- Home

- »

- Next Generation Technologies

- »

-

Online Movie Ticketing Services Market Size Report, 2030GVR Report cover

![Online Movie Ticketing Services Market Size, Share & Trends Report]()

Online Movie Ticketing Services Market Size, Share & Trends Analysis Report By Platform (PC, Mobile), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-593-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

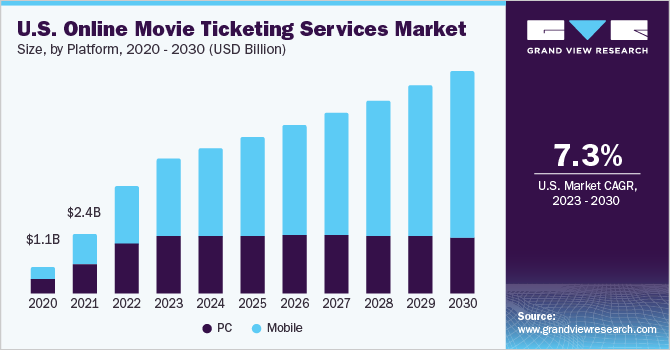

The global online movie ticketing services market size was valued at USD 17,589.7 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030. The growth can be credited to the increasing consumer preference for online booking services over traditional ones. The rising demand for convenient, quick, and hassle-free alternatives for completing day-to-day purchases is playing a key role in the adoption of online platforms. In addition, the growing adoption of smartphones and the increased penetration of the Internet is also favoring the expansion of the market for online movie ticketing services.

Online ticket booking platforms facilitate movie ticket selection, reservation, and purchase. They primarily contain information such as the schedule for movie shows, trailers, and the price of the tickets. Digital ticketing solutions, much like e-commerce platforms, allow moviegoers to easily find show times and buy tickets through various digital platforms that are not exclusive to the movie and entertainment sector. Several tech giants, such as Google, Meta, and Amazon, have already made significant strides in this domain through unique offerings and features.

The market for online movie ticketing services is advancing further due to initiatives by companies to attract, engage, and retain customers. They are focusing on enhancing their offerings to offer a better user experience. For instance, in October 2022, India’s major entertainment platform BookMyShow by BigTree Entertainment Pvt. Ltd., in partnership with the RBL Bank, launched a new credit card called ‘Play’. This card will be available to select customers, providing them attractive offers on transactions across movies, live entertainment, and renting or buying TV series and movies on BookMyShow Stream.

Platform Insights

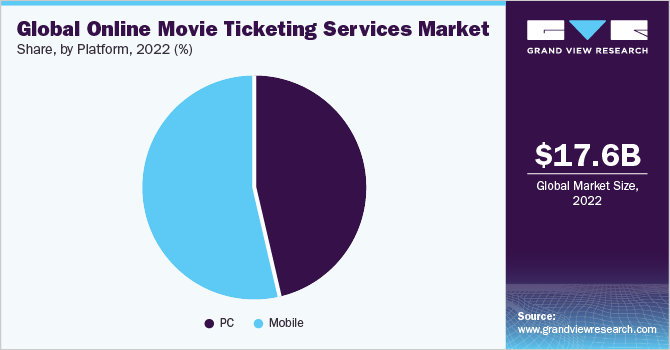

Based on the platform, the PC segment captured a revenue share of over 46.0% in 2022 and is estimated to record a steady growth rate in the coming years in the market. This can be attributed to the rising customer preference for operators’ or third-party websites for booking movie tickets. Besides, the low penetration of mobile applications in certain countries is also driving the demand for computer system-based online bookings for movie tickets.

The mobile segment is estimated to record a CAGR of 11.5% from 2023 to 2030. This can be credited to the increasing usage of mobile apps due to the advantages associated with them. They offer personalization to allow for tailored communication to users based on their location, interests, usage patterns, etc. The market is driven by the increasing adoption of smartphones globally. Their ability to send non-intrusive, instant notifications to users has gained much significance, with businesses actively investing in providing mobile apps endowed with various innovative user-friendly features.

