- Home

- »

- Medical Devices

- »

-

Omics-based Clinical Trials Market Size, Share Report, 2030GVR Report cover

![Omics-based Clinical Trials Market Size, Share & Trends Report]()

Omics-based Clinical Trials Market (2025 - 2030) Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design (Interventional Studies, Observational Studies), By Indication, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-905-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Omics-based Clinical Trials Market Summary

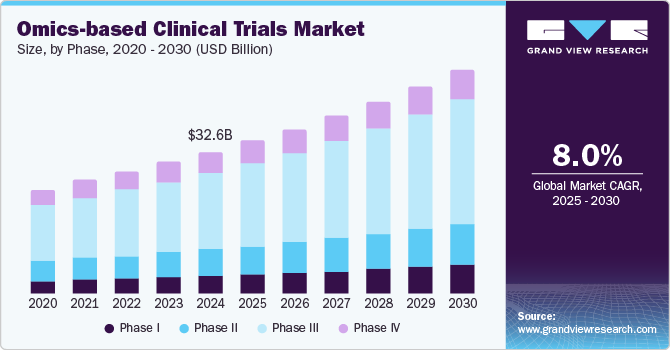

The global omics-based clinical trials market size was valued at USD 32.64 billion in 2024 and is projected to reach USD 51.77 billion by 2030, growing at a CAGR of 8.02% from 2025 to 2030. The growth of the market is mainly due to technological advancements, increasing demand for personalized medicine, growing investment by pharmaceutical companies for efficient drug development, and supportive regulatory environments.

Key Market Trends & Insights

- North America omics-based clinical trials market dominated the global industry and accounted for a 38.0% share in 2024.

- The omics-based clinical trials market in Asia Pacific is expected to grow at the highest CAGR over the forecast period.

- The omics-based clinical trials market in Europe is anticipated to witness lucrative growth over the projected period.

- Based on phase, the phase III segment dominated the market, accounting for 54.5% of the total revenue share in 2024.

- In terms of study design, the observational studies segment is projected to witness the fastest growth in the coming years.

Market Size & Forecast

- 2024 Market Size: USD 32.64 billion

- 2030 Projected Market Size: USD 51.77 billion

- CAGR (2025-2030): 8.02%

- North America: Largest market in 2024

- Saudi Arabia: Fastest growing market

The development of next-generation sequencing (NGS) and high-throughput screening methods has dramatically reduced the cost and time required for genomic analysis. These technological advancements have enabled researchers to conduct large-scale studies efficiently, facilitating the identification of biomarkers and genetic variations associated with diseases. Furthermore, increasing strategic initiatives by the market players is further contributing to market growth. Companies are increasingly focusing on enhancing genomic analysis workflow to streamline processes that minimize the time and effort required for genomic sample analysis.

For instance, in October 2023, Revvity, Inc. entered into a partnership agreement with Element Biosciences, Inc., a developer of the AVITI System, an emerging and innovative genomic sequencing platform. This collaboration aims to develop workflow solutions designed to streamline the genomic analysis of samples, significantly reducing the time and effort involved in the process. Thus, the aforementioned would also promote the adoption of personalized medicine and targeted therapies.

Regulatory bodies are increasingly supporting the integration of omics data in clinical research, recognizing its potential to improve drug safety and efficacy. Collaborative initiatives between government agencies, academic institutions, and the private sector are further boosting omics-based trials. In addition, growing cases of chronic diseases have further boosted the demand for effective and advanced treatment options. According to an article published in April 2024, Omics-based biomarkers have emerged as valuable tools in the clinical practice of metabolic dysfunction-associated steatotic liver disease (MASLD). These biomarkers facilitate improved risk stratification, allowing healthcare providers to identify patients with advanced fibrosis and those at higher risk for adverse outcomes. Thus, increasing applications of omics-based clinical trials would further contribute to the market growth.

Phase Insights

The phase III segment dominated the market, accounting for 54.5% of the total revenue share in 2024. Clinical trial statistics indicate that market growth is driven by an increase in phase III trials, which typically involve a large number of participants. The median cost for a single-phase III trial exceeds USD 19.0 million, reflecting the significant resources required. Omics-based approaches can streamline trial processes by enabling better patient stratification and more targeted therapeutic strategies, ultimately reducing costs and improving trial outcomes. In addition, as a significant portion of phase III trials are outsourced, the need for specialized omics services and expertise is projected to grow.

