- Home

- »

- Pharmaceuticals

- »

-

Oncology Based In-vivo CRO Market Size Report, 2030GVR Report cover

![Oncology Based In-vivo CRO Market Size, Share & Trends Report]()

Oncology Based In-vivo CRO Market Size, Share & Trends Analysis Report By Indication (Blood Cancer, Solid Tumor), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-859-6

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

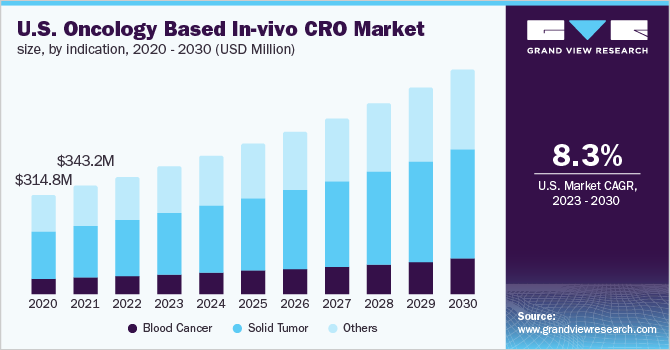

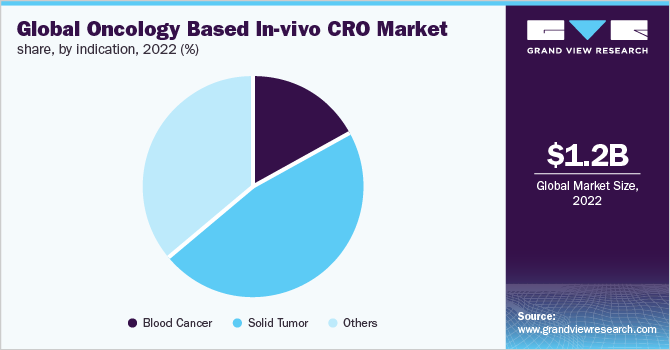

The global oncology based in-vivo CRO market size was valued at USD 1.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.2% from 2023 to 2030. The increasing frequency of outsourcing of R&D activities by major pharmaceutical companies to focus on their core competencies is a high-impact-rendering driver for market growth. Furthermore, the economic efficiency offered by CROs rather than conducting an in-house study is likely to boost their demand over the forecast period.

The oncology based in-vivo CRO activities were heavily disrupted in 2020 owing to the repercussions of the COVID-19 pandemic. Several clinical trials were delayed owing to the ongoing pandemic. Cancer patients are vulnerable to COVID and are at high risk for contracting severe consequences from the disease. According to the International Agency for Research on Cancer (IARC), the global cancer burden was 19.3 million cases in 2020.

The challenge for healthcare providers was to limit the exposure of their patients and patients’ caregivers to COVID patients as well as asymptomatic carriers while continuing to ensure access to clinical trials. However, the future seems promising for the market with the emergence of telehealth and virtual clinical trials. Such technologies allow CRO activities while ensuring the safety of cancer patients. Furthermore, regulatory bodies such as the U.S. FDA have issued guidance and developed new policies to cope with the current scenario and solve the problem of bottlenecked clinical trials.

The present business scenario is witnessing rapid changes in the marketplace and consumer preferences are pushing the players to innovate and generate better-performing products at a faster rate to sustain. CROs have developed their products and services such that they help manufacturers in gaining momentum with their R&D processes and overcome any hurdles that they may face.

Owing to their proficiency and years of experience in the business, CROs perform the given tasks at an exceptionally fast speed. According to a survey conducted by Tufts Center for the Study of Drug Development (CSDD), among the top management of the major pharmaceutical companies, more than 75.0% of executives said that CROs are more time-efficient in comparison to the internal teams, thereby increasing the need for outsourcing.

Pharmaceutical organizations are increasingly outsourcing R&D activities to CROs to stay competitive and flexible in the world of growing knowledge, gradually sophisticated technologies, and an unstable economic environment. The tasks that companies prefer to outsource include a wide range of activities from basic research to late-stage development such as target validation, hit exploration, and lead optimization, genetic engineering, assay development safety, and efficacy tests in animal models as well as clinical trials involving humans.

Indication Insights

The solid tumors segment dominated the market for oncology-based in-vivo CRO and accounted for the largest revenue share of 46.9% in 2022. The segment is also anticipated to register the fastest CAGR growth during the forecast period. The factor responsible for higher research in the field of solid tumors is the presence of over 800 new molecules in the research pipeline, undertaken by large pharmaceutical companies. Furthermore, the availability of grants from institutes such as NIH and NCI, and the existing gap between the demand and supply of treatments for solid cancer also remain promising drivers of growth. Solid tumors are abnormal mass of tissue, which grows during cancer, and affects various body parts including organs, muscles, or bones. These are generally addressed as carcinomas and sarcomas.

