- Home

- »

- Healthcare IT

- »

-

Oncology Information Systems Market Size Report, 2030GVR Report cover

![Oncology Information Systems Market Size, Share & Trends Report]()

Oncology Information Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Products & Services (Solutions, Professional Services), By Application (Medical Oncology, Surgical Oncology), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-036-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Oncology Information Systems Market Summary

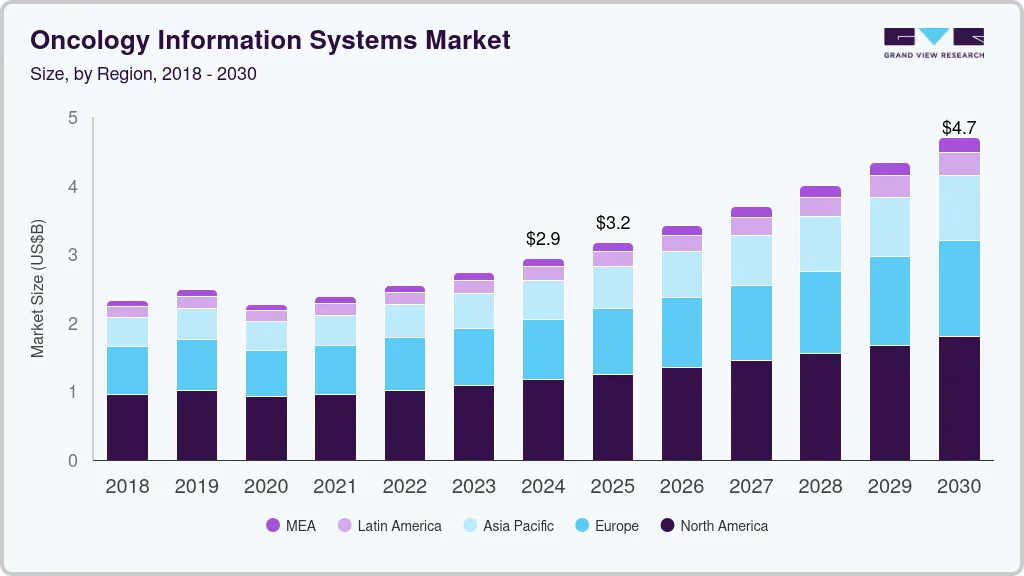

The global oncology information systems market size was estimated at USD 2,944.0 million in 2024 and is projected to reach USD 4,693.9 million by 2030, growing at a CAGR of 8.1% from 2025 to 2030. The increasing burden of cancer cases and the growing need for precision oncology drives the adoption of Oncology Information Systems (OIS).

Key Market Trends & Insights

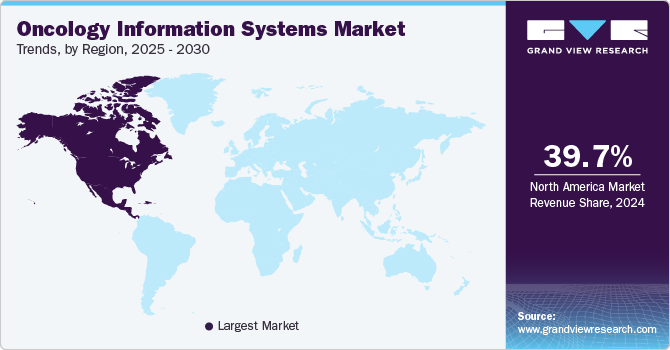

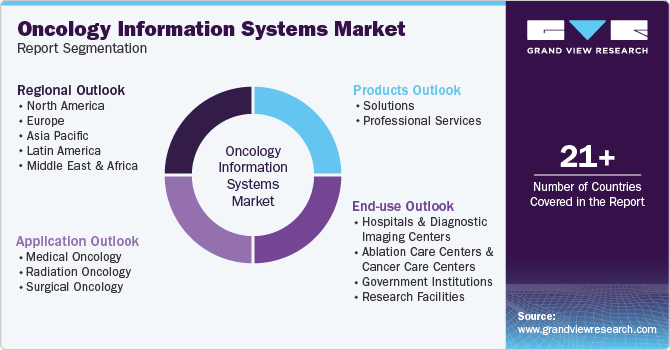

- North America oncology information systems market held the largest revenue share of 39.67% in 2024.