Phase I is projected to witness the fastest growth during the forecast period owing to increasing integration of omics technologies in clinical trial design and execution. As researchers seek to enhance the safety and efficacy of new drugs and devices, omics approaches provide valuable insights into patient-specific responses at a molecular level. This enables more accurate dosing and identification of potential adverse effects early in the development process.

Study Design Insights

The interventional studies segment dominated the market in 2024 owing to its growing emphasis on personalized medicine by facilitating tailored interventions based on individual patient profiles derived from omics technologies. They typically involve a larger patient pool further enhancing the statistical power, which allows for a more comprehensive analysis of the relationships between biomarkers and treatment responses. Moreover, growing application of omics-based data in supporting new therapeutic treatment options, several pharmaceutical and biotech companies are significantly investing in interventional studies.

The observational studies segment is projected to witness the fastest growth in the coming years. These studies allow for the collection of real-world data, which is increasingly valuable for understanding patient outcomes and treatment effectiveness in diverse populations. This type of data is essential for identifying correlations between omics profiles and clinical results, enhancing the relevance of findings in everyday clinical practice. Furthermore, advancements in data analytics and technology are making it easier to conduct large-scale observational studies, thereby attracting more investment from researchers and pharmaceutical companies.

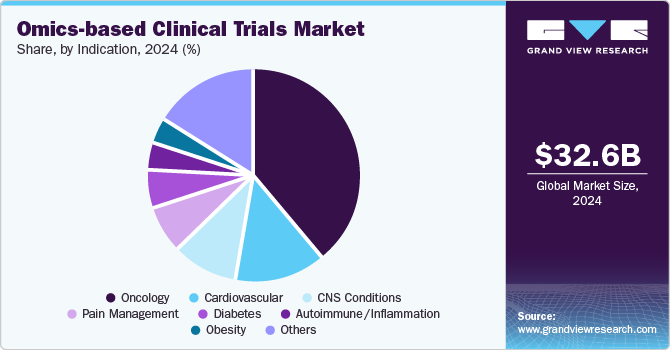

Indication Insights

The oncology segment dominated the market in 2024 owing to increasing prevalence of cancer globally coupled with growing need for more effective treatment strategies. According to an article published by the American Cancer Society in January 2024, it is estimated that there are approximately 2,001,140 new cancer cases and 611,720 cancer-related deaths in the U.S. Moreover, the same article states that the number of cancer cases is predicted to reach 35 million by 2050. Omics technologies, such as genomics, proteomics, and metabolomics, provide critical insights into the molecular mechanisms underlying various cancers, enabling the identification of biomarkers that can inform diagnosis, prognosis, and treatment selection.

The autoimmune/inflammation segment is projected to witness considerable growth in the coming years owing to a significant number of interventional studies focused on autoimmune and inflammatory conditions worldwide. These studies offer numerous advantages, including the reduction of confounding effects, the elimination of bias in the allocation of participants to exposure groups, and the efficient identification of small to moderate clinically significant effects.

Regional Insights

North America omics-based clinical trials market dominated the global industry and accounted for a 38.0% share in 2024. The growth in the region is attributed to the presence of established market players and an increasing number of clinical trials are anticipated to drive market growth. Moreover, supportive regulatory frameworks in the region facilitate the advancement of omics technologies in clinical research. Regulatory agencies, such as the FDA, are increasingly recognizing the importance of omics data in supporting drug development and approval processes. Thus, a supportive environment encourages more companies to conduct omics-based trials, further driving the regional market growth.

U.S. Omics-Based Clinical Trials Market Trends

The omics-based clinical trials market in the U.S. is driven by the growing emphasis on personalized medicine. Researchers and healthcare providers are increasingly utilizing genomic, proteomic, and metabolomic data to tailor treatments to individual patients. This shift enhances the efficacy of therapies and minimizes adverse effects, making omics-based trials essential for developing targeted therapies. According to an article published by the Mayo Clinic in February 2023, an innovative approach to genomics research is emerging, aimed at moving some omics-related studies out of traditional settings like hospitals, labs, and clinics and into the homes and communities of individuals. Thus, increasing access to clinical trials for individuals in rural and underserved areas will expand the participant pool, allowing for more diverse and representative data.

