- Home

- »

- Next Generation Technologies

- »

-

Global Online Food Delivery Market Size & Share Report, 2030GVR Report cover

![Online Food Delivery Market Size, Share & Trends Report]()

Online Food Delivery Market Size, Share & Trends Analysis Report By Type (Platform to Consumer, Restaurant to Consumer), By Region (North America, Europe), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-942-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

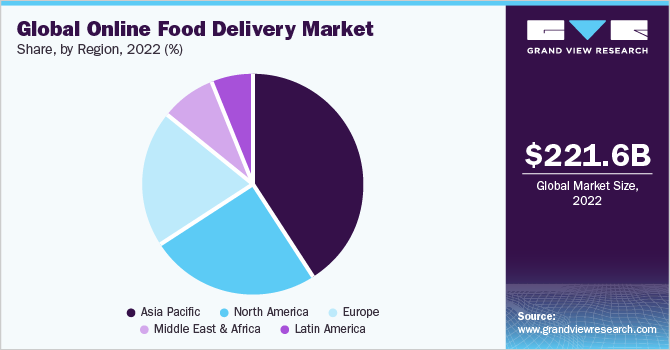

The global online food delivery market size was valued at USD 221.65 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 10.3% from 2023 to 2030. The growth is mainly driven by rising internet penetration coupled with proliferation of smartphones, growing technology advancement, and emergence of cloud kitchens. Cloud kitchens facilitate low set-up costs and help cut down on operational expenses such as employment taxes, servicing personnel, furnishing, utilities, and insurance, making them an attractive investment option. This has compelled several restaurants to venture into cloud kitchen space to stay up to date with evolving market trends.

Market Dynamics

The growth can be attributed to increasing number of restaurants worldwide along with the widening usage of cloud-based technology and growing acceptance of Quick Service Restaurant (QSR) services. Owing to pandemic, many packaged food services, and restaurants chose online sales channels to meet consumer needs. As a result, the added benefit of installing POS systems to identify customer preferences and sales trends precisely is expected to augment market’s growth. Further, several recent advancements in order processing techniques have aided restaurateurs in streamlining their order management. For instance, Kitchen Display System (KDS), a digital menu board for kitchen staff, automatically displays orders based on priority and flags any special dietary requests. This system communicates directly with the restaurant's POS system and tracks meal delivery times. These developments would further drive growth of online food delivery market during forecast period.

Furthermore, food delivery websites, such as GrubHub, PostMates, and Zomato, are allowing restaurants to improve their online presence and providing them with an opportunity to gain new customers and generate extra revenue. At the same time, restaurant review sites are also helping restaurants build up their reputation. While advances in the software and applications related to the food service industry show no signs of abating, restaurants need to adapt to changing ecosystem of their business and adopt management software to remain ahead of the competition. The scenario is anticipated to boost market growth.

Consumers now have access to a variety of applications, including online food delivery services, with improved network connectivity and an increase in number of smartphones. Online food ordering and delivery service is considered a fast-growing business owing to factors such as cost & time saving, safer and healthier food, increased customer loyalty, and highly customizable food options. Digital food innovation is constantly growing with recent advancements such as virtual restaurants and ghost kitchens. According to REVOLVING KITCHEN, the number of digital ordering and delivery is increasing by up to 300% compared to dine-in traffic.

Cloud kitchens witnessed a surge in popularity during COVID-19 pandemic due to the closure of several dine-in restaurants. This trend is expected to remain strong post-pandemic, owing to people getting accustomed to online ordering. According to data published by CloudKitchens.com, U.S. had approximately 1,500 cloud kitchens as of 2020, and about 51% of restaurateurs had shifted their business to cloud kitchens in 2020. Cloud kitchens enable owners to quickly expand their business across multiple locations with minimal upfront investment. Such advantages have fueled rise of cloud kitchens in recent years.

However, managing large delivery volumes is one of the key restraints for market. The growing popularity of online food ordering has increased order volume, leading to logistical challenges for food delivery companies. Several restaurants tie-up with online food delivery platforms to scale up their business. However, restaurants receive an influx of orders each day from these platforms. As such, managing a large volume of orders across multiple platforms can prove to be an uphill task for restaurants. This can also result in improper handling of food and lost orders, leading to degradation in food and service quality and wrong order delivery.

Type Insights

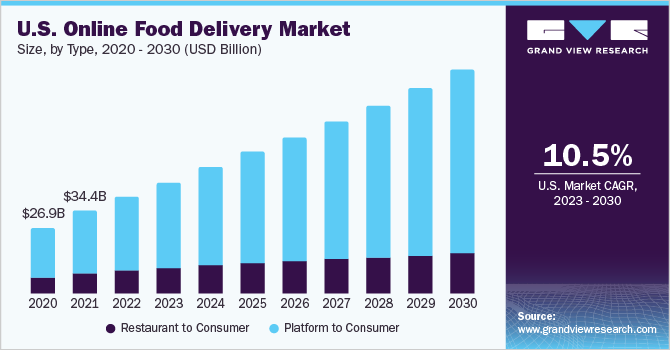

Platform-to-consumer delivery segment held largest revenue share of 69.3% in 2022. The platform-to-consumer delivery segment covers revenues of an online business that acts as an intermediate between customers and multiple food facilities to submit food orders from a customer to a participating food facility and arrange for delivery of the order from food facility to consumer. The growing internet penetration has boosted the food platform-to-consumer delivery service worldwide.