- Oncology information systems market in Asia Pacific is expected to witness the fastest growth over the forecast period.

- Based on products & services, the solutions segment dominated the market with a revenue share of 73.99% in 2024 and is expected to grow at the fastest CAGR during the forecast period.

- Based on application, the medical oncology segment accounted for the largest revenue share of 61.81% in 2024 and is projected to grow at the fastest CAGR from 2025 to 2030.

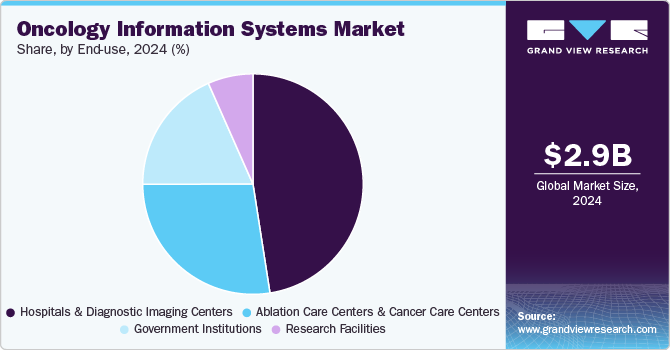

- Based on end-use, the hospitals & diagnostic imaging centers segment held the largest revenue share of 47.53% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,944.0 Million

- 2030 Projected Market Size: USD 4,693.9 Million

- CAGR (2025-2030): 8.1%

- North America: Largest market in 2024

In addition, the shift toward artificial intelligence (AI)-driven treatment planning and real-time patient monitoring is transforming oncological workflows by enhancing accuracy and efficiency.

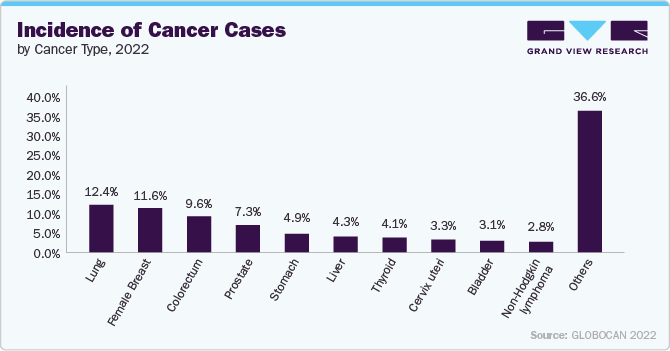

The rising global burden of cancer is a key growth driver for the oncology information system (OIS) market. According to the World Health Organization (WHO), cancer remains a leading cause of mortality globally, accounting for approximately one in every six deaths. In addition, the Global Cancer Statistics 2022 reported 19.96 million new cancer cases and 9.73 million deaths, with lung, colorectal, liver, and breast cancers contributing to the highest mortality rates. The growing number of cancer cases demands efficient patient data management, treatment planning, and precision oncology solutions, further fueling the adoption of oncology information systems (OIS).

Growing investments and advancements in cancer diagnostics and radiology are further supporting OIS adoption. For instance, India’s cervical cancer elimination program, backed by the Indian Council of Medical Research (ICMR), aims to improve screening, early diagnosis, and treatment access, areas where OIS helps streamline data and workflows. Similarly, the Japan International Cooperation Agency (JICA) invested USD 75 million from 2019 to 2023 to enhance oncology infrastructure in Asia Pacific, boosting readiness for OIS implementation. Research projects such as Johns Hopkins University’s USD 20.9 million Cancer Moonshot initiative and the Accuray-Limbus AI partnership for AI-based auto-contouring are also enhancing OIS capabilities in treatment planning and radiotherapy.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) is transforming OIS functionality. AI-enabled OIS platforms process data from electronic health records, genomic profiles, and medical imaging to automate patient management, predict treatment outcomes, and improve tumor detection. For instance, in July 2024, MIT and ETH Zurich developed an AI model to detect stages of Ductal Carcinoma in Situ (DCIS) from breast tissue images, helping to accelerate diagnosis and reduce complex testing. These advancements make OIS essential for delivering data-driven, personalized cancer care and improving patient outcomes.

