- Home

- »

- Next Generation Technologies

- »

-

Online Art Market Size And Share, Industry Report, 2033GVR Report cover

![Online Art Market Size, Share & Trends Report]()

Online Art Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Paintings, Photography, Drawings, Prints), By End User (Foreign Customers, Domestic Customers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-144-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Art Market Summary

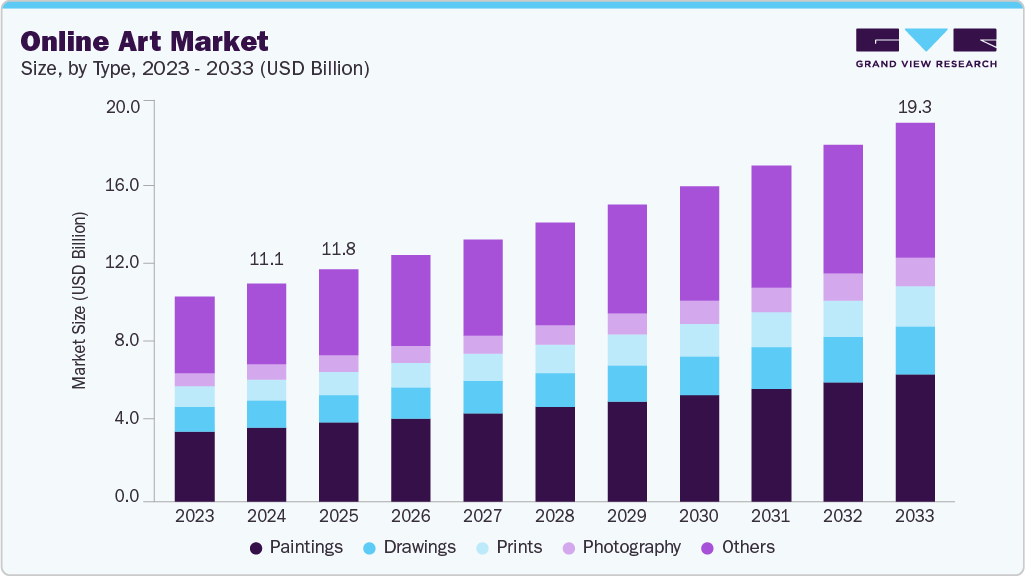

The global online art market size was estimated at USD 11.09 billion in 2024 and is projected to reach USD 19.25 billion by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The market growth can be attributed to the heightened accessibility offered to both buyers and vendors.

Key Market Trends & Insights

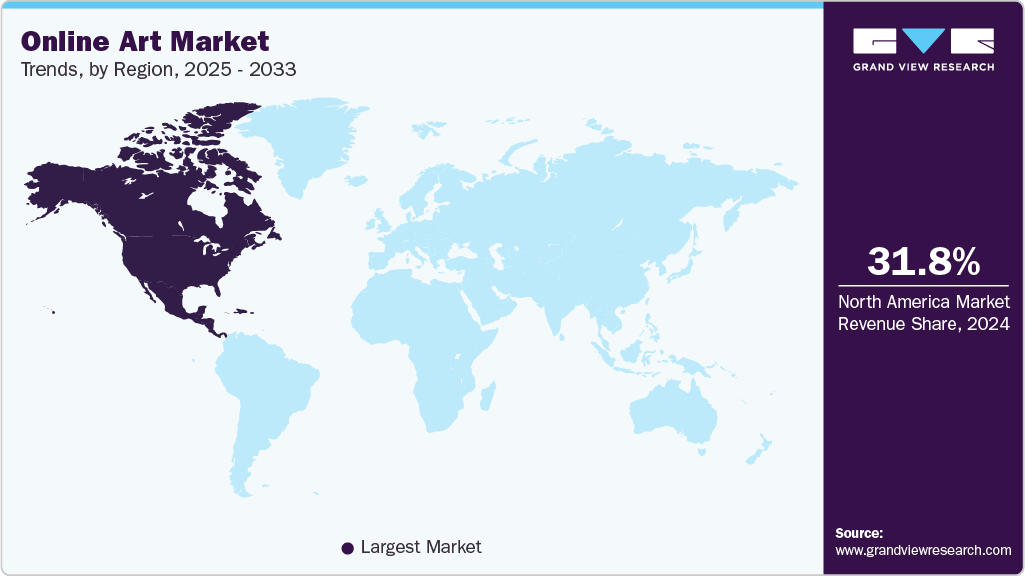

- North America online art market accounted for a 31.8% share of the overall market in 2024.

