- Home

- »

- Next Generation Technologies

- »

-

Online Dating Market Size, Share & Growth Report, 2030GVR Report cover

![Online Dating Market Size, Share & Trends Report]()

Online Dating Market Size, Share & Trends Analysis Report By Platform (Application, Web Portals), By Revenue Generation (Subscription, Advertisement), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-932-1

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

The global online dating market size was valued at USD 9.65 billion in 2022 and is projected to register a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. The significant growth in the popularity of online dating apps such as Tinder Match Group and others across the young population is one of the major factors that propel the market growth during the forecast period. Social networking sites are now playing a crucial role in navigating and documenting romantic relationships among people, which further encourages the use of online dating apps and portals. Moreover, the growing smartphone user base coupled with rising internet penetration further provides ample opportunity for the growth of the market. However, the increasing online fraud and data breaches through dating apps are projected to hinder market growth.

The number of single individuals has been increasing across the globe. Nowadays, individuals across the globe look for specific characteristics when it comes to finding their partner. Such characteristics include similar interests, like-mindedness, and others, and online dating helps them find people with the aforementioned characteristics, due to which adoption is increasing. Service providers of online dating also provide innovative services, and better experiences, in order to meet the expectations of the customers. Online dating is easy to use, convenient, quick, and requires less effort. Moreover, it enables one to limit the number of people who can contact them by using various available features. Hence it is highly adopted and propelling market growth.

The rising number of users of apps such as Tinder, Bumble, Grindr, and others is further projected to contribute to the market growth. Tinder has significant popularity having over 6.7 million average subscribers as of the fourth quarter of 2020.

The COVID-19 outbreak has further increased the number of users of online dating platforms across the globe. The restrictions by the governments of several countries on traveling and the closure of shops, malls, and cafes further encouraged its adoption across the globe. This has led to substantial growth in subscriptions on various online dating platforms worldwide. For instance, Bumble users increased to 1,142.1 thousand in 2020 from 855.6 thousand in 2019. Therefore, the significant increase in the users of online dating platforms across the globe during the pandemic further accelerated the market growth.

Several companies introduced new features keeping in mind the pandemic scenario. Some of the pandemic-special features include a virtual badge that shows people open to virtual dating, a vaccinated badge, video calling, gamification of chats, and so on. Grindr made some changes to its existing features, which included Video Chat, available free to all users. It also shared a COVID-related sexual health guide developed by the City of New York to help users to understand viral transmission risks.

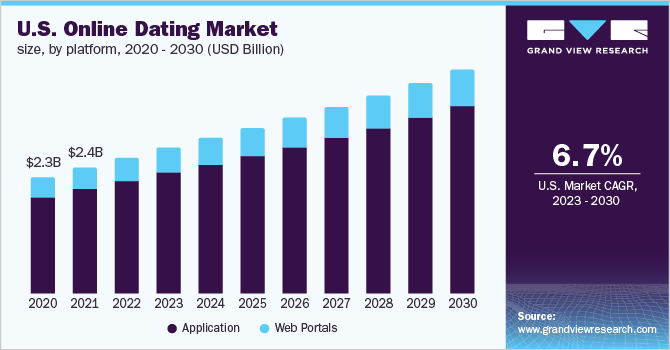

Platform Insights

Based on the platform, the targeted market is further classified into application and web portals. Among these, the application segment contributed to a larger revenue share of over 82% in 2022. A significant portion of the young population uses mobile applications for online dating across the globe, which further supports the market share. Moreover, the growing popularity of apps such as Tinder, Bumble, Badoo, and others across the globe further contributed to the market share. For instance, the average number of subscribers on Tinder increased to 10.4 million in 2020 from 7.9 million in 2018. Therefore, the growing number of subscribers shows the rising popularity of such online dating apps that further contributed to the highest market share.

The web portals segment is forecast to advance with a significant CAGR of 6.2% during the forecast period. The rising number of internet users, coupled with significant usage of online dating websites across the globe, further contributes to the growth. For instance, eHarmony is one of the leading online dating websites that has around 15 million matches. Additionally, the significant advancements in website advertising tools and consumer interest tracing tools are further projected to contribute to market growth.

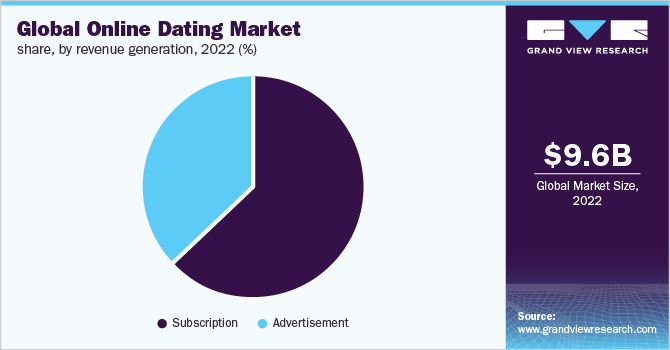

Revenue Generation Insights

Based on revenue generation, the market is classified into subscription and advertisement. Subscription accounted for the largest revenue share of over 63% in 2022 and is expected to continue its dominance over the forecast period. and is expected to continue its dominance during the forecast period. Free applications offer limited features and charge a subscription fee for premium features, as subscription fees vary depending on the apps. Thus, most users adopt subscription models to access the features. Paid subscriptions include unlimited likes and swipes, no ads, and read receipts.

