- Home

- »

- Next Generation Technologies

- »

-

On-board Charger Market Share, Share, Growth Report 2030GVR Report cover

![On-board Charger Market Size, Share & Trends Report]()

On-board Charger Market Size, Share & Trends Analysis Report By Power Output (Less Than 11 kW, 11 kW To 22 kW), By Vehicle Type (Passenger Car, Buses), By Propulsion Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-515-9

- Number of Report Pages: 113

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

On-board Charger Market Size & Trends

The global on-board charger market size was valued at USD 5.21 billion in 2022 and is expected to grow a compound annual growth rate (CAGR) of 18.5% from 2023 to 2030. The high cost of charging an electric vehicle at public charging stations is creating the demand for on-board chargers in the current days. The public chargers near highways, malls, and workplaces are subject to commercial electric rates, which are higher as compared to residential rates. This is creating the need for on-board chargers for an electric vehicle. An on-board charger is used in an electric vehicle for charging the traction battery by converting the AC input received from the grid to DC input required to charge the batteries.

The increase in the number of AC private and public charging stations across the globe is one of the major factors driving the market growth. The AC level 1 on-board charger is deployed in all types of electric vehicles and can be plugged into ordinary power outlets. This type of charger is in demand among the users as it does not require additional electric work, which minimizes the overall costing of installation. Additionally, approvals received for AC level 2 charging stations are also one of the major factors accentuating the market growth. For instance, in October 2020, EVBox, an electric vehicle charging infrastructure provider, announced that its EVBox Iqon, a level 2 commercial charging station, received UL certificate and is now available for installation across North America.

Silicon carbide semiconductor technology is increasingly being used for manufacturing on-board chargers as it provides high power density with an efficiency rate of more than 98%. Various companies are thereby increasing their focus on providing higher power and more efficient silicon carbide on-board chargers, which is creating new opportunities for the market growth. For instance, in January 2020, Innolectric, an on-board charger provider, announced the launch of a 22-kW silicon carbide on-board charger. This new charger was developed by the company under its partnership with STMicroelectronics.

The increasing deployment of electric charging stations worldwide is propelling the market growth. For instance, in February 2021, Shell announced the plan of deploying 500,000 electric charging stations by 2025. On-board chargers are deployed in an electric vehicle that supports AC level 1 and level 2 charging. According to the study published by Idaho National Laboratory, 8% of the charging of Nissan Leaf is carried through DC fast chargers and the rest of the charging is done through AC level 1 and level 2 chargers.

The installation cost of an AC charging station is low compared to DC charging stations. The average cost required for installing a level 2 residential charger is approximately USD 1,354, which includes upgraded electrical services that are necessary for old homes. Additionally, the installation of a workplace level 2 charging station costs USD 2,223. However, the installation of fast DC chargers costs USD 22,626 and requires additional electrical services, owing to which, the demand for AC charging stations is increasing, ultimately accentuating the market growth.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic negatively impacted the sales of electric vehicles in the first half of 2020, which hindered the market growth. According to the statistics provided by the Society of Electric Vehicle Manufacturers, registration of electric vehicles during 2021 declined by 20%, to 236,802 units compared to 295,683 units in 2020. However, efforts are being undertaken by governments, such as the increase in purchase incentives, decline in battery costs, upgrade offers by original equipment manufacturers for EV, during the pandemic provided opportunities for EV adoption. For instance, in Germany, the purchase subsidy provided on BEV, which was to end in 2021, was extended to 2025 due to the pandemic.

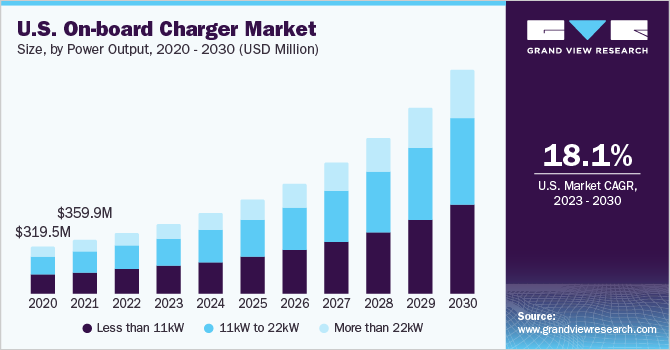

Power Output Insights

The less than 11 kW segment dominated the market and accounted for more than 40.0% share of the global revenue in 2022. Most electric vehicles are expected to feature 6 kW to 11 kW on-board chargers in the coming years. According to the statistics published by OpenSystems Media, approximately 98.2% of on-board chargers will be 6 kW to 11 kW, rather than 3 kW to 5 kW, in the upcoming years. At the same time, benefits offered by less than 11 kW on-board chargers, such as increased charging efficiency and maximized performance, are expected to drive the segment growth.