Europe Omics-Based Clinical Trials Market Trends

The omics-based clinical trials market in Europe is anticipated to witness lucrative growth over the projected period. The growth is due to the expansion of outsourcing activities among pharmaceutical companies. Several companies are entering into a partnership and collaboration agreement to advance their service offerings and accelerate their clinical trial process. This trend is contributing to the growth of the contract manufacturing market across the region.

The UK omics-based clinical trials market is anticipated to experience considerable growth over the forecast period. Increasing government support from agencies such as MHRA has increased investment and collaboration between academia, industry, and healthcare providers. Key therapeutic areas include oncology, cardiovascular diseases, and neurodegenerative disorders. Thus, increasing focus on the development of better treatment options would further drive the demand for omics based clinical trials in the country.

The omics-based clinical trials market in Germany is expected to grow at a considerable rate over the forecast period. Several government initiatives for clinical research activities have accelerated the clinical trials market in the country. Furthermore, advancements in technology and availability of high-quality clinical resources are some of the main factors responsible for the country’s market growth.

Asia Pacific Omics-Based Clinical Trials Market Trends

The omics-based clinical trials market in Asia Pacific is expected to grow at the highest CAGR over the forecast period.The growth can be attributed to constant advancement and growth in the clinical research field. Low cost per patient in Asia Pacific countries and the presence of a diverse group of patients that are easy to recruit are some of the factors contributing to the market growth. According to the data published by Clinical Trials Arena in January 2023, Asia Pacific has emerged as one of the reliant and most promising markets for clinical trials. In addition, more than 27,000 clinical trials were initiated in 2021, and nearly half of them were conducted in the Asia Pacific region. Thus, constant advancements and developments in the field of clinical trials are expected to further contribute to the market growth.

China omics-based clinical trials market is projected to witness significant growth in the coming years owing to the increasing demand for biopharmaceuticals. Pharmaceutical companies in the country are increasing their focus on developing innovative therapies, particularly in oncology and chronic diseases. Thus, these factors are boosting the demand for omics based clinical trials in the country. According to the data published by Labiotech UG, in February 2023, China is leading phase 1 clinical trials globally. The trend is driving the entry of major players such as Catalent Pharma Solutions in China, which is expected to contribute to the market growth.

The omics-based clinical trials market in Japan is expected to witness lucrative growth over the forecast period. Japan is a major potential destination for biopharmaceuticals and global CROs due to advancements in technology, policy reforms, faster recruitment of patients, and presence of a developed R&D infrastructure. Moreover, growing government support such as faster clinical trial approval is expected to encourage market players to invest in the country’s market as it would be easy for the companies to accelerate their product launches. Thus, these factors are expected to drive clinical research studies in the country, further increasing the demand for efficient clinical trial options.

India omics-based clinical trials market is poised to grow in the coming years. Low labor costs, improvements in healthcare infrastructure, and easy availability of technical expertise are expected to be some of the major factors propelling market growth over the forecast period. Moreover, increasing number of clinical trials in India, owing to growing demand for treatment options for cardiovascular diseases, kidney diseases, and diabetes, is one of the major factors driving market growth. Therefore, to meet the growing demand, market players are undertaking several initiatives such as entering into partnership agreements with several clinical trial outsourcing firms in the country to accelerate their product launches.

MEA Omics-Based Clinical Trials Market Trends

The omics-based clinical trials market in the Middle East and Africa is projected to grow at a lucrative rate. Growth in the region can be attributed to rising incidence of chronic diseases. Furthermore, MEA is one of the emerging markets for conducting clinical trials owing to increase in the demand for quality care, presence of a diverse population, and ease in patient recruitment. The region has much to offer with its untapped market for clinical trials with expanding pharmaceutical, biopharmaceutical, and medical devices companies. In addition, the number of CROs in the region has been experiencing an upsurge in the past years. The country's attractive incentive policies have pulled big pharmaceutical companies such as Pfizer, AstraZeneca, and Amgen to expand in the region.