The market is further divided into age, gender, and type based on subscription. The age group is segmented into 18-25 years, 26-34 years, 35-50 years, and above 50 years. The age group 18-25 years accounted for the largest revenue share of 36% in 2022, followed by the 26-34-year age group. The segment's growth is attributed to the growing inclination of the younger generation toward online dating. As per the industry analysis, Tinder is the major player, followed by Bumble in the age group of 18-25 years. The 26-34-year age group is anticipated to progress at the highest CAGR during the forecast period.

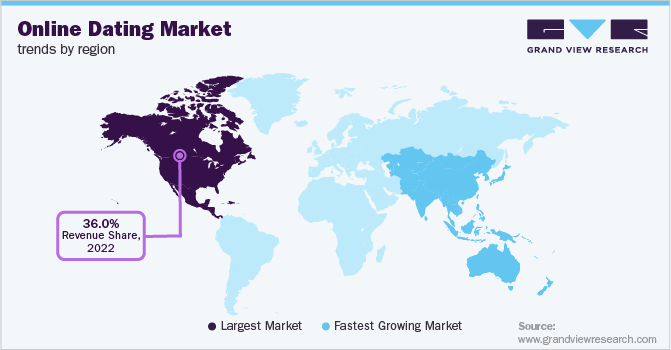

Regional Insights

Asia Pacific is forecast to grow with the highest CAGR of 8.5% from 2023 to 2030. China and India are positively contributing to the growth of the market. The major factors that propel regional growth include the growing trend of online dating sites and apps among the young population in emerging economies. Additionally, substantial growth in smartphone penetration, coupled with growing digitalization in China and India, further propels market growth. An increasing number of users of online dating apps across China, India, and other emerging economies is further projected to provide ample opportunities to the market.

North America is estimated to hold a major revenue share of more than 36% in 2022. The U.S. is positively contributing to the growth of market revenue. The presence of well-established online dating platforms such as Tinder, Bumble, Badoo, and others is one of the driving factors for market growth. For instance, in North America, the average number of subscribers of Match Group online dating service providers was 4.1 million in 2018, which further increased to 4.9 million in 2020. Growth in North America’s average subscribers was primarily driven by Tinder, Hinge, BLK, and Chispa apps.

Key Companies & Market Share Insights

The online dating industry is always changing and updating. In order to stay head-on, players tend to launch new strategies more frequently. Key players are focusing on increasing investments in advertisements through social sites to increase the user base in the market. Moreover, major players are targeting new regions and demography to increase the user base and expand their number of theatres, by either entering the new market solely or by collaborating with local companies across the globe.

Key players are also undertaking major business initiatives such as mergers and acquisitions, partnerships, agreements, the launch of new features, global expansion, and others. For instance, in February 2022, Bumble announced its first acquisition. Bumble acquired Fruitz which is a French dating app. This strategy was adopted by Bumble to expand its footprint in Canada and Western Europe. In addition, in May 2018, Badoo announced the launch of a new feature in its application. This application enables the user to chat face-to-face on live video. Some of the prominent players in the market include:

-

Match Group, LLC (Tinder)

-

Bumble Inc.

-

Grindr LLC

-

eHarmony, Inc.

-

Spark Networks, Inc.

-

The Meet Group, Inc

-

rsvp.com.au Pty Ltd.

-

Coffee Meets Bagel

-

Cupid Media Pty Ltd.

-

Elite Singles

-

The League App, Inc.

Online Dating Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.49 billion

Revenue forecast in 2030

USD 17,281.28 million

Growth Rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Platform, Revenue Generation, and Region

Regional scope

North America, Europe, Asia Pacific, South America, and Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; South Africa

Key companies profiled

Match Group, LLC (Tinder), Bumble Inc., Grindr LLC, eHarmony, Inc., Spark Networks, Inc., The Meet Group, Inc, rsvp.com.au Pty Ltd., Coffee Meets Bagel, Cupid Media Pty Ltd., Elite Singles, The League App, Inc. among others

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Dating Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global online dating market report based on platform, revenue generation, and region:

-

Online Dating Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

Application

-

Web Portals

-

-

Online Dating Revenue Generation Outlook (Revenue, USD Million, 2017 - 2030)

-

Subscription

-

Age

-

18-25 years

-

26-34 years

-

35-50 years

-

Above 50 years

-

-

Gender

-

Male

-

Female

-

-

Type

-

Annually

-

Quarterly

-

Monthly

-

-

-

Advertisement

-

-

Online Dating Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online dating market size was estimated at USD 9.65 billion in 2022 and is expected to reach USD 10.49 billion in 2023.

b. The global online dating market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 17.28 billion by 2030.

b. North America dominated the online dating market with a share of 36.5% in 2022. This is attributable to the presence of well-established online dating platforms in the region.

b. Some key players operating in the online dating market include Match Group, LLC (Tinder); Bumble Inc.; Grindr LLC; eHarmony, Inc.; Spark Networks, Inc.; The Meet Group, Inc; rsvp.com.au Pty Ltd.; Coffee Meets Bagel; Cupid Media Pty Ltd.; Elite Singles; and The League App, Inc.

b. Key factors that are driving the online dating market growth include the significant growth in the popularity of online dating apps, growing smartphone users coupled with internet penetration.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."