The 11 kW to 22 kW segment is anticipated to register the significant growth over the forecast period. The 11-22 kW chargers are tri-phase AC chargers that charge an electric vehicle in two to four hours. A tri-phase AC charger is commonly used as a public charge point. According to the statistics provided by Transport & Environment, 61% of European public chargers are tri-phase AC chargers.

Vehicle Type Insights

The passenger cars segment dominated the market and accounted for more than 54.0% share of the global revenue in 2022. The increasing sales of electric passenger cars globally are expected to create the demand for on-board chargers. For instance, over 750,000 all-electric cars were registered in the U.S. in 2022, which was 57% higher than 2021.

The buses segment is expected to register the fastest growth over the forecast period. An on-board charger is used in buses for converting the AC to DC for charging the battery. The increase in sales of zero-emission buses globally is expected to accentuate the segment growth. According to the statistics provided by Sustainable Bus, a web magazine focused on the electric buses market, by 2040, the sales of electric buses are expected to rise to 83%.

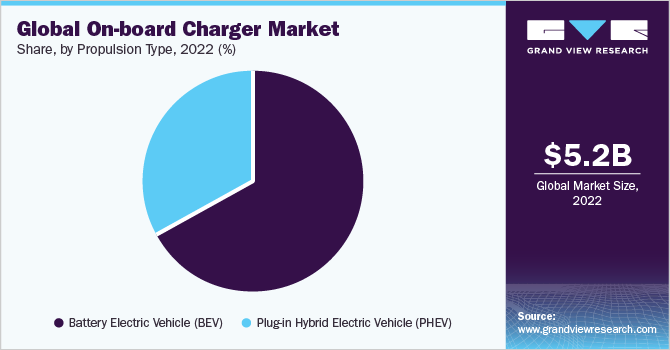

Propulsion Type Insights

The BEV segment dominated the market and accounted for more than 67.0% share of the global revenue in 2022. In Battery Electric Vehicle (BEV), the propulsion is provided through the plug-in charged battery. The rise in BEV vehicles is driving the segment growth. Various companies such as Tesla, Inc., Volkswagen, Audi, and Mercedes-Benz have accounted for the large share in the BEV segment. In 2022, 484,351 Tesla BEVs were registered in the U.S. which was 41% higher than 343,000 registrations in 2021.

The PHEV segment is expected to register the fastest growth over the forecast period. Various Plug-in Hybrid Electric Vehicle (PHEV) manufacturers are adopting on-board chargers with an output between 3 to 3.7 kW, which is driving the segment growth. Car models such as Hyundai Sonata PHEV, Kia K5 PHEV, and Outlander PHEV use on-board chargers for charging their batteries. PHEVs are witnessing exponential growth across the world. In February 2022, BYD, a China-based electric vehicle manufacturer, sold 191,664 PHEVs, witnessing an increase of 119%, compared to 2021.

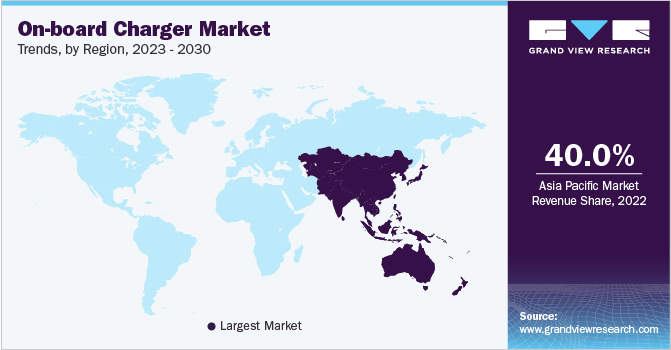

Regional Insights

The Asia Pacific region dominated the on-board charger market and accounted for more than 40.0% share of the global revenue in 2022. The growing demand for on-board chargers in Asia Pacific is driven by the increasing adoption of EVs, expanding charging infrastructure, and the availability of renewable energy sources. As the region continues to prioritize sustainability and green technologies, the demand for on-board chargers is likely to continue to grow in the years to come.

