- Home

- »

- Next Generation Technologies

- »

-

Online Investment Platform Market Size, Share Report, 2030GVR Report cover

![Online Investment Platform Market Size, Share & Trends Report]()

Online Investment Platform Market (2022 - 2030) Size, Share & Trends Analysis Report By Solution (Portfolio Management, Funds & Trading Management), By Service, By Deployment, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-963-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Investment Platform Market Summary

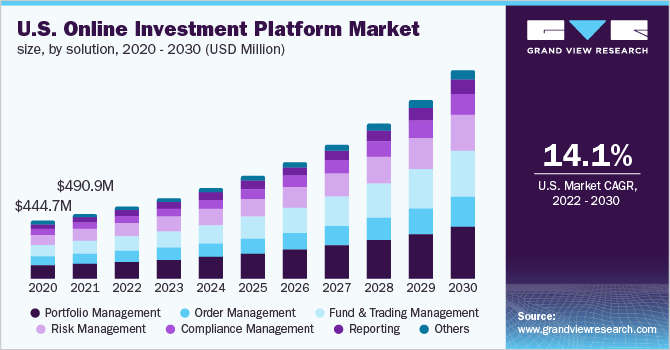

The global online investment platform market size was estimated at USD 1.88 billion in 2021 and is projected to reach USD 5.90 billion by 2030, growing at a CAGR of 13.9% from 2022 to 2030. The increasing popularity of cryptocurrency as an asset and its adoption as an investment is anticipated to drive the market over the forecast period.

Key Market Trends & Insights

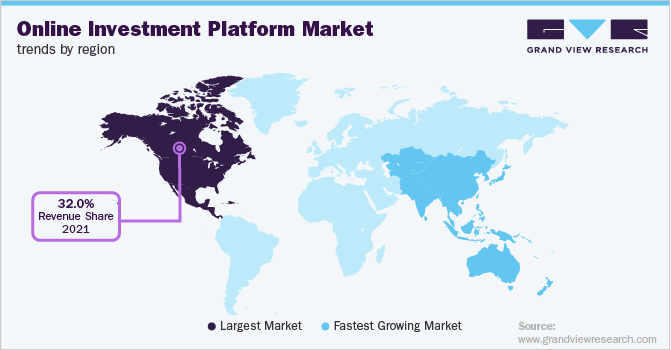

- North America dominated the global online investment platform market with the largest revenue share of over 32.0% in 2021.

- By solution, the portfolio management segment led the market with the largest revenue share of more than 24.0% in 2021.

- By service, the advisory services segment led the market with the largest revenue share of 35.0% in 2021.

- By deployment, the mobile-based segment led the market with the largest revenue share of over 52.0% in 2021.

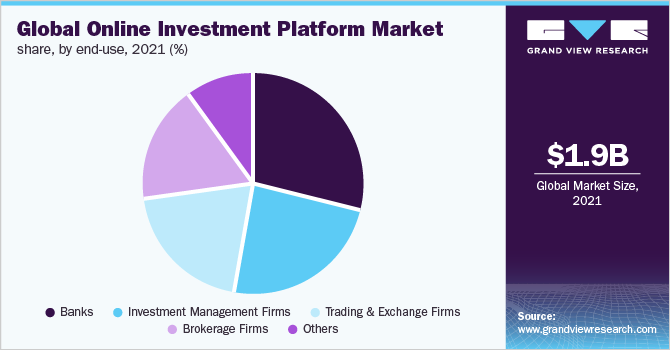

- By end use, the investment management firms segment is projected to register at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 1.88 Billion

- 2030 Projected Market Size: USD 5.90 Billion

- CAGR (2022–2030): 13.9%

- North America: Largest market in 2021

In addition, growing online investors across the world are expected to drive the growth of the industry. Furthermore, the introduction of P2P payments in online investment applications, which offers secure and safer transactions, also bodes well for market growth.

The growing number of High Net Worth Individuals (HNWIs) worldwide and their rising interest in digital investments are expected to drive the growth of the market over the forecast period. Moreover, HNWIs are popular among private equity firms due to the additional work required to maintain and safeguard their investment. For instance, as per the report by World Health Report by Capgemini in 2021, the U.S. accounted for the most number of HNWIs people, with over 7.54 million. In addition, the percentage of HNWIs has gone up to 13.5% over the previous year in the U.S.

