- Home

- »

- Communication Services

- »

-

Online Dating Application Market Size & Share Report, 2030GVR Report cover

![Online Dating Application Market Size, Share, & Trend Report]()

Online Dating Application Market (2023 - 2030) Size, Share, & Trend Analysis by Revenue Generation Subscription, (Age (18 - 25 years, 26 - 34 years, 35 - 50 years, above 50 years), Gender, and Type) and by Region and Segment Forecasts

- Report ID: GVR-4-68039-647-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Dating Application Market Summary

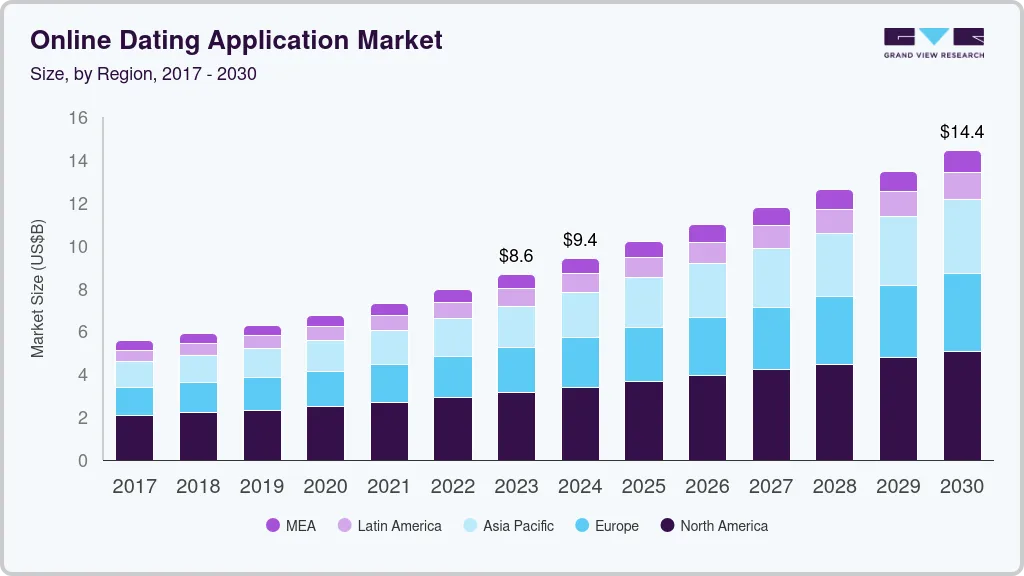

The global online dating application market size was valued at USD 7,939.2 million in 2022 and is projected to reach USD 14.42 billion by 2030, growing at a CAGR of 7.6% from 2023 to 2030. Online dating applications are gaining tremendous popularity among young individuals, especially millennials.

Key Market Trends & Insights

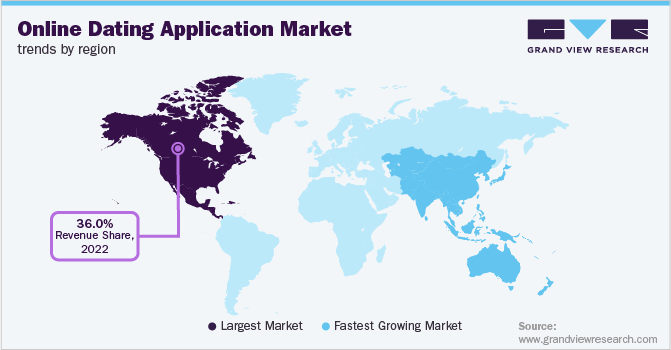

- North America accounted for the highest share of about 36% in the global market.

- The U.S. accounted for the highest share of about 58 percent in the year 2022.

