- Home

- »

- Power Generation & Storage

- »

-

Offshore Pipeline Market Size, Share & Growth Report, 2030GVR Report cover

![Offshore Pipeline Market Size, Share & Trends Report]()

Offshore Pipeline Market (2023 - 2030) Size, Share & Trends Analysis Report By Diameter, By Product, By Line Type, By Installation Type, By Depth, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-150-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Offshore Pipeline Summary

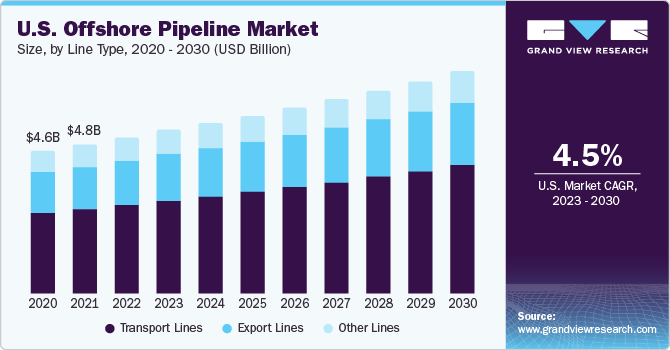

The global offshore pipeline market size was estimated at USD 13.97 billion in 2022 and is projected to reach USD 19.51 billion by 2030, growing at a CAGR of 4.2% from 2023 to 2030. The rising global demand for energy, particularly oil and natural gas, is poised to highlight the necessity for offshore pipelines, as they are vital in transporting such resources from offshore fields to onshore processing facilities, ensuring a stable supply of energy.

Key Market Trends & Insights

- The North America accounted for the largest revenue share of over 45.0% in 2022.

- The Asia Pacific is experiencing steady growth in the forthcoming years.

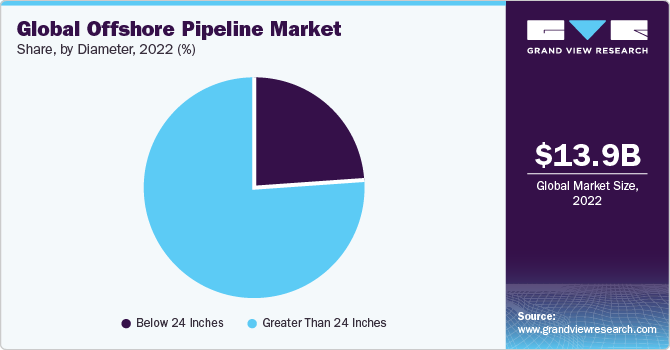

- Based on diameter, the greater than 24 inches diameter segment accounted for the largest revenue share of 76.2 % in 2022.

- Based on line type, the transport lines serve as a bridge between offshore drilling platforms or production facilities and onshore processing plants or refineries.

- Based on installation type, the S-lay method is used for shallow to medium water depths and is particularly suitable for areas with favorable sea conditions.

Market Size & Forecast

- 2022 Market Size: USD 13.97 Billion

- 2030 Projected Market USD 19.51 Billion

- CAGR (2023-2030): 4.2%

- North America: Largest market in 2022

As per the U.S. Energy Information Administration (EIA), dry natural gas production from shale formations in the country reached approximately 28.5 trillion cubic feet in 2022, accounting for around 80% of the overall dry natural gas production in the U.S. for that year. The U.S. shale gas revolution has significantly boosted natural gas production. Offshore pipelines are vital to transport shale gas from offshore fields to processing facilities and consumers, thus driving market growth.

The availability of efficient offshore pipelines enables energy companies to exploit offshore shale gas reserves economically. It ensures a smooth and reliable flow of natural gas to consumers from its source, enabling further exploration and production activities. Moreover, the reliability & efficiency of offshore pipelines makes natural gas an attractive and feasible energy source for industries as well as households, further boosting the demand for the product.

According to the U.S. Department of Energy, the country is the leading natural gas producer in the world. Natural gas accounts for around 33.33% of the primary energy consumption in the U.S. and is mainly utilized for heating and electricity generation purposes. Thus, the rising global demand for natural gas has led to its liquefaction and conversion to LNG for international markets. Offshore pipelines function as the backbone of the U.S. LNG export sector, facilitating the transportation of liquefied natural gas from production sites to export terminals. The positive outlook of the U.S. LNG export space is expected to drive the demand for offshore pipelines during the projection period.

On the other hand, offshore pipeline projects require extensive capital investment due to the complexities involved in underwater construction, safety measures, material costs, and strict compliance with environmental regulations. Moreover, securing adequate funding for such large-scale projects has become challenging, especially during economic downturns, which is expected to hinder market growth in the coming years.

Diameter Insights

Based on diameter, the market is bifurcated into greater than 24 inches and below 24 inches segments. Greater than 24 inches diameter segment accounted for the largest revenue share of 76.2 % in 2022. These pipes allow the efficient transportation of a high volume of oil and natural gas. Moreover, it experiences less friction loss, enabling resources to be transported over longer distances without a significant pressure drop.

Below 24 inches are suitable for transporting moderate volumes of oil and gas, making them an economical choice for offshore projects. Besides, these pipes are easier to handle and install, allowing for quicker deployment and commissioning of offshore pipelines.

Regional Insights

North America accounted for the largest revenue share of over 45.0% in 2022 due to the presence of vast offshore energy resources, including significant oil and gas reserves in the Gulf of Mexico. Abundant availability of these resources creates a strong demand for offshore pipelines to transport oil and natural gas to processing facilities and markets, thus driving market growth.