Restaurant-to-consumer delivery segment is likely to expand at a significant CAGR of 7.4% over forecast period. The segment growth can be attributed to increased internet penetration, quicker access to smartphones, improved food-service logistics, and changing lifestyles of consumers. Several established restaurant chains, such as Fassos by Rebel Foods, Freshmenu, and Biryani Kilo are aggressively investing in cloud kitchens as many consumers purchase their food through their platforms.

Regional Insights

Asia Pacific held largest revenue share of over 40.78% in 2022 and is expected to register highest CAGR from 2022 to 2028. The regional growth can be attributed to changing lifestyle and food preferences of consumers along with rapid urbanization have led to an increase in number of online food delivery, thereby driving the demand for various types of food service equipment.

Restaurants in countries such as China, India, and Japan are adopting software technologies that allow customers to order and pay at the table using their smartphones and other devices. Various developments and initiatives are anticipated to contribute to regional market's growth during forecast period.

Europe held a significant revenue share in 2022. The outbreak of COVID-19 pandemic has driven Europe online food delivery market, as millions of people ordered food online. The source of appealing, user-friendly applications, and tech-enabled driver networks, and changing consumer expectations, has unlocked the Read-to-Eat (RTE) as an essential category in the region. U.K. is rapidly moving toward a cashless economy. This is expected to increase the usage of multiple payment wallets and budget-friendly POS terminals, favoring the regional market growth.

Key Companies & Market Share Insights

To broaden their product offering, industry players utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions. In January 2022, Delivery Hero Group announced the acquisition of Glovo, an online food and grocery solution provider with more than 70,000 monthly active couriers and more than 130,000 monthly active partners. The acquisition was aimed at helping the company in enhancing its business by increasing the user base. Some prominent players in the global online food delivery market include:

-

Delivery Hero SE

-

DoorDash

-

Domino's Pizza Inc.

-

Ele.me (Alibaba Group Holding Limited)

-

Grubhub

-

McDonald's

-

Deliveroo

-

Papa John's International, Inc.

-

Pizza Hut

-

Just Eat Takeaway.com

-

Uber Technologies Inc.

-

Waiter.com, Inc.

-

Zomato Ltd.

Recent Development

-

In December 2022, Grubhub announced the partnership with Kiwibot, a food delivery company, to provide meal through robot on college campuses across the U.S. This strategic partnership would provide an integrated delivery service that allows students to leverage Kiwibot delivery from Grubhub’s application. Additionally, the delivery options on college campuses provide students more opportunities to get their chosen foods while establishing healthy relationships with technological developments that contribute the campus life more efficient and effective.

-

In December 2022, Domino's Pizza Inc. announced its expansion in the two new countries - Latvia and Uruguay. The first dominos store would open in Riga at Deglava 100 by franchisee Morgacita Ltd., Latvia and second would open in Montevideo at 1163 Luis Alberto de Herrera by franchisee Alsea, Uruguay.

-

In November 2022, Domino's Pizza Inc. launch 100 custom Chevy Bolt electric vehicles in the U.S., to attract delivery drivers who don’t have a cars of their own. Further, collaborating with Enterprise fleet Management, the company would get maintenance for the electric delivery fleet, financing, telematics solutions, vehicle acquisition, and local hands-on account management.

-

In March 2022, Zomato announced its latest feature, the 10-minute delivery of food. The feature would be available in prime cities only and is aimed at helping Zomato in attracting more customers and strengthening its position in the Indian market.

Online Food Delivery Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 254.52 billion

Revenue forecast in 2030

USD 505.50 billion

Growth Rate

CAGR of 10.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

Delivery Hero SE; DoorDash; Domino's Pizza Inc.; Ele.me (Alibaba Group Holding Limited); Grubhub; McDonald's; Deliveroo; Papa John's International, Inc.; Pizza Hut; Just Eat Takeaway.com; Uber Technologies Inc.; Waiter.com, Inc.; Zomato Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Food Delivery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global online food delivery market report based on type and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Restaurant to Consumer

-

Platform to Consumer

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online food delivery market size was estimated at USD 221.65 billion in 2022 and is expected to reach USD 505.50 billion in 2022.

b. The global online food delivery market is expected to grow at a compound annual growth rate of 10.3% from 2023 to 2030 to reach USD 505.50 billion by 2030.

b. Asia Pacific dominated the online food delivery market with a share of over 40% in 2022. This is attributable to the growing middle-class population, and rising spending on food delivery.

b. Some key players operating in the online food delivery market include Delivery Hero SE, DoorDash, Domino's Pizza Inc., Ele.me (Alibaba Group Holding Limited), Grubhub, McDonald's, Deliveroo, Papa John's International, Inc., Pizza Hut, Just Eat Takeaway.com, Uber Technologies Inc., Waiter.com, Inc., and Zomato Ltd.

b. Key factors that are driving the online food delivery market growth include the rising number of smartphone and internet users coupled with growing trends toward food delivery mobile applications across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."