Regional Insights

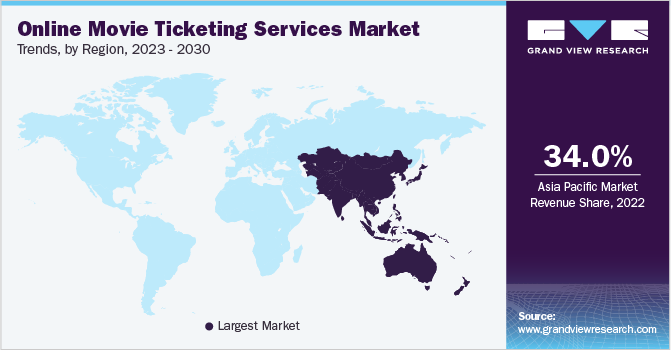

Asia Pacific captured a revenue share of over 34.0% in 2022, owing to the increasing regional consumer preference for online transactions. The rising smartphone penetration and the untapped advertising potential is encouraging operators to form new ways to drive online ticket sales. They are forming strategic alliances to gain a competitive edge in the market. In April 2022, Imax expanded its partnership with the Japanese cinema company ‘Aeon Entertainment’ for 2 theatres. It involves the theaters being equipped with laser projection systems deployed at Aeon Cinemas outside Tokyo and near Osaka.

Latin America is expected to record a CAGR of 10.6% from 2023 to 2030, aided by the increasing consumer interest in movies and entertainment, coupled with rising disposable incomes in emerging economies across the region. An increasing number of people in these nations are willing to spend more on leisure activities. In addition, considerable economic growth, the launch of new movie theatres and multiplexes, and growing internet penetration is favoring the growth of the regional market for online movie ticketing services.

Key Companies & Market Share Insights

Key industry players offering online movie ticketing services are actively involved in strategic initiatives, such as mergers and acquisitions, collaborations, and partnerships to strengthen their presence in the market. In February 2023, AMC Theatres launched a ticket pricing solution - Sightline at AMC, which is based on the seat location at each auditorium. This new initiative will provide moviegoers with different options to leverage their viewing preferences. They now have the option to pay more, or less, for a movie ticket as per their seat selection. Some of the prominent players in the global online movie ticketing services market are:

-

AMC Theatres

-

AOL Inc.

-

BigTree Entertainment Pvt Ltd.

-

Cinemark Holdings Inc.

-

Cineplex Inc.

-

KyaZoonga, Inc.

-

Fandango

-

INOX Leisure

-

MovieTickets.com

-

TicketPlease

-

VOX Cinemas

Online Movie Ticketing Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 22,269.6 million

Revenue forecast in 2030

USD 39,379.7 million

Growth rate

CAGR of 8.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

AMC Theatres; AOL Inc.; BigTree Entertainment Pvt Ltd.; Cinemark Holdings Inc.; Cineplex Inc.; KyaZoonga; Fandango; INOX Leisure; MovieTickets.com; TicketPlease; VOX Cinemas

Pricing and purchase options

Free re Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Movie Ticketing Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global online movie ticketing services market report based on platform and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

PC

-

Mobile

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Mexico

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online movie ticketing services market size was estimated at USD 17,589.7 million in 2022 and is expected to reach USD 22,269.6 million in 2023.

b. The global online movie ticketing services market is expected to grow at a compound annual growth rate of 8.5% from 2023 to 2030 to reach USD 39,379.7 million by 2030.

b. Based on region, Asia Pacific captured the revenue share of nearly 34.0% in 2022 owing to the increasing consumer preference for online transactions across the region. The increasing smartphone penetration and the untapped potential for advertising is encouraging the operators to create new ways to increase the ticket sale through online channels.

b. The key players in this online movie ticketing services market include AMC Theatres, AOL Inc., Bigtree Entertainment Pvt Ltd., Cinemark Holdings Inc., Cineplex Inc., Kyazoonga, Fandango, Inox Leisure Ltd., MovieTickets.com, Ticketplease, and VOX Cinemas, among others.

b. Key factors that are driving the online movie ticketing services market growth include growing penetration of internet and broadband services, growing focus on paperless transaction, and rise in disposable income among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."