The European regional market is expected to register significant growth over the forecast period. The players in Europe are continuously making efforts to expand their EV offerings, which is thereby driving the demand for on-board chargers. According to the BMW vision, the company has planned to electrify its SUVs, sedans, and Mini vehicles in Europe by 2030. At the same time, an increase in subsidies provided on the purchase of electric vehicles is also one of the major factors driving the market growth in the region.

Key Companies & Market Share Insights

The market is highly fragmented in nature. It is characterized by the presence of a large number of players. The players in the market are focused on strategies such as mergers and acquisitions and partnerships for strengthening their offerings. For instance, in March 2023, at a construction trade show CONEXPO-CON/AGG, EDN SRL, an Italian manufacturer of on-board chargers showcased its new on-board battery chargers (BHP22 for Europe and BHP19 for the US) for electric and plug-in hybrid applications in the off-highway sector. The company claims their chargers to be compact and lightweight and are integrated with conversion technology that enhances power density.

The players in the market are also focusing on expanding their EV charging capabilities by partnering with other players. For instance, in March 2021, Eaton announced the acquisition of Green Motion SA, a manufacturer and designer of electric vehicle charging software and hardware. Through this acquisition, Eaton expanded its electric charging capabilities. Some prominent players in the on-board charger market include:

-

Bel Fuse Inc.

-

Delta Energy Systems

-

STMicroelectronics

-

Toyota Industries Corporation

-

Eaton

-

Stercom Power Solutions GmbH

-

innolectric AG

-

BRUSA Elektronik AG

-

AVID Technology Limited

-

Ficosa Internacional SA

On-board Charger Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.98 billion

Revenue forecast in 2030

USD 19.67 billion

Growth rate

CAGR of 18.5% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion/million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Power output, vehicle type, propulsion type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; China; South Korea; Japan; India; Australia; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

Bel Fuse Inc.; Delta Energy Systems; STMicroelectronics; Toyota Industries Corporation; Eaton; Stercom Power Solutions GmbH; innolectric AG; BRUSA Elektronik AG; AVID Technology Limited; Ficosa Internacional SA.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

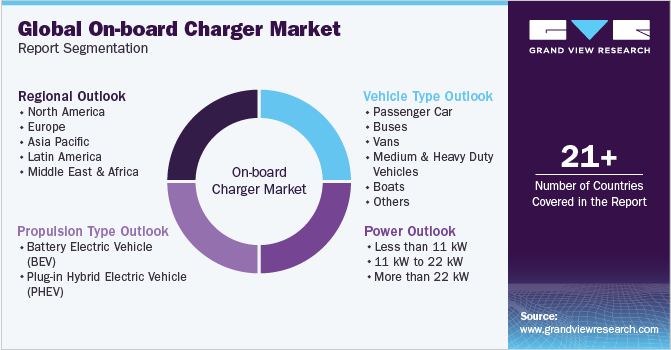

Global On-board Charger Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global on-board charger market report based on power output, vehicle type, propulsion type, and region:

-

Power Output Outlook (Revenue, USD Billion, 2017 - 2030)

-

Less than 11 kW

-

11 kW to 22 kW

-

More than 22 kW

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Passenger Car

-

Buses

-

Vans

-

Medium & Heavy Duty Vehicles

-

Boats

-

Others

-

-

Propulsion Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Battery Electric Vehicle (BEV)

-

Plug-in Hybrid Electric Vehicle (PHEV)

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the on-board charger market with a share of over 40.0% in 2022. This is attributable to the rise in government efforts for promoting electric vehicle sales in various countries such as China, India, and others.

b. Some key players operating in the on-board charger market include Bel Fuse Inc.; Delta Energy Systems; STMicroelectronics; Toyota Industries Corporation; Eaton; Stercom Power Solutions GmbH; innolectric AG; BRUSA Elektronik AG; AVID Technology Limited; Ficosa Internacional SA.

b. Key factors that are driving the on-board charger market growth include an increase in penetration of electric vehicles and a rise in government efforts for promoting electric vehicles sales.

b. The global on-board charger market size was estimated at USD 5.21 billion in 2022 and is expected to reach USD 5.98 billion in 2023.

b. The global on-board charger market is expected to grow at a compound annual growth rate of 18.5% from 2023 to 2030 to reach USD 19.67 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."