- The online art industry in the U.S. held a dominant position in 2024.

- By type, the paintings segment accounted for the largest share of 33.8% in 2024.

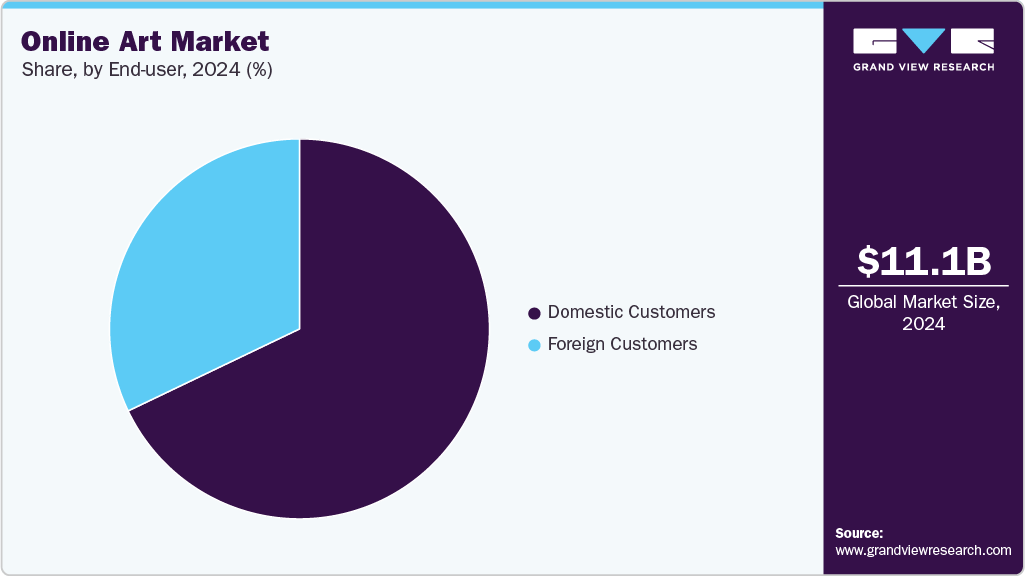

- By end user, the domestic customer segment held the largest market share of 67.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.09 Billion

- 2033 Projected Market Size: USD 19.25 Billion

- CAGR (2025-2033): 6.3%

- North America: Largest market in 2024

Online platforms have streamlined the process for art enthusiasts to purchase artworks from online platforms, obviating the necessity of visiting physical galleries or auction houses. This heightened convenience has broadened the potential of art consumers, thereby driving the growth of the market.Digitalization has been a pivotal force behind the market's expansion. The internet has facilitated the creation of online platforms where artists can exhibit their works, and collectors can explore a vast array of art globally. This digital landscape has dismantled geographical constraints, allowing artists and buyers to engage without the limitations of physical proximity. Consequently, the market offers a more diverse range of artistic styles and genres, enticing a larger and more diverse audience.

Technological advancements in the areas of telecommunication and smartphone technology have resulted in the growth of the market. For instance, according to DataReportal, an online reference library, almost 5.19 billion people are using the internet globally, thus offering an opportunity for the art market to sell art online. Furthermore, the launch of 5G services across various geographies offers faster internet speed to customers, enabling them to purchase online art with no geographic boundary limitations. Similarly, the latest smartphones enable the customer to purchase online art directly through their phones.

Furthermore, transparency and information are pivotal in attracting participants to the market. Online platforms typically offer comprehensive artwork information, including artist backgrounds, provenance, and pricing history. This transparency fosters trust among buyers and allows them to make informed decisions, which is crucial in an industry often characterized by opaqueness. Advanced technologies, such as data analytics and machine learning, are increasingly employed to personalize recommendations, enhancing the buying experience and helping buyers discover art that aligns with their tastes.