- By Revenue Generation, The subscription segment led the market and accounted for more than 62% share of the overall revenue in 2022

Market Size & Forecast

- 2022 Market Size: USD 7,939.2 Million

- 2030 Projected Market Size: USD 14.42 Billion

- CAGR (2023-2030): 7.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The usage of these apps has witnessed a tremendous rise, especially among the LGBTQ+ community, owing to the social stigma associated with the community in many countries. The industry is highly fragmented with a large number of local as well as global players in the market. Companies are taking advantage of the growing popularity of smartphones, increasing internet speed, and accessibility. There is a rise in users exploring the applications through their smartphones, allowing them to access online dating services at their convenience.

Moreover, the growing demand for paid subscriptions is expected to spur market growth during the forecast period. The success rate of marriage is declining and the number of singles is increasing all around the world. The recent trend observed among people, particularly the younger age group, is prioritizing career over getting settled and married. Most people now prefer to live alone. This factor is playing a significant role in increasing the popularity of online dating. Several statistics have highlighted the growing trend of staying unmarried among individuals in different parts of the world.

Most countries lack a clear legal framework for online dating applications to prevent sexual violence and online gender-based violence. Regulators across the world are trying to regulate or at least provide rules for dating apps as they try to protect the individuals using these apps. In the U.K., in 2013, the market players set up the Online Dating Association (ODA) to take collective responsibility for the market and operations. In Singapore, through the Social Development Network, the government has been actively regulating matchmaking apps.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a favorable effect on the market. In terms of the total number of COVID-19 patients worldwide, Europe and the Asia Pacific were among the worst impacted regions. Additionally, things became worse in the U.S. Governments throughout the world issued orders for a complete lockdown, staying at home, and social seclusion due to the virus's rapid spread. People's social and romantic lives were impacted by the total lockdown. As singles searched for companionship and connection amid their social isolation, the use of apps increased dramatically.

At the start of the pandemic, demand for dating applications spiked. OkCupid reported a "700% spike in dates" between March 2020 and May 2020, and video calls on Bumble increased by 70%. Tinder recorded 3 billion swipes in one day in March 2020 and declared 2020 to be its busiest year. In comparison to 2019, Hinge's sales increased in 2020. Throughout the pandemic, this increased demand persisted. With the pandemic scenario in mind, several companies added additional functions to the dating app. A few of the unique aspects of the pandemic include gamification of discussions, vaccination badges, and virtual badges that show users are open to virtual dating and video calling. New tools were needed as app users grew more interested in meaningful connections.

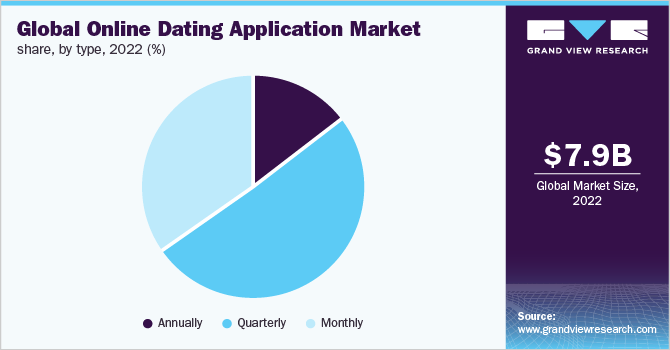

Revenue Generation Insights

The subscription segment led the market and accounted for more than 62% share of the overall revenue in 2022 owing to the increasing subscriptions given the extra features in paid subscriptions, such as no ads, unlimited likes, and read receipts among others. The subscription segment is expected to grow at a CAGR of 7.7% during the period 2023 to 2030. Based on subscription, the market is further sub-segmented into age, gender, and type. By age, the subscription segment is categorized into four age groups: 18-25 years, 26-34 years, 35-50 years, and above 50 years. The 18-25-year age group accounted for the highest market share of about 58% in the year 2022.

The 18-25-year age group leads in terms of share owing to the fact that the younger generation is more inclined towards application. The younger generation is using these apps not only to find romantic relationships but also platonic friendships. The usage of these apps among the 26-34-year age group is rising owing to the high divorce and separation rates. People use dating apps to give themselves a second shot at love or romance. The 26-34-year age group is expected to be the fastest-growing segment accounting for a CAGR of 8.0%.