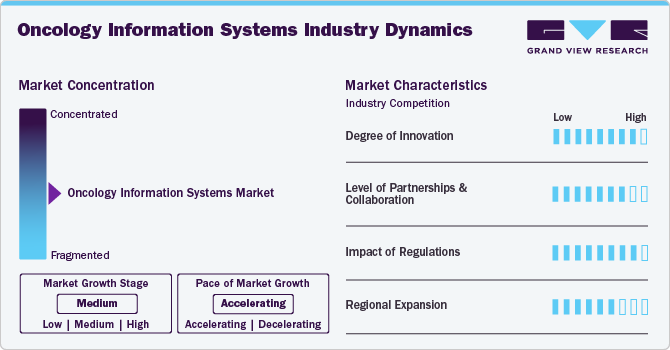

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the oncology information systems market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, the regional expansion observes moderate growth.

The degree of innovation in the industry is high. The market is experiencing significant innovation as numerous players introduce new AI-integrated products to simplify hospital workflows and enhance patient care. For instance, in October 2024, GE Healthcare launched CareIntellect. This AI-powered cloud-based oncology application allows healthcare providers to assess disease progression and identify deviations from the treatment plan, helping them make informed decisions regarding future treatment regimes. This application also helps assess clinical trial eligibility and tracks adherence to treatment protocols.

The level of partnerships & collaboration activities by key players in the industry is high to increase their capabilities, expand product portfolios, and improve competencies. For instance, in June 2022, Accuray Incorporated and Limbus AI Inc. entered a strategic partnership to amalgamate Limbus’ AI-powered auto-contouring algorithms with Accuray’s adaptive radiotherapy capabilities.

"Accuray is focused on improving the care of patients undergoing radiation therapy. Providing practical adaptive solutions for clinics of any size, in any location, is one approach and the software offered by Limbus AI will play a big role in making this goal a reality. The partnership with Limbus represents another step forward for Accuray in the development of innovative artificial intelligence (AI)-driven solutions that meet the needs of providers and enables them to deliver personalized patient care, such as with our Synchrony AI-driven real-time target tracking with dynamic delivery technology, on both the Radixact and CyberKnife Systems."

- Joshua H. Levine, chief executive officer of Accuray.

The impact of regulations on the market is high. Oncology information systems are considered under healthcare information systems. The regulations for Healthcare Information Systems in the U.S. are primarily focused on protecting Personal Health Information (PHI) and ensuring secure data exchange. Moreover, in Europe, the European Medicines Agency (EMA) oversees the regulation of medical devices and software under the Medical Device Regulation (MDR). Regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the General Data Protection Regulation (GDPR) in Europe impose strict requirements on data privacy and security for software that handles sensitive patient information.

The level of regional expansion in the industry is moderate. Increasing demand for oncology information systems in developing countries, owing to the robust investments in healthcare IT. For instance, in February 2022, Elekta announced the establishment of an office in Manila, Philippines to expand its business presence and product offerings in Southeast Asian markets. Through this business establishment, Elekta will address the gap in Philippines’ radiation therapy market and patient accessibility.

Case Study: Integration of RaySearch’s RayStation treatment planning system and the RayCare oncology information system by the department of radiation oncology at Heidelberg University Hospital to enhance personalized care for cancer patients.

“RayCare enables us to unify our workflows where possible and keep them specific where needed. With a single system, we can centralize planning workflow support and resources, communication and QA checkpoints. The whiteboard function gives us an excellent overview of the patient throughout the treatment process, and it can be used to follow-up and manage the workflow tasks.”