While the market is poised for growth over the forecast period, it does face certain challenges. One significant challenge is authenticity and provenance verification. Ensuring the authenticity of artworks, particularly in the case of digital art and NFTs, can be complex. Buyers need confidence that they are acquiring genuine pieces, and artists want their work protected from unauthorized reproduction and sale. Furthermore, the market faces issues related to fraud and counterfeit art, with some unscrupulous actors attempting to pass off counterfeit or copied works as genuine, which can erode trust within the market. Establishing and maintaining trust and authenticity in the online art space remains critical for its continued success.

Type Insights

The paintings segment accounted for the largest share of 33.8% in 2024. The growth of the paintings segment can be attributed to the advancement in the high-resolution images, which enable the buyer to verify the authenticity and the art. Furthermore, paintings often hold significant investment value, attracting art collectors and investors to online marketplaces. The digital realm has also enabled artists to create and sell their paintings with unprecedented ease, contributing to the segment's growth. As online platforms continue to evolve, the paintings segment is likely to remain a key driver of expansion in the market, appealing to both seasoned collectors and newcomers.

The photography segment is expected to grow at a significant CAGR during the forecast period. The growing digitalization and the ease of online presentation have allowed photographers to showcase their work to a global audience, eliminating geographical constraints. The affordability of photography, both for artists and buyers, makes it an attractive option for emerging talent and new collectors, fostering an inclusive art ecosystem. Furthermore, photography's ability to capture contemporary life and societal changes, coupled with its potential as an investment, further fuels its growth. Online galleries and virtual exhibitions have expanded the reach of photographic art, enhancing its presence and influence in the ever-evolving market.

End User Insights

The domestic customer segment held the largest market share of 67.9% in 2024. The domestic customer has a deep cultural connection to artworks from their region, gravitating towards pieces that resonate with their cultural heritage. In addition, their familiarity with the local art scene, including prominent artists and galleries, facilitates informed purchasing decisions. Logistically, buying art domestically is typically more convenient, with lower shipping costs and fewer customs hurdles. Many domestic buyers also prioritize supporting local artists and communities, fostering a sense of pride and connection. Moreover, they often better grasp local market dynamics, enhancing their confidence in purchasing decisions.

The foreign customer segment is expected to grow at a significant CAGR during the forecast period. Foreign customers are increasingly drawn to purchasing art online as it provides a global marketplace at their fingertips. They value the diverse selection of artworks worldwide, appreciating the opportunity to explore unique and unconventional pieces that may need to be more readily available in their local art scenes. These online art platforms offer transparency and information, which build the trust of foreign customers, helping them make informed decisions about their art acquisitions. Furthermore, the convenience of international shipping options simplifies securely receiving artworks from abroad.

Regional Insights

The North America online art market held a significant share in 2024. The region's tech-savvy population readily embraces digital platforms for art transactions, fostering the growth of the market across the region. Furthermore, North America's substantial population of high-net-worth individuals and art collectors, coupled with a well-established culture of art collecting, generates a strong demand for online art platforms. Moreover, the region's prestigious art schools, museums, galleries, and supportive infrastructure ensure a thriving ecosystem for artists and collectors.

U.S. Online Art Market Trends

The U.S. online art market held a dominant position in 2024 owing to a strong base of affluent collectors, well-established art institutions, and digital-savvy consumers. Leading U.S.-based platforms such as Artsy and Saatchi Art have expanded their reach, offering curated collections and AI-driven recommendations to enhance user engagement.

Europe Online Art Market Trends

The Europe online art market was identified as a lucrative region in 2024. The growth in the region is attributed to a well-established network of galleries, auction houses, and collectors transitioning to digital platforms. The region benefits from a high level of digital literacy, strong cultural heritage, and widespread access to high-speed internet, which have all contributed to increasing online art sales.

The UK online art industry is expected to grow rapidly in the coming years. The UK serves as a major hub for the European online art market, anchored by its global art capital status and a robust network of galleries and auction houses. Companies such as Christie’s and Sotheby’s, headquartered in London, have significantly invested in digital strategies, including online-only auctions and virtual exhibition tours.

The Germany online art industry held a substantial market share in 2024 due to the strong public and private cultural funding and a tech-oriented population. Berlin, known for its vibrant art scene, is home to numerous startups and online platforms promoting contemporary and digital art.

Asia Pacific Online Art Market Trends

The Asia Pacific online art industry is anticipated to grow at a CAGR of 7.7% during the forecast period. Robust economic growth in countries such as China and India has led to a burgeoning middle class with rising disposable income, expanding the pool of potential art buyers. Moreover, the region's tech-savvy population, characterized by countries such as South Korea and Japan, is increasingly comfortable with online platforms, fostering the digital art market's development.