The growing emergence of blockchain technology is also one of the major factors driving the growth of the market. The benefits offered by the blockchain network to help resolve the issues related to disputes and data discrepancies are creating its importance in online investment platforms. In addition, growing blockchain-enabled trading investment platforms globally, such as CoinSwitch Kuber also bodes well for the market growth. These trading investment platforms enable users to trade and invest in cryptocurrencies.

The market is anticipated to be driven by one of the most dominant features offered by these platforms such as its speed while executing the orders. In addition, the lower- latency of these platforms helps investors and traders to save their time and money, thereby driving the industry growth. Furthermore, the growing initiatives by various government bodies across the globe to promote digitalization are expected to drive the market over the forecast period. Moreover, the rising demand for personalized online investment platforms is also propelling the growth.

However, growing concerns about the security provided by online investment platforms are expected to limit market growth over the forecast period. In addition, technical glitches such as optimization issues associated with these platforms are also expected to hinder the growth. On the other hand, the growing awareness of online investment platforms in developing economies is expected to create growth opportunities. Moreover, the growing demand for cloud-based online investment platform solutions is expected to create growth opportunities.

COVID-19 Impact Analysis

The COVID-19 pandemic has played a major role in driving the growth of the market over the forecast period. The growing preference for the online investment platform due to the effect of a pandemic is opening opportunities for the online investment platform market. The rising awareness of online investing among the general public across the globe has led to the popularity of online investment platforms. As a result, various online investment solution providers are making efforts to enhance their platforms by including real-time alerts and user assistance.

Solution Insights

The portfolio management segment accounted for the largest revenue share of more than 24.0% in 2021. The growing adoption of Systematic Investment Plans (SIPs) is anticipated to contribute to the segment growth. In addition, various efforts are pursued by several portfolio and asset management companies to enhance their offerings which are expected to boost the demand for solutions offered by online investment firms. At the same time, benefits offered by portfolio management, such as improved selection process, and efficient use of resources, among others are also accentuating the segment growth.

The funds & trading management segment is anticipated to witness the fastest growth over the forecast period. The increasing internet penetration has led consumers to opt for online funding and trading across the globe, which is anticipated to fuel the segment growth. Funds & Trading management platform eliminates the middlemen by offering more control and direct access to the investors for their investments. This feature offered by online funds and trading management platforms is boosting the segment growth over the forecast period.

Service Insights

The advisory services segment dominated with a revenue share of more than 35.0% in 2021. The increasing adoption of advisory services among SMEs, as well as high-net-worth individuals, is anticipated to boost the segment growth. Advisory services provide prevention and risk reduction services to their clients to improve overall efficiency and enhanced strategies for maximum returns. Hence, these features offered by advisory service providers bode well for segment growth in the near future.

The managed services segment is expected to register steady growth over the forecast period. Managed Services allows investors to manage funds and hedge losses. The increased penetration of artificial intelligence technology and IoT platforms is anticipated to drive the segment growth. Such technical enhancements are followed by various investment firms to gain a competitive advantage and strengthen the market position are expected to drive the growth of the segment.

Deployment Insights

The mobile-based segment held the largest revenue share of over 52.0% in 2021. The growing inclination of investors toward mobile-based investment platforms is anticipated to drive the growth. The ease and convenience offered by mobile-based trading are further boosting growth. The rising number of mobile-based investment platform providers is driving the segment growth. For instance, in June 2022 Coinmetro, a rapidly expanding European-based cryptocurrency exchange updated its smartphone app. The enhancement made in the app will provide users with a more enhanced app experience on their smartphones.

The web-based segment is expected to register significant growth over the forecast period. The growing demand for web-based investment platforms due to its benefits, such as third-party API integration for real-time portfolio performance and assistance, is anticipated to drive the segment growth. Various investment firms are incorporating web-based technology into their in-house models, such as Robo-advisors, to offer investors with a competitive advantage. For instance, in April 2021, MOFSL launched PHYGITAL, a web-based investment platform to assist nascent investors.

End-use Insights

The banks segment held the largest revenue share of over 29.0% in 2021. The increasing implementation of cloud-based investing solutions within banking institutions is anticipated to drive growth. Cloud-based investing offers several advantages for banks, such as lower infrastructure costs, greater flexibility, and lower maintenance. Banks are increasingly embracing cloud technology to perform massive and complicated daily and intraday liquidity risk calculations, closely monitor peer-to-peer transactions and mobile banking transactions, improve regulatory compliance, and become more adaptable.