Asia Pacific is experiencing steady growth in the forthcoming years owing to strategic geographical locations, LNG imports, and growing industrialization. Asia Pacific has a large and growing population, leading to an increase in the demand for energy resources. Offshore pipelines are vital for meeting the rising energy needs of densely populated coastal regions and, thus are expected to stimulate the product demand over the forecast period.

Product Insights

Based on product, offshore pipeline market is segmented into oil, gas, and refined products. Growing global demand for energy, particularly oil, is expected to fuel the need for offshore pipelines to transport crude oil and refined petroleum products from offshore fields to onshore processing facilities and end-users. Discoveries of substantial natural gas reserves in offshore fields, including shale gas, contribute to the growth of offshore gas pipeline projects. The availability of these reserves drives investments in the exploration and development of offshore gas fields, thus driving market growth.

Line Type Insights

Based on line type, the global market is segmented into transport lines, export lines, and other lines. Transport lines serve as a bridge between offshore drilling platforms or production facilities and onshore processing plants or refineries. They ensure a seamless flow of extracted resources from the ocean floor to land-based facilities. Exports lines play a pivotal role in facilitating the global trade of energy products, ensuring a seamless flow of resources from offshore sources to consumers across different countries and regions.

Installation Type Insights

Based on installation type, the market for offshore pipelines is divided into S-lay, J-lay, and Tow-in. S-lay method is used for shallow to medium water depths and is particularly suitable for areas with favorable sea conditions. Moreover, S-lay installations, being relatively straightforward, contribute to shorter project timelines.

J-lay installation technique involves the use of a specialized vessel equipped with a J-shaped pipe-laying system, enabling the installation of pipelines in deep waters. It is mainly employed for projects involving complex subsea configurations, such as pipelines connecting multiple wells or subsea structures.

Tow-in installation method is a cost-effective method, especially for medium to long-distance pipelines. It eliminates the need for expensive offshore construction vessels, as the pipelines are assembled onshore and then towed to the installation location.

Depth Insights

Based on depth, the market is segmented into shallow water and deepwater. Shallow water pipelines are relatively easier and less expensive to install compared to pipelines in deeper waters. In addition, they allow for simpler construction methods and equipment, reducing installation complexities. Deepwater pipelines span long distances from offshore drilling platforms to onshore facilities. Moreover, it involves substantial costs due to the technical challenges and requirement of specialized equipment.

Key Companies & Market Share Insights

Major players are undertaking different strategies such as product launches, mergers, joint ventures, acquisitions, and geographical expansions. For instance, in March 2023, Romania's gas pipeline operator, Transgaz, intends to construct a USD 530 million pipeline connecting the Neptun Deep block in the Black Sea to the national grid. OMV Petrom, majority controlled by Romgaz and Austria's OMV, is set to make the final investment decision on the USD 4 billion Neptun Deep block by mid-2023. The Neptun Deep block is anticipated to produce a minimum of six billion cubic meters of gas annually and will be integral to the 308.3km gas pipeline, a component of the 'Gas transmission pipeline Black Sea – Podisor' project.

Key Offshore Pipeline Companies:

- SAIPEM SpA

- LARSEN & TOUBRO LIMITED

- McDermott International Ltd.

- Allseas

- China Petroleum Pipeline Engineering Co., Ltd.

- TechnipFMC plc

- SUBSEA7

- Petrofac Limited

- Penspen

- Sapura Energy Berhad

- Furgo

Offshore Pipeline Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.63 billion

Revenue forecast in 2030

USD 19.51 billion

Growth rate

CAGR of 4.2 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Diameter, product, line type, installation type, depth, region

Regional scope

North America; Europe; Asia Pacific; Rest of the World (Latin America, Middle East & Africa)

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; South-east Asia

Key companies profiled

SAIPEM SpA; LARSEN & TOUBRO LIMITED; McDermott International Ltd.; Allseas; China Petroleum Pipeline Engineering Co., Ltd.; TechnipFMC plc; SUBSEA7; Petrofac Limited; Penspen; Sapura Energy Berhad; Furgo

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Offshore Pipeline Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global offshore pipeline market report based on diameter, product, line type, installation type, depth, and region:

-

Diameter Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 24 Inches

-

Greater Than 24 Inches

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil

-

Gas

-

Refined Products

-

-

Line Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Transport Lines

-

Export Lines

-

Other Lines

-

-

Installation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

S-lay

-

J-lay

-

Tow-in

-

-

Depth Outlook (Revenue, USD Million, 2018 - 2030)

-

Shallow Water

-

Deepwater

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

South-east Asia

-

-

Rest of the World

-

Latin America

-

Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global offshore pipeline market size was estimated at USD 13.97 billion in 2022 and is expected to reach USD 14.63 billion in 2023.

b. The global offshore pipeline market is expected to witness a compound annual growth rate of 4.2% from 2023 to 2030 to reach USD 19.51 billion by 2030.

b. Greater Than 24 Inches diameter dominated the market and accounted for over 76.23% of the revenue in 2022. The increasing number of projects in oil and gas is expected to augment the market growth.

b. Some key players operating in the offshore pipeline market include Atteris, Fugro, L&T Hydrocarbon Engineering, Mcdermott, Penspan, Petrofac, Saipem, Sapura Energy Berhad, Senaat, and Subsea.

b. Key factors that are driving the market growth include increasing demand for crude oil and refined products from refineries and the petroleum industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.