The Japan online art market is expected to grow rapidly in the coming years. The growth in the region is driven by growing interest in digital art forms, including NFTs and limited-edition prints. While the country has a rich heritage in traditional art, younger consumers are fueling demand for modern, accessible formats via online channels.

The China online art market held a substantial market share in 2024 due to the rapidly expanding middle class, high smartphone penetration, and strong government support for cultural industries. Leading domestic platforms such as Artron are instrumental in shaping the digital art buying experience, offering features such as AI curation and live-streamed auctions.

Key Online Art Company Insights

Some of the key companies in the online art market include Fine Art America, Artspace LLC, Artfinder, DeviantArt, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Fine Art America is an art marketplace and print-on-demand technology company. It serves as a comprehensive platform for hundreds of thousands of artists, photographers, graphic designers, illustrators, and iconic brands to sell wall art, home decor, apparel, and various other products globally. Artists can easily upload their images, set prices for over 25 different print-on-demand products, and sell to a worldwide audience. Fine Art America handles all aspects of order fulfillment, including printing, framing, packaging, shipping, and payment collection, through its extensive network of 14 to 16 global production facilities located across five countries, ensuring products are delivered ready-to-hang with a 30-day money-back guarantee.

-

Artspace LLC is an online marketplace specializing in contemporary art, offering a wide range of artworks from internationally acclaimed artists, galleries, and cultural institutions worldwide. The platform aims to make fine art accessible to a broad audience, including those who may have limited knowledge of art or live far from galleries. Artspace features over 2,000 active artists from around 400 galleries across 30 countries, including prestigious institutions such as The Guggenheim, The Whitney Museum, and the Museum of Contemporary Art Chicago.

Key Online Art Companies:

The following are the leading companies in the online art market. These companies collectively hold the largest market share and dictate industry trends.

- Fine Art America

- Artspace LLC

- Saatchi Art

- Artfinder

- DeviantArt

- Ugallery

- Singulart

- Artsy

- Artsy

- The Artling

Recent Developments

-

In May 2025, Times OOH collaborated with ArtCrush Gallery, a digital art platform, to bring digital artworks by both global and Indian artists into public spaces across India and Mauritius. Through this partnership, digital art is being displayed across Times OOH’s vast digital network, including key airports, Mumbai Metro Line 1, and premium city media assets in Bengaluru and Ahmedabad, as well as at the Mauritius Airport managed by TIM Global. This initiative replaces conventional advertising content with striking digital artworks curated from ArtCrush’s global community of over 20,000 artists, offering commuters and travelers an engaging and culturally enriching visual experience.

-

In December 2024, YourArt acquired a majority stake in Artmajeur, an online art platform founded in 2000. This strategic acquisition brings together both platforms under the new name "ArtMajeur by YourArt," creating a powerful new entity in the global online art marketplace. The combined platform now boasts over 3.6 million artworks, 130,000 artists, and nearly 700 galleries, operating across 78 countries including France, Japan, the United States, China, Brazil, and Mexico.

Online Art Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.79 billion

Revenue forecast in 2033

USD 19.25 billion

Growth rate

CAGR of 6.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report industry

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Fine Art America; Artspace LLC; Saatchi Art; Artfinder; DeviantArt; Ugallery; Singulart; Artsy; ETSY; The Artling

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Art Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global online art market report based on type, end user, and region.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Paintings

-

Drawings

-

Prints

-

Photography

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2021 - 2033)

-

Foreign Customers

-

Domestic Customers

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online art market size was estimated at USD 11.09 billion in 2024 and is expected to reach USD 11.79 billion in 2025.

b. The global online art market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach USD 19.25 billion by 2033.

b. North America dominated the online art market with a share of 31.8% in 2024. The region's tech-savvy population readily embraces digital platforms for art transactions, fostering the growth of the online art market across the region.

b. Some key players operating in the online art market include Fine Art America; Artspace LLC; Saatchi Art; Artfinder; DeviantArt; Ugallery; Singulart; Artsy; ETSY; The Artling.

b. Key factors that are driving the market growth include rising Internet penetration and adoption of smart devices and the global reach and convenience offered to customers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.