The investment management firms segment is expected to continue witnessing significant growth over the forecast period. The increase in demand for investment management firms for the management of funds and stocks is anticipated to drive the growth. This is because investment management firms use online platforms to run simulations and manage investment risks. For instance, in July 2022, a Middle Eastern industry alliance for investment management has been established. The Middle East Investment Management Association (MEIMA) will be the region's first regional institution of its kind, serving as the legitimate representative and insights hub for an industry that is a cornerstone of the Middle East economy.

Regional Insights

North America accounted for the largest revenue share of over 32.0% in 2021. The growing preference for digital investment platforms across North America is expected to propel the growth of the regional market. The rising technological advancements are anticipated to drive growth. At the same time, the presence of the best online brokers & trading platforms in the U.S. is driving regional growth. The U.S. stock trading platform market is growing at a rapid pace, with over half of the population possessing stocks which are creating the demand for enhanced online trading platforms & tools.

Asia Pacific is expected to register the highest CAGR over the forecast period. The growth can be attributed to the growing awareness in countries, such as China, India, and Japan, about the benefits offered by online trading platforms. For instance, in January 2021, PT Ajaib Sekuritas Asia, a provider of online investment platforms, announced a USD 25 million Series A round led by venture capitalist Horizons Ventures. PT Ajaib Sekuritas Asia intends to use Series A to fund its #MentorInvestai campaign, which involves teaming up with the federal government to teach the younger generation about financial investment and planning.

Key Companies & Market Share Insights

The market can be described as a highly competitive industry characterized by several prominent players. Numerous participants are opting for several strategies to improve their offerings, such as strategic partnerships, new product launches, and geographic expansion. For instance, in June 2022, Fiserv announced its collaboration with Checkbook, Inc. to diversify its portfolio. The main aim of this collaboration is to provide businesses with digital payout solutions to reduce the operational costs related to paper checks.

Furthermore, in March 2021, eToro Ltd announced to take the company public. This announcement comes after the acquisition of Corp V. In addition, numerous institutional investors would become new eToro investors. Softbank Vision Fund 2, ION Investment Group, Fidelity Management & Research Company LLC, and Wellington Management are among them. Some prominent players in the global online investment platform market include:

-

eToro Ltd.

-

Fiserv, Inc.

-

Profile Software

-

Fidelity Investments

-

E*TRADE Financial Holdings, LLC

-

Temenos AG

-

SS&C Technologies, Inc.

-

FIS

-

InvestEdge, Inc.

-

Calypso Technology, Inc.

Online Investment Platform Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.09 billion

Revenue forecast in 2030

USD 5.90 billion

Growth rate

CAGR of 13.9% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

eToro Ltd.; Fiserv Inc.; Profile Software; Fidelity Investments; E*TRADE Financial Holdings LLC; Temenos AG; SS&C Technologies, Inc. FIS; InvestEdge, Inc.; Calypso Technology, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Online Investment Platform Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global online investment platform market report based on solution, service, deployment, end-use, and region:

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Portfolio Management

-

Order Management

-

Funds & Trading Management

-

Risk Management

-

Compliance Management

-

Reporting

-

Others

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Advisory Services

-

System Integration & Deployment

-

Technical Support

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Web-based

-

Mobile-based

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Banks

-

Investment Management Firms

-

Trading & Exchange Firms

-

Brokerage Firms

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global online investment platform market size was estimated at USD 1.88 million in 2021 and is expected to reach USD 2.09 billion in 2022

b. The global online investment platform market is expected to grow at a compound annual growth rate of 13.9% from 2022 to 2030 to reach USD 5.90 billion by 2030

b. North America dominated the online investment platform market with a share of 32.25% in 2021. The growing preference for digital investment platforms across North America is expected to propel the growth of the regional market.

b. Some key players operating in the online investment platform market include eToro Ltd.; Fiserv Inc.; Profile Software; Fidelity Investments; E*TRADE Financial Holdings LLC; Temenos AG; SS&C Technologies, Inc. FIS; InvestEdge, Inc.; Calypso Technology, Inc.

b. Key factors that are driving the online investment platform market growth include increasing adoption of digital investment platforms and wealth management and technological advancements in the Fintech industry

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.