Blood cancer-based in-vivo research is expected to witness lucrative growth over the forecast period. The rapid rise in investigational molecules for oncology along with research in the field of stem cells is anticipated to promote high investment within the in-vivo space for oncology. Blood cancer is inclusive of all the tumors that are either generated in the blood or have the capability to migrate within the blood system. Broadly these comprise myelomas, lymphomas, and leukemia.

Regional Insight

North America dominated the oncology based in-vivo CRO market and accounted for the largest revenue share of 49.6% in 2022. This can be attributed to the presence of technologically advanced CROs present in this region. The U.S. has the highest per capita healthcare spending and the availability of funding and grants from government organizations such as the National Institute of Health (NIH) fosters research activities. The trend for reducing the R&D cost level is most common in major life sciences companies. Clinical trial sponsors are facing huge pressure owing to the increasing complexity of the research methodology to reduce time and cost. The increasing R&D activities and the need to reduce the overall trial expenditure are expected to drive the need for CROs in North America.

Asia Pacific is projected to exhibit lucrative growth in the market for oncology based in-vivo CRO over the forecast period. The presence of untapped opportunities, constantly improving healthcare infrastructure, economic development, and a huge patient base is some factors responsible for the rapid growth. This region also ranks on top in ease of doing business. Moreover, with the availability of qualified labor and other resources, Asia Pacific would be the key destination for in-vivo CRO projects over the forecast period.

Key Companies & Market Share Insights

Key market players are undertaking various strategic initiatives such as the signing of the new partnership agreement, collaborations, mergers and acquisitions, and geographic expansion, aiming to strengthen their services, and manufacturing capacities, thus providing a competitive advantage. For instance, in August 2022, Thermo Fisher Scientific Inc. announced an agreement with Prescient Therapeutics to advance the commercialization & development of the OmniCAR cell therapy platform. This agreement would assess the viability of leveraging automated closed-cell therapy solutions to create a unique technique for producing cell treatments on the OmniCAR platform without the use of viruses. Some prominent players in the global oncology based in-vivo CRO market include:

-

Charles River Laboratory

-

ICON Plc

-

Thermo Fisher Scientific Inc.

-

Eurofins Scientific

-

Taconic Biosciences

-

Crown Bioscience

-

LabCorp

-

WuXi AppTec

-

EVOTEC

- The Jackson Laboratory

Oncology Based In-vivo CRO Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.3 billion

Revenue forecast in 2030

USD 2.3 billion

Growth rate

CAGR of 8.2% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

Charles River Laboratory; ICON Plc; LabCorp; Eurofins Scientific; Taconic Biosciences; Crown Bioscience; Thermo Fisher Scientific Inc., Inc.; WuXi AppTec; EVOTEC; The Jackson Laboratory

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oncology Based In-vivo CRO Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oncology based in-vivo CRO market report based on indication and region.

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood cancer

-

Syngeneic model

-

Patient Derived Xenograft (PDX)

-

Xenograft

-

-

Solid tumors

-

Syngeneic model

-

Patient Derived Xenograft (PDX)

-

Xenograft

-

-

Others

-

Syngeneic model

-

Patient Derived Xenograft (PDX)

-

Xenograft

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global oncology based in-vivo contract research organization market size was estimated at USD 1.2 billion in 2022 and is expected to reach USD 1.3 billion in 2023.

b. The global oncology based in-vivo contract research organization market is expected to grow at a compound annual growth rate of 8.2% from 2023 to 2030 to reach USD 2.3 billion by 2030.

b. North America dominated the oncology based in-vivo contract research organization market with a share of 46.9% in 2022. This is attributable to the increasing frequency of outsourcing R&D activities by the major pharmaceutical companies in order to focus on their core competencies is the vital impact rendering driver.

b. Some key players operating in the oncology based in-vivo contract research organization market include Crown Bioscience, Charles River Laboratory, ICON Plc., Eurofins Scientific, Taconic Biosciences, LabCorp, EVOTEC, The Jackson Laboratory, and Wuxi AppTec. Other players operating in this space are MI Bioresearch, Inc., Living Tumor Laboratory, Champion Oncology, Inc., and Xentech.

b. Key factors that are driving the oncology based in-vivo contract research organization market growth include a focus on core competencies by the pharmaceutical players, and accelerating time to market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."