel to and from offshore rigs and platforms. They also provide crucial services such as anchor handling, towing, and platform maintenance. The high operational demands placed on OSVs necessitate using specialized lubricants to ensure the reliability and efficiency of their engines, gear systems, and hydraulic equipment.

The Floating Production, Storage, and Offloading (FPSOs) segment is expected to grow fastest over the forecast period, driven by the increasing adoption of FPSOs in deepwater and ultra-deepwater projects, where traditional offshore platforms are not feasible. The complex and continuous operations of FPSOs require a wide range of lubricants to maintain the performance and longevity of their machinery, including engines, compressors, turbines, and gear systems. The rising investments in offshore oil and gas exploration, particularly in regions such as Brazil, West Africa, and Southeast Asia, are expected to fuel the demand for FPSOs and offshore lubricants.

Regional Insights

North America accounted for a significant revenue share in the global offshore lubricants market in 2023 driven by the region’s robust offshore oil and gas exploration and production activities, particularly in the Gulf of Mexico. The presence of advanced infrastructure and technology in the U.S. and Canada supports the efficient extraction and processing of hydrocarbons, necessitating high-performance lubricants.

U.S. Offshore Lubricants Market Trends

The U.S. held a significant revenue share of the North America offshore lubricants market in 2023 attributed to its extensive offshore drilling activities and the presence of major oil and gas companies. The Gulf of Mexico remains a key area for offshore operations, with numerous rigs and production facilities requiring a steady supply of specialized lubricants.

Europe Offshore Lubricants Market Trends

The European offshore lubricants market is projected to grow steadily from 2024 to 2030. Ongoing offshore exploration and production activities in the North Sea and the Mediterranean support regional growth. European countries also invest in renewable energy projects, such as offshore wind farms requiring specialized lubricants. The stringent environmental regulations in Europe drive the adoption of eco-friendly lubricants, further supporting market growth.

The UK is expected to play a significant role in the growth of the European offshore lubricants market. The country’s extensive offshore oil and gas operations in the North Sea and its leadership in offshore wind energy are key drivers of lubricant demand. The UK’s focus on sustainability and innovation in lubricant technology also contributes to market growth.

Asia Pacific Offshore Lubricants Market Trends

The Asia Pacific offshore lubricants market is projected to grow at a CAGR of 3.5% from 2024 to 2030 driven by the increasing offshore exploration and production activities in countries such as China, India, Indonesia, and Malaysia. The region’s expanding energy needs and investments in offshore projects are boosting the demand for high-performance lubricants. In addition, the rise of offshore wind farms in Asia Pacific contributes to the market growth, as these installations require specialized lubricants for their machinery and equipment.

China held a substantial share of the Asia Pacific offshore lubricants market in 2023. The country’s significant market share is due to its extensive offshore oil and gas exploration activities, particularly in the South China Sea. China’s focus on increasing its domestic energy production to reduce reliance on imports drives investments in offshore projects, thereby boosting the demand for lubricants.

Latin America Offshore Lubricants Market Trends

The Latin America region dominated the global offshore lubricants market with a revenue share of 29.0% in 2023, which is attributed to the significant offshore oil and gas exploration activities in the region, which are driven by substantial investments and favorable government policies. Brazil's pre-salt oil fields have been particularly influential, with the country currently producing over 3 million barrels of oil daily. By 2032, this production is projected to reach 4.9 million barrels per day, with the pre-salt fields contributing to nearly 80% of the total production.

In addition, Guyana's expanding offshore oil sector, particularly with discoveries such as the Liza field, has significantly driven the demand for offshore lubricants. These developments underscore the strategic importance of the region and its potential for ongoing growth in the offshore energy sector.

Key Offshore Lubricants Company Insights

The global offshore lubricants market is driven by major companies such as Shell, Chevron Corporation, BP Plc, Exxon Mobil, Total S.A., Aegean Marine Petroleum, and Fuchs.

-

Shell is one of the top suppliers of finished lubricants and offers an extensive product portfolio that includes high-performance lubricants designed to meet the demanding conditions of offshore environments.

-

Chevron Corporation is known for its high-quality lubricant products that cater to the needs of offshore drilling and production activities. The company’s lubricants are engineered to provide superior protection and performance in harsh marine conditions, ensuring the reliability of critical offshore equipment.

Key Offshore Lubricants Companies:

The following are the leading companies in the offshore lubricants market. These companies collectively hold the largest market share and dictate industry trends.

- Shell

- Chevron Corporation

- BP Plc

- Exxon Mobil

- Total S.A.

- Aegean Marine Petroleum

- Fuchs

- Gulf Oil Corporation

- Idemitsu Kosan Co. Ltd.

- JXTG Nippon Oil & Energy Corporation

Recent Developments

-

In January 2024, Shell U.K. Limited acquired MIDEL and MIVOLT, further strengthening its global lubricants portfolio. MIDEL and MIVOLT's specialized transformer oils complement Shell's existing offerings, enabling the company to serve a broader range of customers in power distribution, offshore wind parks, utility companies, and traction power systems.

-

In May 2024, Gulf Marine Services (GMS) announced the strategic expansion of its Singapore-based fleet by adding two marine barges and a supply vessel to meet the rising demand for marine support services in the region and marks the initial phase of a broader global fleet expansion program.

Offshore Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 179.9 million

Revenue forecast in 2030

USD 222.2 billion

Growth rate

CAGR of 3.6% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Key companies profiled

Shell, Chevron Corporation, BP Plc, Exxon Mobil, Total S.A., Aegean Marine Petroleum, Fuchs, Gulf Oil Corporation, Idemitsu Kosan Co. Ltd., JXTG Nippon Oil & Energy Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Offshore Lubricants Market Report Segmentation

This report forecasts revenue & volume growth of the global offshore lubricants market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agrochemicals market report based on application, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Engine Oil

-

Hydraulic Oil

-

Gear Oil

-

Grease

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Offshore Rigs

-

FPSOs

-

OSVs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Guyana

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.