- Dr. Kai Schubert, Medical Physicist at the Department of Radiation Oncology and Radiation Therapy at Heidelberg University Hospital

Products & Services Insights

The solutions segment dominated the market with a revenue share of 73.99% in 2024 and is expected to grow at the fastest CAGR during the forecast period. The software solutions used in OIS help maintain patient records, predict treatment results, and plan treatment regime for cancer patients. These software solutions facilitate exchange of patient information across healthcare organizations to create a bridge between practitioners and radiology centers, which improves the safety and efficiency of cancer treatment. In addition, these software solutions also help physicians and surgeons select a suitable treatment, which, in turn, helps improve the survival rates of cancer patients. For instance, in December 2024, Varian, a Siemens Healthineers company, received 510(k) clearance from the U.S. FDA to sell its RapidArc Dynamic treatment planning solution.

“RapidArc Dynamic is the latest example of Varian’s sustained investment in innovation, and ushers in a radical transformation in radiotherapy planning and delivery designed to bring flexibility to care teams using for arc therapy,”

-said Sasa Mutic, PhD, President, Radiation Oncology Solutions for Varian.

Moreover, the professional services segment is expected to grow significantly over the forecast period, as these services are increasingly outsourced. As hospitals and clinics lack in-house resources and skills required for the deployment of OIS software, these services are outsourced. Outsourcing can be a short-term project or a long-term contract.

Application Insights

The medical oncology segment accounted for the largest revenue share of 61.81% in 2024 and is projected to grow at the fastest CAGR from 2025 to 2030. Medical oncology is a modality of cancer treatment that involves the use of immunotherapy, chemotherapy, hormonal therapy, and targeted therapy. This modality offers a comprehensive and efficient approach to treating cancer. Furthermore, increasing prevalence of cancer is expected to drive market growth. Increasing usage of the above therapies for effective treatment of cancer is expected to drive market growth.

The surgical oncology segment is also expected to witness significant growth during the forecast years.Cancer care has evolved rapidly over the decades. Surgery is no longer the treatment for most solid malignancies, but the combination of surgery and multi-modal therapies mostly focused on radiotherapy, targeted molecular therapies, and chemotherapy is the preferred treatment. As a result, surgeons have to communicate with different specialists for treatment and have to work with a multi-disciplinary team. Thus, increasing complexity in surgical treatments for solid malignancies is expected to drive growth of the surgical oncology OIS market.

End-use Insights

The hospitals & diagnostic imaging centers segment held the largest revenue share of 47.53% in 2024. Hospitals increasingly adopt OIS to streamline workflows, integrate multidisciplinary data, and enhance treatment planning. By connecting oncologists, radiologists, and pathologists, OIS enables comprehensive patient data management, reducing errors and improving efficiency. In addition, the integration with EHRs minimizes redundant testing and optimizes resource utilization. As hospitals expand radiation oncology services and seek cost-effective cancer care solutions, the demand for OIS is expected to grow, driving market expansion and innovation in oncology treatment.

The ablation care centers and cancer care centers segment is anticipated to grow at the fastest CAGR over the forecast period, driven by the rising adoption of minimally invasive cancer therapies. These centers utilize OIS to integrate real-time imaging, ablation devices, and patient data for precise tumor targeting. These centers utilize OIS to integrate real-time imaging, ablation devices, and patient data for precise tumor targeting. For instance, RaySearch Laboratories’ RayCare OIS supports liver ablation workflows by automating treatment planning and tracking procedural outcomes, enhancing efficiency in clinics.

Regional Insights

North America oncology information systems market held the largest revenue share of 39.67% in 2024. The use of oncology information systems for cancer patients is on the rise, driven by the need for efficient, precise, and advanced cancer treatment and care methods. In addition, the availability of advanced healthcare infrastructure and cancer research institutions, substantial healthcare spending, high patient disposable incomes, and a well-established reimbursement framework all contribute to the increased implementation of oncology information systems.