Saudi Arabia omics-based clinical trials market is projected to witness the fastest growth rate owing to the growing awareness about the benefits of effective pharmaceutical solutions, and rising investments in R&D. The pharmaceutical industry in Saudi Arabia is expected to gain substantial benefits over the forecast period due rising prevalence of diseases, presence of CMOs, and the growing number of clinical trials.

Key Omics-based Clinical Trials Company Insights

Key players operating in the omics-based clinical trials market are undertaking various initiatives to strengthen their market presence and increase the reach of their services. Companies such as Parexel International Corporation, Pharmaceutical Product Development (PPD), ICON plc are continuously involved in expanding their facilities, collaborating, and engaging in partnerships, mergers, and acquisitions of companies. These are key strategic initiatives that are influencing industry dynamics. For instance, in June 2024, Thermo Fisher Scientific Inc. announced the launch of new solutions designed to accelerate research workflows at the annual American Society for Mass Spectrometry (ASMS) Conference in California. The latest mass spectrometry and chromatography instruments, along with advanced software solutions, offers researchers the chance to achieve deeper analytical insights with tailored flexibility. This innovation improves productivity and efficiency, ultimately accelerating translational research workflows and driving the advancement of omics-based clinical trials.

Key Omics-based Clinical Trials Companies:

The following are the leading companies in the omics-based clinical trials market. These companies collectively hold the largest market share and dictate industry trends.

- Parexel International (MA) Corporation

- Thermo Fisher Scientific Inc.

- Charles River Laboratories

- ICON plc

- SGS Société Générale de Surveillance SA

- Eli Lilly and Company

- Pfizer Inc.

- Laboratory Corporation of America

- Novo Nordisk A/S

- Rebus Biosystems, Inc.

Recent Developments

-

In October 2024, PacBio and Macrogen announced the opening of new laboratory to enhance genomics innovation in Singapore. The collaboration aims to translate genomic discoveries into clinical and commercial solutions, ultimately advancing personalized medicine and expanding the scope of omics-based research and trials.

-

In September 2024, Eli Lilly and Company entered into a collaborative agreement with the 5 Prime Sciences to accelerate early development and target discovery in the field of cardio-metabolic diseases. This innovation is expected to enhance patient outcomes and attract further investment in biotechnology and personalized medicine, thereby expanding the overall market for omics-based research and therapies.

-

In January 2023, BioNTech entered into a partnership agreement with the UK Government to Deliver Personalized mRNA Cancer Immunotherapies to Up to 10,000 Patients by 2030. This collaboration emphasizes the importance of personalized medicine, leveraging advanced genomic and proteomic technologies to tailor therapies to individual patient profiles.

Omics-Based Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 35.20 billion

Revenue forecast in 2030

USD 51.77 billion

Growth rate

CAGR 8.02% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, study design, indication, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China, India, South Korea, Thailand, Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Parexel International (MA) Corporation, Thermo Fisher Scientific Inc., Charles River Laboratories, ICON plc, SGS Société Générale de Surveillance SA, Eli Lilly and Company, Pfizer Inc., Laboratory Corporation of America, Novo Nordisk A/S, Rebus Biosystems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Omics-Based Clinical Trials Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global omics-based clinical trials market report based on phase, study design, indication, and region.

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Interventional Studies

-

Observational Studies

-

Expanded Access Studies

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Autoimmune/inflammation

-

Pain management

-

Oncology

-

CNS conditions

-

Diabetes

-

Obesity

-

Cardiovascular

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global omics-based clinical trials market size was estimated at USD 32.64 billion in 2024 and is expected to reach USD 35.20 billion in 2025.

b. The global omics-based clinical trials market is expected to grow at a compound annual growth rate of 8.02% from 2025 to 2030 to reach USD 51.77 billion by 2030.

b. North America dominated the omics-based clinical trials market with a share of 38.0% in 2024. This is attributable to the presence of major pharmaceutical companies availability of advanced technologies together, and the rising demand for omics-based clinical trials.

b. Some key players operating in the omics-based clinical trials market include Parexel International (MA) Corporation, Thermo Fisher Scientific Inc., Charles River Laboratories, ICON plc, SGS Société Générale de Surveillance SA, Eli Lilly and Company, among others

b. Key factors that are driving the omics-based clinical trials market growth include an increase in the number of clinical trials for various therapeutic areas and growing prevalence of chronic disorders such as cancer

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.