Regional Insights

North America accounted for the highest share of about 36% in the global market. The high market share is owing to the presence of a large number of players in the North America online dating application industry. Prominent players like Tinder and Bumble all have their roots in North America. Further, in North America, the U.S. accounted for the highest share of about 58 percent in the year 2022. In terms of growth, Canada is expected to grow at the fastest rate at an anticipated CAGR of 7.3% during the forecast period.

Asia Pacific is estimated to be fastest growing region over the forecast period. The regional share was valued at USD 1,764.8 Million in 2022 and expected to exhibit fastest growth. The growth in the region is primarily driven by the large single population in the region, the growing purchasing power of the consumers, and urbanization among others.China and India together held the majority of share in the region, accounting for about 58% share in the Asia-Pacific region.

Key Companies & Market Share Insights

Market players in the online dating application industry are adopting technologies such as artificial intelligence in online dating applications. Several new features are being introduced regularly on these dating apps in an attempt to keep their existing consumer base satisfied as well as expand their consumer base. Industry players are undertaking mergers and acquisitions with their competitors to expand their geographic presence and capture the escalating market potential. For instance, in February 2022, Bumble Inc. announced the acquisition of Fruitz, a dating app specifically catered for the younger audience generally called Gen Z. Fruitz has seen rapid growth across France, Netherlands, Belgium, Sweden, Switzerland, and Canada in recent years. The acquisition would enable Bumble Inc. to expand its presence in these countries.

Major market players are also extensively focusing on product development to further expand their customer base. For instance, in February 2022, Tinder introduced its Blind Date feature. Blind Date is a social experience that pairs users before allowing them to view each other's profiles, making the first impression based on dialogue rather than photographs. Members who utilized the Blind Date option made 40% more matches than those who used the Fast Chat function with profiles exposed in early testing, indicating daters' eagerness to communicate. Some prominent players in the global online dating application market include:

-

Tinder

-

Bumble Inc.

-

Plentyoffish

-

OkCupid

-

Badoo

-

Grindr LLC

-

eHarmony, Inc.

-

Spark Networks SE

-

The Meet Group

-

rsvp.com.au Pty Ltd.

-

Zoosk, Inc.

-

The League

-

Coffee Meets Bagel

-

Happn

-

Feeld Ltd.

-

3Fun

-

Lex

-

#Open

-

Taimi

-

Bloom Community

Online Dating Application Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.64 billion

Revenue forecast in 2030

USD 14.42 billion

Growth rate

CAGR of 7.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Revenue generation, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Sweden; Japan; China; India; Brazil; Mexico; South Africa

Key companies profiled

Tinder; Bumble Inc.; The Meet Group; Spark Networks SE; eHarmony

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Dating Application Market Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global online dating application market report based on revenue generation and region:

-

Revenue Generation Outlook (Revenue, USD Million, 2017 - 2030)

-

Subscription

-

Age

-

18 - 25 years

-

26 - 34 years

-

35 - 50 years

-

Above 50 years

-

Gender

-

Male

-

Female

-

Type

-

Annually

-

Quarterly

-

Monthly

-

-

Advertisement

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Online Dating Application market size was estimated at USD 7.94 billion in 2022 and is expected to reach USD 8.64 billion in 2023.

b. The global Online Dating Application market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 14.42 billion by 2030.

b. The subscription segment dominated the market in 2022 and accounted for a share of more than 62.0%. This is attributable to the increasing number of subscriptions owing to the premium features provided in the subscription model.

b. Some of the key players in the Online Dating Application market include Tinder; Bumble; Plentyoffish; OkCupid; Badoo; Grindr LLC; eHarmony, Inc.; Spark Networks, Inc.; The Meet Group, Inc.; rsvp.com.au Pty Ltd.; Zoosk, Inc.; The League; Coffee Meets Bagel

b. Key factors that are driving the Online Dating Application market growth include increasing penetration of smartphones & the internet and the increasing single adult population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.