U.S. Oncology Information Systems Market Trends

Oncology information systems market in the U.S.held the largest revenue share in 2024. Growing prevalence of cancer among various demographics and rising demand for advanced innovative oncology information systems are some of the driving factors for the U.S. For instance, according to an article published in the PubMed Journal in January 2024, 2 million new cancer cases were expected to be diagnosed in the U.S. in 2024, with 611,720 cancer deaths. Moreover, an increase in investments in cancer research by companies is driving industry growth. A wide range of novel technologies are being developed, which have the potential to drastically change the treatment regime.

Europe Oncology Information Systems Market Trends

Oncology information systems marketin Europe is anticipated to grow significantly over the forecast period. The primary factor driving this demand is the rising prevalence of cancer in European countries. In addition, a shift from conventional cancer care to advanced treatment solutions is contributing to the increased demand for oncology information systems. Moreover, EU policymakers are promoting various digital health programs, which are expected to boost market growth during the forecast period. For instance, the European Federation for Cancer Images (EUCAIM) project is a significant initiative funded by the Digital EU Programme (DIGITAL) as part of Europe’s Beating Cancer Plan.

UK oncology information systems market is expected to grow significantly over the forecast period.An increasing number of initiatives, including the development of integrated care systems for digital health and eHealth is expected to drive the UK market. For instance, the NHS in England has allocated USD 22.8 million to 64 NHS trusts. This funding is aimed at deploying artificial intelligence tools specifically designed to expedite the diagnostic process for lung cancer.

Oncology information systems market in Germany dominated the European market with the largest share in 2024. Increase in the significance of IT due to efficient utilization of resources, improvement in workflow & delivery of services, and enhanced patient centricity are significant contributing factors to the growing adoption of these technologies in hospitals. Furthermore, various initiatives taken by the market players are further propelling the market growth. For instance, in 2024, the Partex Group, through its companies Innoplexus AG and Amrit AG, presented results from a pilot project at the German Cancer Congress 2024 in Berlin. This project was conducted in collaboration with the German Cancer Society’s Working Group for Internal Oncology (AIO) and aimed to explore the feasibility and effectiveness of modern AI-supported technologies in oncology.

Asia Pacific Oncology Information Systems Market Trends

Oncology information systems market in Asia Pacific is expected to witness the fastest growth over the forecast period. The region experiences a high demand for oncology information systems due to the rising prevalence of cancer and an increase in government spending on healthcare. Furthermore, this region’s market growth can also be attributed to R&D investments in artificial intelligence producing technologically advanced healthcare solutions. Moreover, developing healthcare infrastructure in Asia Pacific countries, such as Indonesia, China, & India, is expected to propel the market over the coming years.

China oncology information systems market held the largest share in 2024. The country’s growing geriatric population and associated increase in disease burden, along with improving healthcare facilities & growing healthcare expenditure, are anticipated to propel the market. The Strengthening Information Society Research Capacity Alliance program states that the State Council requires hospitals to invest at least 5% of their annual revenue in healthcare information systems that include OIS. Thus, such systems are being widely used in large hospitals in China and is being adopted in other healthcare setups.

Oncology information systems market in India is expected to grow significantly over the forecast period. The market is driven by the growing geriatric population, increasing burden of chronic diseases, and government initiatives supporting the country’s eHealth scenario. In addition, efforts to improve healthcare infrastructure are likely to boost the market. The Government of India has undertaken various initiatives to support digital health. Significant investments have been made to develop healthcare IT infrastructure.

Latin America Oncology Information Systems Market Trends

Oncology information systems market in Latin Americais anticipated to grow significantly. Countries’ steps into digital health have taken various forms, ranging from adopting telemedicine solutions to implementing more extensive standards, such as the government’s approach to applying SNOMED to its medical data systems to accomplish future integration. The advent of 5G technology has opened new avenues for telemedicine, particularly in the field of oncology. For instance, in November 2021, the first telemedicine demonstration utilizing a 5G network for breast cancer was launched in Chile, marking a significant step in Latin America.

Middle East & Africa Oncology Information Systems Market Trends

Oncology information systems market in Middle East & Africa is expected to grow significantly over the forecast period. Market growth in this region can be attributed to the steady development of healthcare facilities in emerging economies and an increase in healthcare expenditure. Some of the key countries in the region, such as Saudi Arabia and the UAE, have exhibited significant growth & major changes in healthcare facilities. Furthermore, the growing demand for healthcare IT services, along with the increasing use of blockchain technology in oncology information systems, is anticipated to drive market growth.

Key Oncology Information Systems Company Insights

The market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth. Some of the emerging players in the market are OncoLens, Inventigen Technologies Pvt. Ltd., Prowess, Inc. etc.

Key Oncology Information Systems Companies:

The following are the leading companies in the oncology information systems market. These companies collectively hold the largest market share and dictate industry trends.

- Accuray Incorporated

- Elekta

- BrainLab

- DOSIsoft SA

- FLATIRON HEALTH

- RaySearch Laboratories

- Oracle (Cerner Corporation)

- Koninklijke Philips N.V.

- Varian Medical Systems, Inc. (Siemens Healthineers).

Recent Developments

-

In August 2024, the Connecticut Proton Therapy Center integrated RaySearch Laboratories AB’s oncology information system RayCare and the IBA ProteusONE compact proton therapy system as its treatment platform.

“We are happy to welcome yet another RayCare customer. For our installed base of RayStation customers the selection of RayCare as oncology information system will enhance efficiency and user experience, both in the treatment planning process and treatment delivery.”

-Johan Löf, founder and CEO, RaySearch

-

In January 2024, RaySearch Laboratories launched RayStation 2024A, enhancing clinical workflows in treatment planning. RayStation 2024A also integrates with the oncology analytics system RayIntelligence.

-

In January 2023, ViewRay, Inc. announced that Chindex Medical Limited ordered 10 MRIdian MR-Guided Therapy Systems. In September 2022, the National Medical Products Administration approved MRIdian's expansion into China, offering patients advanced SMART radiation therapy.

"The integration of a ground-breaking radiation therapy system that's guided by MRI is key to remaining at the forefront of personalized cancer care. MRIdian will allow physicians to offer a leading-edge, state-of-the-art technology to address the increasing burden of cancer prevalence in China."

- Marie Li, CEO of Chindex.

-

In May 2022, Elekta launched Elekta Espirit, a next-generation automated treatment planning system with enhanced precision & accuracy that offers more personalized care.

Oncology Information Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.17 billion

Revenue forecast in 2030

USD 4.69 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products & services, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Accuray Incorporated; Elekta; Prowess, Inc.; BrainLab; DOSIsoft SA; FLATIRON HEALTH; RaySearch Laboratories; Oracle (Cerner Corporation); Koninklijke Philips N.V.; Varian Medical Systems, Inc. (Siemens Healthineers).

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oncology Information Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oncology information systems market report based on products & services, application, end-use, and region:

-

Products & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Patient Information Systems

-

Treatment Planning Systems

-

-

Professional Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Oncology

-

Radiation Oncology

-

Surgical Oncology

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Diagnostic Imaging Centers

-

Ablation Care Centers and Cancer Care Centers

-

Government Institutions

-

Research Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global oncology information systems market size was estimated at USD 2.94 billion in 2024 and is expected to reach USD 3.17 billion in 2025.

b. The global oncology information systems market is expected to grow at a compound annual growth rate of 8.14% from 2025 to 2030 to reach USD 4.69 billion by 2030.

b. The medical oncology segment dominated the global oncology information systems market and accounted for the largest revenue share of 61.81% in 2024.

b. Solutions dominated the OIS market with a share of 73.99% in 2024. This is attributable to the ability of these software solutions to facilitate the exchange of patient information across healthcare organizations, creating a bridge between practitioners and radiology centers, which helps improve the safety and efficiency of cancer treatment.

b. North America dominated the global oncology information systems market and accounted for the largest revenue share of 39.67% in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.